Updated December 30, 2023

What is Earnest Money?

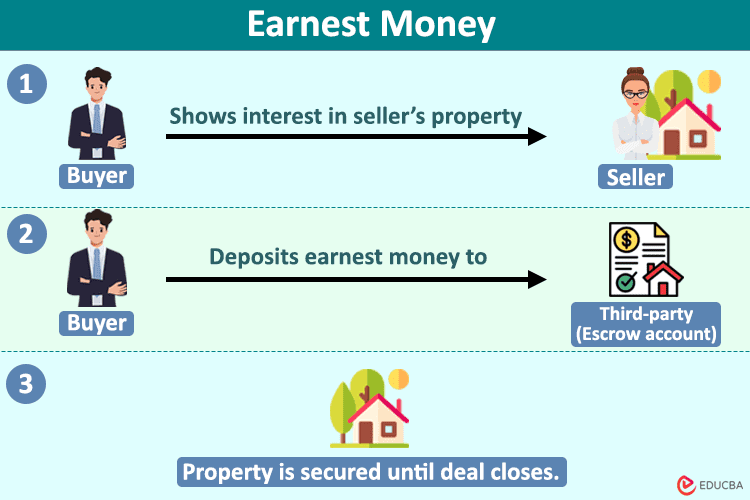

Earnest money, also known as a good-faith deposit, is an initial token amount a buyer pays to the seller as a sign to show their genuine interest in purchasing the seller’s property or asset.

In real-estate agreements, it is termed as earnest money deposits, typically ranging from 1%-5% of the property’s sale price. The deposit amount depends on the market conditions, the seller’s offer, and the buyer’s negotiation skills. While it does not force a buyer to buy that property, it does allow the seller to remove the property sale offer from the market till the deal is complete.

This deposit is paid to a third party or held in an escrow account until the transaction is complete. Securing the property with this deposit gives the buyer time to gather the remaining amount to meet the property’s purchase cost. Upon finalization of the sale, the earnest money either contributes to the buyer’s down payment or adds to the total purchase amount.

Table of Contents

- What is Earnest Money?

- How Does it Work?

- Is it Refundable?

- Example

- Importance

- How to Protect it?

- Earnest Money Vs. Down Payment

How Does Earnest Money Work?

The following is the process of how earnest money works.

1. Buyer makes an offer.

When a buyer finds an interesting property, they make an offer to the seller. Along with the offer, they include an amount of earnest money.

2. Seller accepts the offer.

If the seller accepts the offer, they both sign a “purchase agreement” transaction. This agreement includes details of earnest money, the due date, and terms and conditions for refunding the money if anything goes wrong. Meanwhile, the seller takes the property sale offer out from the market.

3. Buyer deposits the earnest money.

After signing the agreement, the buyer sends the good-faith amount to a third party (real estate or broker) or escrow account. The buyer usually doesn’t send the money directly to the seller.

4. Purchase of property is complete.

If the buyer finds no defaults on the property and the deal closes successfully, then the earnest amount is credited as a down payment or closing costs.

However, suppose the deal doesn’t go according to the agreement and the buyer breaches the contract. In that case, the seller keeps the deposited money as compensation for taking the property off the market.

Is Earnest Money Refundable?

Whether earnest money is refundable depends upon the purchase agreement and local laws. The agreement mentions the conditions in the “Contingency Clause.” The following are some scenarios of contingency clauses where the deposited money is refundable.

1. Due diligence contingency

This due diligence contingency gives the buyer a specified period to conduct research and investigations on the property after paying the earnest money. It allows them to review documents and meet their expectations before finalizing the purchase. During this due diligence period, the buyer may back out of the deal and get a full refund of earnest money.

2. Home inspection contingency

This contingency permits the buyer to hire a reputed home inspector to assess the property’s condition. If the inspector finds any major issues, such as water leakage, mold, structural damage, or faulty electrical wiring, the buyer can ask the seller for repairs. The buyer can also request a reduction in the sale price or withdraw the deal and get their money back.

3. Appraisal contingency

Under this contingency clause, the buyer can hire an appraiser agent to inspect the property’s value. They will compare the property’s sales value with other similar properties. If the buyer finds that the selling price of the property is more than the market price, they can break the deal or ask the seller to lower the price.

4. Financing/mortgage contingency

Sometimes, the buyer needs more money to fulfill the remaining balance, and under this clause, they get time to apply for a mortgage or loan. For some reason, if the mortgage application is not approved and the buyer does not secure finance in the stipulated period, then under this clause, they can break the agreement.

5. Title contingency

A title contingency clause ensures that the property has a clear title and is free from legal issues or disputes. If the buyer finds out any future issue may arise during the property transfer process, they can request the seller to resolve them or withdraw from the deal.

Example of Earnest Money

Let’s understand the concept of earnest money better with the following example.

Sherin is a buyer interested in buying Kelly’s home property. Kelly’s selling property is $200,000, and Kelly is willing to give Sherin time to decide. After a while, Sherin agrees to pay an earnest money deposit of $2000 to reserve the home. Kelly approves the deal, and both sign a purchase agreement. Also, Sherin has a month to finalize her decision. Until then, Kelly will secure and take her property sales offer from the market.

The agreement consists of the following contingency clause.

- Home inspection contingency: If Sherin discovers any structural or major repair issues during the home inspection, she is entitled to a full refund of the earnest money.

- Financing contingency: If Sherin fails to secure the necessary funds to complete the purchase by the due date, Kelly must refund the entire amount.

- Forfeiture clause: If Sherin breaches (breaks) any condition of the agreement without giving a valid reason, Kelly can keep the earnest money.

However, Sherin finds no issue and pays the remaining amount ($198,000) to proceed with purchasing the property. Here, Kelly has to deduct the earnest money ($2,000) from the final cost.

Importance of Earnest Money

The following are the importance of earnest money.

- If there are many buyers for the same property, sellers can choose the one ready to make earnest money. This will help sellers to scrutinize the best buyer for their property.

- For buyers, they show their genuine interest in purchasing the property, and they are committed and serious about the transaction.

- For sellers, it provides financial security; if the buyer defaults without a valid reason, they can keep the money as compensation for the time their property was off the market.

- It gives buyers enough time to inspect and evaluate their finances before finalizing the deal.

How to Protect Your Earnest Money?

The following are the strategies you can apply to protect your earnest money.

1. Put in writing

You should write every term because relying on verbal communication can cause misunderstandings.

2. Review purchase agreement

You should carefully read and understand the agreement’s terms and conditions and clear any doubts. Also, ensure that the agreement is signed by both you and the seller.

3. Understand contingency clauses

Contingency clauses play an important role in agreement because they mention the conditions of transactions. You must carefully understand the clauses like home inspection, financing, and appraisal to get your money back.

4. Use an Escrow Account

You should never deposit money directly into the seller’s account; instead, pay to a reputable real-estate third-party agent or escrow account. It will ensure that the escrow agent releases money after meeting set conditions.

5. Ask for receipt

You must confirm that the payment is deposited into the correct escrow account and always ask for a receipt as proof of payment.

6. Stay updated

You must keep track of the due date or timeline mentioned in the agreement. If you miss the deadline or take a longer time, you might lose the deal, and the seller may keep your money.

Earnest Money Vs. Down Payment

| Earnest Money | Down Payment |

| It represents the initial payment made in good faith before finalizing the deal. | It represents the closing payments made for the property. |

| It may be refundable or not. | It is non-refundable. |

| It helps buyers to stand out from the rest and locks the deal. | It helps in the finalization process and ensures the property of the buyer. |

| This amount is sent to a third-party agent or in an escrow account. | This amount is paid directly to the seller’s account. |

Final Thoughts

Earnest money is a standard approach buyers use to gain the trust of sellers. After paying this amount, the seller usually locks the property under the buyer. It is advantageous to both parties, and they should carefully agree to terms and conditions with thorough research.

Frequently Asked Questions

Q1. How is the earnest money deposit amount calculated?

Answer: It depends on the type of property and the transactions involved. Generally, it varies from 1%- 5% of the total sale or purchase price. For example, if the property’s selling price is $10,000, the earnest money deposit will range from $2,000 to $5,000. It also depends upon market conditions, market value of similar property, property type, etc.

Q2. How does an earnest deposit differ from a security deposit?

Answer: In real estate, both these terms are used. Earnest money signifies a buyer’s commitment to purchase the property. At the same time, the security deposit is the tenant’s payment to the landlord before occupying the rental property.

Recommended Articles

We hope this article on earnest money was beneficial to you. You can also refer to the articles below for related topics.