Updated July 24, 2023

Dilution Formula (Table of Contents)

What is the Dilution Formula?

The term “dilution” refers to the situation where the company’s existing shareholder’s ownership percentage reduces due issuance of new shares by that company.

In other words, with the increase in the number of new shares issued, the percentage shareholding of the existing shareholders will decrease if they don’t buy the new shares. It is also known as equity or stock dilution.

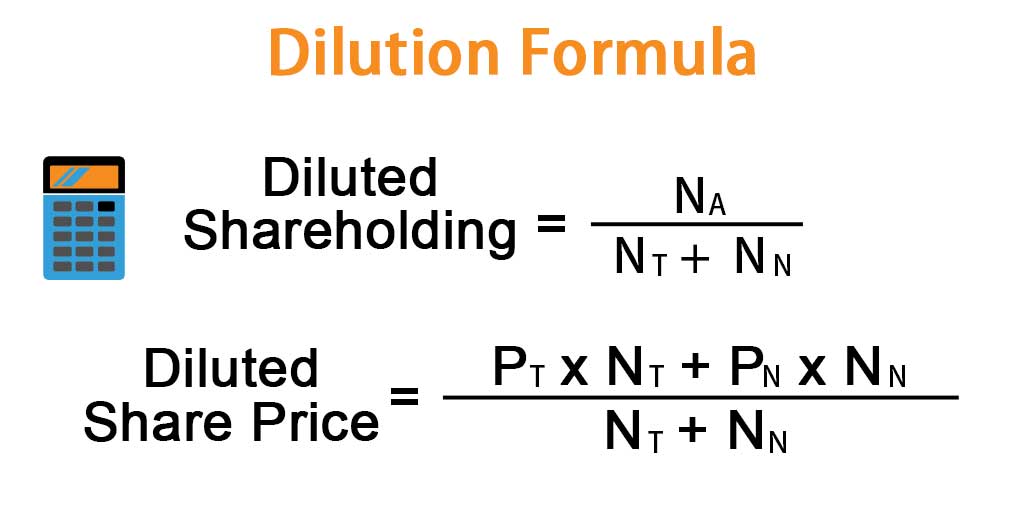

The formula for a diluted shareholding of an existing shareholder (say A) can be expressed as the number of existing shares held by A divided by the sum of the total number of existing shares and the total number of new shares issued. Mathematically, it represents as,

where,

- NA = Number of Existing Shares of A

- NT = Total Number of Existing Shares

- NN = Total Number of New Shares

Further, the diluted share price formula expresses a weighted average of existing and new shares, as shown below.

where,

- PT = Current price of existing shares

- PN = Issue price of new shares

Examples of Dilution Formula (With Excel Template)

Let’s take an example to understand the calculation of Dilution in a better manner.

Dilution Formula – Example #1

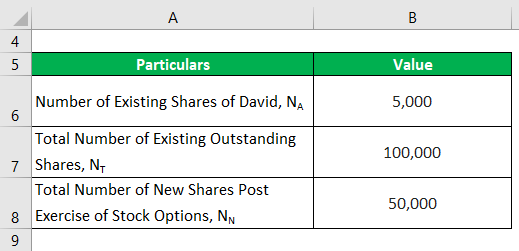

Let us take the example of Tuber Inc., wherein the company issued 50,000 stock options to some of its employees. David, one of the company’s non-employee stockholders, currently has 5,000 shares out of the total outstanding shares of 100,000. Now, calculate David’s diluted shareholding if the company’s employees exercise their stock options.

Solution:

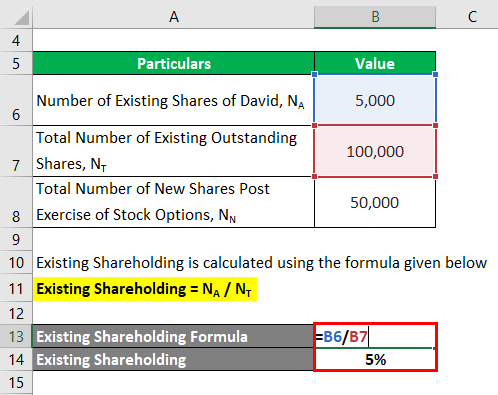

Existing Shareholding calculates by using the formula given below

Existing Shareholding = NA / NT

- Existing Shareholding = 5,000 / 100,000

- Existing Shareholding = 5%

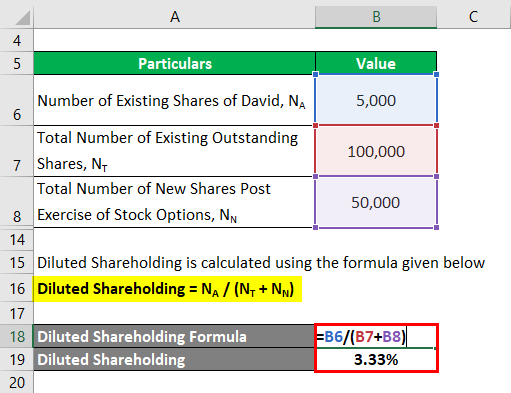

Diluted Shareholding calculates by using the formula given below

Diluted Shareholding = NA / (NT + NN)

- Diluted Shareholding = 5,000 / (100,000 + 50,000)

- Diluted Shareholding = 3.33%

Therefore, the shareholding of David expects to dilute from 5% to 3.33% in case all the stock options are exercised.

Dilution Formula – Example #2

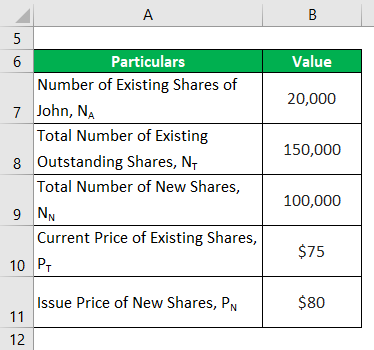

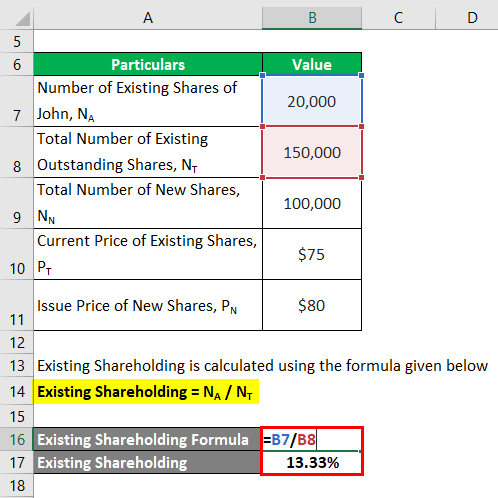

Let us take the example of another company scheduled to undertake a capex plan funded by issuing additional 100,000 shares. Currently, John holds 20,000 shares out of the total of 150,000 outstanding shares of the company and has no plans to purchase the new shares. Calculate the diluted shareholding of John post new shares issuance. Also, compute the diluted share price if the current price is $75 per share and the new shares are expected to be issued at $80 per share.

Solution:

Existing Shareholding calculates by using the formula given below

Existing Shareholding = NA / NT

- Existing Shareholding = 20,000 / 150,000

- Existing Shareholding = 13.33%

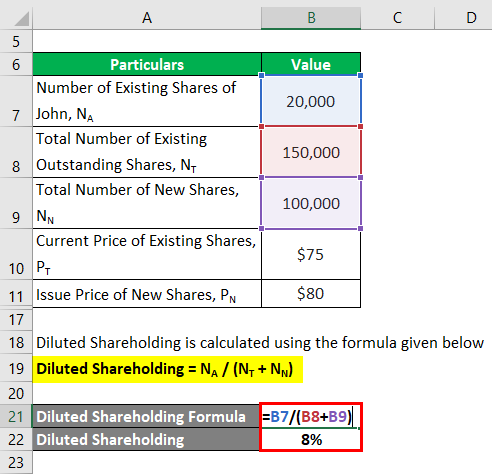

Diluted Shareholding calculates by using the formula given below

Diluted Shareholding = NA / (NT + NN)

- Diluted Shareholding = 20,000 / (150,000 + 100,000)

- Diluted Shareholding = 8%

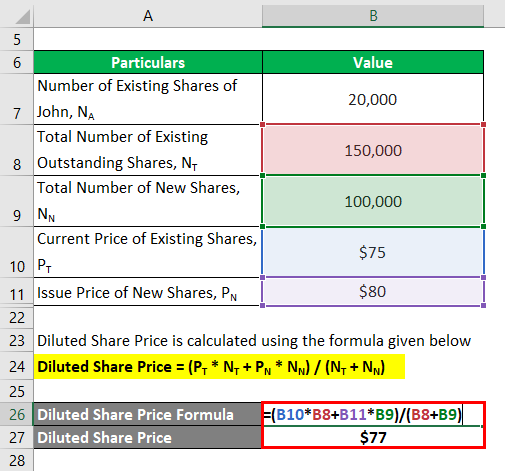

Diluted Share Price calculates by using the formula given below

Diluted Share Price = (PT * NT + PN * NN) / (NT + NN)

- Diluted Share Price = ($75 * 150,000 + $80 * 100,000) / (150,000 + 100,000)

- Diluted Share Price = $77 per share

Therefore, the shareholding of John is expected to dilute from 13.33% to 8%, while the share price is expected to increase from $75 per share to $80 per share with the new issuance.

Explanation

The formula for dilution derives by using the following steps:

Step 1: First, determine the number of shares the subject shareholder holds (A in this case), and NA denotes it.

Step 2: Next, determine the total number of shares of the company before the issuance of new shares, and NT denotes it.

Step 3: Next, determine the number of new shares issued by the company, and NN denotes it.

Step 4: Finally, the formula for a diluted shareholding of shareholder A can be derived by dividing the number of existing shares held by A (step 1) by the sum of the total number of existing shares of the company (step 2) and a total number of new shares issued (step 3) as shown below.

Diluted Shareholding of A = NA / (NT + NN)

Relevance and Use of Dilution Formula

The concept of dilution primarily revolves around the stock ownership in a company. The number of outstanding shares in the stock market is known as the “float”. The concept of dilution comes into play when a company issues additional stock, usually through a secondary offering. Thus, the existing shareholders’ ownership stake in the company, who bought the shares during its initial offering, becomes smaller.

Dilution Formula Calculator

You can use the following Dilution Formula Calculator

| NA | |

| NT | |

| NN | |

| Diluted Shareholding of A | |

| Diluted Shareholding of A = | NA / (NT + NN) | |

| 0 / (0 + 0) = | 0 |

Recommended Articles

This is a guide to the Dilution Formula. Here we discuss how to calculate the Dilution Formula along with practical examples. We also provide a Dilution Formula calculator with a downloadable Excel template. You may also look at the following articles to learn more –