Updated July 24, 2023

Difference Between EBITDA vs Operating Income

EBITDA is the short form used for Earnings before interest, taxes, depreciation, and amortization. EBITDA can be defined as a measure that is taken into use for the purpose of evaluating the operating performance of an entity. Unlike EBIT or Earnings before interest and taxes, EBITDA does not take certain expenses into consideration that are non-cash and non-operating in nature. EBITDA vs Operating Income in this article, it can be said that EBITDA ignores the accounting pertaining to the capital structure and is used in order to showcase the financial performance of an organization. The formulas used for the calculation of EBITDA are:

or

Operating income or OI can be defined as a metric of profitability that is used by the readers of the financial statements to determine what amount of revenue will actually be left after making adjustments pertaining to the deduction of direct and indirect operational costs from the sales revenue. Operating income is also termed as operating profits or EBIT. The formula used for the calculation of Operating income is:

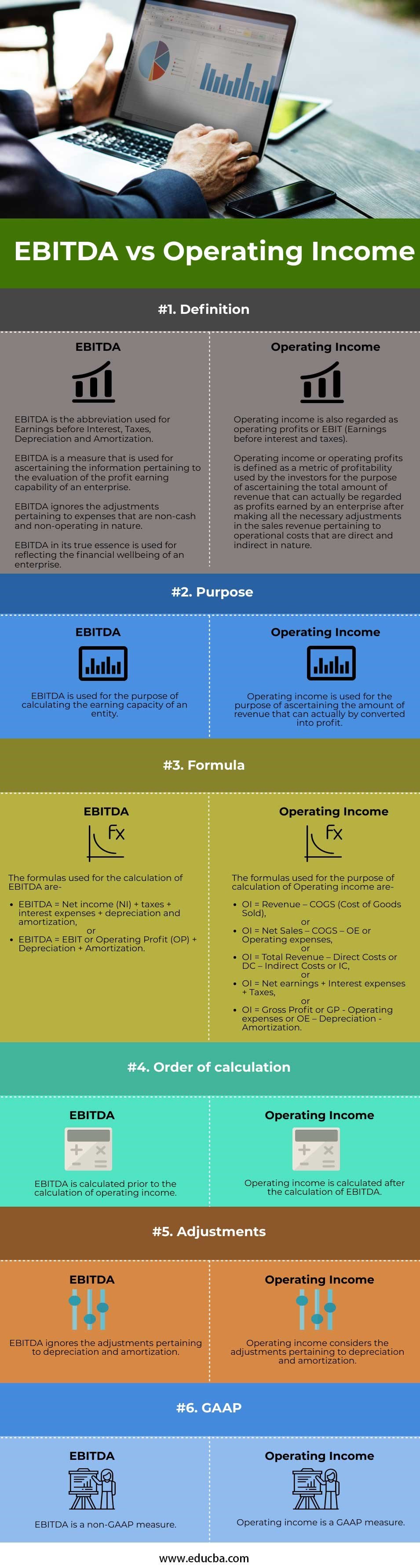

Head To Head Comparison Between EBITDA vs Operating Income(Infographics)

Below are the Top 6 differences between EBITDA vs Operating Income:

Key Differences Between EBITDA vs Operating Income

The key differences between EBITDA and operating income are provided and discussed as follows:

- Earnings before interest, taxes, depreciation and amortization or EBITDA is a non-GAAP measure whereas Operating income or OI is a GAAP measure.

- EBITDA is taken into use for ascertaining the information pertaining to the earning capacity of an enterprise whereas Operating income is taken into use for finding out what amount of revenue can be regarded as profit earned by an enterprise.

- When it comes to the order of the calculation part, EBITDA is calculated prior to the calculation of operating income.

- The calculation of EBITDA does not take adjustments like depreciation and amortization into due consideration whereas the calculation of operating income does take these adjustments into due consideration.

- There are various formulas used for the calculation of Earnings before interest, taxes, depreciation, and amortization or EBITDA and Operating Income or OI. The formulas for the calculation of EBITDA and Operating Income are provided as follows:

For EBITDA,

or

For Operating Income,

or

or

or

or

EBITDA vs Operating Income Comparison of Table

Given below are the major comparison between EBITDA vs Operating Income:

| Basis of Comparison | EBITDA | OI |

| Definition | EBITDA is the abbreviation used for Earnings before Interest, Taxes, Depreciation, and Amortization. EBITDA is a measure that is used for ascertaining the information pertaining to the evaluation of the profit earning capability of an enterprise. EBITDA ignores the adjustments pertaining to expenses that are non-cash and non-operating in nature. EBITDA in its true essence is used for reflecting the financial wellbeing of an enterprise. | Operating income is also regarded as operating profits or EBIT (Earnings before interest and taxes). Operating income or operating profits is defined as a metric of profitability used by the investors for the purpose of ascertaining the total amount of revenue that can actually be regarded as profits earned by an enterprise after making all the necessary adjustments in the sales revenue pertaining to operational costs that are direct and indirect in nature. |

| Purpose | EBITDA is used for the purpose of calculating the earning capacity of an entity. | Operating income is used for the purpose of ascertaining the amount of revenue that can actually be converted into profit. |

| Formula | The formulas used for the calculation of EBITDA are:

|

The formulas used for the purpose of calculation of Operating income are: OI = Revenue – COGS (Cost of Goods Sold), or

|

| Order of calculation | EBITDA is calculated prior to the calculation of operating income. | Operating income is calculated after the calculation of EBITDA. |

| Adjustments | EBITDA ignores the adjustments pertaining to depreciation and amortization. | Operating income considers the adjustments pertaining to depreciation and amortization. |

| GAAP | EBITDA is a non-GAAP measure. | Operating income is a GAAP measure. |

Conclusion

EBITDA is a metric widely used as an alternate for a statement of cash flow. EBITDA is also used by business owners for the purpose of comparing their financial performance with their competitors that are operating in the same industry. On the other hand, OI, or operating income is used for the purpose of calculating the total amount of profits that are earned by an organization by performing its business functions. EBITDA is a measure that reflects profits before the adjustments pertaining to interest, taxes, depreciation, and amortization are taken into consideration.

On the other hand, OI or operating income reflects the profits that are ascertained after making adjustments pertaining to operating expenses that include depreciation as well as amortization. To conclude, it can be said that both EBITDA and operating income are the metrics taken into use for ascertaining the profit-earning ability of an enterprise. EBITDA is used for ascertaining the information pertaining to the income-generating capacity of an enterprise whereas operating income is concerned with the information pertaining to the income that can be converted into profits.

Recommended Articles

This is a guide to EBITDA vs Operating Income. Here we discuss the difference between EBITDA vs Operating Income, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–