Difference Between Dividends vs Capital Gains

A dividend is a periodic interest payment to an investor when the investor is holding stocks. A dividend is not exactly interesting; it is the reward from the company to the investor, which is part of a company’s earnings. The board of directors of a company decides on dividends, which the voters approve. Investors earn a capital gain when they sell their investment for more than its original purchase price. A capital gain can be short-term or long-term. Short-term means term in one year or less, and long-term means term more than one year.

Dividends

Companies determine the payout rate and schedule frequency for paying dividends to investors, such as yearly, quarterly, or monthly. Companies pay dividends to attract investors, but each company defines a limited period during which investors must hold stocks to be eligible for dividends. Companies commonly pay dividends in the form of cash or stocks.

Let’s take an example where an investor has invested $1,000 in 2017 in the stock of HIL Limited and got 100 stocks; the price of one stock is $10. After one year, the company declared a profit of $100 Million and decided to give a dividend of $2 per share. So, the investor got $200 as a dividend over his investment in the company.

The dividend also impacts share price as payment of dividends leads to the flow of funds from the company’s book. Suppose a company trading at $50 on a particular day, the same day the company declares its dividend as $5, as news in the market leads to an increase or decrease in trading price. Here, after an announcement of the news, the company’s stock price will increase and may hit $57; after payment of the amount, a company’s book will decrease with the total dividend paid share price decrease and reach $51.

A decision to pay a dividend may or may not depend on the performance of a company; if a company is undergoing financial problems, it may possibly it will not give a dividend to investors, and if a company is performing well, then it may perhaps not provide a dividend to the investor.

Capital Gains

Capital gain is the profit earned from capital assets. Investors can profit when the value of assets increases, but they cannot realize the gain until they sell the asset, making the profit unrealized until the sale occurs. Once an investor sells his assets, the positive price difference will be capital gain, which is the investor’s profit.

Capital gains are liable for tax if invested in the short term, whereas tax liability will differ if an investment is in the long term. This is subject to a type of investment.

Let’s see an example to understand capital gain.

An investor invested $1,000 in 2017 in the stock of HIL Limited and got 100 stocks; the price of one stock is $10. After one year, when he needed money, he sold his stocks in HIL Limited, trading at $20.He sells his 100 shares and earns $2,000. As his purchase price was $1000. Then profit will be:-

= $2000 – $1000

= $1000

So, the capital gain will be $1000 without taxes. The value of capital gain increases with time but is subject to market conditions.

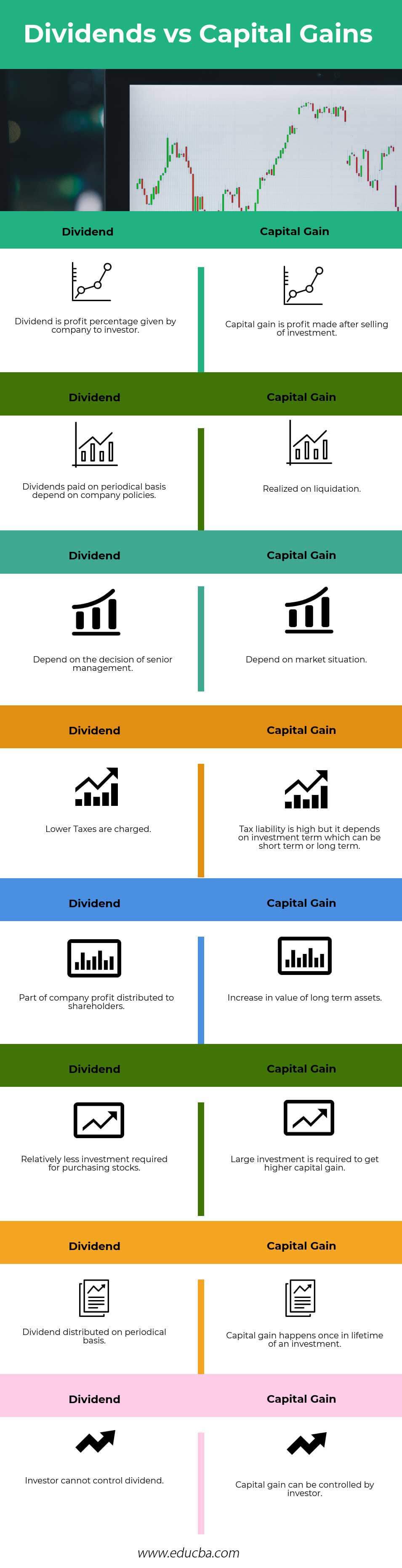

Head To Head Comparison Between Dividends vs Capital Gains (Infographics)

Below is the top 8 difference between Dividends vs Capital Gains

Key Differences Between Dividends vs Capital Gains

Both Dividends vs Capital Gains are popular choices in the market; let us discuss some of the significant differences:-

- A dividend is the profit percentage given by the company to investors, whereas Capital gains in s profit made after selling of investment.

- Company policies determine the periodic payment of dividends, whereas investors realize capital gain by selling their investments to other investors.

- A dividend depends on senior management’s decision and is decided by voting, whereas capital gain is attained by a market situation or macroeconomic factors that influence the market.

- In dividend taxes, a charge is low as income is normal, whereas, in capital gain, taxes are high, but it depends on investment terms, which can be short-term or long-term.

- Dividends involve distributing a portion of the company’s profits to shareholders, whereas capital assets increase in value over the long term.

- Purchasing stocks for dividends requires relatively less investment, whereas to achieve higher capital gain, investors need to make a significant investment.

- Dividend distributed periodically depends on company policies, whereas capital gain happens once in a lifetime of an investment.

- Company management decides the dividend amount in dividends, so investors cannot control it, whereas investors can control their capital gain by selling when prices are high.

- Dividend gives a steady income, whereas capital gain converts stock/assets into cash.

Dividends vs Capital Gains Comparison Table

Below is the 8 topmost comparison between Dividends vs Capital Gains

|

Dividend |

Capital Gain |

| A dividend is the profit percentage given by a company to the investor. | Capital gain refers to the profit earned after selling an investment. |

| Dividends are paid periodically depending on company policies. | Realized liquidation. |

| Depends on the decision of senior management. | Depends on the market situation. |

| Lower Taxes are charged. | Tax liability is high, but it depends on investment terms, which can be short-term or long-term. |

| Part of the company’s profit is distributed to shareholders. | Increase in value of long-term assets. |

| Relatively less investment is required for purchasing stocks. | One typically needs to make a significant investment to achieve higher capital gains. |

| Dividends are distributed periodically. | Capital gain happens once in a lifetime as an investment. |

| The investor cannot control dividends. | An investor can control capital gain. |

Conclusion

Dividend vs capital gains is the tool to generate income for investors. The amount earned can be changed subject to changes in the market situation and also attracts taxes. So, while investing, these points need to be kept in mind. Dividend vs capital gains help to earn money in the long earn, and differences within the financial plan will help to utilize the money efficiently in the long run.

Recommended Articles

This has guided the top difference between Dividends vs Capital Gains. Here, we also discuss the Dividends vs Capital Gains key differences with infographics and the comparison table. You may also have a look at the following articles to learn more.