Updated July 4, 2023

What is Double-Entry Accounting?

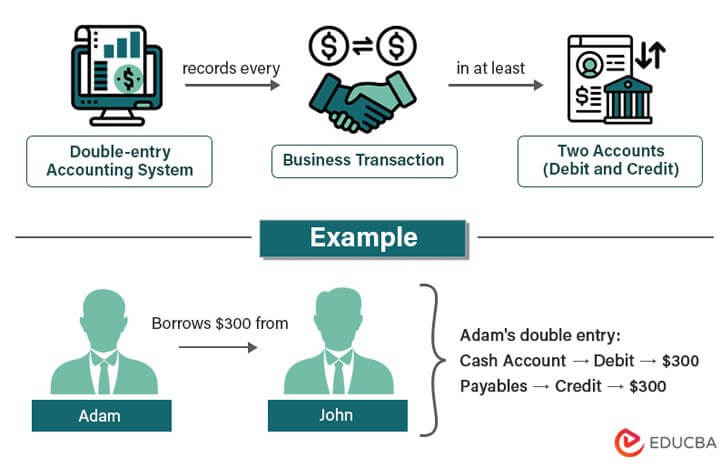

Double-entry accounting is a system that records every financial transaction in two accounts, one account has a debit, and the other has a credit. By doing so, the system ensures that the total debits are equal to the total credits, making it easy to identify errors and maintain accurate financial records.

For example, if John lends $300 to Adam, Adam’s savings account will have a debit of $300 (money added), and his payable account will have a credit of $300 (indicating his debt to John).

|

Particulars for Adam |

Debit |

Credit |

| Cash (savings account) | $300 | |

| Payable | $300 |

Key Highlights

- The essential rule of a double-entry accounting system is that every credit in one book of accounts must have a corresponding debit in another book of accounts.

- It is essential for preparing accurate financial statements, such as balance sheets, income statements, and cash flow statements.

- The system is an industry-standard and is often required by investors, lenders, and government regulators.

- While the system may seem complex initially, with practice and training, it can become second nature and offer significant benefits for businesses.

How does the Double-Entry System Of Accounting Work?

The double-entry system of accounting works by following these steps:

Step 1: Identify the financial transaction

- Determine the event that has occurred and needs an addition to the record.

- The event can be a purchase, sale, payment, or receipt of cash.

Example: A business purchases office supplies worth $1,000 on credit from a supplier.

Step 2: Determine the accounts

- Identify the accounts impacted by the transaction.

- Every transaction affects at least two accounts, one for debit and the other for credit.

Example: Office supply purchase on credit affects two accounts – the office supplies account (an asset account) and the accounts payable account (a liability account).

Step 3: Determine the type of accounts

- Determine the classification of the accounts impacted by the transaction

- The accounts fall under the classifications of asset, liability, equity, revenue, or expense accounts.

Example: The office supplies account is an asset account, and the accounts payable account is a liability account.

Step 4: Record the transaction in the general journal

- Debit the account receiving an increase in value and credit the account receiving a decrease in value

Example: The accountant records the purchase of office supplies on credit in the general journal with the following entry:

Debit: Office supplies account – $1,000

Credit: Accounts payable account – $1,000

Step 5: Post the transaction to the general ledger

- Transfer the information from the general journal to the general ledger

- Organize transactions by account for easier analysis and financial statement preparation

Example: The records from the general journal count in the office supplies and accounts payable accounts in the general ledger.

Step 6: Prepare the trial balance

- Summarize all accounts and their balances to ensure that debits equal credits

- Identify any discrepancies or errors in the accounting system

Example: The trial balance for the business would be as follows:

|

Account Name |

Debit |

Credit |

| Office Supplies | $1000 | |

| Accounts Payable | $1000 | |

| Total | $1000 | $1000 |

(balances match, and accounting records balanced)

Step 7: Prepare the financial statements

Use information from the trial balance to prepare the financial statements as shown below:

| Income Statement | |

| Revenue | $0 |

| Expenses | $0 |

| Net Income | $0 |

|

Balance Sheet |

Amount |

| Assets: | |

| Office Supplies account | $1,000 |

| Total Assets | $1,000 |

| Liabilities: | |

| Accounts Payable account | $1,000 |

| Equity: | $0 |

| Liabilities + Equity | $1,000 |

| Cash Flow Statement: | |

| Cash inflows: | $0 |

| Cash outflows: | $0 |

| Net cash flow: | $0 |

Principles of Double-Entry Accounting

#1 Duality Principle

The duality principle states that every financial transaction has two parts – a debit and a credit. It means that when there is a debit in one account, there is credit in another account, and vice versa. The use of debits and credits ensures that businesses maintain an error-free accounting equation.

For example, when a company purchases $1,000 worth of inventory on credit, the journal entry would be:

Debit: Inventory account for $1,000 (increase in assets)

Credit: Accounts payable account for $1,000 (increase in liabilities)

#2 Accounting Equation

The accounting equation states that the total assets of a business must be equal to the total liabilities and equity. The equation is:

For example, if a company has $100,000 in assets, $50,000 in liabilities, and $50,000 in equity, the balance sheet would reflect the accounting equation:

$100,000 = $50,000 + $50,000

Understanding Debit and Credit

Debit and credit represent the increase or decrease in the value of an account.

- A debit results in an increase in an asset account or a decrease in a liability or equity account.

- A credit marks a decrease in an asset account or an increase in a liability or equity account.

For example, if a company purchases inventory worth $1,000 on credit, the journal entry would be:

Debit: Inventory account for $1,000 (increase in assets)

Credit: Accounts payable account for $1,000 (increase in liabilities)

In this example, the debit represents the increase in the value of the inventory account, while the credit represents the increase in the value of the accounts payable account.

Types of Accounts

The most common types of accounts used in double-entry accounting are:

- Asset Accounts: Asset accounts represent the resources owned by a company, such as cash, accounts receivable, inventory, property, and equipment. When a company acquires assets, it debits the asset account, and when it uses, sells, or disposes of an asset, it credits the asset account.

- Liability Accounts: Liability accounts represent the company’s obligations, such as accounts payable, loans, and taxes payable. These accounts have a credit when the company incurs liabilities and a debit when the company pays off the liabilities.

- Equity Accounts: Equity accounts represent the residual interest of the owners in the company after they pay off all the liabilities. These accounts include common stock, retained earnings, and dividends paid. Equity accounts have a credit when the company generates profits and debited when the company incurs losses or pays dividends.

- Revenue Accounts: Revenue accounts represent the income the company has earned from its normal business operations, such as sales revenue, service revenue, and interest income. These accounts have credit when the company generates revenue and debit when the revenue gets recognized or refunded.

- Expense Accounts: Expense accounts represent the costs incurred by the company to generate revenue, such as salaries, rent, utilities, and supplies. These accounts have a debit when the company incurs expenses and a credit when the expenses get paid off or reduced.

Double-Entry Accounting Examples

#1 Software Developer

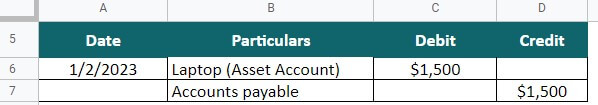

Ava is a software developer who buys a new laptop for her freelance business for $1,500. Use a double-entry system of accounting to record the transaction.

Solution:

Step 1: When Ava buys the laptop, she incurs a liability since she has not yet paid for it. Therefore, we would debit the asset account (laptop) and credit the accounts payable account.

Step 2: Once Ava pays for the laptop, we debit the accounts payable account and credit the expense account to reflect the reduction in liability and increase in expense.

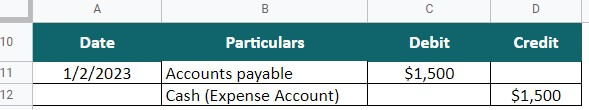

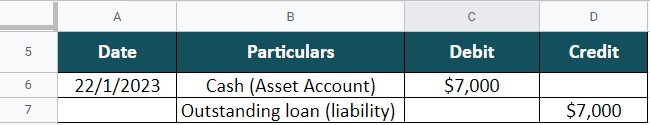

#2 Loan from Creditors

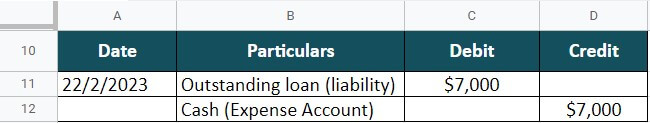

ABC Ltd. takes a loan of $7,000 from the bank. The company repays the loan after a month. Record the transaction using a double-entry system.

Solution:

Step 1: ABC Ltd. borrows $7,000 from the bank. Therefore, record a debit in the asset account and a credit in the liabilities account.

Step 2: After one month, ABC Ltd. repays the loan. Accordingly, record a debit in the liabilities account and a credit in the expense account.

Double-Entry vs. Single-Entry Accounting

|

Particulars |

Double-Entry |

Single-Entry |

| Number of Accounts | Each transaction affects at least two accounts, providing a complete financial picture. | Only records transactions in the cash register, giving a partial view. |

| Safety | Involves at least two accounts, reducing the risk of fraud. | More susceptible to fraud due to lack of cross-checking. |

| Function | It aims to balance the total debit and credit amounts. | Records expenses and earnings separately over a given period. |

| Accuracy in statement preparation | Accountants detect mistakes in the journal and ledger, ensuring accurate financial statements. | Financial statements may be less accurate since accountants take numbers directly from the ledger. |

| Credibility | Considered a more reliable method of accounting. | Less reliable for managing large-scale transactions. |

| Spotting of Errors | Mistakes are easier to identify and correct with two entries per transaction. | Errors are harder to spot without a second set of records. |

| Size of the business | Suitable for businesses of all sizes, including multinationals and conglomerates. | Best suited for smaller companies or fewer transactions. |

Advantages and Disadvantages

|

Advantages |

Disadvantages |

| It is easy to find errors in the entries, as a mismatch in the ledger shows in the trial balance itself, before going to the final statements. | It needs the engagement of a larger workforce in the process. |

| There is a record for both the debit and credit accounts. Thus, it calculates both the profit and loss accurately. | It has a high maintenance cost and can be expensive for small businesses as they have only a handful of transactions. |

| There is no risk of fraudulent transactions. | It is time-consuming and complex. |

Frequently Asked Questions (FAQs)

Who is the father of double-entry accounting?

Luca Pacioli (1447-1517), a mathematician from Italy, is the father of double-entry accounting. In 1494, he published a book called “Summa de Arithmetica, Geometria, Proportioni et Proportionalità,” which included a section on double-entry bookkeeping. The book became widely popular and influential and helped to establish double-entry bookkeeping as the standard method of bookkeeping.

What is credit vs. debit?

In accounting, credit, and debit refer to entries recorded in financial records. A credit entry represents money received or reduced liabilities, while a debit entry represents money paid out or an increase in assets. For instance, when a company receives payment from a customer on credit, it credits its accounts. Similarly, when a business purchases new equipment, it debits its asset account.

What is an example of double entry in accounting?

A company selling a product for $1,000 is an example of double-entry bookkeeping. The company debits its cash account for $1,000 and credits its revenue account for the same amount. This action increases the company’s total assets by $1,000 while accurately recording the revenue earned from the product sale.

Recommended Articles

This is EDUCBA’s guide to Double-Entry Accounting. For further study, please refer to EDUCBA’s Recommended Articles.