Updated July 24, 2023

Difference Between EBITDA vs Net Income

Earnings before interest tax depreciation and amortization popularly known as EBITDA is a measure of financial performance and profitability and is mainly used as an alternative to net income Net income can be defined as the amount left after all the expenses, including depreciation and taxes, are paid off. In this article, EBITDA vs Net Income, basic importance is stated.

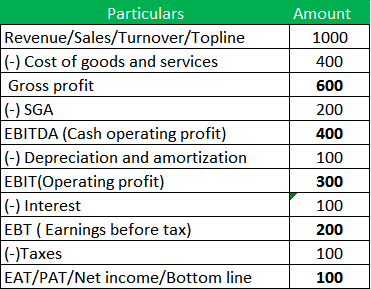

The word profit in the finance world can generally be of any of these three categories – Gross profit, Operating profit, and Net profit. Let’s see the difference between all of these.

Gross profit: Revenue minus all the directly related costs. Directly related cost is known as the cost of goods and services (e.g.: Raw material cost)

Operating Profit: Gross profit minus all the overheads or operating expenses, including depreciation, amortization, and depletion amounts.

Net profit: Operating profit after deducting the taxes and interest gives the net income.

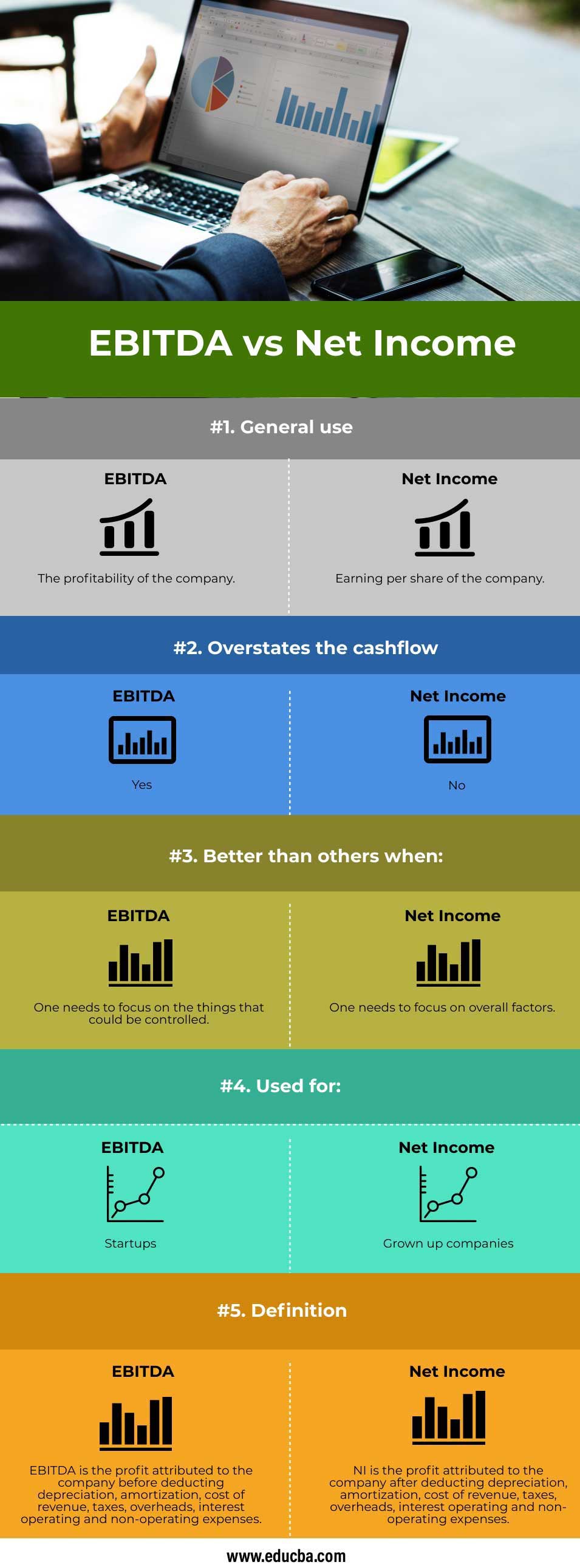

Head To Head Differences Between EBITDA vs Net Income (Infographics)

Below are the top 5 differences between EBITDA vs Net Income:

Key Differences Between EBITDA vs Net Income

The unique differences for EBITDA vs Net Income are discussed below:

This can vary as per the company. A few companies may not mention EBITDA and EBIT together.

OR

So the chain is in this way:

SGA ( Sales general and administrative expenses): Expenditure used for selling and administrative purposes

Interest: Depends on the loan company borrowed and the interest rate. Finance structure is what deals with the interesting part.

Taxes: Depends on the location of your company and which taxes norms does it fall under.

Depreciation: Depending on the depreciation and amortization. As these are non-cash items, that means one doesn’t lose out on cash. It’s the value in the statements that decrease the assets. So EBITDA is also called cash operating profit. It tells you the company’s operating performance.

Example: If a company purchases a truck for RS 100. On the asset side, the asset of Rs100 would increase, and Cash of RS 100 is decreased. Assume the truck has a useful life of 5 years. Every year, the company will charge a depreciation expense of Rs 20 as 100/5, assuming no residual value and using straight-line depreciation.

NI = Revenue: All the costs needed to work the business. In simple words, Net income referred to total revenue – total expenses. Suppose you are having a business of selling cars. You had total revenue of Rs250000 for this quarter. One cannot keep the entire amount because the person needs to pay the rent, employees’ salary, electricity bill, cost of material, taxes, and interest. Let’s say all these expenses came around Rs 100000. So after deducting all the expenses (RS 100000) from the revenue(RS 250000), the net income comes to around Rs 150000.Net income has different names like PAT( Profit after taxes) or bottom-line.

As one needs to pay interest, cost associated with the businesses or non-cash items like depreciation and amortization, these all are deducted from revenue before arriving at the net income. It means Net Income is used to examine the profit-making ability of a company after paying all the expenses during the working of the company, whereas EBITDA is used to examine the profit-making ability of a company before paying all the expenses during the working of the company.

- Comparing the different companies in the same sector, EBITA margin can be a great measurement. It is one of the most useful measures for computing profitability.Net income is used to calculate Earnings per share ( EPS ). Like net income, when divided by the no of shares outstanding, gives EPS. EPS is a good metric for investors to analyze the earnings from per share.

- EBITDA does not include the business aspects, considering it as cashflow will lead to a lot of blunder. However, cashflow calculations start with Net income and making adjustments while deriving cash flow from operations.

- EBITDA can be used and analyzed when one needs to comment on the factors which can be controlled. As EBITDA decreases, the effect of outside, uncontrollable factors. E.g., depreciation and taxes cannot be controlled by the company. As the government decides taxes. Depreciation, amortization done on intangibles or tangible properties, plant, or equipment depends on the depreciation schedule.

- Investors or businessmen, whenever you hear them saying Net income, means they are examining the company’s profit-making ability. When in an early-stage company doesn’t make a great bottom margin for startups or ventures, the only purpose is to maximize the sales. So the EBITDA margin is a great tool for startups. A good EBITDA means the company is not having problems in making a profit. The low EBITDA margin states the earnings of the company are not stable. Whenever any investor searches for investment in early-rising companies, they focus on the EBITDA rather than NI. On the other hand, net income is used when the company is established and knowing the company’s financial health.

EBITDA vs Net Income Comparison Table

Let’s discuss the top comparison between EBITDA vs Net Income:

| Basis of Comparison | EBITDA | Net Income |

| General use | The profitability of the company. | Earning per share of the company. |

| Overstates the cashflow | Yes | No |

| Better than others when | One needs to focus on the things that could be controlled. | One needs to focus on overall factors. |

| Used for | Startups | Grown-up companies |

| Definition | EBITDA is the profit attributed to the company before deducting depreciation, amortization, cost of revenue, taxes, overheads, interest operating and non-operating expenses | NI is the profit attributed to the company after deducting depreciation, amortization, cost of revenue, taxes, overheads, interest operating and non-operating expenses. |

Conclusion

The company can adjust these indicators by changing a few parameters like depreciation or interest rates or savings on taxes. Both of these ratios are based on the income statements; an investor can check other ratios based on the other statements like balance sheet and cash flow statements to get a better understanding. Although EBITDA is a measure of profitability, just depending on it for future estimations would be dangerous. By analyzing the company’s growth and profitability, one can comment with a better surety about the company’s health. As there are many different margins and ratios available for doing analysis and many factors, affect the same, studying and getting an overall picture before making any decision can lead to fruitful results.

Recommended Articles

This is a guide to EBITDA vs Net Income. Here we discuss the introduction to EBITDA vs Net Income, key differences with infographics, and a comparison table. You can also go through our other suggested articles to learn more–