Definition of Earned Income

The definition of earned income, which comes in line with Internal Revenue Services, is that it comprises the daily wage, salary earned by employees, bonuses paid, commissions given, tips distributed, the net earning that one accumulates from being self-employed, and it may also comprise of the disability benefit/union strike benefit or like deferred payment of retirement funds.

As stated above it comprises several categories of income that one may earn either by being an employee working for a firm or by means of employment. These income categories align with the Internal Revenue Service and can be defined as any income from a job or self-employment. Income earned from investments in other avenues or any government benefit received is not considered earned income. Taxpayers whose household income is significantly low may be allowed a tax credit on their earned income provided they fulfill the stated conditions to avail of the same.

When it comes to tax purposes, the definition of earned income is relatively more straightforward, where it means any income that one has received for the job done by one for the employer or on a self-employment basis. The different criteria of income received which doesn’t classify are as follows: money accumulated from non-deferred pension plans, alimony, any capital gains on the sale of the property, interest earned from a bank account or any form of investments, dividends earned on investing in stocks, interest on bonds and any passive income which has been collected from a source of rental property. It is usually that both earned income and other forms of income are taxable, but the rate of taxation may vary.

Example of Earned Income

The most basic example can be the income in the form of a salary one gets while working for an employer or the income generated by operating a business where a person is himself or herself self-employed. Nowadays freelancing is a very common job where one works based on his/her skill set and his/her preference without any fixed employer. It is finding related projects from around the globe and using one’s skill to provide the desired work to the client on a timely basis. As soon as the project is over and the output is handed over to the client, the client must provide pre-decided compensation to the freelancer for getting the job done.

This income is also stated as earned income and is subject to taxation based on the local tax rules. When an employee makes a bonus in the hospitality industry, apart from daily wages, employees are subject to tipping also. These tips or bonuses earned by employees are also termed earned income and are subject to taxation.

What Qualifies Earned Income?

- It consists of employee salaries which are taxable and even the net earnings generated from self-employment.

- Any alimony provided, child support, social security, and unemployment benefits do not qualify as earned income.

- It also consists of any kind of tips or bonus which has been earned by employees.

- It is something that is taxable under Tax laws and doesn’t come for free except in a few cases or scenarios where if the income level is below a certain threshold, the tax credit is provided.

- For those in the tech industry, earnings from consulting, freelancing, or working full-time roles found through platforms that allow you to browse top Web3 job openings also qualify as earned income.

Impact of Earned Income

- It provides a source of living for households and employees can also fetch an extra income in form of bonuses.

- As tipping is also classified under earned income in the hospitality industry it provides an added-on income apart from the usual salary.

- Apart from corporate tax is a major chunk of tax for the federal government where employees working for employers or self-employed individuals has to contribute a certain part of their income in the form of tax to the federal government.

- It helps in uplifting the economy of a nation by proving employment facilities to common people and helping them find a way of living.

- The bridges the gap between the poverty level in a nation and helps people to survive a decent standard of living.

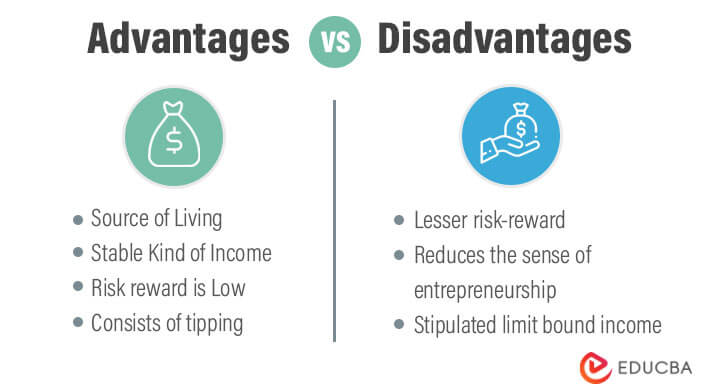

Advantages and Disadvantages

Let’s review a few notable benefits and drawbacks.

Advantages

- Earned incomes act as a source of living for people who are not in a state to do business and prefer a salaried job.

- It is more of a stable kind of income that is guaranteed every month or day depending on the agreement and unlike business where the risk is also high and at times it may suffer loss.

- The risk-reward relationship is comparatively low when compared to business but the stability of income generated is relatively higher than business.

- It also consists of tipping which acts as some form of extra income for certain industries where the basic salary may be low.

- From a tax point of view earned income contributes greatly to the economy in the form of tax payments which help the government utilize the same for public benefits.

Disadvantages

- Earned income has a relatively lesser risk-reward relation when compared to the income generated from the business.

- It takes away the feeling of entrepreneurship and people tend to become more prone to become salaried employees.

- People can find a couple of loopholes to enjoy the benefit, and tax credits and pay less tax to the government.

- One must learn the living on a stipulated limit bound income and never aspire for some other ventures which require bigger investments.

Conclusion

As stated above we found what are the categories and what qualifies for the same. Also, we discussed on the pros and cons and how it is crucial for the economy and its people to have a steady source of earned income.

Recommended Articles

This is a guide to Earned Income. Here we discuss the definition and impact of earned income along with its advantages and disadvantages. You may also have a look at the following articles to learn more –