Updated November 27, 2023

Difference Between Dividends EX-Date vs Record Date

Ex-Dividend Date: The ex-Dividend date is two days before the record date. This is because trade gets settled in T + 2 days. The owner of the stock on the day before the ex-dividend date will receive the dividend. Ex-dividend date onward, the new stock buyer will not get a dividend. A stock price decreases on the ex-dividend date by an amount roughly equal to the dividend paid because a dividend decreases a company’s asset, which will reflect in the stock price.

Record Date: A record date is when whoever holds the share will receive the dividend. An investor must buy shares before the ex-dividend date to own them on the record date and be eligible for the dividend. Even though investors are holding shares for months and selling shares just before the ex-dividend date will disqualify investors from the dividend payment.

A dividend is a profit distributed to a shareholder by the company. One must understand four important dividend dates to understand the basics of dividends.

- Declaration Date

- The Ex-Dividend Date

- The Record Date

- The Payment Date

Declaration date: The date the company’s board of directors announces its approved dividend payment. On the declaration date, a board of directors announces the record date & the payment date.

Payment date: The payment date Is when the actual dividend is paid via bank account transfer or checks.

Example of the dividend important dates

|

Type |

Date |

Notes |

| Declaration Date | July 21, 2017 | Infosys announced a dividend |

| Ex-Dividend Date | Sep 14, 2017 | The date before you must buy the share to be eligible for dividend payment. |

| Record Date | Sep 16, 2017 | The date on which you must be on the books as a shareholder to receive the dividend |

| Payment date | Oct 2, 2017 | The date on which Infosys pays a dividend to its shareholders. Investors on the book as shareholders as of Sep 16, 2017, will get a dividend. |

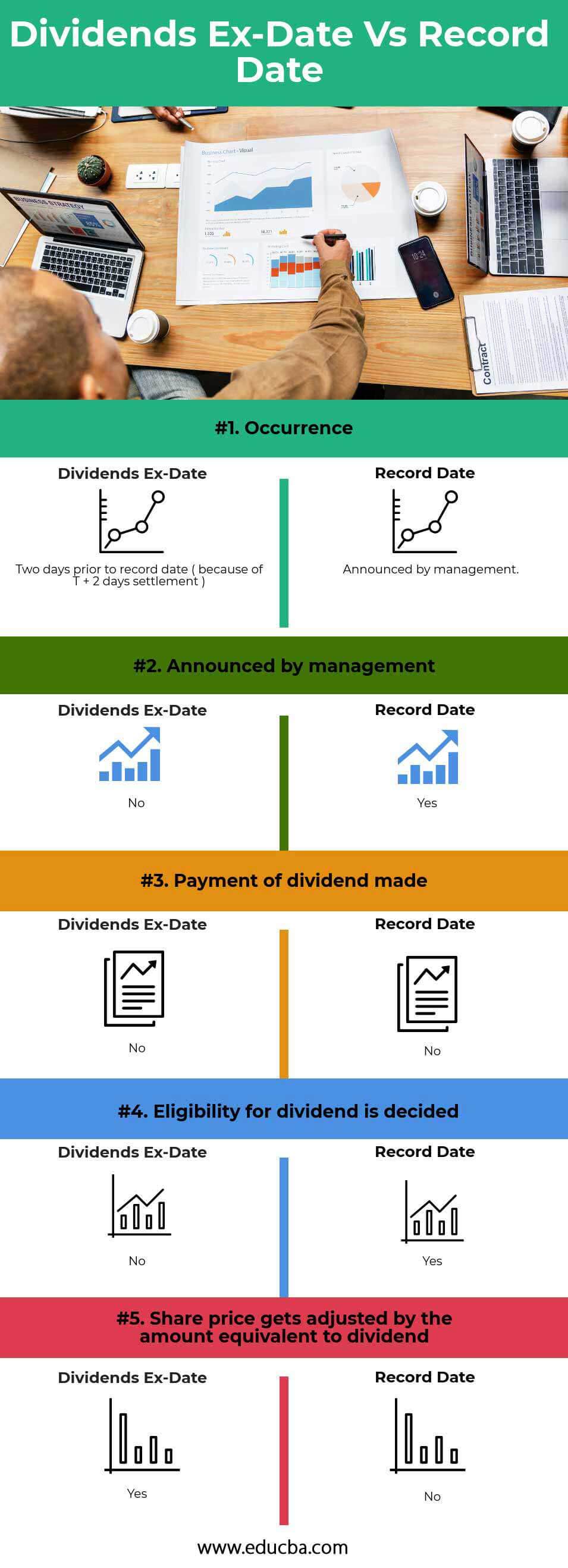

Head To Head Comparison Between Dividends EX-Date vs Record Date (Infographics)

Below is the top 5 difference between Dividends EX-Date vs Record Date

Key Differences Between Dividends EX-Date vs Record Date

Both Dividends EX-Date vs Record Date are popular choices in the market; let us discuss some of the major differences between Dividends EX-Date vs Record Date

The ex-dividend date is two days before the record date.

Stock price gets adjusted by the amount of dividend on the ex-dividend date.

The management announces the record date. A buyer on the ex-dividend date will not be eligible for the dividend, but the seller will be eligible for the dividend.

Comparison Table

Below is the 5 topmost comparison between Dividends EX-Date vs Record Date

| Parameter | Ex-Dividend Date | Record Date |

| Occurrence | Two days before the record date ( because of T + 2 days settlement ) | Announced by management |

| Announced by management |

No |

Yes |

| Payment of dividend made |

No |

No |

| Eligibility for the dividend is decided |

No |

Yes |

| Share price gets adjusted by the amount equivalent to a dividend |

Yes |

No |

Conclusion

To be eligible for the dividend,

- You should buy shares before the ex-dividend date

- You should be on the book as a shareholder on the record date announced by the management at the time of declaration.

- Stock price gets adjusted almost equivalent to the dividend declared amount.

- If you purchase stock after the ex-dividend date or on the ex-dividend date, you will not be eligible for the dividend.

- If you are eligible for the dividend, you will receive a dividend on the payment date.

Recommended Articles

This has guided the top difference between Dividends EX-Date vs Record Date. Here, we also discuss the key differences between infographics and comparison tables. You may also have a look at the following articles to learn more.