Introduction to Digital Yuan

Digital currencies, led by China’s e-CNY or digital yuan, have significantly impacted the financial world in recent years. This article aims to dive into the origins, technology, benefits, challenges, and global implications of e-CNY, shedding light on its important role in reshaping the future of finance. The digital yuan presents various investment opportunities, but investors must educate themselves before diving in. A valuable resource for learning about investing in this market is Yuan International.

The Birth of the Digital Yuan

1. Historical Background of Digital Yuan

China’s interest in digital currencies dates back to the early 2010s, spurred by a desire to modernize its financial system and reduce reliance on traditional banking channels. This initiative gained momentum with the rise of cryptocurrencies like Bitcoin, showcasing blockchain technology’s potential.

2. Motivations Behind Digital Yuan

The development is derived from various reasons, including the desire to combat money laundering, improve financial inclusion, and consolidate control by the central government. Additionally, China viewed e-CNY as a strategic move to lessen reliance on the U.S. dollar in international trade.

3. Key Steps in Digital Yuan Development

The journey of the e-CNY involved important milestones such as establishing the Digital Currency Research Institute, initiating pilot programs across different cities, and collaborating with major Chinese banks and businesses. These steps served as the building blocks for the evolution of the digital yuan.

Technology Behind the Digital Yuan

1. Blockchain and DLT

The e-CNY stands out from cryptocurrencies like Bitcoin and Ethereum because it doesn’t use public blockchains. Instead, it operates on a centralized, permissioned blockchain managed by the People’s Bank of China (PBOC), providing a higher level of control and stability.

2. Role of Central Banks

Central banks globally are exploring digital currencies, with China taking a leading role. The People’s Bank of China (PBOC), as the central bank, plays an important role in issuing, regulating, and overseeing the e-CNY.

3. Features and Capabilities

The e-CNY is a versatile digital currency with features like instant transactions, off payments, and programmable money. It also integrates with existing financial systems, making it easier for people to adopt.

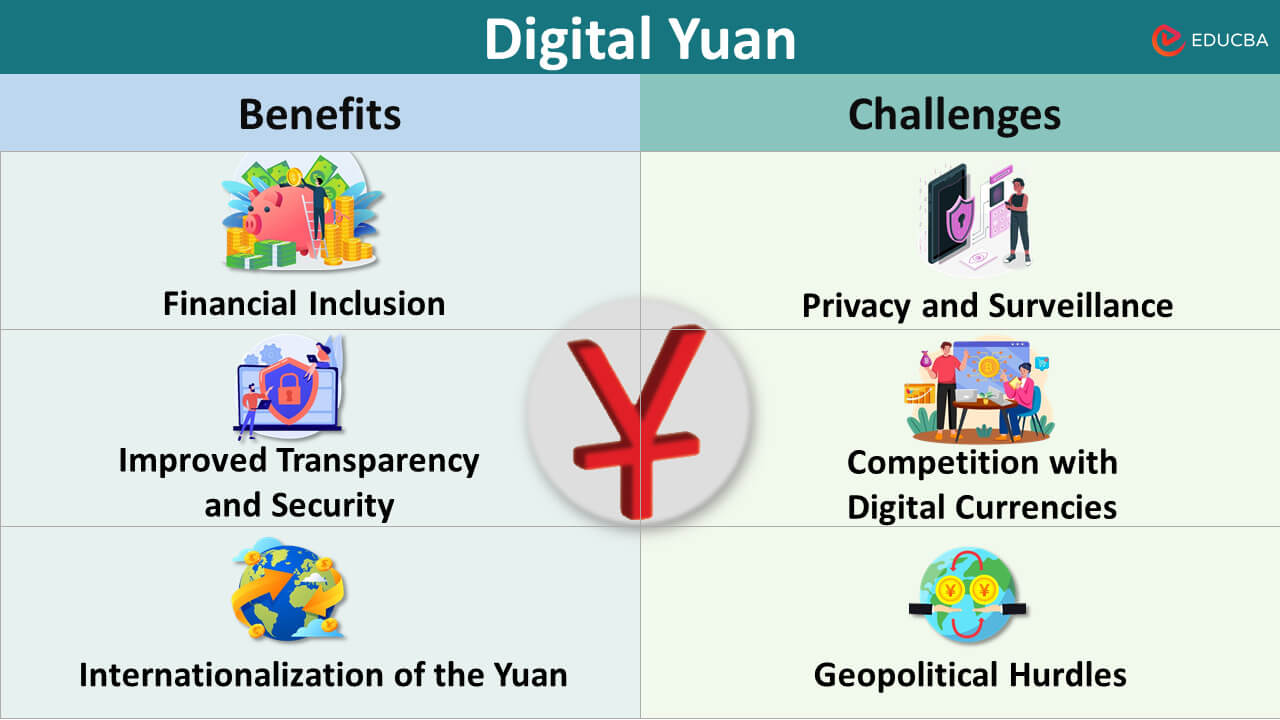

Benefits of a Digital Yuan

The Digital Yuan represents a digitized form of China’s official currency, the renminbi (RMB). Here are some potential advantages linked to the integration of the Digital Currency:

1. Financial Inclusion

Digital currencies can improve financial inclusion by providing access to various financial services for unbanked or underbanked individuals. The Digital Yuan could be more accessible to a broader population range.

2. Improved Transparency and Security

Blockchain technology makes transactions transparent and traceable, reducing fraud and corruption risks. Moreover, the e-CNY incorporates cutting-edge security measures.

3. Internationalization of the Yuan

It facilitate cross-border transactions, potentially challenging the dominance of the U.S. dollar in global trade and finance.

Challenges of a Digital Yuan

The Digital Yuan presents several potential benefits, but its implementation also faces various challenges. Here are some of the challenges associated it:

1. Privacy and Surveillance

The centralized nature of the e-CNY raises concerns about privacy and surveillance. The government can track transactions, raising questions about individual financial autonomy.

2. Competition with Existing Digital Currencies

The e-CNY will face competition from cryptocurrencies like Bitcoin and stablecoins like USDC. Striking a balance between control and innovation is a challenge for China.

3. Regulatory and Geopolitical Hurdles

China’s aggressive push into the digital currency space has raised concerns among other nations and international organizations. Balancing national interests with global cooperation is vital.

Testing and Rollout of Digital Yuan

Here is a general overview of the testing and rollout:

- The e-CNY underwent extensive testing in pilot programs across cities like Shenzhen and Suzhou. These trials provided valuable insights and feedback.

- Following successful trials, China expanded e-CNY testing to more regions and industries, including transportation, retail, and hospitality.

- The e-CNY is gradually integrating with existing payment systems and financial infrastructure, increasing its usability and accessibility to the public.

International Implications of Digital Yuan

The Digital Yuan is China’s central bank digital currency (CBDC), and it has important global implications. It could affect different aspects of worldwide finance and economics. Here are some potential international implications associated with it:

- The Digital currency (e-CNY) has the potential to reshape global trade and finance by challenging the dominance of the U.S. dollar.

- If widely accepted, it could become a reserve currency. This might impact global economic stability, trade balances, and exchange rates.

- Other countries and central banks closely monitor China’s digital currency initiatives, prompting some nations to explore their digital currencies.

- The dynamics of cooperation and competition among central banks will shape the future of digital currencies on the global stage.

- The impact of the Digital Yuan on international finance and trade remains a key consideration for countries worldwide.

Future Outlook of Digital Yuan

The future outlook is one of continued development, with potential implications for both domestic and international financial landscapes. The following trends and considerations could shape the future of the Digital Yuan:

- The e-CNY is expected to gain more users, potentially going global based on geopolitical and regulatory changes.

- As China refines its digital currency policies, it aims to balance innovation, regulatory control, and international collaboration.

- The e-CNY’s success or failure will significantly influence the future of digital currencies, prompting further innovation and adaptation in the financial industry.

Final Thoughts

In conclusion, the digital yuan, or e-CNY, is China’s ambitious venture into digital currency. Motivated by various factors and historical context, its development has brought technological advancements and potential benefits and challenges. The e-CNY’s evolving impact on the global financial landscape and the future of digital finance is uncertain but undeniably significant. The world closely watches as China reimagines the yuan’s role in the digital age.

Recommended Articles

If you found this article useful, please check out the following recommendations: