Updated October 19, 2023

What is Econometrics?

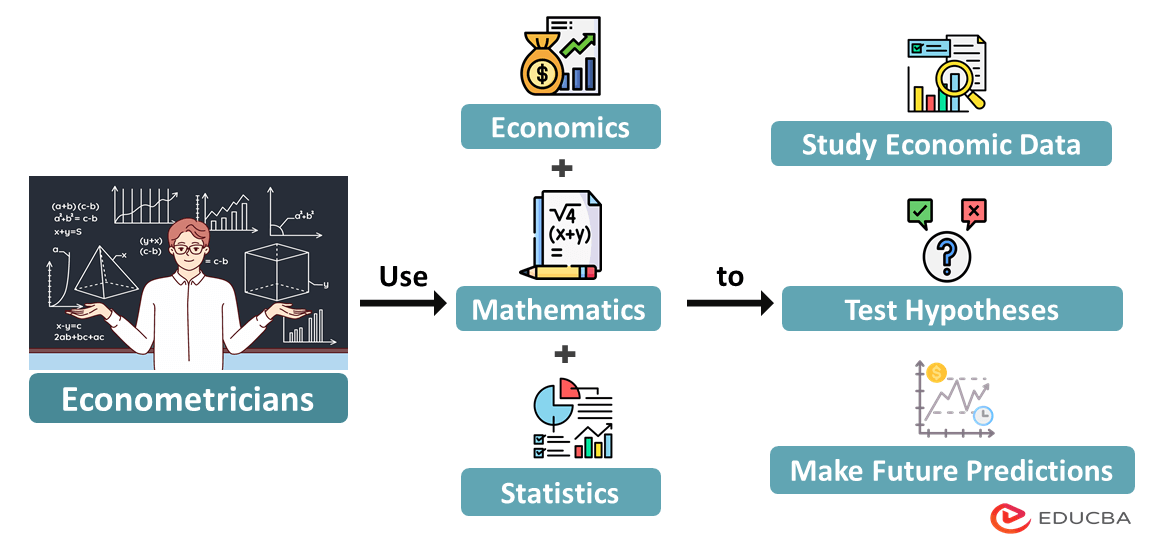

Econometrics is a field that combines economics, mathematics, and statistics to study and understand economic relationships. It helps economists make sense of real-world economic data, test hypotheses, and make future predictions.

In simple terms, econometrics uses mathematical and statistical techniques to answer questions like:

- How do changes in one economic variable (e.g., wages) affect another (e.g., employment)?

- Can we predict future economic trends based on past data?

- What policies are effective in improving economic outcomes?

Econometricians create models that show the relationship between two factors and then use data to estimate and test these models. They analyze data to conclude about the economic world, helping policymakers and businesses make informed decisions.

Table of Contents

Methodology of Econometrics

Econometricians use econometrics in the following manner:

1. Statement of Theory or Hypothesis

It is the first step where econometricians formulate and define a research question, economic theory, or hypothesis they want to test. It also involves identifying independent and dependent variables.

2. Specification of the Mathematical Model of the Theory

In this step, econometricians create a mathematical model or equations representing the structure of the theory or hypothesis they are studying. The mathematical model/equation shows the exact relationship between variables.

3. Specification of the Statistical or Econometric Model

After creating a mathematical model, econometricians create an econometric model/equation. This equation includes an error term (U) to cover all the other factors indirectly affecting the variables.

4. Obtaining the Data

They then collect relevant data from surveys, government reports, or existing datasets to test the theory’s reliability. They must also ensure that the data is of quality and relevance, as it is crucial for the accuracy of the analysis.

5. Estimation of the Parameters of the Econometric Model

The econometricians then estimate the parameters of the econometric model using statistical methods like regression analysis. These parameters represent the coefficients in the mathematical model and provide insights into the relationships between variables.

6. Hypothesis Testing

This step involves using statistical tests to find if the estimated parameters support or reject the theory. This helps determine whether the relationship we identified between the variables is statistically significant.

7. Forecasting or Prediction

The econometricians use the econometrics model to predict future economic outcomes based on the estimated relationships.

8. Using the Model for Control or Policy Purposes

Finally, if the theory or hypothesis proves reliable and robust, policymakers may use this as a valuable model to make informed decisions and implement economic policies.

Example #2: Healthcare

Econometrics enables researchers to study whether a new treatment method can save healthcare expenses if a medicine’s prices can be reduced or predict the demand for healthcare services.

For example, a medical researcher uses an econometrics model to figure out how changing healthcare rules can make a specific drug 15% cheaper to produce, making it more affordable for patients.

Example #3: Government Policies

Suppose the government is considering a tax cut. Researchers use econometrics to estimate how these new tax rates affect government revenue, consumer spending, and business activity. This analysis can provide policymakers with important information to help them make informed decisions.

Types of Econometrics

#1 Theoretical Econometrics

- This branch focuses on analyzing existing or developing new econometric models and theories.

- Researchers create new mathematical equations or hypotheses to analyze economic data and determine unknown variables.

- They can ensure that these new theories can produce accurate conclusions.

- It also helps to understand economic relationships and behavior between economic variables.

#2 Applied Econometrics

- Applied econometrics uses existing econometric theories and models in real-world scenarios.

- It involves collecting and analyzing real economic data with existing statistical methods to assess how well these models fit real data.

- This information is crucial for making informed decisions and policies in various economic sectors.

Importance & Limitations

Here are some of the importance and limitations of econometrics.

| Importance | Limitations |

| Econometrics helps researchers test economic theories using real-world data. | Econometric models assume that all parameters remain constant, but many factors are not constant. |

| It enables researchers to test these hypotheses by examining data and statistical relationships. | Selecting the correct model is challenging. Choosing the wrong model can lead to incorrect results and interpretations. |

| It translates qualitative statements into numerical values for precise analysis. | Incomplete, old, or inaccurate data can affect the accuracy of forecasts. |

| Policymakers use it to assess the consequences of various policy decisions. | These models often assume linear relationships between variables, but sometimes, relationships may be nonlinear, making the model less accurate. |

Final Thoughts

Econometrics is a powerful and versatile field that is central to economics and policymaking. Econometricians bridge the gap between economic theory and real-world observations by applying statistical and mathematical techniques to economic data. This enables us to gain empirical insights, make informed decisions, and predict economic trends.

Frequently Asked Questions (FAQs)

Q1. What is the scope of econometrics?

Answer: The scope of econometrics is vast, encompassing macroeconomics, microeconomics, finance, healthcare, public policy, and more. It provides real evidence, shaping economic policy. However, it’s crucial to be aware of its limitations and challenges. Thus, econometric analysis should be conducted rigorously and cautiously.

Q2. What are the types of data in econometrics?

Answer: The following are the types of data in econometrics:

- Time-Series data: Time-series data is collected at different time intervals, like daily, monthly, or yearly, for a single individual or entity. It helps identify patterns, trends, and relationships within data to develop strategies for managing economic fluctuations. For example, policymakers study stock prices or GDP growth rates over a year to understand market trends.

- Cross-sectional: Cross-sectional data is collected at a single point of time from different individuals or firms. Researchers study differences among entities and how various factors influence economic outcomes within a specific timeframe. For example, econometricians study companies within a specific industrial field where each observation represents a particular company’s financial metrics, like revenue for a given year.

- Pooled Data: This data type combines time-series and cross-sectional data to examine how different individuals or entities change over time and how they are related. For example, researchers can study various health parameters, like an individual’s blood pressure and cholesterol level over several years, and examine these same parameters from different individuals to compare and understand the health pattern.

Recommended Articles

This article provides detailed information about econometrics, including its methodology, types, examples, and importance. We hope this article was useful to you. You can also refer to our other articles,