Updated July 24, 2023

Difference Between EBIT vs Net Income

EBIT vs Net Income in this article, EBIT stands for earnings before interest and taxes and it is used to measure the operating performance of an entity with respect to its profitability before taking the interest, taxes, or cost of capital into due consideration. EBIT can be defined as a method that is taken into use for evaluating the profitability of an entity. The calculation of EBIT ignores the expenses pertaining to interest and taxes. EBIT can be calculated by either of the two ways i.e. either by deducting the operating expenses (O.E.) of the company from the revenues earned by the same (Revenue – O.E. = EBIT) or by adding up the net income (NI), interest, and taxes of the company (NI + Interest + Taxes = EBIT).

On the other hand, Net Income is used to evaluate the total profits earned by an entity after making necessary adjustments for interest and taxes borne by the entity. Net income or NI can be calculated by deducting the interest, taxes, depreciation of the financial assets, and other expenses incurred by the company from the total revenue earned by the same. Unlike EBIT, the calculation of EBIT takes into account the expenses pertaining to interest, taxes, depreciation, etc. In other words, net income can be defined as the final income earned by an entity after making adjustments for all the expenses pertaining to interest, taxes, depreciation, etc. The formula used for the determination of Net Income is-

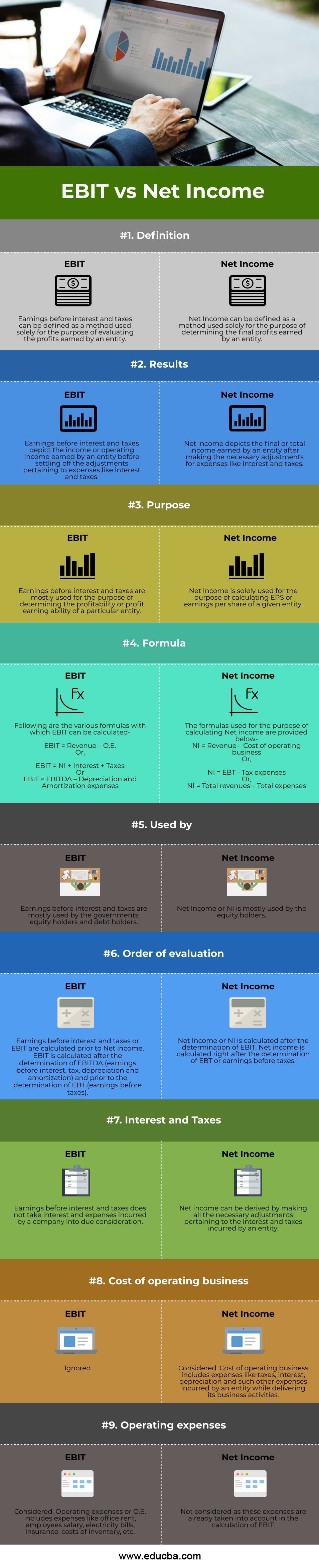

Head To Head Comparison Between EBIT vs Net Income (Infographics)

Below are the Top 9 comparisons between EBIT vs Net Income:

Key Differences Between EBIT vs Net Income

The key differences between earnings before interest and taxes and net income are discussed as follows:

- EBIT or earnings before interest and taxes are calculated prior to the calculation of EBT (Earnings before taxes) and after the determination of EBITDA (earnings before interest, tax, depreciation, and amortization). On the other hand, net income is calculated after the calculation of EBT.

- EBIT ignores the adjustments pertaining to expenses like interest and taxes incurred by the company. On the other hand, net income is calculated by taking the expenses pertaining to interest and taxes into consideration.

- EBIT is calculated for the purpose of determining the income or operating income earned by a company prior to the payment of interest and taxes. On the other hand, net income is calculated for the purpose of determining the total or final income earned by an entity after paying off its expenses like interest and taxes.

- EBIT takes into account the operating expenses like office rent, insurance, employees’ salary, electricity bill, printing and stationery bills, utility bills, etc. On the other hand, net income considers the cost of operating a business such as taxes, interest, depreciation of financial assets, and such other expenses borne by a company while performing its business operations.

- The calculation of EBIT is done prior to the calculation of net income.

Comparison Table

Let’s discuss the top comparison between EBIT vs Net Income:

| Basis of Comparison |

Ebit or Earnings Before Interest and Taxes |

Ni or Net Income |

| Definition | Earnings before interest and taxes can be defined as a method used solely for the purpose of evaluating the profits earned by an entity. | Net Income can be defined as a method used solely for the purpose of determining the final profits earned by an entity. |

| Results | Earnings before interest and taxes depict the income or operating income earned by an entity before settling off the adjustments pertaining to expenses like interest and taxes. | Net income depicts the final or total income earned by an entity after making the necessary adjustments for expenses like interest and taxes. |

| Purpose | Earnings before interest and taxes are mostly used for the purpose of determining the profitability or profit earning ability of a particular entity. | Net Income is solely used for the purpose of calculating EPS or earnings per share of a given entity. |

| Formula | Following are the various formulas with which EBIT can be calculated- EBIT = Revenue – O.E. Or, EBIT = NI + Interest + Taxes Or EBIT = EBITDA – Depreciation and Amortization expenses |

The formulas used for the purpose of calculating Net income are provided below- NI = Revenue – Cost of operating business Or, NI = EBT – Tax expenses Or, NI = Total revenues – Total expenses |

| Used By | Earnings before interest and taxes are mostly used by the governments, equity holders, and debt holders. | Net Income or NI is mostly used by equity holders. |

| Order of Evaluation | Earnings before interest and taxes or EBIT are calculated prior to Net income. EBIT is calculated after the determination of EBITDA (earnings before interest, tax, depreciation, and amortization) and prior to the determination of EBT (earnings before taxes). | Net Income or NI is calculated after the determination of EBIT. Net income is calculated right after the determination of EBT or earnings before taxes. |

| Interest and Taxes | Earnings before interest and taxes do not take interest and expenses incurred by a company into due consideration. | Net income can be derived by making all the necessary adjustments pertaining to the interest and taxes incurred by an entity. |

| Cost of operating business | Ignored | Considered. The cost of operating a business includes expenses like taxes, interest, depreciation, and such other expenses incurred by an entity while delivering its business activities. |

| Operating expenses | Considered. Operating expenses or O.E. includes expenses like office rent, employees’ salary, electricity bills, insurance, costs of inventory, etc. | Not considered as these expenses are already taken into account in the calculation of EBIT. |

Earnings before interest and taxes can be defined as an indicator used solely for the purpose of calculating the profits or operating profits earned by an entity. On the other hand, net income can be defined as an indicator that is solely used for the purpose of calculating the EPS or earnings per share of an entity. EBIT is taken into use by the government, shareholders, and debt holders whereas net income is mostly used by the equity holders. EBIT ignores expenses concerning the interest and taxes incurred by an entity whereas the calculation of net income considers interest and taxes paid by an entity.

Recommended Articles

This is a guide to EBIT vs Net Income. Here we discuss the difference between EBIT vs Net Income, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–