Updated July 25, 2023

Disposable Income Formula (Table of Contents)

What is the Disposable Income Formula?

The term Disposable Income means Income which is available for household consumption, saving and investment. In other words, disposable income is the final take away income available after all the tax payments and employee deductions. Economist considers it as an important indicator to measure the household financial resources and is an important indicator of demand. Disposable income also called Disposable personal income (DPI).

It is calculated for an individual as below –

For the economy or country, it is calculated as –

Examples of Disposable Income Formula (With Excel Template)

Let’s take an example to understand the calculation of Disposable Income in a better manner.

Disposable Income Formula – Example #1

Let’s take a simple example to understand the disposable income formulae

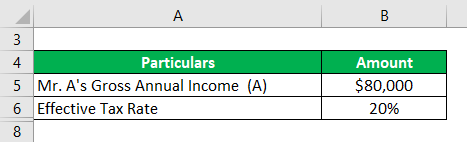

Let’s assume that a household of Ms. A has a total gross annual income of $80,000 and the income tax rate is 20% making the total tax payables a total of $16000. Using this data we have to calculate the disposable personal income for Ms. A for that year.

Solution:

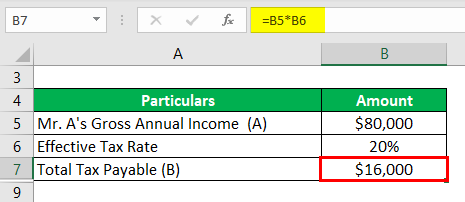

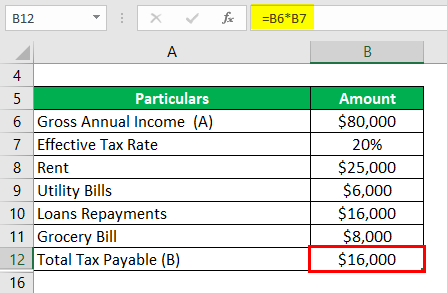

Total Tax Payable is Calculated as

- Total Tax Payable = $80,000 * 20%

- Total Tax Payable = $16,000

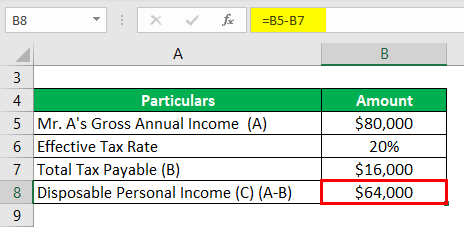

Disposable Income is calculated using the formula given below

Disposable Personal Income Formula = Personal Income – (Payable Taxes + Other Deductions)

- Disposable Income = $80,000 – $16,000

- Disposable Income = $64,000

Disposable Income Formula – Example #2

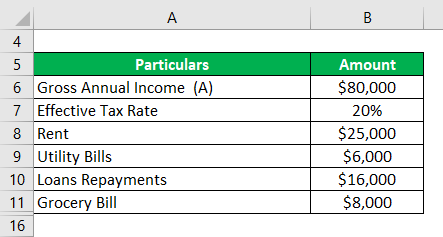

Let us continue with the same example for the next year of the household of Ms. A to understand the difference between disposable income and discretionary income.

The gross annual income of Ms. A is now $80,000. Similar to our previous example in calculating the Disposable Personal Income we need to subtract the total tax payable from Gross Annual Income.

Solution:

Payable Taxes is calculated as

- Total Tax Payable = ($80000 *20%)

- Total Tax Payable = $16000

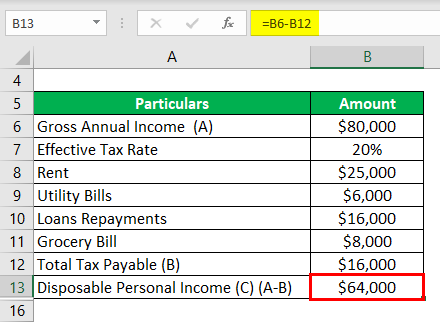

Disposable Income is calculated using the formula given below

Disposable Personal Income Formula = Personal Income – (Payable Taxes + Other Deductions)

- Disposable Income = $80,000 – $16,000

- Disposable Income = $64,000

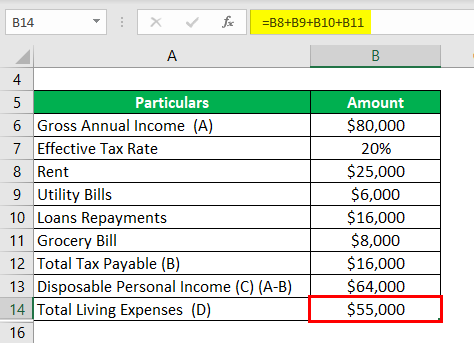

Total Living Expenses is calculated as

- Total Living Expenses = $25,000 + $6,000 + $16,000 + $8,000

- Total Living Expenses = $55,000

After-tax deduction the Disposable Income available is $64000. Ms. A spent some of her income on necessities which are the rent of $25000, utility bills $6000, Loans Repayments $16000 and grocery bills $8000, in total she spent $55000 on her living expenses.

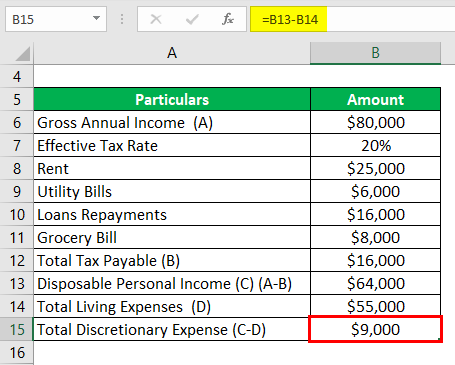

Now to Calculate the total discretionary expense, we need to subtract total living expenses from disposable personal income.

Discretionary Expense is calculated as

- Total Discretionary Expense = $64,000 – $55,000

- Total Discretionary Expense = $9,000

This is the leftover with her total discretionary income which she can use to save/invest or spend.

Disposable Income Formula – Example #3

Disposable income is not just limited to individuals and households but is an important measure for the economy. Just like households disposable income for a country is calculated by summing up the income, taxes and all the transfers in the country from other countries.

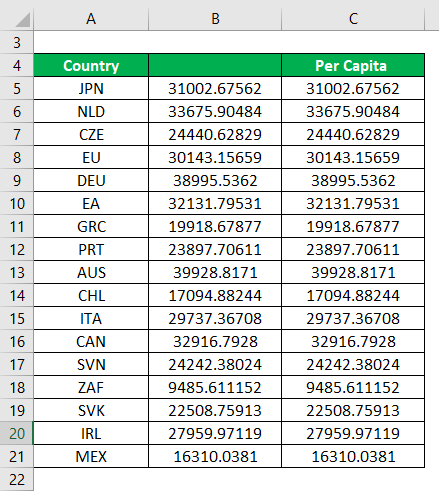

Let us look at the data of annual growth of disposable income of a few countries

The above table shows the per capita disposable income. As seen above the per capita income of countries differs significantly. From the above data, it is seen that Australia has the highest amount of per capita GDP while South Africa has the lowest followed by Mexico.

This data is used by policy-makers and the government to make important decisions. The year on year growth of disposable income is used more widely than the absolute figure.

To simplify this calculation let us look at a simple example to be calculated for the country of Zambia–

- National Income of Zambia = $50,000

- Net Indirect Taxes Received in Zambia = $25,000

- Net Transfers from the Rest of the Countries in Zambia = $10,000

- Net National Disposal Income from Zambia = $85,000

Explanation

The Disposable Personal Income can be derived by using the following steps:

Step 1: Firstly, Identify the total Gross Annual Income.

Step 2: Identify all the Personal Income taxes and deductions (like Health care deductions, retirement savings deductions, other employee deductions, etc.)

Step 3: Finally, the formula for Disposable Income can be derived by subtracting all the tax payables & deductions (step 1) and the total gross annual income (step 2).

After calculating the Disposable Personal Income, we also need to figure out the discretionary income. Discretionary Income means money available after all the living expenses made. Living expenses cover loan repayment, insurance costs, grocery bills, transportation, etc.

Relevance and Use of Disposable Income Formula

Disposable income is an important indicator used by nations to maintain the health of the country. The amount of taxes have a direct impact because of taxable income if the tax rate increases the purchasing power of the consumers in the economy decreases. Maintaining the disposable income is the duty of the government of the country. Even if there is a little imbalance the impact will have to be borne by the consumers and they will have less amount of disposable income in hand, and this will have an impact on the entire economy.

A lot of statistical measures have been derived from Disposable income. For example, a lot of economists use this indicator as a starting point to calculate key economic metrics like discretionary income, savings rate and marginal propensity to consume and to save.

Recommended Articles

This is a guide to Disposable Income Formula. Here we discuss how to calculate Disposable Income along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –