Updated October 26, 2023

That said, mutual funds offer many benefits that trading on stocks does not. But along with these mutual funds benefits come the risks as well. Read on to learn more about the various kinds of top mutual funds today.

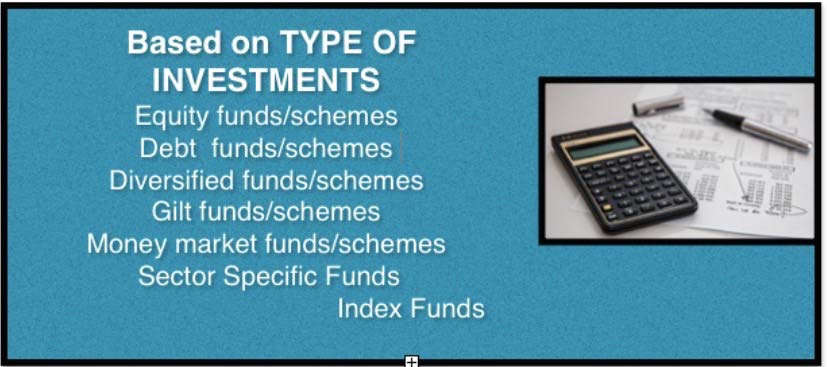

Mutual Funds -Varying Typologies

Each Mutual Fund can declare the type of instrument it will invest in based on the nature of the investments. It is divided further into equity fund schemes, diversified funds, gilt funds, money market funds, sector-specific debt fund schemes, and index funds.

Image source: pixabay.comBased on the time of closure of the scheme, the mutual fund’s basics can also be divided into open and closed-ended schemes. An open-ended scheme is one that does not have a specific closing date. So, while open-ended funds are more liberal in their outlook, close-ended funds are fairly narrow-minded! While debt funds or schemes are also called income funds, diversified funds or schemes are called balanced funds.

Image source: pixabay.comBased on tax incentive schemes, mutual funds can be split into tax saving and not tax saving funds. Another typology is possible based on periodicity/time of payouts, such as dividends. The categorization is as follows:

- Dividend Paying Fund Schemes

- Reinvestment Schemes

Schemes can also be in various permutations and combinations. For example, equity funding is open-ended and can have a dividend-paying plan. What is important is that mutual funds work for the mutual benefit of investors and companies.

Look before your leap is a fit adage for the mutual fund markets. Before investment, one should be clear about the nature of the scheme and choose as per risk aversion and periodicity of dividends from the scheme.

Mutual Funds: Various Types

Index Funds

They are those mutual funds that invest in a portfolio of securities representing the entire particular market or its piece. An example is the entire stock market or part of it, such as international stocks or small firms. Funds can be built to duplicate the performance of their relevant market. Index funds track the market’s indexes. These funds are affordably priced and easy to maintain. For instance, an NSE index fund will aim to provide the same return as the NSE index.

Actively Managed Funds

It is actively managed by professionals or portfolio managers who pick stocks that match investment strategies. Concerning the market index, such funds aim to outperform it. For example, rather than tracking the NSE index, active stock managers in India will try to outdo the index. Investors have to pay managers for their work, and it is up to the mutual fund managers to outsmart the index.

Lifecycle or Target Date Funds

It invests in a combination of bonds and stocks. These mutual funds originate from investments in several funds. The allocation of the fund to its investments changes over a while. The investor turns older with age, and the ratio of money allocated to stocks versus bonds becomes conservative. It works well if you have a portfolio manager to monitor the funds.

Lifestyle funds involve a blend of stock and bond funds that do not change over time. Lifestyle funds can be moderate, aggressive, or conservative.

Tax-Managed Funds

Mutual funds aim to keep taxable capital gains plus other distributions to fund holders to the smallest percentage.

Balanced Funds

Basically, those funds invest in a combination of stocks and bonds. These funds typically have a conservative mix of close to 60% in stocks and the remaining pre-cutting in bonds. Balanced funds are a combination of growth and income funds. They provide current income and more growth later. Such mutual funds have low to moderate stability. Further striking an even keel, they promise moderate mutual funds returns, though the investor does experience some risk.

Income Funds

They are those mutual funds that invest in fixed-income securities, generating a regular income. Though this is a stable option, it is not without its risks. The income fund’s interest rates are sensitive to a certain degree.

Open or Close: The Many Options

A close-ended fund has outstanding fixed shares that operate for a fixed duration of around a decade. These funds have a set redemption period and are only available briefly. They appear on the stock exchange. All year long, flexible funds are available for subscription. These are open-end funds because investors have the flexibility to purchase or sell their investment at any point in time. These do not appear on the stock exchange, in contrast to close-ended funds.

Image source: pixabay.comOpening a World of Possibilities: Different Open-Ended Funds

Debt/income plans use debentures, government securities, and other debt instruments to route a significant portion of the investable cash. With this kind of mutual fund, there is a low risk and low returns. Capital appreciation is low as against equity mutual funds.

Money market mutual fund schemes aim at capital preservation whereby gains will follow through as interest rates are higher on these funds as against bank deposits. These funds pose less risk and are highly liquid. These funds are ideal for investors who want short-term instruments while waiting for better options. Reasonable returns are the USP of these funds.

Equity or growth funds are popular mutual funds among retail investors. For long-term benefits, this is the best open-ended fund. It could be a high-risk investment for the short term, but it more than makes up for it in the long term.

Index schemes follow passive investment strategies and benchmark indices such as Sensex and Nifty. Another type of open-ended funds is sectoral funds invested in specific sectors such as IT, pharmaceuticals, or capital market segments such as small, medium, and large caps. The risks are high, but so are the returns.

Another type of open-ended scheme is tax saving, which offers long-term opportunities and tax benefits. Called Equity Linked Savings schemes, they have a 3-year lock-in period.

Balanced funds are open-ended funds that enjoy growth and income at regular intervals and are perfect for investors who are cautious yet risk-taking.

Closing the Investment Gap Safely: Close-Ended Mutual Fund Schemes

Close-ended mutual funds have a stipulated maturity period, and investors can invest during the New Fund Offer period for a limited time. These are protective mutual funds that invest and guard capital simultaneously. A close-ended mutual fund is capital protection. The principal remains secure in this kind of fund while receiving acceptable returns. This mutual fund actively invests in high-quality fixed-income securities with limited exposure to equities.

Fixed Maturity Plans, or FMPs, are mutual fund schemes within a specific maturity period. Schemes include debt instruments that mature in line with a particular period and earn interest components of securities within a portfolio. Investors refer to the interest component of fixed-income securities as coupons. Passive functioning characterizes fixed maturity plans, which incur lower costs than actively managed plans.

Interval Mutual Funds: Best of Both Worlds

Operating within the combination of open and close-ended schemes, they allow investors to trade units at predetermined intervals.

Managing the Mutual Fund: Active Versus Passive Distinction

Actively managed funds mean there are active attempts by the portfolio manager to outperform the market or trade benchmarks. Passive management includes holdings where the securities measure and replicate the mutual fund’s performance of benchmark indexes.

One of a Kind: Specialty Funds

Certain mandates, such as social causes, commodities, and real estate, are associated with these funds. An example of this kind of mutual fund is social or ethical investing. The fund invests in mutual fund companies that promote environmental stewardship, human rights, and inclusion while avoiding the defense, military, gambling, or alcoholic beverages industries.

Funds of Funds: The Bigger Picture

These funds invest in other funds and are similar to balanced funds. They have higher MER as against stand-alone mutual funds.

The Philosophy of Investing: Many Approaches

Portfolio managers follow different investment philosophies and styles of investing to meet a fund’s investment objectives. Funds with different investment styles permit diversification beyond the type of investment and are a good means of reducing risk.

- Top-Down Approach: This approach towards investing looks at the larger economic picture and invests in specific companies that look set to perform well in the long term.

- Bottom-Up Approach: This focuses on choosing specific companies that perform well regardless of the state of the industry and/or economy.

- A blend of the two generally follows portfolio managers overseeing a global portfolio.

- Technical analysis is another style of investing that relies on past market data to detect the direction of investment prices.

Around the World: Mutual Funds by Region

Global or international funds are those where the investor invests anywhere in the world. The benefit of these funds is that they are a component of a well-balanced portfolio that carries country and political risks while reducing risk through diversification.

Image source: pixabay.comInvestment firms target specific sectors of the economy, including health, finance, and biotechnology with sector funds. It is a mutual fund scheme that is extremely risky and immensely profitable.

Regional funds focus on certain parts of the world, like a particular region or nation. These mutual fund stocks make investing easier in foreign countries, but you have to be ready for a high percentage of losses. Local factors tend to be very influential in deciding the fate of such mutual funds. From political leadership to economic status, the region’s dynamics affect the mutual fund and the money made from it.

Conclusion

Image source: pixabay.com Rob Chernow said that the best part about mutual funds is that they offer safety and diversification but do not necessarily offer diversification or safety.Many analysts have discussed how mutual funds are subject to risks, and the offer document is an important consideration. Mutual funds have a risk-reward trade-off whereby the higher the risk, the greater the reward.

The only trick is minimizing the risk and maximizing the gains. But the catch is that reward is only possible where there is a risk. Mutual funds are an investment that is just as risky as futures trading. The only difference is that you are entrusting the capital to a portfolio manager who is a skilled professional adept at getting the rewards without incurring the risks. Choosing the right mutual fund and how to invest in mutual funds can have immediate and long-term financial repercussions. Cash is a fact, but profit is an opinion. Mutual funds make that opinion a certainty.

Recommended Articles

Here are some articles that will help you to get more details about the Mutual Fund, so just go through the link.