Updated July 5, 2023

What is the EBITDA?

EBITDA is a financial metric to evaluate a company’s financial performance that stands for earnings before interest, taxes, depreciation, and amortization. It is the net income a company generates before deducting interest, taxes, depreciation, and amortization expenses.

For example, Berkshire Hathaway Inc. has an EBITDA of $9.95 billion. It indicates that the company earns more than 9 billion dollars before deducting all its expenses. It signifies that the company is profitable.

The EBITDA Formula is as follows,

Key Highlights

- EBITDA is an acronym for earnings before interest, taxes, depreciation, and amortization, which measures a company’s operating performance.

- The calculation includes summing up the expenses, such as interest, tax, and depreciation expenses, with the net income

- It is an important metric for a company as it can help measure its profitability and compare the data to other companies in the industry

- It is also a good measure of a company’s ability to service its debt and pay its dividends to its shareholders.

EBITDA Formula

The formula for EBITDA is,

Top-Down (Net income):

Bottom-Up (EBIT):

- Net income is a company’s total earnings minus taxes or other expenses. We can find it on the income statement

- Interest expense is the cost of borrowing money. We can locate it on the income statement

- Deductible tax expenses are those that help reduce any taxable income. It is available in the income statement

- Depreciation and amortization expense describe the cost allocation of tangible or intangible assets over their useful life. It is present on the cash flow statement

- EBIT is earnings before interest and taxes, which indicates a company’s operating profit. It is on the income statement.

Stepwise Calculation of EBITDA

We can derive EBITDA using the following steps:

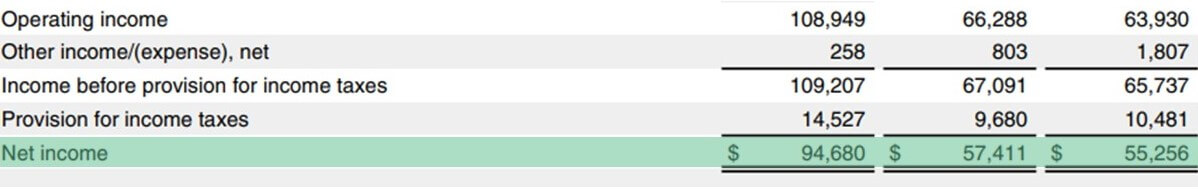

Step 1: First, determine the company’s net income during the year, which is easily available as a line item in the income statement. The image below shows the net income for three years (all data is in Millions $).

Step 2: Next, figure out the interest expense incurred by the company, which is usually a finance cost in the income statement. It is a product of the interest rate and the outstanding debt.

Step 3: Third, determine the income tax paid during the year, and it is a product of the effective corporate tax rate and the income before tax. It is also present as a line item in the income statement.

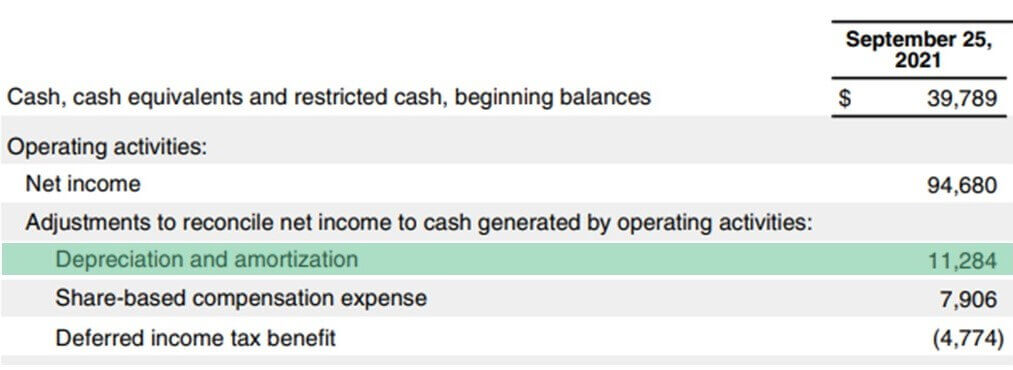

Step 4: Afterward, determine the depreciation & amortization expense on the tangible and intangible assets. It is also easily available in the cash flow statement.

Step 5: Finally, we can derive the formula for EBITDA by adding interest (step 2), tax (step 3), and depreciation & amortization (step 4) to the net income (step 1), as shown below.

Real Company Examples

Example #1:

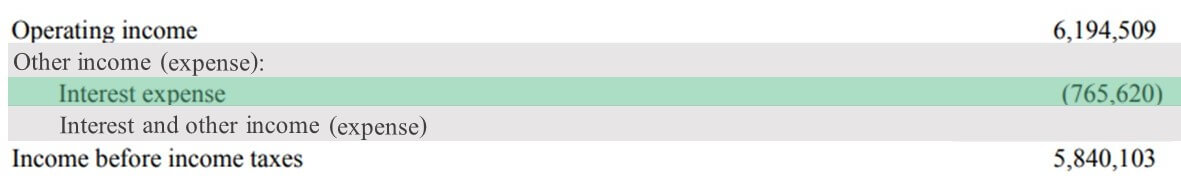

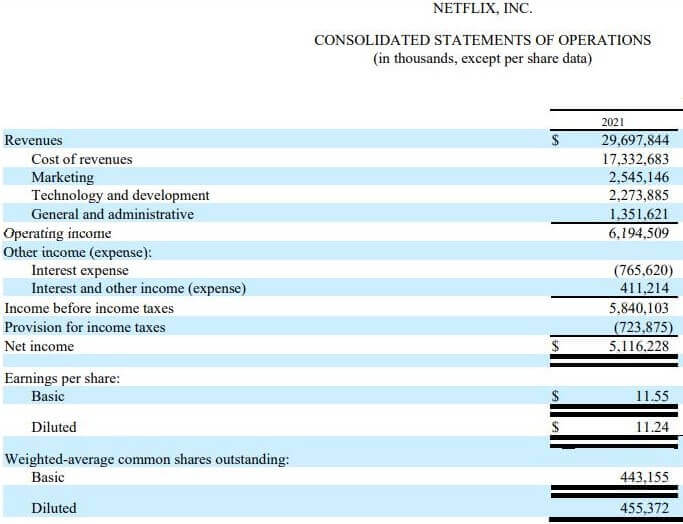

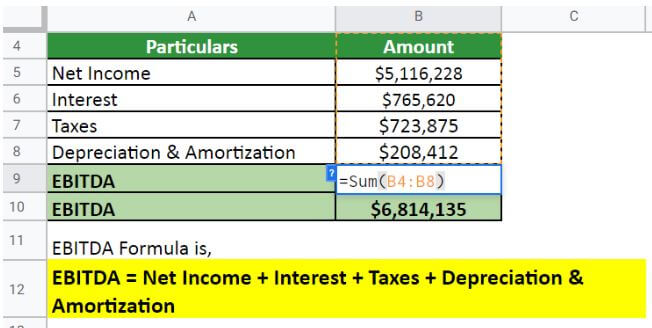

Let us take the example of Netflix Inc. As per the recent annual report, the company has clocked a turnover of $29,697,844. The information is available on their income statement.

Let us calculate Netflix’s EBITDA during the financial year 2021.

(Image Source: Netflix Annual Report 2021)

Solution:

As per the annual report of Netflix,

- Net income: $5,116,228

- Interest: $765,620

- Tax: $723,875

- Depreciation & amortization: $208,412

Implementing the formula,

EBITDA = $5,116,228+ $765,620+ $723,875+ $208,412

EBITDA = $6,814,135

Therefore, Netflix’s EBITDA is $6,814,135 million during the year 2021.

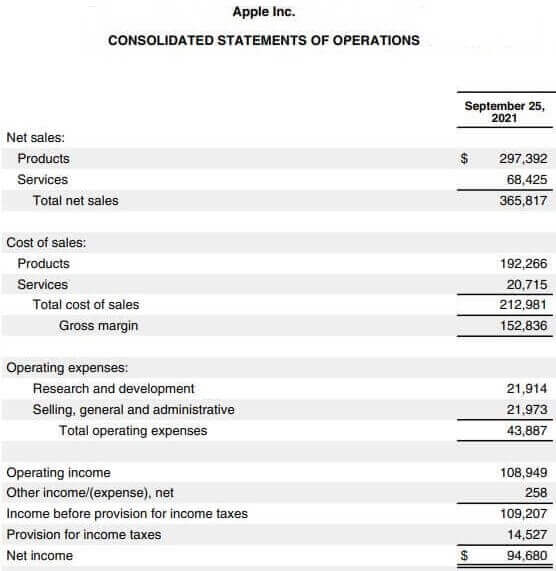

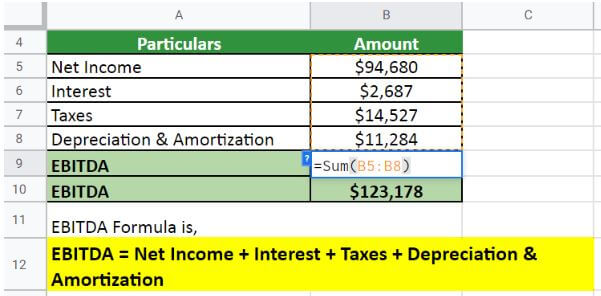

Example #2:

Let us take an example of Apple Inc. As per the latest annual report for the year ending on September 25, 2021, calculate Apple Inc.’s EBITDA.

(Image Source: Apple Annual Report 2021)

Solution:

As per the annual report of Apple,

- Net income: $94,680

- Interest: $2,687

- Tax: $14,527

- Depreciation & amortization: $11,284

Implementing the formula,

EBITDA = $94680+ $2,687 + $14,527 + $11,284

EBITDA = $123,178

Therefore, Apple’s EBITDA was $123,178 million during the year 2021.

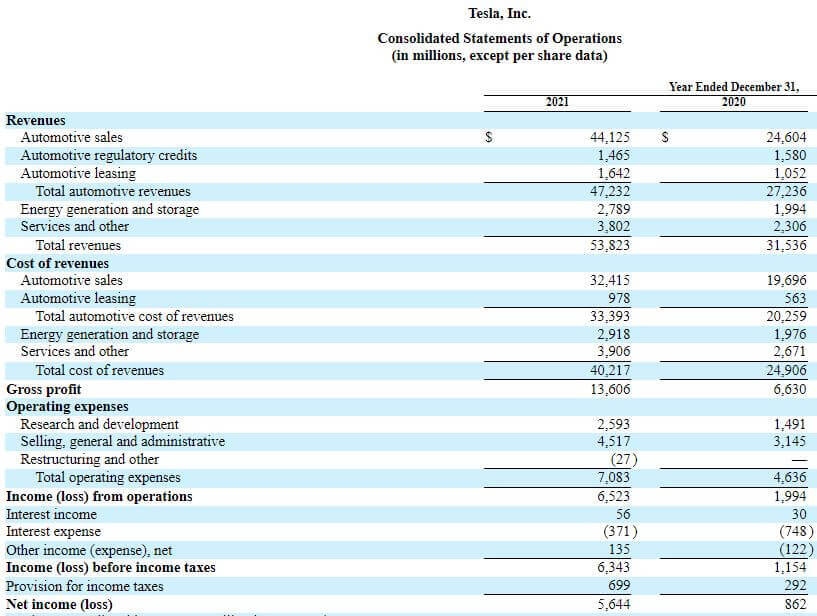

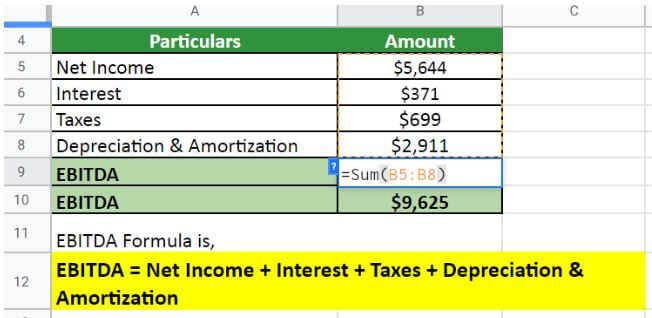

Example #3:

Let us take another real-life example of Tesla. As per their latest annual report for the year ending on December 31, 2021, the information is available. Calculate Tesla’s EBITDA.

(Image Source: Tesla Annual Report 2021)

Solution:

As per the annual report of Tesla,

- Net income: $5,644

- Interest: $371

- Tax: $699

- Depreciation & amortization: $2,911

Implementing the formula,

EBITDA = $5,644 + $371 + $699 + $2,911

EBITDA = $9,625

Therefore, Tesla had an EBITDA of $9,625 million in 2021.

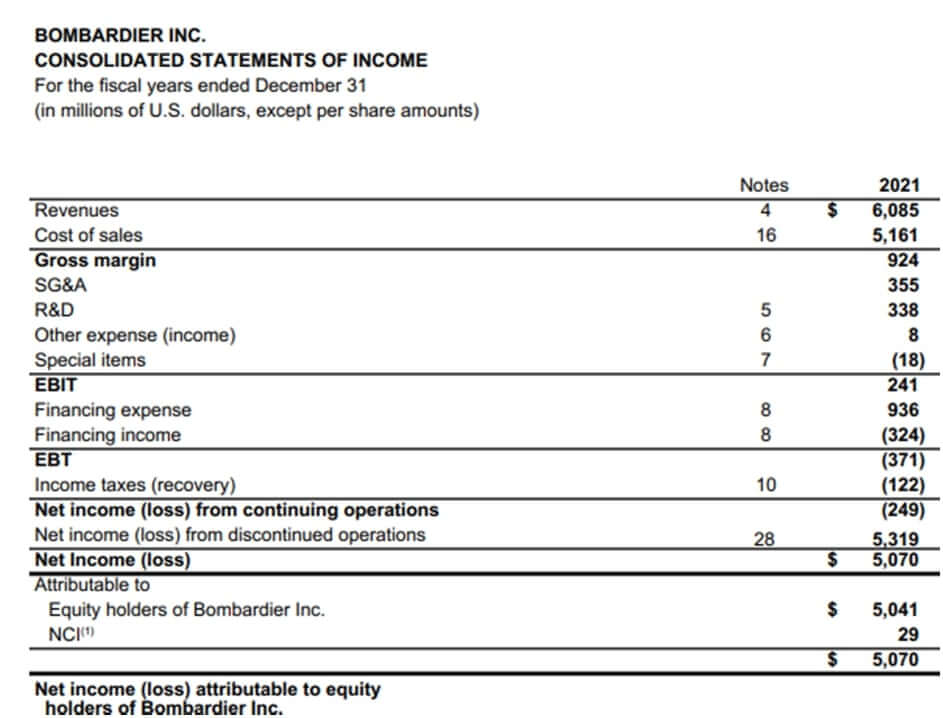

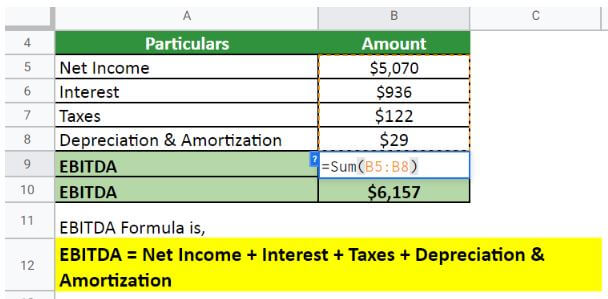

Example #4:

Let us take the real-life example of Bombardier Inc. to calculate EBITDA. The following information is available from the income statement as per the annual report for the year ending December 31, 2021. Calculate Bombardier Inc.’s EBITDA during the financial year 2021.

(Image Source: Bombardier Inc Annual Report 2021)

Solution:

As per the annual report of Bombardier,

- Net income: $5,070

- Interest: $936

- Tax: $122

- Depreciation & amortization: $29

Implementing the formula,

EBITDA = $5,070+ $936+ $122 + $29

EBITDA = $6,157

Therefore, Bombardier had an EBITDA of $6,157 million in 2021.

More Examples

Example #1: Top-Down Approach

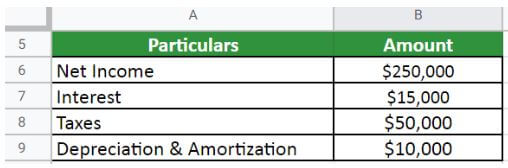

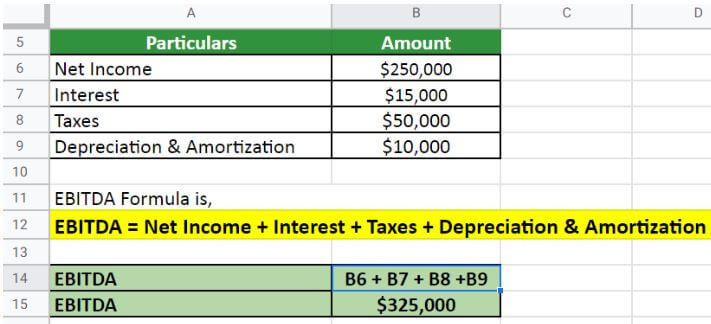

ABC Limited is a retail company with a supermarket in the US. Their income for the year ending 31st December 2021 is $250,000. In addition, interest, tax, depreciation & amortization expenses are $15,000, $50,000, and $10,000, respectively. Let us calculate their EBITDA.

Given,

Solution:

We use the following formula to calculate EBITDA,

EBITDA = Net Income + Interest + Taxes + Depreciation & Amortization

EBITDA = $250,000 + $15,000 + $50,000 + $10,000

Thus, EBITDA is $325,000 million.

Example #2: Bottom-Up Approach

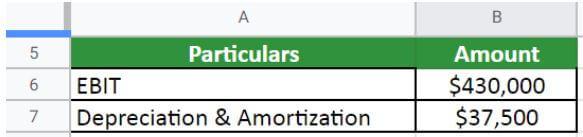

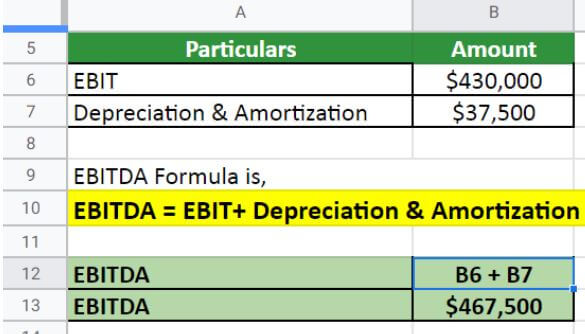

XYZ Limited is a company operating in the US. Their EBIT as of 31st December 2021 is $430,000, and depreciation & amortization expenses are 37,500. Calculate their EBITDA.

Given,

Solution:

Let us calculate EBITDA,

EBITDA = $430,000 + $37,500

Thus, EBITDA is $467,500 million

Utility & Relevance

- From the perspective of a financial analyst, EBITDA is one of the most important metrics as it helps in assessing the performance of the company in terms of its operating profit

- It is a non-GAAP measure that excludes expenses to give an accurate picture of a company’s profitability

- As depreciation and amortization are two of the most significant expenses that a company can have, excluding them makes the measure accurate

- It is a proxy for cash flow, as it excludes items that impact cash flow. Additionally, as the changes in capital structure do not affect it, it can be helpful while comparing companies of different sizes.

- However, analysts should perform EBITDA analysis among companies in the same industry (similar accounting) and of the scale (similar tax bracket); otherwise, the analysis would not result in any meaningful outcome.

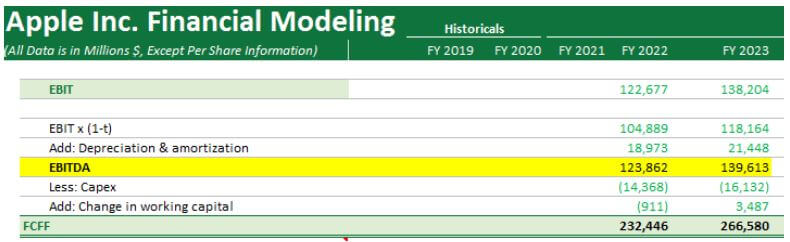

Importance of EBITDA in Financial Modeling

EBITDA is an essential metric in financial modeling because it measures a company’s operating profitability. Profitability is critical to investors because it is a vital driver of a company’s value. It is also helpful for analyzing a company’s historical financial performance.

However, there are a few limitations to using EBITDA to measure profitability. One is that it only includes some sources of revenue and expenses. Another is that management can manipulate it through accounting decisions. Despite these limitations, EBITDA is still a valuable financial modeling and analysis metric.

You can find EBITDA in the DCF model of Apple Inc. below;

Importance of EBITDA for a company

- It is a helpful metric for investors to use when considering whether to invest in a company

- It tells us how much profit a company generates from its core businesses before accounting for financing decisions, tax implications, or other one-time items

- It is also a helpful metric for comparing companies of different sizes and in various industries

- It helps evaluate companies that have recently undergone significant changes, such as mergers or acquisitions.

EBITDA Formula Calculator

You can use the following EBITDA Formula Calculator

| Net Income | |

| Interest | |

| Tax | |

| Depreciation & Amortization | |

| EBITDA | |

| EBITDA = | Net Income + Interest + Tax + Depreciation & Amortization | |

| 0 + 0 + 0 + 0 = | 0 |

Frequently Asked Questions (FAQs)

Q1. How do you calculate EBITDA?

Answer: To calculate EBITDA, take the company’s net income and add back all interest, taxes, depreciation, or amortization expenses. It gives the company’s earnings before deducting any of these expenses.

The EBITDA formula is EBITDA = Net Income + Financing Expense + Tax + Depreciation & Amortization.

Q2. What is the difference between EBIT vs. EBITDA?

Answer: EBIT (earnings before interest and taxes) and EBITDA (earnings before interest, taxes, depreciation, and amortization) are financial metrics that measure a company’s profitability. While EBIT computes the earnings, including interest and taxes, EBITDA includes depreciation & amortization too. Generally, EBITDA is a more accurate measure of a company’s operating cash flow.

Q3. What is adjusted EBITDA?

Answer: Adjusted EBITDA is similar to EBITDA businesses use to measure their financial performance. The significant difference is that adjusted EBITDA considers additional expenses each firm makes. As a result, it provides a precise operating cash flow for every firm.

Q4. What are EBITDA multiples?

Answer: EBITDA multiple is a ratio where a company’s enterprise value is divided by its EBITDA, i.e., EV/EBITDA. Enterprise value (EV) is a company’s market capitalization plus its debt minus any cash on its balance sheet.

EBITDA multiples are useful for valuing companies by comparing companies with different capital structures. Firms with higher EBITDA multiples are usually more valuable.

Q5. What is the EBITDA margin?

Answer: The EBITDA margin is a measure of a company’s profitability. Companies calculate it by dividing the EBITDA by its revenue.

The formula is EBITDA Margin = EBITDA / Revenue * 100.

The EBITDA margin is a helpful metric for comparing the profitability of companies in the same industry. It is also an excellent way to compare a company’s profitability over time. A high margin indicates that a company is profitable and efficient, while a low margin means a company needs to improve.

Q6. What is a good EBITDA?

Answer: The company’s EBITDA depends on several factors, including its industry, size, and growth prospects. For example, a small startup in a high-growth sector may have a very different EBITDA than a large, established company in a mature industry. However, economists and analysts say a good EBITDA value is above 10%.

Q7. What does EBITDA mean in business?

Answer: It’s a measure of a company’s profitability that excludes expenses. It also measures a company’s ability to generate cash flow. Investors often use EBITDA to compare companies across industries as it removes the impact of different accounting practices.

Recommended Articles

This is a guide to the EBITDA Formula. Here we discuss how to calculate EBITDA along with practical examples. We also provide an EBITDA calculator with a downloadable Excel template. You may also look at the following articles to learn more –