Difference Between Direct Cost vs Indirect Cost

Businesses incur costs while generating revenue. If we look at the cost sheet of the company, we will see that total cost is a combination of direct cost vs indirect cost. These costs are very important for running any kind of business.

A direct cost is attributable to a specific product or service. For example, the cost of raw materials utilized in manufacturing a product represents a direct cost. An indirect cost, on the other hand, is a cost that cannot be directly attributed to a single cost objective but rather is identified with two or more final cost objectives or intermediate cost objectives.

In this Direct cost vs Indirect Cost article, we will try to understand the comparative analysis between direct cost vs indirect cost:

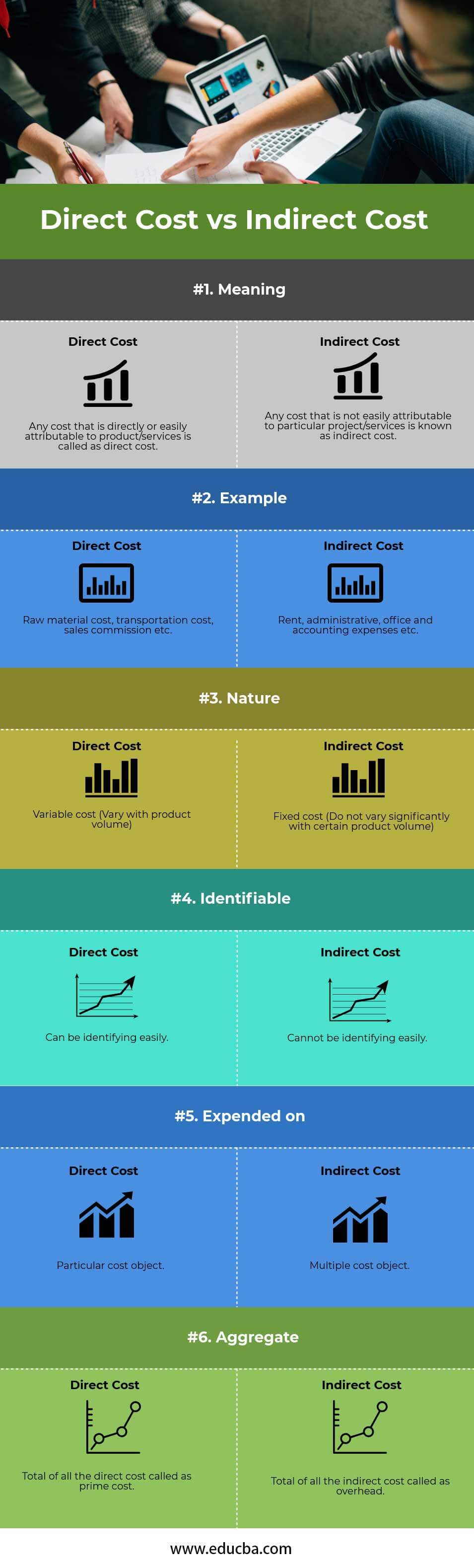

Head To Head Comparison Between Direct Cost vs Indirect Cost (Infographics)

Below is the top 6 difference between Direct cost and Indirect Cost

Key Differences

Both are part of the total costs; let us discuss some of the major differences:

- A direct cost is a specialized cost that only uses variable costs to make decisions. It does not consider fixed costs, which are assumed to be associated with time periods in which they are incurred. Indirect costs use only fixed costs to make decisions.

- Comparing changes in the cost to changes in the associated cost object is the best method for determining whether a cost is direct. Indirect costs, on the other hand, encompass costs that multiple activities use and cannot assign to specific cost objects.

- The direct cost concept is extremely useful for short-term decisions but can lead to adverse results if used for long-term decision-making, as it does not include all costs that may apply to long-term decisions. On the other hand, the indirect cost concept is useful for short-term and long-term decision-making. Indirect costs are those necessary to keep your business in operation.

- Direct costs vary significantly within certain product volumes and are therefore considered variable. Conversely, indirect costs do not vary significantly within certain product volumes or other activity indicators and are therefore considered fixed costs.

- The operating leverage concept measures a company’s composition of fixed and variable costs in total cost. Suppose a large portion of the company’s costs is fixed cost (indirect cost). In that case, it has high operating leverage, and the company can earn a large profit on each incremental sale, but it must attain sufficient sales volume to cross the breakeven point. On the other hand, if a large portion of the company’s costs consists of variable (direct costs), the company has low operating leverage, resulting in a smaller profit earned on each incremental sale. Still, it does not have to generate much sales volume to cover its lower fixed cost.

- Direct costs are easily traceable as per the cost object. Identifying indirect costs, however, is not easy.

- As an example, we can say that direct costs are the costs incurred for the raw material used in product manufacturing. Since one can directly attribute how much expenses are per unit of raw material, we call it direct cost. On the other hand, the organization incurs administration expenses as an indirect cost, representing a cost for the organization as a whole.

Direct Cost vs Indirect Cost Comparison Table

Below is the important comparison between Direct cost vs indirect cost

| Basic Comparison |

Direct Cost |

Indirect Cost |

| Meaning | A direct cost is a cost directly or easily attributable to a product or service. | Any cost not easily attributable to a particular project/service is indirect. |

| Example | Raw material cost, transportation cost, sales commission, etc. | Rent, administrative, office, and accounting expenses, etc. |

| Nature | Variable cost (Vary with product volume) | Fixed cost (Do not vary significantly with certain product volumes) |

| Identifiable | Identifying it is easy. | It is not easily identifiable. |

| Expended on | Particular cost object. | Multiple cost object. |

| Aggregate | Prime cost is the total of all direct costs. | Overhead is the total of all indirect costs. |

Conclusion

Understanding the difference between direct and indirect costs is crucial for business operations. Because while operating a business, if you don’t know how to allocate costs and attribute them properly, it would be very difficult to determine the profit per unit after selling products or services.

Identifiable direct costs are useful for making short-term decisions but cannot be employed for long-term decisions since they do not encompass all other costs that might apply to such decisions. Therefore, the main challenge while operating a business is indirect costs. Indirect costs are unidentifiable costs; the business can see how much it can expand on a long-term basis, and then it can measure the profits.

Recommended Articles

This has been a guide to the top difference between Direct cost vs indirect cost. Here we also discuss the Direct cost vs indirect cost key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.