All About the Direct Tax vs Indirect Tax

In Direct tax vs. Indirect tax, a direct tax is when the government directly takes money from an individual or company’s income. In contrast, an indirect tax is the money that the government collects when anyone sells or purchases goods/services.

Direct Tax vs Indirect Tax

As they say, nothing is certain except death and taxes. Since we would like to focus on the more cheerful of these two options, let’s talk of taxation. Taxes come in various avatars. They include sales tax, income tax, service tax, corporate tax, and many others. There are so many taxes that an average person often doesn’t even know he/she is paying for one.

In this article, we will discuss the following:-

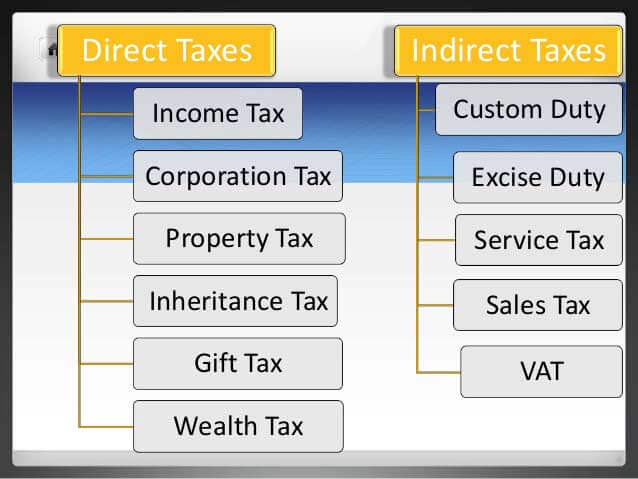

- Direct Tax vs Indirect Tax Infographics

- Direct taxes

- Indirect taxes

- Distribution – Direct tax vs Indirect tax

- Examples of Key direct taxes

- Examples of Key Indirect Taxes

- Highlights of direct tax

- Highlights of indirect tax

- Why are taxes necessary?

- Conclusion – Direct tax vs Indirect tax

The 2016 Union Budget is just around the corner, and like all years, there’s a lot of noise regarding taxes. Well, taxes don’t merely mean your income tax. While income tax is an example of direct tax, we don’t see indirect taxes.

The most fundamental direct and indirect tax classification is based on who collects them from the taxpayer.

Here’s how the two Direct tax vs Indirect tax differ.

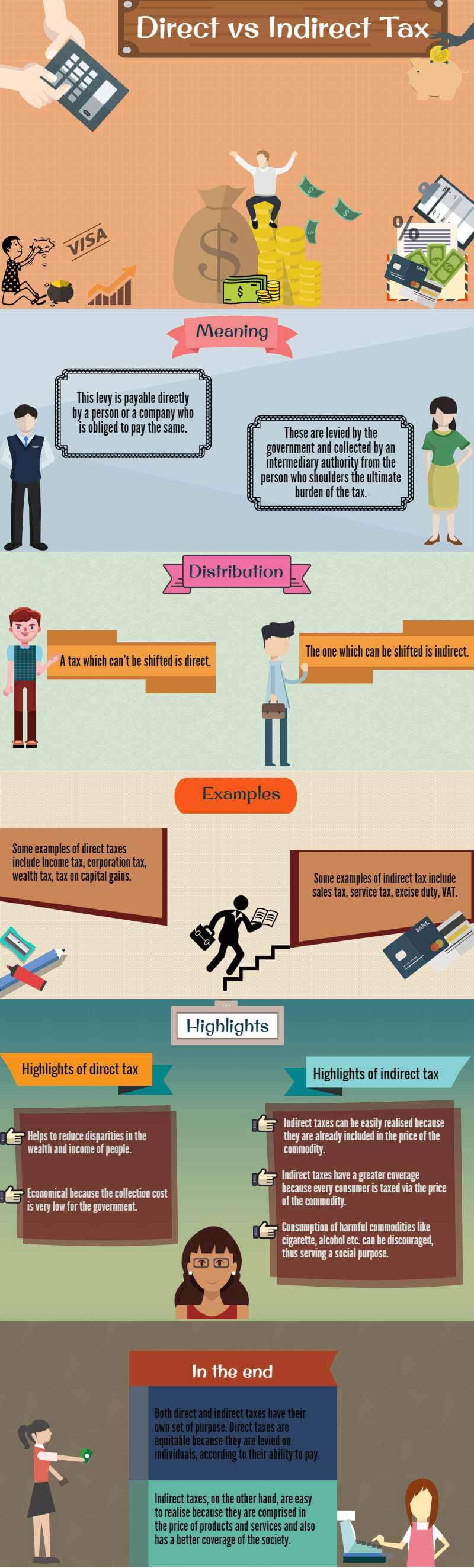

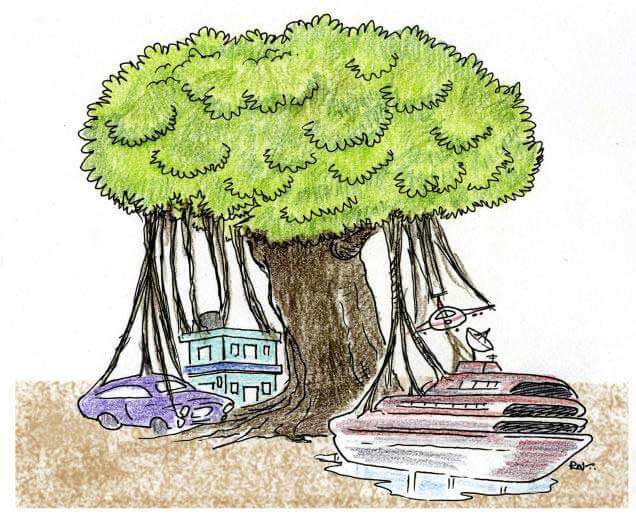

Direct Tax vs Indirect Tax Infographics

Direct Taxes

It may include income from salary, house property, professional or business income, capital gains, and income from other sources, like the savings account or recurring deposit interests. The tax liability depends on the gender and residential status of a person subject to tax.

Indian companies must pay taxes on their earned income, both within the country and overseas, as mandated by law. In contrast, in the case of non-resident companies, the tax must be paid on the money earned in India.

Property tax, applied according to the rules in the state, must be paid by house owners. Finally, individuals must pay tax on gifts that exceed ₹50,000 per annum.

The responsibility to declare income to calculate the direct tax liability is on the individual. Non-payment or evasion could lead to heavy penalties.

Indirect Taxes

Indirect taxes can result in an increase in the total amount payable for certain products or services. The tax on a product may be shown separately from the product’s price or included in the price, such as the service tax on food bills being displayed separately, while the tax on petrol is included in the product’s price.

There are various forms of indirect tax, including customs duty on imported and exported goods, excise duty on goods and services produced domestically, service tax on services, value-added tax (VAT) applied at each stage of sale, and securities transaction tax on stock exchange transactions. These taxes are indirect because they can be passed on to another party. They are first levied at the manufacturer level and eventually borne by the final consumer.

Distribution – Direct Tax vs Indirect Tax

The gist of direct and indirect tax distribution lies in the shifting. A tax that can’t be shifted is direct, and the one which can be shifted is indirect. While the conventional distinction between a direct and indirect tax is logical enough, it’s very difficult to apply in practice. It calls for a fair knowledge of people’s behavior on indirect tax payments.

You can’t categorize it as indirect or direct unless you know whether the tax has shifted from an immediate payer to someone else. Difficulties may arise when the tax is imposed in a way that some of it is shifted to others while some is borne by the individual.

Does it mean that a tax can be partly indirect or direct? Surely not. It’s better to put it this way that a possibility of shifting to any degree may be regarded as a condition for indirect tax. On the other hand, the absence of shifting may be considered a direct tax.

Economic experts differentiate between direct and indirect taxes based on the point of assessment. Critics criticize indirect taxes for their regressive nature, as they are collected regardless of financial position. They impact lower-income families more, especially when applied to essentials like medicine or food, as they are based on spending rather than income.

Proponents of direct and indirect taxes argue that direct taxes penalize higher-income households because they require these households to pay a higher percentage of their income as taxes, potentially leading to tax avoidance. They also argue that sales tax provides more discretion to taxpayers, as they can control their consumer spending to manage the amount of tax paid.

Examples of Key Direct Taxes

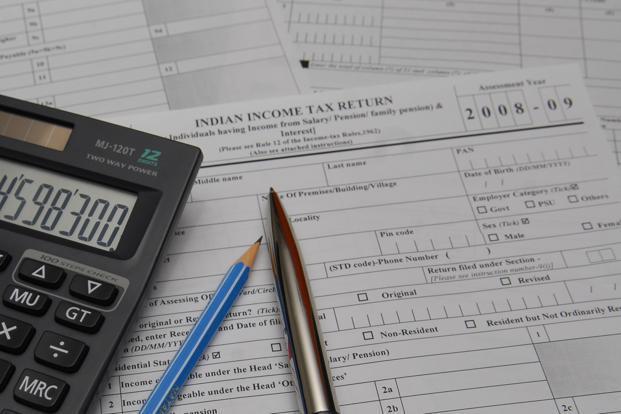

Income Tax

Every so often, the working population of a country jointly celebrates the freedom, power, and liberty that come with being rewarded for a job well done. The gut-twisting excitement and warmth of achievement usually come at different times, via different channels, for different sections of society. But all categories of earners have two things in common: the feeling of success and achievement and the slight tinge of sadness when they realize that the amount they earned isn’t what they expected because of the income tax they must pay.

(Image source: pixabay.com)

Individuals pay income tax based on stable income during a specific financial year. According to the Income Tax Act, “individuals” include HUFs, trusts, cooperative societies, and all artificial judicial persons. Taxable income means the total earned income minus all applicable exemptions and deductions. Income tax is paid by individuals when their net income exceeds the minimum taxable limit, and it is calculated based on the varying rates announced in the Union Budget for each slab in a financial year.

Corporation Tax

Businesses and companies operating within the country pay this tax on the income earned from all their operations at home and abroad during a particular financial year. The tax rates vary depending on whether the company is incorporated in India or elsewhere.

(Image source: pixabay.com)

Wealth Tax

Wealth tax is levied on individuals, HUFs, and companies on the value of assets owned in a particular financial year and on the valuation date. Tax is imposed at 1% on the assessee’s net wealth exceeding ₹30 lakhs. Here, net wealth includes unproductive assets like cash in hand over ₹50,000. Income tax applies to bullion or gold jewelry, cars, yachts, aircraft, boats, or urban land, which are not exempted. The wealth tax doesn’t include productive assets like bonds, stocks, commercial property, mutual funds, fixed deposits, etc.

Tax on Capital Gains

Profits earned from the sale of property fall under capital gains tax. Property means precious metals, residential buildings, bonds, stocks, etc. The tax authorities charge capital gains tax at two different rates, depending on how long a taxpayer owned a property, i.e., long-term and short-term capital gains. Deciding period of ownership greatly varies among various classes of property.

Examples of Key Indirect Taxes

Sales Tax

This tax is levied on the sale of movable goods. It’s collected by the Union government, in case of inter-state sales i.e. Central Sales Tax (CST), or by state governments for all intra-state sales i.e. Value Added Tax (VAT). The tax rates vary depending on the type of product.

Service Tax

This tax is a part of the Central Excise in India. The government taxes services provided within the country, excluding Jammu and Kashmir. The Central Board of Excise Customs (CBEC) collects the service tax. The government levies excise duty as an indirect tax on specific services, referred to as “taxable services”. The service tax has expanded over the past several years to include new services. They recently introduced a list of negative services.

(Image source: pixabay.com)

The object behind imposing service tax is to lessen the degree of taxation on both manufacturing and trading units, sans forcing the government to compromise on revenue. To levy service tax, the value of a taxable service must be the gross amount charged by a service provider for services rendered.

Excise Duty

It applies to manufacturing goods sold in India. The Union government collects excise duty directly from the manufacturer once the goods are produced. The manufacturer includes the excise duty and the cost of the goods when selling to the buyer and passes it on as a bundled amount.

VAT

The government imposes a value-added tax (VAT) as a multi-point tax on every stage of sale based on the value added to a particular product. The manufacturer/resale stage collects VAT and considers tax rebates on purchases and inputs.

Highlights of Direct Tax

- Direct tax helps to reduce disparities in the wealth and income of people.

- Economical because the collection cost is very low for the government.

- The direct tax is based on the ability to pay, which achieves some extent of economic and social justice.

A direct tax is often considered a progressive tax because of the ability to pay. The direct tax rates of progressive taxes increase with a rise in income and decrease with a fall in income.

Highlights of Indirect Tax

- Collecting indirect taxes is easy because they are already embedded into the commodity’s price.

- The extensive coverage of indirect tax is because every consumer is taxed through the price of the commodity.

- The imposition of indirect taxes can discourage the consumption of harmful commodities, such as cigarettes, alcohol, etc., thereby serving a social purpose.

(Image source: pixabay.com)

Why are Taxes Necessary?

A government needs resources for running the administration of a country. Taxes have been levied ever since public administration came into being with the rule of kings. It’s a system to collect and distribute the surplus from the rich to the poor. A country’s development and the provision of various civic amenities require taxes. They are often the rider for a country’s growth. The administration’s effectiveness and efficiency determine a country’s progress rather than the volume of taxes collected from its citizens and business enterprises. Many countries levy many taxes but spend the money on populist schemes instead for the real welfare of their people.

Conclusion – Direct Tax vs Indirect Tax

Both Direct taxes vs Indirect tax has their own set of purpose. Direct and indirect tax differences are equitable because they are levied on individuals according to their ability to pay. They are also economical because of the lower collection cost. However, the direct tax doesn’t cover all sections of society.

On the other hand, it’s easy to realize the differences between direct and indirect taxes because they are included in the prices of products and services and have broader coverage in society. The good thing is that the tax rate is high for harmful products to dissuade people from using them.

Government policies change with time and affect a country’s taxation system. Tax structures guide public welfare demands and the need to foster growth. Authorities, at the same time, must ensure that taxes serve their intended purpose.

Recommended Articles

So here are some articles that will help you to get more detail about Direct tax vs Indirect tax, direct tax and indirect tax difference, direct tax and indirect tax meaning with examples, and also about the direct tax and indirect tax definition so just go through the link which is given below.