Making the Right Choice for Your Online Store

E-commerce business owners find operating their ventures enormously exciting, yet they must select the correct e-commerce merchant account provider to determine success or failure. Choosing an unreliable payment processing solution will result in high fees, security vulnerabilities, and dissatisfied customers.

Choosing the right account for your online store requires what specific approach? Readers will find a complete walkthrough of merchant accounts with detailed information about selecting the best provider based on business needs.

What is an E-commerce Merchant Account?

An e-commerce merchant account is a specialized bank account that enables businesses to process online payments using digital wallets, debit cards, and credit cards. It is a secure bridge between customers’ banks and the business, ensuring smooth and secure transactions.

Here is how it works:

- A customer purchases on your website.

- Your e-commerce merchant account processes the transaction.

- Once approved, the system transfers the funds to the business bank account.

A merchant account adds an extra layer of security, reducing fraud and chargebacks. Without one, businesses may rely on third-party payment processors, often with higher fees and limited control.

Why Choosing the Right Provider Matters

Selecting the incorrect e-commerce service provider account company can cause:

- High transaction costs that lessen profitability

- Weak safety features that growth fraud dangers

- Limited charge options that inconvenience customers

- Long-term contracts with hidden charges

To ensure easy business operations, selecting the right issuer is crucial.

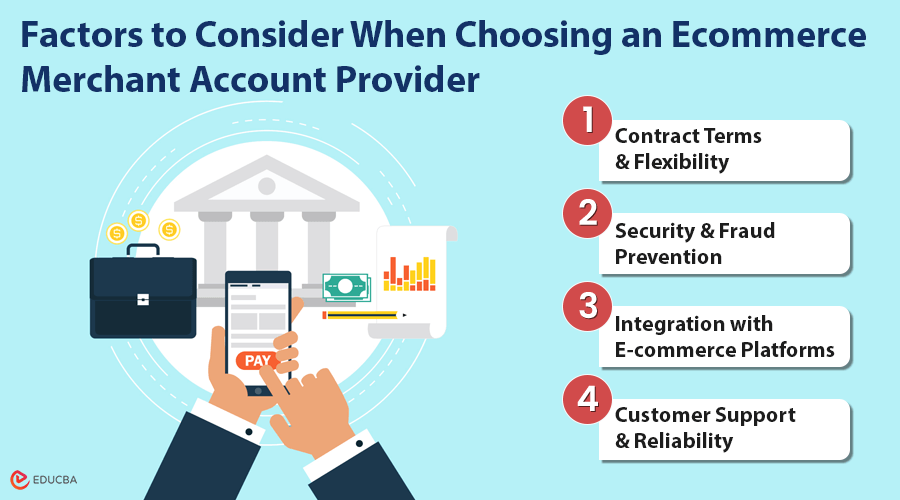

Factors to Consider When Choosing an Ecommerce Merchant Account Provider

Every merchant account provider has extraordinary rate structures. Some fee a flat percentage per transaction, while others use an interchange-plus or tiered pricing model. Businesses must carefully assess the pricing to keep away from pointless prices.

- Contract Terms and Flexibility: Some companies lock companies into lengthy-term contracts with excessive early termination expenses. Look for companies offering monthly agreements or clear cancellation coverage without consequences.

- Security and Fraud Prevention: Online transactions are vulnerable to fraud. A suitable e-commerce merchant account company must provide sturdy security features, PCI compliance, chargeback protection, and fraud-tracking equipment to shield the enterprise and its customers.

- Integration with E-commerce Platforms: Not all service provider bills match each e-commerce platform well. Businesses should ensure the issuer integrates seamlessly with their current purchasing cart, website builder, or accounting software program.

- Customer Support and Reliability: Payment problems can arise at any time, and resolving them can affect sales. A provider with 24/7 customer service through telephone, e-mail, and live chat is critical for easy operations.

Best E-commerce Merchant Account Providers

Here are a few top-rated e-commerce merchant account providers that cater to e-commerce agencies:

- AdaptivPayments: Developer-friendly integration, transparent pricing, and multi-currency support.

- Square: Ideal for small businesses, offering simple pricing and no long-term contracts.

- PayPal: Trusted globally with easy integration for on-site and off-site payment processing.

- Net: Backed by Visa, providing strong security features and reliability for businesses of all sizes.

Each provider has unique advantages, so businesses should compare their specific needs before deciding.

Final Thoughts

Choosing the right e-commerce merchant account provider is crucial for seamless payment processing and business growth. Businesses can assess transaction fees, fandom compatibility, and customer support to find a provider that aligns with their needs. A well-chosen merchant account provider streamlines transactions and enhances customer trust and satisfaction.

Recommended Articles

We hope this guide on choosing the right e-commerce merchant account provider helps you streamline your online payment process and boost your business’s success. Check out these recommended articles for more tips and strategies to enhance your e-commerce platform.