Updated July 6, 2023

What is Deregulation?

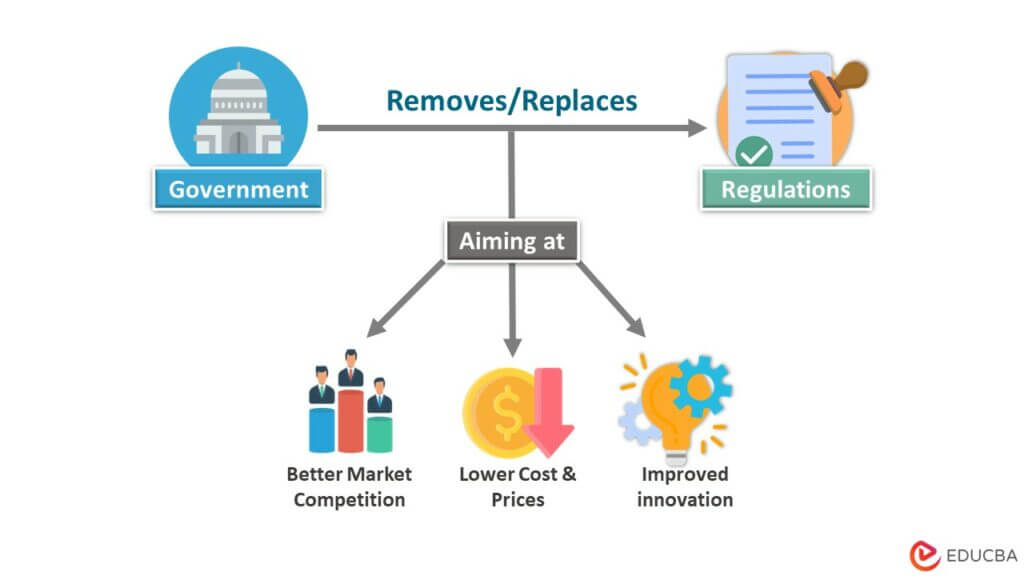

Deregulation is removing, reducing, or replacing government rules to increase competition within the sector or industry. For instance, during covid, laws regarding doctors obtaining licenses before using telehealth systems were deregulated, as these laws were restricting Medicare beneficiaries’ access to remote treatment.

Deregulation aims to open up business operations, improve decision-making, and eliminate corporate constraints. It enables private banks to regulate their financial functions regarding their capital investments and allocations. It provides them the edge to compete globally.

Key Highlights

- Deregulation removes government power from an industry, usually implemented to create a competitive advantage.

- Steep competition fosters innovation, and consumers enjoy lower prices when there is perfect competition.

- It encourages economic development by allowing businesses to operate more freely.

- Also, smaller companies won’t be able to compete with bigger firms due to legacy growth over the years.

How Does Deregulation Work?

Reducing rules, regulations, and workings allows for greater investment, money, market, and exchange opportunities. Before the great depression, there was proper regulation of financial institutions. However, the learned lesson post the year 1929 was autonomy and independence. Banks had more freedom in deciding their financial standing, which helped them balance valuations and reduce the operating costs that the government controls in power.

Discourses concerning rules evolve; the fundamental reason is that some laws become ineffective and restrictive over time. An illustration would be how former US President Donald Trump relaxed various laws that acted as barriers to accessing health care, including telehealth, as part of his policy reaction to COVID-19. Hence, it is a must for positive economic growth.

Examples

#1: Banking Industry

Banks in the United States were not allowed to undertake their client’s money to buy securities exchanges due to higher volatility. However, after the deregulation of the Glass-Steagall Act’s repeal in 1999, banks started investing the client’s money leading to further crashes in the market and loss of client’s money.

#2: Aviation Industry

The government completely controlled the Aviation Industry before 1978. However, due to CAB Sunset Act, it was also influenced by the private players. It led to a more flexible airline modus operandi.

Importance

- It provides autonomy that eases the mode of doing business and provides greater flexibility in the decision-making process.

- The banks can enjoy lower prices as a capital investment due to the match-up of supply and demand variables that affect the financial world.

- It helps create physical capital and financial resources.

Causes

Market-growth Acceleration

- It helps in accelerating market growth and the opportunities attached to it.

- Business profitability improves economic growth.

Innovation Encouragement

- Entrepreneurs can foster innovation and creativity in the financial landscape by experimenting with numbers.

- Unnecessary regulation inhibits innovation.

Ensure Business Freedom

- Businesses can have the freedom to innovate and experiment with new modus operandi.

- The company gets the flexibility to follow less stringent policy measures.

Effects

- New business opportunities exist in the marketplace due to less or no regulation that enhances investment opportunities.

- It also increases competition among the firms, leading to perfect competition and lowering prices.

- Due to the autonomy provided, businesses develop new products, cut costs, and focus on operational optimization.

Benefits

- It caters to economic growth by fostering autonomy, innovation, and higher expansion of production services.

- Allows the new private players to try their hands at creating a healthy business environment.

- It gives more flexibility to the government to keep a check on the market by introducing technology without getting into IT Acts.

Final Thoughts

Market failures are the key reasons to remove deregulation in the economy. An economy cannot function effectively without regulation as it keeps autonomy in check and restricts the stakeholders from making informed decisions. It comes with easing stringent policy restrictions concerning the internal economy, as it will boost the country’s reputation at a global level.

Frequently Asked Questions (FAQs)

Q1. What is deregulation?

Answer: Deregulation is a procedure for reducing government control in a segmented market that typically helps gain a competitive edge. The fiasco between the components of regulation and the government non-interventions has created chaos in the market condition.

Q2. What is an example of deregulation?

Answer: There have been many instances of deregulation in the world. Some examples are the Airline in the US, Mail Delivery in the UK, and the Energy sector in the UK.

Q3. What are the reasons for deregulation?

Answer: Deregulation occurs when the economy’s performance dwindles due to strict policy measures, orthodox economic practices, and less cooperation with global practices.

Q4. Who benefits from deregulation?

Answer: Deregulation benefits Businesses, corporations, and governments due to policy ease and higher autonomy.

Q5. What is another term for deregulation?

Answer: Privatization, re-regulations, and centralization are some other deregulation terms.

Q6. How deregulation helps the banks?

Answer: Deregulation provides a free hand to increase investment, capital, market, and exchange opportunities by slashing laws, regulations, and workings. It gives financial institutions and global banks autonomy to make informed decisions on investment opportunities.

Recommended Articles

We hope this practical guide from EDUCBA on deregulation was helpful. For further knowledge, we recommend these articles,