Updated November 23, 2023

Diluted EPS Formula (Table of Contents)

Diluted EPS Formula

Where,

Convertible Securities = Convertible preferred shares + Convertible debt + Stock options + warrants

Examples

Suppose Company ABC has the following structure of shares and dilutive securities at the end of a fiscal year:

- Weighted average Common shares outstanding: 800,000

- Convertible preferred shares: 10,000, convertible into 5 shares of common stock each and paying a dividend of $10 per share

- Convertible debt: $20,000 of 5% bonds convertible into 5,000 shares

- Stock Options outstanding at the beginning of the year: 10,000 with an exercise price of $45 (Average market price of company shares during the year was $55 per share)

- Net Income before preferred dividend=$2,000,000, tax rate 25%

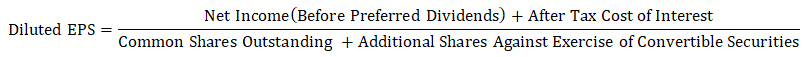

| Particulars ($) | Basic EPS | Diluted EPS |

| Net income | 20,00,000 | 20,00,000 |

| Less: Preferred Dividend | 1,00,000 | – |

| Add: After-tax cost of interest. | – | 750 |

| Numerator | 19,00,000 | 20,00,750 |

| Weighted average number of common shares outstanding | 8,00,000 | 8,00,000 |

| Additional shares are issued if preferred shares converted | – | 50,000 |

| Additional shares are issued if the debt is converted. | 5,000 | |

| Additional shares issued If options are exercised (in-the-money) | – | 181.8 |

| Denominator | 8,00,000 | 8,56,818 |

| EPS | 2.38 | 2.34 |

- Diluted EPS = (20,00,000 + 750) / (8,00,000 + 50,000 + 5,000 + 1,818)

- Diluted EPS = 20,00,750 / 8,56,818

- Diluted EPS = 2.34

Explanation of Diluted EPS Formula

- Definition: Diluted EPS represents a company’s earnings performance (income per share), assuming all its dilutive convertible securities are exercised. Convertible securities could be preferred shares, debentures, unexercised stock options, and warrants. Diluted EPS considers what would happen if the holder exercises the dilutive securities. Since dilutive securities effectively increase the number of shares outstanding, EPS falls.

- Dilutive vs Antidilutive securities: Each of these convertible securities needs to be dilutive, which means that their inclusion in the computation of diluted EPS should not yield a higher EPS value than basic EPS.

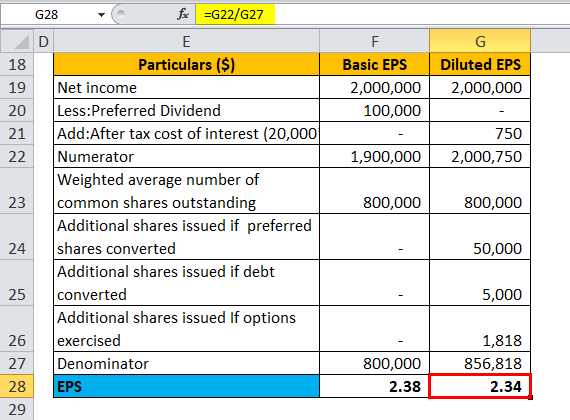

For example, consider Company AD has the following structure of shares and convertible securities at the end of a fiscal year:

- Weighted average Common shares outstanding: 800,000

- Convertible preferred shares: 10,000, convertible into 3 shares of common stock of each and paying a dividend of $10 per share

- Net income before preferred dividend=$2,000,000

| Particulars ($) | Basic EPS | Diluted EPS, if converted |

| Net income | 20,00,000 | 20,00,000 |

| Less: Preferred Dividend | 1,00,000 | – |

| Numerator | 19,00,000 | 20,00,000 |

| Weighted average number of common shares outstanding | 8,00,000 | 8,00,000 |

| Additional shares are issued if preferred shares converted | – | 30,000 |

| Denominator | 8,00,000 | 8,30,000 |

| EPS | 2.38 | 2.41 |

Diluted EPS Formula = Net Income(Before Preferred Dividends)+After Tax Cost of Interest / (Common Shares Outstanding +Additional Shares Against Exercise of Convertible Securities)

- Diluted EPS = (20,00,000 + 0) / (8,00,000 + 30,000)

- Diluted EPS = 20,00,000 / 8,30,000

- Diluted EPS = 2.41

Since Diluted EPS (if preferred are converted) exceeds basic EPS, these convertible preferred shares are anti-dilutive and will not be included in the computation of diluted EPS. Hence, diluted EPS is always less than or equal to basic EPS.

- Computation for convertible preferred shares/debentures: In these cases, diluted EPS is calculated using the if-converted method, which assumes that the securities had been converted at the beginning of the year.

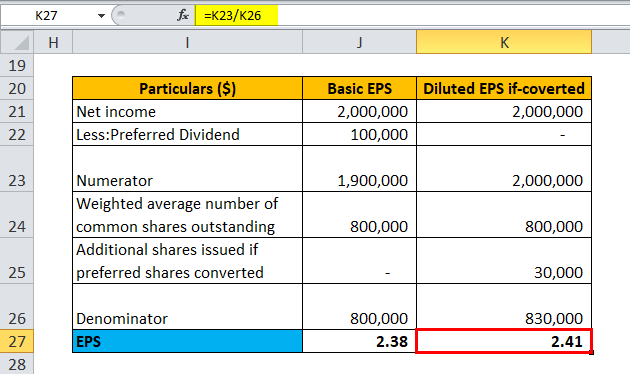

For preferred shares, after conversion, there would be no preferred shares outstanding; hence no preferred dividends would be given, and additional common shares would be issued, which would increase common shares’ outstanding value. Consider the above example of company ABC assuming only convertible preferred shares are there, and other convertibles are absent. The computation would be as follows:

| Particulars | Basic EPS | Diluted EPS |

| Net income | 20,00,000 | 20,00,000 |

| Less: Preferred Dividend | 1,00,000 | – |

| Numerator | 19,00,000 | 20,00,000 |

| Weighted average number of common shares outstanding | 8,00,000 | 8,00,000 |

| Additional shares are issued if preferred shares are converted | – | 50,000 |

| Denominator | 8,00,000 | 8,50,000 |

| EPS | 2.38 | 2.35 |

Diluted EPS Formula = Net Income(Before Preferred Dividends)+After Tax Cost of Interest / (Common Shares Outstanding +Additional Shares Against Exercise of Convertible Securities)

- Diluted EPS = (20,00,000 + 0) / (8,00,000 + 50,000)

- Diluted EPS = 20,00,000 / 8,50,000

- Diluted EPS = 2.35

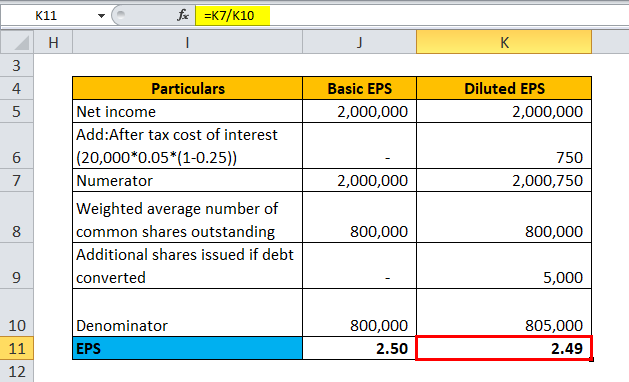

There would be additional common shares if conversion takes place for convertible debentures. At the same time, the company will not pay any interest on the convertible debt, meaning that net income will increase by the post-tax amount of interest payment. Consider the above example of company ABC assuming only convertible debt is there and other convertibles are absent. The computation would be as follows:

| Particulars | Basic EPS | Diluted EPS |

| Net income | 20,00,000 | 20,00,000 |

| Add: After-tax cost of interest

(20,000*0.05*(1-0.25))*** |

– | 750 |

| Numerator | 20,00,000 | 20,00,750 |

| Weighted average number of common shares outstanding | 8,00,000 | 8,00,000 |

| Additional shares are issued if debt is converted | – | 5,000 |

| Denominator | 8,00,000 | 8,05,000 |

| EPS | 2.50 | 2.49 |

*** Tax rate-25%, interest rate-5%, debt-$20,000

Diluted EPS Formula = Net Income(Before Preferred Dividends)+After Tax Cost of Interest / (Common Shares Outstanding +Additional Shares Against Exercise of Convertible Securities)

- Diluted EPS = (20,00,000 + 750) / (8,00,000 + 5,000)

- Diluted EPS = 20,00,750 / 8,05,000

- Diluted EPS = 2.49

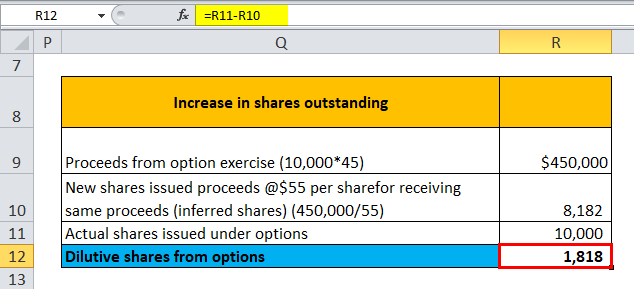

- Computation for stock options and warrants: Under IFRS, shares outstanding are calculated by an increase for an excess of many newly converted shares over and above the no of “inferred” shares that would have to be issued at the average market price of the period for receiving the conversion proceeds. Consider the above example of company ABC assuming only unexercised stock options exist and other convertibles are absent. The computation would be as follows:

| Increase in shares outstanding | |

| Proceeds from option exercise (10,000*45) | $4,50,000 |

| New shares issued proceeds @$55 per share for receiving same proceeds (inferred shares) (450,000/55) | 8,182 |

| Actual shares issued under options | 10,000 |

| Dilutive shares from options | 1,818 |

Dilutive shares from options = Actual shares – New shares issued

- Dilutive shares from options = 10,000 – 8,182

- Dilutive shares from options = 1,818

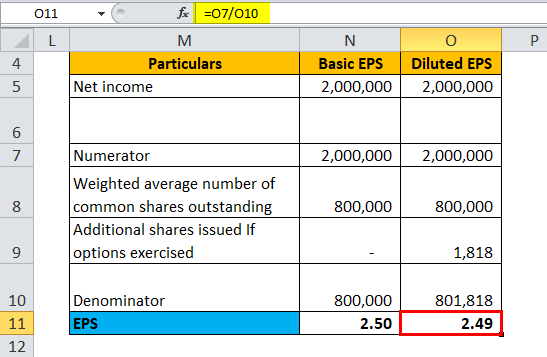

| Particulars | Basic EPS | Diluted EPS |

| Net income | 20,00,000 | 20,00,000 |

| Numerator | 20,00,000 | 20,00,000 |

| Weighted average number of common shares outstanding | 8,00,000 | 8,00,000 |

| Additional shares are issued If options are exercised | – | 1,818 |

| Denominator | 8,00,000 | 8,01,818 |

| EPS | 2.50 | 2.49 |

Diluted EPS Formula = Net Income(Before Preferred Dividends)+After Tax Cost of Interest / (Common Shares Outstanding +Additional Shares Against Exercise of Convertible Securities)

- Diluted EPS = (20,00,000 + 0) / (8,00,000 + 1,818)

- Diluted EPS = 20,00,000 / 8,01,818

- Diluted EPS = 2.49

Only in-the-money options may be considered for dilution since they will most likely be exercised. The options are considered in the money if the exercise price is lower than the average market price during the specified period used for computing EPS.

Significance and Use of Diluted EPS Formula

- Complex capital structure and conservatism: Most companies have a complex capital structure consisting of securities with conversion options for which the companies are committed to issuing additional shares in the future. A complex capital structure is specially maintained to lower the cost of capital. For example, financial institutions lending convertible debt would charge lower interest than equivalent non-convertible debt. When assessing a company’s financial health, however, it is more appropriate to take the more conservative diluted EPS, assuming all conversions are exercised, although it is unlikely that all conversions will occur simultaneously.

- The difference in basic and diluted EPS: Most analysts and investors are critical of the big difference between basic and diluted EPS. This means the company has a very complex capital structure and significant commitments should the exercise materialize. Another point to note is the actual difference figure. A $0.1 difference between the two EPS may not be as significant in the case of $10 million outstanding shares as in the case of $10 billion outstanding shares. In the former case, $1 million is not available to exist, investors, while in the latter case, it is $1000 million.

- Diluted EPS vs Basic EPS for comparison: Diluted EPS and basic EPS are the same for a simple capital structure with no conversion options. When comparing with a complex capital structure, it is more appropriate to use Diluted EPS to facilitate an “apple to apple” comparison across time and peers.

- Impact on company’s P/E and other valuation measures: Diluted EPS adversely impacts the P/E ratio, so shareholders generally dislike companies issuing dilutive securities. Again, analysts find it is less difficult to calculate P/E using a total market cap in the numerator and total earnings in the denominator in case of a complex capital structure rather than checking for each conversion in the financial statements.

Diluted EPS Formula Calculator

You can use the following Diluted EPS Formula Calculator

| Net Income | |

| After Tax Cost of Interest | |

| Common Shares Outstanding | |

| Additional shares issued if preferred shares converted | |

| Additional shares issued if debt converted | |

| Additional shares issued If options exercised (in-the-money) | |

| Diluted EPS Formula = | |

| Diluted EPS Formula = |

| |||||||||

|

Diluted EPS Formula in Excel (With Excel Template)

Here, we will do the same example of the Diluted EPS formula in Excel. It is very easy and simple.

You can easily calculate the Diluted EPS using the Formula in the template provided.

Example #1

Example #2

Example #3

Example #4

Example #5.1

Example #5.2

Recommended Articles

This has been a guide to a Diluted EPS formula. Here, we discuss its uses along with practical examples. We also provide a Diluted EPS Formula Calculator with a downloadable Excel template. You may also look at the following articles to learn more –