Updated November 23, 2023

Difference Between Depreciation vs Amortization

Depreciation refers to the reduction in the cost of tangible fixed assets over their lifespan proportionate to using the asset in that specific year. Depreciated tangible assets include plants, equipment, machinery, buildings, and furniture. Depreciation of tangible assets can be done by using either a straight-line method or an accelerated depreciation method. Amortization refers to reducing the cost of intangible assets over their lifespan. Examples of intangible assets that are amortized are patents, trademarks, lease rental agreements, concession rights, brand value, etc. Amortization of the intangible assets is mostly done using the straight-line method.

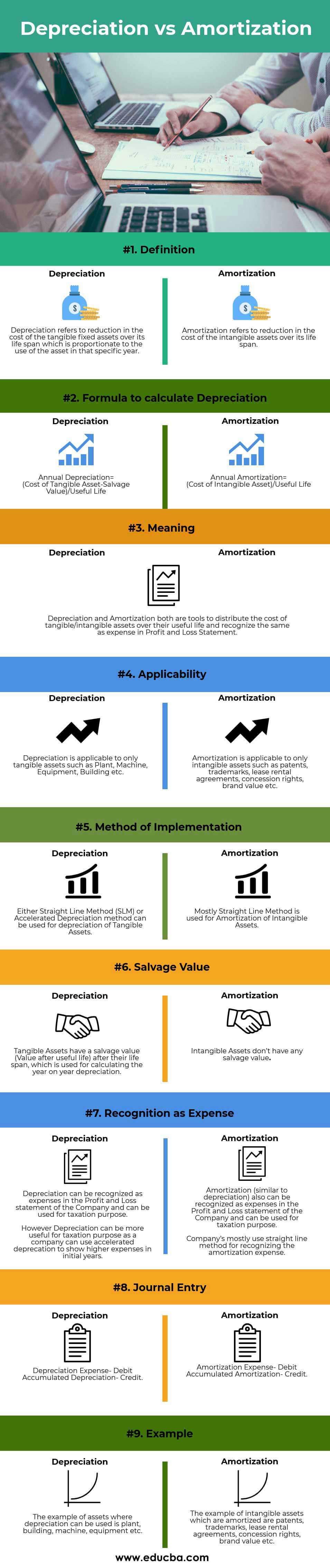

Head To Head Comparison Between Depreciation vs Amortization(Infographics)

Below is the top 9 difference between Depreciation vs Amortization

Key Differences Between Depreciation vs Amortization

Both Depreciation vs Amortization are popular choices in the market; let us discuss some of the major differences between Depreciation vs Amortization:

- Depreciation is used to distribute and expense the cost of Tangible Assets over their useful life. However, Amortization is used to expense the value of Intangible assets over their useful life.

- Tangible Assets are depreciated using either the straight-line method or the accelerated depreciation method. However, amortization of intangible assets is mostly done using only the straight-line method.

- Tangible assets carry some salvage value which is used in the calculation of depreciation. Intangible assets don’t have any salvage value.

- Both depreciation and amortization are used in the finance industry for accounting and tax purposes.

- Both depreciation and amortization are recognized as an expense in the profit and loss statement of the Company for taxation purposes.

- Taxation advantage is more significant in the case of depreciation than amortization, as an accelerated method of depreciation can be used in the case of tangible assets.

- Journal entries for both depreciation vs amortization are the credit to the Accumulated Depreciation/Amortization account and a debit to the depreciation/amortization expense account.

- Depreciation applies to plants, buildings, machinery, equipment, or tangible fixed assets. However, amortization applies to intangible assets such as copyrights, patents, collection rights, brand value, etc.

Depreciation vs Amortization Comparison Table

Below is the 9 topmost comparison between Depreciation vs Amortization

| Sr. No. | Particulars | Depreciation | Amortization |

| 1 | Definition | Depreciation refers to the reduction in the cost of tangible fixed assets over their lifespan proportionate to using the asset in that specific year. | Amortization refers to reducing the cost of intangible assets over their lifespan. |

| 2 | A formula to calculate Depreciation | Annual Depreciation=

(Cost of Tangible Asset-Salvage Value)/Useful Life |

Annual Amortization=

(Cost of Intangible Asset)/Useful Life |

| 3 | Meaning | Depreciation and Amortization are tools to distribute the cost of tangible/intangible assets over their useful life and recognize the same as an expense in the Profit and Loss Statement. | |

| 4 | Applicability | Depreciation applies to only tangible assets such as Plants, Machines, Equipment, Buildings, etc. | Amortization applies to only intangible assets such as patents, trademarks, lease rental agreements, concession rights, brand value, etc. |

| 5 | Method of Implementation | The Straight Line Method (SLM) or the Accelerated Depreciation method can be used to depreciate Tangible Assets. | Mostly Straight Line Method is used for the Amortization of Intangible Assets. |

| 6 | Salvage Value | Tangible Assets have a salvage value (Value after useful life) after their lifespan, which calculates the year-on-year depreciation. | Intangible Assets don’t have any salvage value. |

| 7 | Recognition as Expense | Depreciation can be recognized as expenses in the Profit and Loss statement of the Company and can be used for taxation purposes.

However, Depreciation can be more useful for taxation as a company can use accelerated depreciation to show higher expenses in initial years. |

Amortization (similar to depreciation) also can be recognized as expenses in the Profit and Loss statement of the Company and can be used for taxation purposes.

The company mostly uses the straight-line method for recognizing the amortization expense. |

| 8 | Journal Entry | Depreciation Expense- Debit

Accumulated Depreciation- Credit |

Amortization Expense- Debit

Accumulated Amortization- Credit |

| 9 | Example | Example of assets where depreciation can be used is the plant, building, machine, equipment, etc. | Examples of intangible assets that are amortized are patents, trademarks, lease rental agreements, concession rights, brand value, etc. |

Examples of Depreciation vs Amortization

Below are the examples for better understanding:

Example of Depreciation

A Company purchased a machine at $100 million. The life of the machine is 5 Years. The salvage value of the machine is 10% of the purchase value. The depreciation as per the straight-line method is as below:

- Cost of Machine= $100 million

- Salvage Value= 100*10%= $10 million

- Depreciable value = Cost of Machine –Savage Value

- Depreciable value = 100-10= $90 million

- Life of the Machine= 5 Years

Now we will find the Annual Depreciation for the machine using the Annual Depreciation formula.

Annual Depreciation for the Machine = 90/5

Annual Depreciation for the Machine = $18 million

Calculation of depreciation year on year and reduction in asset value is provided below table:

| Year | 1 | 2 | 3 | 4 | 5 |

| Opening Depreciation (million $) | 0 | 18 | 36 | 54 | 72 |

| Addition (million $) | 18 | 18 | 18 | 18 | 18 |

| Cumulative Depreciation (million $) | 18 | 36 | 54 | 72 | 90 |

| Year | 1 | 2 | 3 | 4 | 5 |

| Cost of Fixed Asset(million $)= A | 100 | 100 | 100 | 100 | 100 |

| Accumulated Depreciation(million $)= B | 18 | 36 | 54 | 72 | 90 |

| Net Cost of the Asset(million $)= A-B | 82 | 64 | 46 | 28 | 10 |

Example of Amortization

A Company involved in the construction, development, and operation of roads and highways has been granted a toll collection right of $800 million by the highway ministry to be collected over 20 Years.

Amortization expenses that the Company can claim under the straight-line method are as under:

Annual Amortization Expense = (800-0)/20 Years

Annual Amortization Expense = $40 million

Conclusion

Depreciation vs Amortization is used to distribute an asset’s cost (be it tangible or intangible) over its useful life. Depreciation is more precisely used for tangible assets, and amortization is used for intangible assets. Both Depreciation vs Amortization are recognized as expenses in the revenue statement of the Companies and used for taxation purposes. Both Depreciation vs Amortization broadly serve the purpose of taxation and accounting.

Recommended Articles

This has been a guide to the top difference between Depreciation vs Amortization. Here we also discuss the Depreciation vs Amortization key differences with infographics and comparison table. You may also have a look at the following articles to learn more.