Updated July 6, 2023

Dollarization Meaning

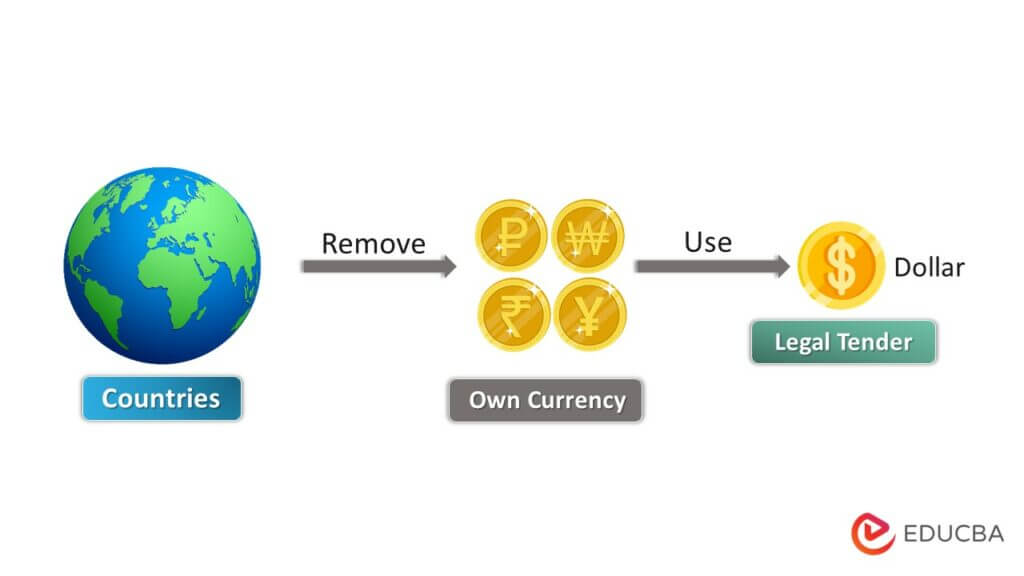

Dollarization is a currency substitution where a country devalues its own currency and uses the US dollar or other currency as legal tender. i.e., medium of exchange.

For example, in November 1965, when the Zimbabwe prime minister declared independence, they changed the national currency from the pound to the dollar. Therefore, Zimbabwe has been using dollars as its national currency for years until 2009, when the currency became the Zimbabwe dollar.

Dollarization is beneficial to an economy as it lowers the average inflation rate. Depositors switch to dollars and drain the banks of liquid local currency. If Depositors sense capital controls or the bank is in jeopardy, they will switch to dollars or withdraw their savings, emptying banks of local currency liquidity. The interest rates fall, new investors come in, and the government attains credibility instantly by hiring the Federal Reserve.

Key Highlights

- Dollarization means currency substitution – using the US dollar instead of the devalued domestic currency as a medium of exchange.

- An economy benefits from its lower average inflation rate and reduced inflation variability.

- However, it is costly because the dollarizing country gives up independent monetary policy and loses some of the ability to respond to output shocks and, thus, smooth the domestic business cycle.

- It is at least partly, a political process involving more than strictly economic decisions.

How Does Dollarization Work?

Dollarization works when a particular country uses another country’s currency to curb hyperinflation. However, the term’s effective use depends on the price index of the specific country and its related consumer behavior.

The effect of dollarization on the country’s economic condition is proportional to the modus operandi of the central banks issuing currencies. For instance, Russia, in the year 2022, is using INR as its primary currency for purchasing, indicating its weakened home currency.

Examples

#1: Cambodia

Cambodia accepts two currencies, USD and domestic Riel. It practices unofficial dollarization, as the government did not officiate it and favored depolarization. Three factors contributed to its unofficial state – financial institutions that mushroomed after the 1870s and 1980s marked economic mismanagement followed by a transfer of $1.7 billion during the peace-building activity of UNTAC. It is one of the most dollarized countries in South East Asia.

#2: Peru

Due to high hyperinflation rates in the 1970s, the Peru government adopted partial dollarization. The citizens would keep assets stored in foreign currency. After around 30 years, the inflation rate stabilized at 3.7% in 1999. The nation then gradually started de-dollarizing; today, it is less than 40% dollarized.

Effects

- Dollarization is seen as part of a package of American‐backed business‐friendly adjustments and often creates strong domestic opposition.

- It could exacerbate or highlight existing structural disparities within economies through the different effects it might have on other groups, in the same way that market‐friendly reforms have created winners and losers.

- The government heavily imports inputs and capital for industrial production in a developing economy. Imports include a multitude of consumer goods.

- Governments needing well-developed financial structures rely heavily on borrowing from abroad.

- Conversely, developing countries need a well-developed internal market and often suffer severe income distribution problems.

- To raise capital, they rely heavily on exports and taxes upon them to pay for long‐term debt and imports.

- Therefore, when the exchange rate choice affects the prices of both imports and exports, the effects on factor prices can be profound. As factor prices change, the political groups involved will react.

Risks

- Commercial banks collect a large chunk of foreign currency denominations in the form of loans and deposits, which can lead to credit loss that impacts their profitability and the cash in hand when the home currency value steeply decreases.

- It is a complication for foreign banks that intend to borrow money to repay their loans when there is a steep decline in their home currency. It results in a decrease in credit scores.

- Depositors will start making transactions in dollars, leading to a further drop in the home currency in the case of capital risks or bankruptcy.

- A high incidence of dollarization exponentially increases financial chaos in the cases where the home banks cannot pay their loan back due to rising rates.

Advantages and Disadvantages

| Advantages |

Disadvantages |

| Administrative expenses reduce as there is no cost of maintaining an infrastructure for production and management of separate national money. | Devaluations in the currency structure lead to a loss in economic value. |

| It can establish a firm basis for a sounder financial sector with financial integration with the United States. There is an improvement in the service quality of domestic financial institutions. | Dollarization also impacts the country’s image of the outside world. For example, Zimbabwe had to face criticisms for managing its hyper-inflated economy. |

| There could be a substantial reduction in interest rates for local borrowers. | The home country loses its monetary powers as the currency valuation of the other economy takes charge. |

Final Thoughts

Dollarization indicates the implementation of another country’s currency as legal tender. Countries with high inflation that want to stabilize their price levels use this method. The countries that align with the US in trade will benefit from this process.

Frequently Asked Questions (FAQs)

Q1. What are the effects of dollarization?

Answer: It is seen as an American‐backed business‐friendly adjustment and gets a lot of domestic opposition. It may favor a group, not the rest, in the domestic economic arena of the underdeveloped or developing economy. The government heavily imports capital for industrial production and goods.

Q2. What countries use dollarization?

Answer: There are a handful of countries that are using dollarization. Some prominent examples are Ecuador, Panama, Zimbabwe, and the Marshall Islands. Others are The British Virgin Islands, Micronesia, The Turks and Caicos, Palau, Timor and Leste, Bonaire, and El Salvador.

Q3. How does dollarization work?

Answer: After WWII, some countries wanted to establish global economic stability and prosperity. These countries found pegging their domestic currency to convertible currency. Another option was to go for full dollarization and ultimately abandon their currency for international currencies like the US dollar or the Euro. It stabilizes the local currency and has a similar value to the foreign currency.

Q4. What are some benefits of dollarization?

Answer: The cost of maintaining infrastructure reduces to maintain extra national money. There is a sound financial sector with financial integration with the United States. It also lowers interest rates and attracts investors.

Q5. What are the disadvantages of Dollarization?

Answer: As the country can no longer control the money supply and exchange rate, it loses its freedom. The country’s capital will be in control of the US Federal Reserve. Moreover, the other country’s authorities don’t need to make decisions favorable to the dollarized country’s economic condition.

Q6. What causes Dollarization?

Answer: It happens when the country faces hyperinflation and they don’t have enough money to manage it. Hence, they value US currency to stabilize prices.

Recommended Articles

This was a guide to Dollarization. To learn more, please read the following articles: