Updated November 8, 2023

Earmarking Meaning

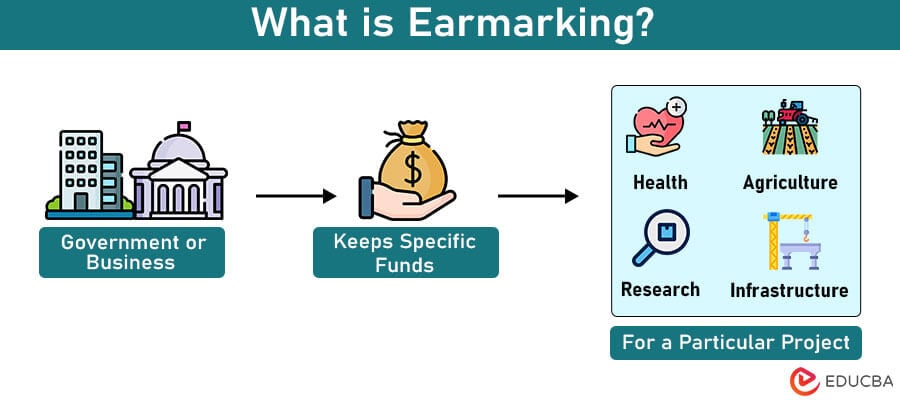

Earmarking is when the government or a business assigns a fixed amount of money specifically for a particular purpose like education or product research.

Earmarking of funds means keeping them exclusively for one specific reason. The main goal of earmarking funds is to keep public spending clear and responsible. The government can issue appropriation bills to earmark funds; similarly, companies can mention the earmarked funds in their budget or spending plan. It helps make sure the money is used for those exact reasons as intended and not for other reasons.

If a company has extra money left from the designated funds, it can choose to use it for another project or save it for a future similar project. The government can do the same with leftover earmarked funds; they can save it for a similar project or revoke the earmark bill.

For example, a government allocates $1 million for constructing a school. Thus, the state can use the money for construction materials, labor, and related expenses. However, if there’s a surplus of funds, the government anticipates that these remaining funds will be utilized solely for the school’s development or another school construction project.

Earmarking Types

Following are the different fields in which earmarking is common and useful.

1. Agriculture

In the agriculture industry, earmarking could mean using money for improving farming methods, developing new crops, or enhancing animal husbandry practices.

2. Politics

In politics, earmarking funds refers to allocating money allotted for particular projects or initiatives.

3. Banking

Within banking, earmarking means setting aside money for purposes like ensuring liquidity or meeting reserve requirements.

6. Bankruptcy

Regarding bankruptcy, earmarking funds could signify separating money to cover specific expenses or creditors during the bankruptcy process.

Real-World Examples

Some real-life examples of the earmarking of funds are as follows.

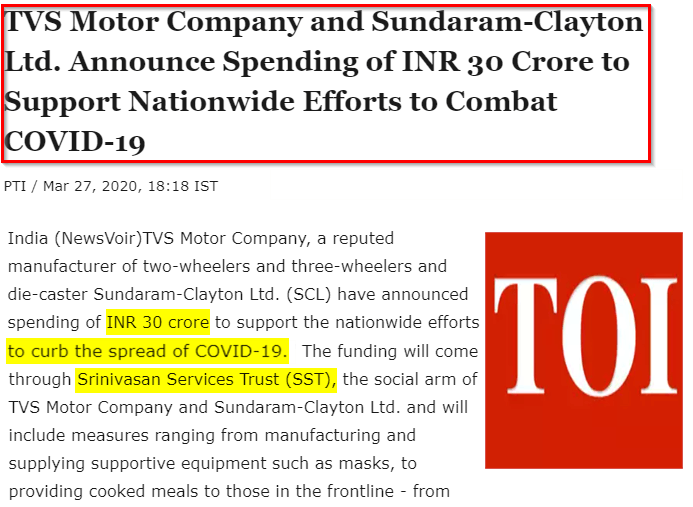

Example #1: COVID-19 – India

In 2020, India’s Sundaram-Clayton Ltd., a part of TVS Motor Company, earmarked INR 30 Crore ($3.6 million) from the Srinivasan Services Trust (SST) to help fight the COVID-19 pandemic. The Chairman, Venu Srinivasan, mentioned that at such a time of global health crisis, the company wanted to help the government keep the situation under control. The funds were to be used to provide safety equipment like masks and meals for the frontline workers.

(Image Source: Times of India)

Example #2: Investments – US

In 2023, RTP Global, a renowned venture capital firm, has set aside $1 billion to invest in startups in several places in Asia, North America, Europe, etc. The earmark, split into two halves: $660 and $340 million, is called RTP IV. The $660 million is for all early-stage investments like setting up research and production of the product. The other half, $340 million, is for investing in companies they already have investments in.

(Image Source: Money Control)

Example #3: Infrastructure – UK

In May 2023, England’s Suffolk County Council leader, Matthew Hicks, announced that they are earmarking £10 million ($12.2 million) to rebuild or repair roads in the nearby villages and residential areas. They will be focusing on improving the common roads, other than highways, that are not used very frequently. However, the final approval is still pending from the cabinet.

(Image Source: BBC)

What is an Earmarked Grant?

Firstly, government grants are money the government gives to directly support individuals or businesses. Regarding earmarked grants, it is almost the same, with one significant difference.

If you receive a general grant, you can use the money for any purpose related to the broad category. For example, if you get a small business grant, you can use the money for anything from production, office construction, investments, etc.

However, in earmarked grants, you can only use the money for the exact purpose specified by the government. For instance, if you get a grant earmarked for purchasing the latest technology for your business, you can use it for that purpose only.

Benefits of Earmarking

Earmarking can have several benefits, including the following:

For Governments:

- Revenue Protection: Earmarking protects funds from being redirected to unnecessary expenses due to political influences or changes in budget priorities. It ensures adequate funds for essential programs even in political distress.

- Efficiency: Directly allocating capital to particular programs streamlines the connection between revenue and the services provided. It increases the efficiency of public expenditure.

- Public Support: It often leads to public approval, as people are more likely to support taxes when they see direct benefits to a cause. It can mitigate resistance to taxation for these particular programs.

- Accountability: Aligning funds with specific services enhances transparency, allows clear funds tracking, and encourages responsible spending.

For Businesses:

- Cost Awareness: Businesses, especially startups and small businesses, must earmark capital for their necessary operations like inventory, payroll, etc. It will help them stay efficient and use their resources effectively in the early stages of their business.

- Improved Performance and Relationships: Companies must keep separate funds for periodic investments and external liabilities like vendor payments. It will help them make crucial investments in equipment and build better relationships with their suppliers.

Recommended Articles

We are hoping that you found this article on Earmarking helpful and interesting. If you did, please check out our other articles as well,