Updated July 17, 2023

What is Dividend Policy

The term “dividend policy” refers to the different profit distribution techniques used by companies that dictate whether or not the dividends should be paid and if yes, then what amount of dividends should be paid out to the shareholders and the frequency at which it should be paid out.

Typically, when a company generates profit it can either retain the entire profit within the business or distribute some portion or entire profit to the shareholders in the form of dividends.

Explanation of Dividend Policy

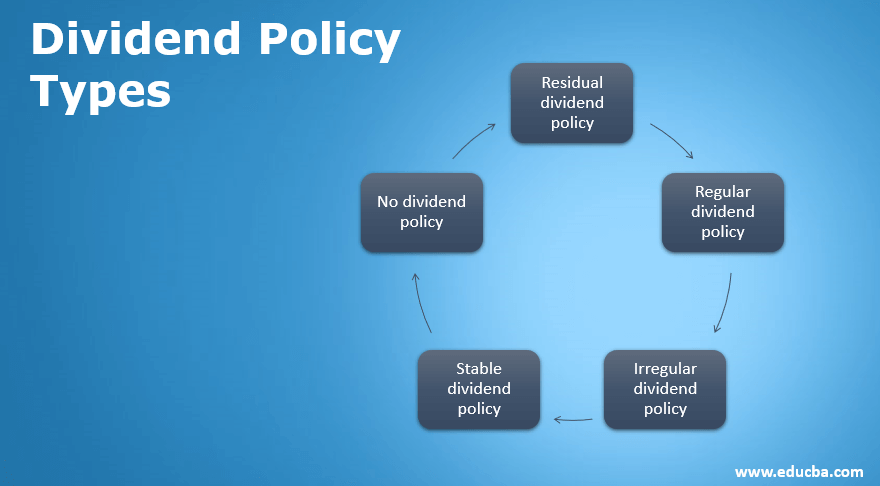

Dividend policy is a very important and integral part of the corporate strategy of any company as it influences investors’ confidence and indicates the company’s financial health. The management of the company must factor in the business environment, the company’s growth strategy, liquidity position, etc. before determining the amount and frequency of dividend payments. There are broadly five types of dividend policies:

- Residual dividend policy

- Regular dividend policy

- Irregular dividend policy

- Stable dividend policy

- No dividend policy

Types of Dividend Policy

Types of dividend policy types are given below:

- Residual Dividend Policy: In this type of dividend distribution, the company pays dividends based on the number of leftover earnings. In residual dividend policy, a company pays dividends only after ensuring that all the planned investments have been done. In most cases, the dividend payment happens when the part of the profit earmarked for funding the capital expenditure proposals is put aside. This policy reduces the need for raising external funds to a large extent.

- Regular Dividend Policy: In this type of dividend policy, profit distribution to the shareholders is made at the usual rate. Regular dividend policy is usually preferred by investors who seek a steady stream of income, such as retired persons, middle-class families, etc. The objective of this policy is to provide regular and substantial dividend flow, while also allowing the company to maintain enough liquidity so that it can take advantage of any attractive future investment opportunity. This type of dividend policy can only be followed by companies with long-standing and stable earnings.

- Irregular Dividend Policy: In this type of dividend policy, companies don’t pay dividends regularly due to various reasons, such as lack of liquidity, volatility in future earnings, etc. In fact, the companies following this dividend strategy are exactly opposite in nature to the companies with regular dividend policy – they don’t have a history of stable earnings. In other words, investors in these companies are never sure whether or not they will be any dividends during a year, and if yes, what amount will be paid as a dividend.

- Stable Dividend Policy: In this type of dividend policy, the investors receive dividends consistently, although the number of dividends may vary from year to year. Basically, the companies decide to distribute a certain portion of the profit to the shareholders every year in the form of dividends. These companies are mostly mature and don’t intend to pursue any strong growth strategy. Further, the policy is best suited for investors for whom a steady source of income today is more important than capital appreciation. The stable dividend policy can be further sub-classified into – constant dividend per share, constant payout ratio, and constant dollar dividend

-

- Constant Dividend Per Share: In this policy, a company pays a fixed amount of dividend per share every year irrespective of the profit generated by it. Such companies create a reserve fund that ensures that it is able to pay the same dividend in those years too when it fails to achieve an adequate level of earnings. Please note that the amount of dividend is largely constant year after year, but the rate of the dividend may vary depending on the level of earnings during each year.

- Constant Payout Ratio: In this policy, the dividend paid every period is a fixed proportion of the earnings during that period. In other words, the percentage of profit distributed to the shareholders in the form of dividends remains constant. So, the dividends paid in such a company will vary as the earnings fluctuate from one period to another.

- Constant Dollar Dividend: In this policy, a company pays a relatively lower rate of dividend per share to avoid instances of no dividend payment in case of weak financial performance. In other words, dividends paid in dollar terms largely remain constant irrespective of the profit level during the period.

- No Dividend Policy: This type of dividend distribution policy is followed by companies that require capital for funding attractive future growth opportunities or to support liquidity stretch due to unfavorable working capital position. There are also instances where a company decides against paying any dividend so that it can retain the entire profit for reinvesting in the future growth of the business. However, in such a scenario the company should be able to convince its shareholders about the no-dividend policy. Some of the current investors might become disgruntled as such a policy doesn’t benefit them in the near term, although it may result in capital appreciation in the longer term. So, shareholders who stay for longer with the company may reap the benefits of capital appreciation by way of more profits in the future.

Conclusion

So, we can understand that from the perspective of a company dividend policy is as important as dividend payment because a company’s dividend policy is seen as the reflection of its financial position. On the other hand, many investors consider it to be an important factor when deciding on which stocks to invest in as dividends can earn them a higher return on investment.

Recommended Articles

This is a guide to Dividend Policy Types. Here we also discuss the introduction and types of dividend policy along with a detailed explanation. You may also have a look at the following articles to learn more –