Updated September 12, 2023

Meaning of Earnings

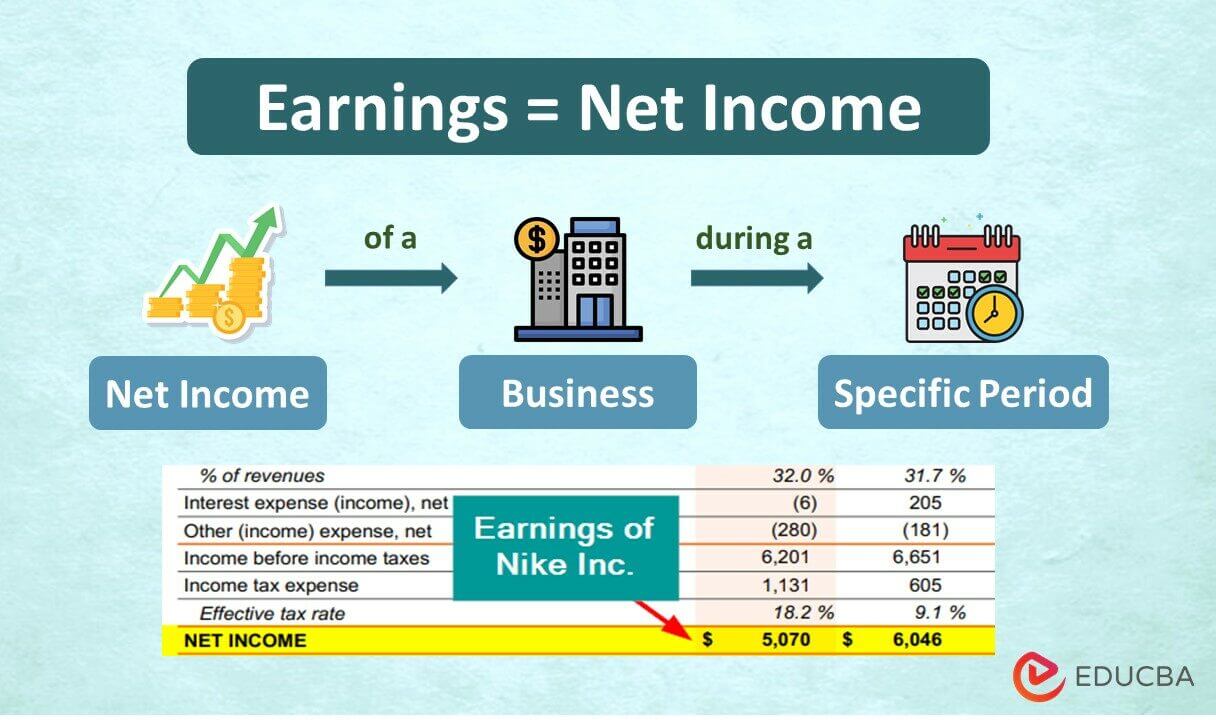

Earnings are the net income or amount a business or organization generates during a certain period.

Companies usually calculate it by subtracting taxes, interest, and cost of sales from total revenue of a specific period. Moreover, it represents a company’s net profit or loss, which is crucial in determining stock market value. For this reason, managing and monitoring earnings is essential for companies to plan future budgets, investments, and other financial decisions.

Table of Contents

Key Highlights

- Earnings are a business or organization’s net income during a certain period.

- It is calculated by subtracting total expenses (COGS, operating expenses) and deductions (taxes) from a company’s total revenue.

- It helps evaluate a business’s financial health by monitoring revenue, profits, and expenses to make informed decisions to increase profits and efficiency.

Real-World Example: HDFC Bank Ltd.

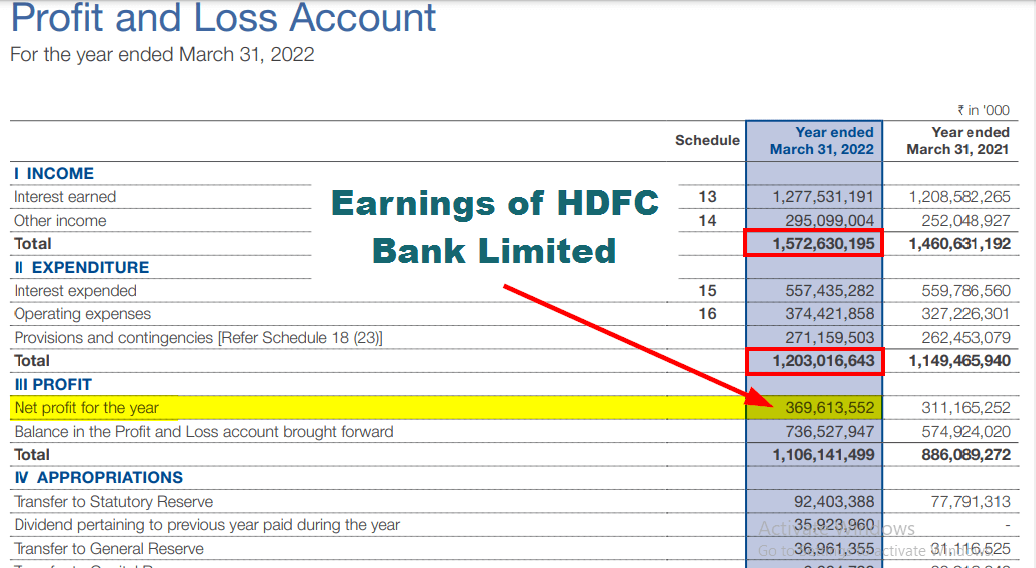

The image below shows HDFC Bank’s income statement (Profit and Loss Account) from its annual report for 2021-2022. In 2022, the company earned a total income of ₹1,572,630,195 and incurred a total expenditure of ₹1,203,016,643. Therefore, the net profit, which is the earnings, amounted to ₹369,613,552 (calculated as total income minus total expenditure). Please note that this data is in the format of “₹ in ‘000.”

(Image Source: HDFC Bank Limited 2022 Annual Report)

Formula

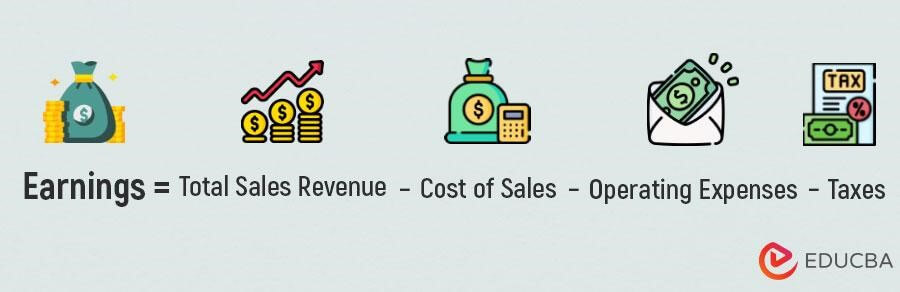

The formula for calculating earnings is:

Earnings = Total Sales Revenue – Cost of Sales – Operating Expenses – Taxes

Where,

- Total Sales Revenue = The total income generated from sales.

- Cost of Sales= Total expenses or costs associated with producing goods.

- Operating Expenses = Total costs of running a business.

- Taxes = Payments paid to the government.

Examples

Let’s understand how to calculate a company’s earnings with the help of the following examples.

Example #1

Consider a company named Starlight with total sales revenues of $25 million in a given year. The cost of raw materials and supplies sales was $9 million, and its operating expenses were $2 million. Let’s calculate the company’s earnings if its tax deduction was $1 million.

Given:

Total sales revenue = $25,000,000

Cost of sales = $9,000,000

Operating expenses =$2,000,000

Taxes= $1,000,000

So, applying the formula,

Earnings = Total Sales Revenue – Cost of Sales – Operating Expenses – Taxes

= $25,000,000 – $9,000,000 – $2,000,000 – $1,000,000

= $13,000,000

The total earnings of Starlight company is $13,000,000.

Example #2

Suppose Super_Tech Innovations manufactures 4000 units of generators and sells them at $50 each. The material cost was $12,000, the labor cost was $5,000, and the overhead was $3,000. The operating expenses were $ 8,000, and the tax deduction was $1000. Let’s calculate the total earnings of the Super_Tech company.

Given:

No. of units sold: 5000

Price per unit: $50

Material cost: $12,000

Labor cost: $4,000

Overhead cost: $3,000

Operating expenses: $8,000

Tax: $1,000

Solution:

Step 1: Calculate total sales revenue

Total Sales Revenue = Total units sold x Price per unit

= 4000 x 50

= $ 200,000

Step 2: Calculate total cost of sales

Total Cost of Sales = Material cost + Labor cost + Overhead cost

= $12,000 + $5,000 + $3,000

= $20,000

Step 3: Calculate total earnings

Earnings = Total Sales Revenue – Cost of Sales – Operating Expenses – Taxes

= $200,000- $20,000-$8,000 -$1,000

=$1,71,000

So, the total earnings of the Super_Tech company is $1,71,000.

Importance

- Earnings allow companies to measure their performance, help them make strategic decisions, and assess the health of their operations.

- Additionally, it is useful to assess future investments and financial goals.

- It is also crucial for shareholders, as they provide insight into a company’s value and potential for growth. It helps them to know the potential of a company before investing.

Uses

- It represents a company’s financial status and growth.

- It is helpful to identify the valuation of a company individually as well as in comparison to its peers.

- By comparing the income and balance statements, analysts can identify whether a company is functioning proficiently or not.

Earnings vs. Revenue

| Particulars | Earnings | Revenue |

| Meaning | Earnings refer to the total money a company makes after deducting all expenses. | Revenue is the total money a company makes from its operational activities before deducting any expenses. |

| Calculation | Subtract total expenses and deductions from total revenue to calculate earnings. | Calculate by adding all amounts generated through sales or other business operations. |

| Measures | It measures the profitability of a company and its ability to generate profits. | It measures a company’s total sales, which is useful in tracking sales performance. |

Final Thoughts

Maximizing profits is crucial for a business to succeed in the long run. To achieve this, companies must adopt measures to manage their expenses, such as investing in better technology and producing new products in demand. Companies can improve their earnings and ensure long-term sustainability by taking necessary steps and actions for revenue management.

Frequently Asked Questions (FAQs)

Q1. What is earning also known as?

Answer: Earning is a company’s net profit. It is also known as bottom line or after-tax net income.

Q2. What earnings are taxable?

Answer: Taxable earnings are income from employment, like wages and salary, interest, business profits, dividends, capital gains, and more. They are subject to specific income tax laws and other taxes depending on the amount and government regulations.

Recommended Articles

We hope this EDUCBA guide on Earnings was helpful to you. You can learn more about related topics from the following articles: