Updated July 12, 2023

Definition of EBITDA Margin

The acronym “EBITDA” stands for earnings before interest, tax, and depreciation & amortization. As the same suggests, EBITDA margin refers to the profitability metric that helps in assessing the operational efficiency or the operating profit generated by each dollar of the revenue.

In other words, the earnings before interest, tax, and depreciation & amortization margin determine the profitability of a company after allocating all direct and indirect costs that are associated with the production process (known as operating expenses that include the cost of raw material, labor cost, selling expense, etc.).

The earnings before interest, tax, depreciation & amortization margin are good indicators of an entity’s operating performance when tracked over time. An increasing trend in the earnings before interest, tax, and depreciation & amortization margin indicates improving operational efficiency. Further, It can also improve with an increase in the scale of operations in the case of companies with high operating leverage (a higher mix of fixed cost components in the cost structure).

Formula:

The formula for (earnings before interest, tax, and depreciation & amortization) margin can be derived by adding back interest expense, taxes paid, and depreciation & amortization charge to the net income of the company, then dividing the result by the total sales and then express it in terms of percentage. The Mathematical representation of the formula is:

or,

Examples of EBITDA Margin (with Excel template)

Let’s take an example to understand the calculation in a better manner.

Example #1

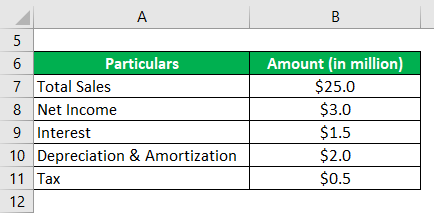

Let us take the example of a company that is a manufacturer of soft drinks in the city of Lumberton, North Carolina (USA). As per the latest annual report for the year 2018, the company has booked a net income of $3.0 million on a total sales of $25.0 million. Further, it incurred an interest expense of $1.5 million and charged depreciation & amortization of $2.0 million. The company paid $0.5 million in taxes during the year. Calculate the EBITDA margin of the company during the year.

Solution:

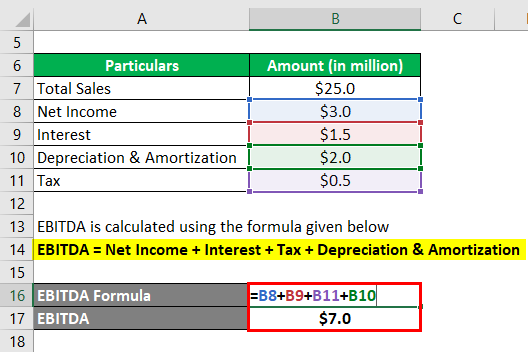

The formula to calculate EBITDA is as below:

EBITDA = Net Income + Interest + Tax + Depreciation & Amortization

- = $3.0 million + $1.5 million + $0.5 million + $2.0 million

- = $7.0 million

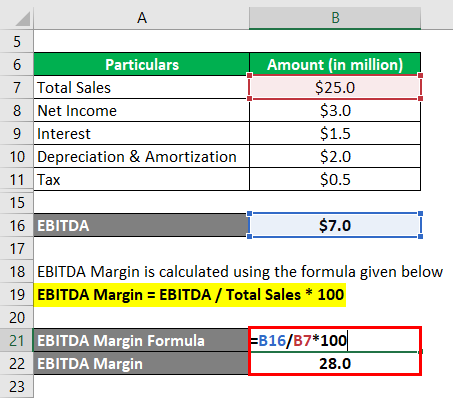

Use the below formula to calculate EBITDA Margin:

EBITDA Margin = EBITDA / Total Sales * 100

- = $7.0 million / $25.0 million * 100

- = 28.0%

Therefore, the company’s EBITDA margin stood at 28.0% during the year.

Example #2

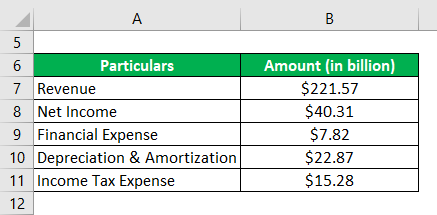

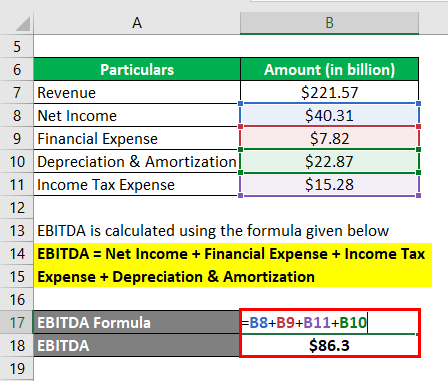

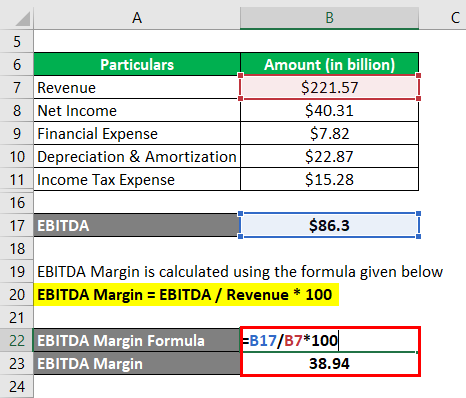

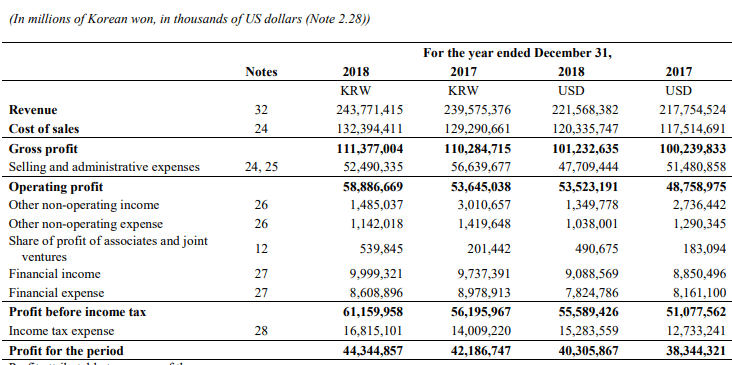

Let us take the example of Samsung to illustrate the computation of EBITDA margin based on its recent annual report. According to its income statement, the company achieved total revenue of $221.57 billion, generating a net income of $40.31 billion. However, it incurred a financial expense of $7.82 billion during the same period, depreciation & amortization of $22.87 billion, and income tax expense of $15.28 billion. Therefore, calculate Samsung’s (earnings before interest, tax, and depreciation & amortization) margin during the year based on the given information.

Solution:

The formula to calculate EBITDA is as below:

EBITDA = Net Income + Financial Expense + Income Tax Expense + Depreciation & Amortization

- = $40.31 billion + $7.82 billion + $15.28 billion + $22.87 billion

- = $86.28 billion

The formula to calculate EBITDA Margin is as below:

EBITDA Margin = EBITDA / Revenue * 100

- = $86.28 billion / $221.57 billion * 100

- = 38.94%

Therefore, Samsung managed an EBITDA margin of 38.94% during the year.

Source Link: Samsung Balance Sheet

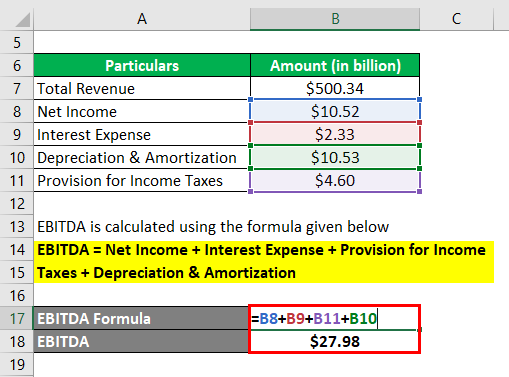

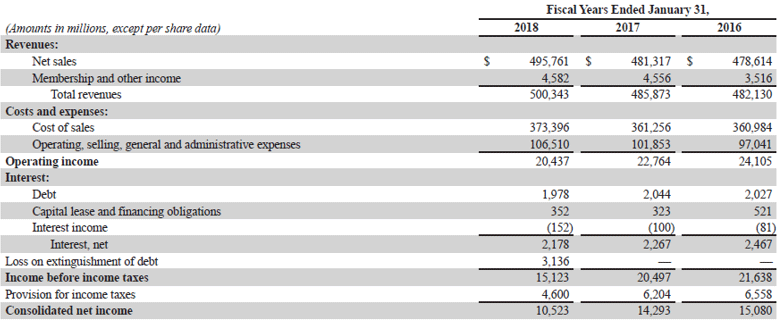

Example #3

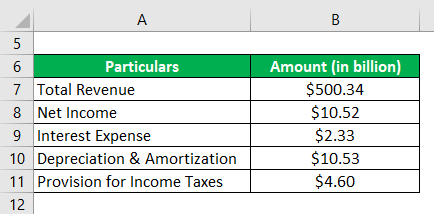

Let us take the example of Walmart Inc. to further illustrate the concept of (earnings before interest, tax and depreciation & amortization) margin. According to the annual report for the year 2018, the company achieved total revenue of $500.34 billion, with a corresponding interest expense of $2.33 billion, depreciation & amortization of $10.53 billion, and provision for income taxes of $4.60 billion. Therefore, if the net income generated during the year is $10.52 billion, calculate the EBITDA margin of Walmart Inc. for the year.

Solution:

The formula to calculate EBITDA is as below:

EBITDA = Net Income + Interest Expense + Provision for Income Taxes + Depreciation & Amortization

- = $10.52 billion + $2.33 billion + $10.53 billion + $4.60 billion

- = $27.98 billion

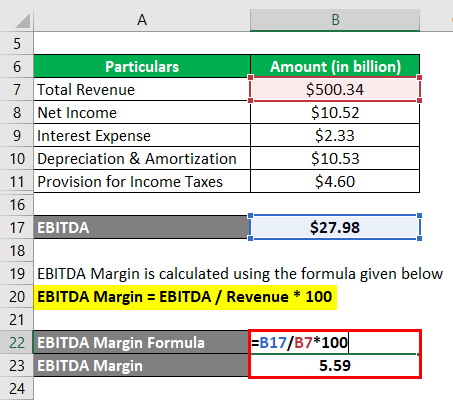

Th formula to calculate EBITDA Margin is as below:

EBITDA Margin = EBITDA / Revenue * 100

- = $27.98 billion / $500.34 billion * 100

- = 5.59%

Therefore, Walmart Inc.’s EBITDA margin remained at 5.59% during the year 2018.

Source: Walmart Annual Reports (Investor Relations)

Advantages of EBITDA Margin

- Captures the overall operational efficiency of a company.

- It is a good performance trend indicator across time periods.

- It is very useful to compare operational efficiency among peers.

Limitations of EBITDA Margin

- It excludes the impact of debt, so companies with high debt are better off to present (earnings before interest, tax, and depreciation & amortization) margin.

- GAAP does not regulate it; companies can manipulate their computation.

Conclusion

So, it can be concluded that the (earnings before interest, tax and, depreciation & amortization) margin is one of the most significant measures of a company’s operational performance. However, one should take cognizance that in peer analysis, the EBITDA margin should be compared with entities in the same industry and of a similar scale; otherwise, it would not yield any meaningful insight.

Recommended Articles

This is a guide to the EBITDA Margin. Here we discuss how it can be calculated using a formula, the Advantages and Limitations of EBITDA Margin, and a downloadable Excel template. You can also go through our other suggested articles to learn more –