Updated July 17, 2023

What are Derivatives in Finance?

In finance, “derivative” refers to the financial instrument whose value is derived based on the underlying asset. A derivative represents a financial contract between two or more parties, and its price is decided based on fluctuations in the underlying asset price. Common examples of underlying assets are commodities, bonds, stocks, currencies, etc. Derivative instruments are purchased through exchanges or over the counter.

Explanation

Typically, derivatives are either used as a hedging instrument or as the speculating directional movement of the underlying asset. As such, derivatives derive their value from the fluctuations in the underlying asset’s value.

The need for derivatives came from international traders who wanted to safeguard themselves against fluctuations in exchange rates. Hence, introducing derivatives initially aims to hedge the movement in exchange rates for internationally traded goods. However, derivatives have gained a wide range of utilities over some time. Today there are derivatives for managing risks associated with unexpected weather changes.

Examples of Derivatives in Finance

Different examples are mentioned below:

Example #1

Let us use the WTI oil price future contract to illustrate the concept of derivatives. Let us assume that in April 2020, ABC Inc., when WTI oil was trading at $19.10 per barrel, purchased 10 futures contracts for WTI oil for $30.00 per barrel that expires on 31st August 2020. Each future agreement represents 1,000 barrels of oil. The company anticipated a steep increase in oil prices in the near term. By entering into the derivative contract, the company mitigated its risk as it obliged the seller to deliver oil to the company at $30.00 per barrel upon contract expiry.

In August 2020, the WTI oil prices went up to $42.61 per barrel, which means the company made a profit of $12.61 (= $42.61 – $30.00). So, at the expiry of the contract ABC Inc. made a total profit of $126,100 (= $12.61 * 1,000 barrels * 10 future contracts). This is how future contract works.

Example #2

Let us now take the example of a swap option. Let us assume that ABC Inc. has raised $1 million in debt and pays a variable rate of interest, currently 5%. On the other hand, XYZ Inc. has also borrowed $1 million in debt but pays a fixed interest rate of 6%. Now, ABC Inc. is apprehensive that the interest rates may rise soon, while XYZ Inc. intends to take advantage of the current lower floating rate. As such, both companies enter into a swap contract under which ABC Inc. will pay the fixed interest rate (6%), and XYZ Inc. will pay the variable interest rate (5%).

At the start of the swap, ABC Inc. will have to pay 1% (= 6% – 5%) of the debt to XYZ Inc. as the difference between the two interest rates. However, if the interest rates fall such that the variable rate becomes 4%, then ABC Inc. will have to pay XYZ Inc. 2% (= 6% – 4%) as the difference between the two interest rates. On the other hand, if the interest rates rise to 7%, then XYZ Inc. will have to pay ABC Inc. 1% (= 7% – 6%) as the difference between the two interest rates. This is how a swap option works.

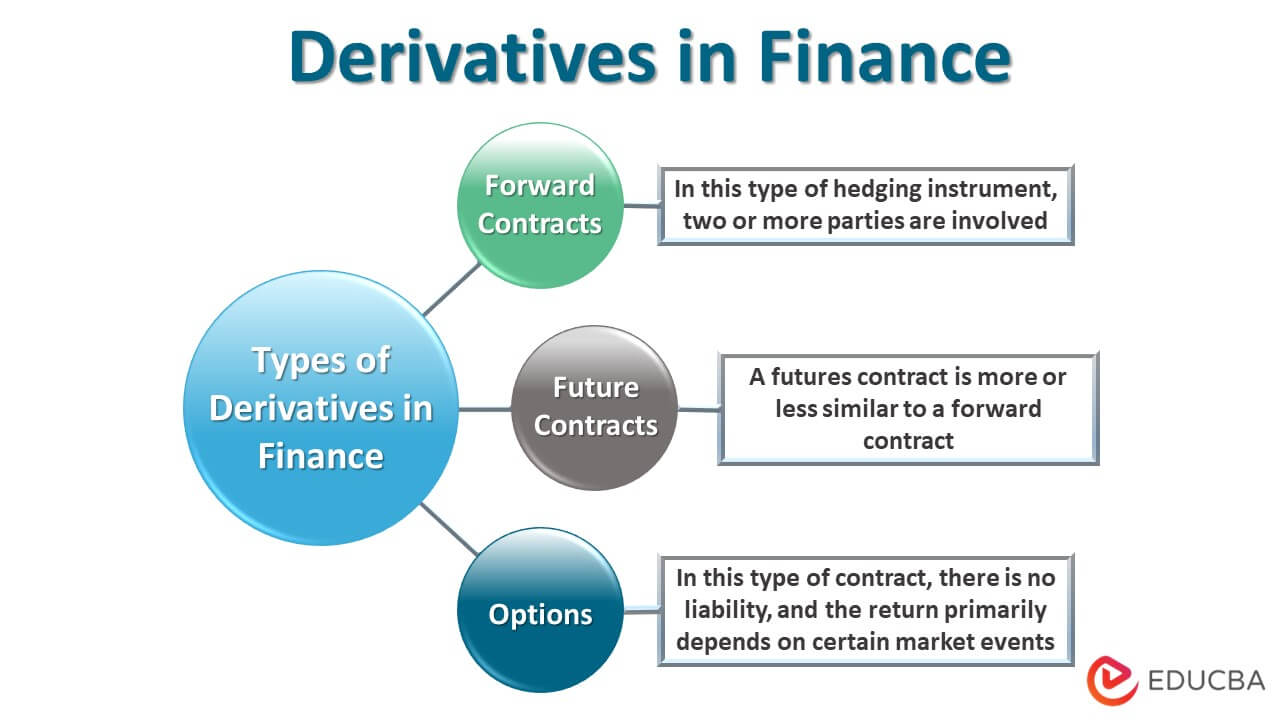

Types of Derivatives in Finance

There are three broad categories of derivatives in finance. They are – Forward contracts, Future contracts, and Options.

- Forward Contracts: This hedging instrument involves the active participation of two or more parties. The participating parties (buyers and sellers) actively decide on a specified price for the agreement, regardless of the current market price of the underlying asset. After that, the seller must deliver the asset at the said price on a specified future date. This way, the instrument buyer can hedge the risk to a certain level.

- Future Contracts: A futures contract is more or less similar to a forward contract. The primary distinction between a futures contract and a forward contract is that the former allows for transferability, thereby enhancing its liquidity compared to a forward contract. The buyer can enter a new contract and shift the previous buying obligation to someone else.

- Options: In this type of contract, there is no liability, and the return primarily depends on certain market events. An option holder can exercise the right to buy or sell an asset without obligation. The call option gives the right to buy an asset, and the put option gives the right to sell an asset at a pre-determined price known as the option’s strike price.

Risk of Derivatives in Finance

The significant risks associated with derivative instruments are:

- The inability to properly value a derivative instrument due to its complicated nature exposes the involved parties to the risk of enormous losses.

- The unpredictable behavior of the underlying asset may lead to significant losses when derivatives use it for speculation.

- Some over-the-counter contracts are vulnerable to counter-party default risk as they lack proper due diligence.

Why Use Derivatives in Finance?

Derivative instruments are used for the following purposes:

- To hedge the risk associated with the value of the underlying asset.

- Speculate and book profit in case of favorable movement in the underlying asset.

- To gain exposure to certain exotic underlying assets, which is impossible otherwise (e.g., weather derivatives).

Recommended Articles

This is a guide to Derivatives in Finance. Here we also discuss the introduction and types of derivatives in finance, along with examples and uses. You may also have a look at the following articles to learn more –