Updated July 6, 2023

Economic Depreciation Meaning

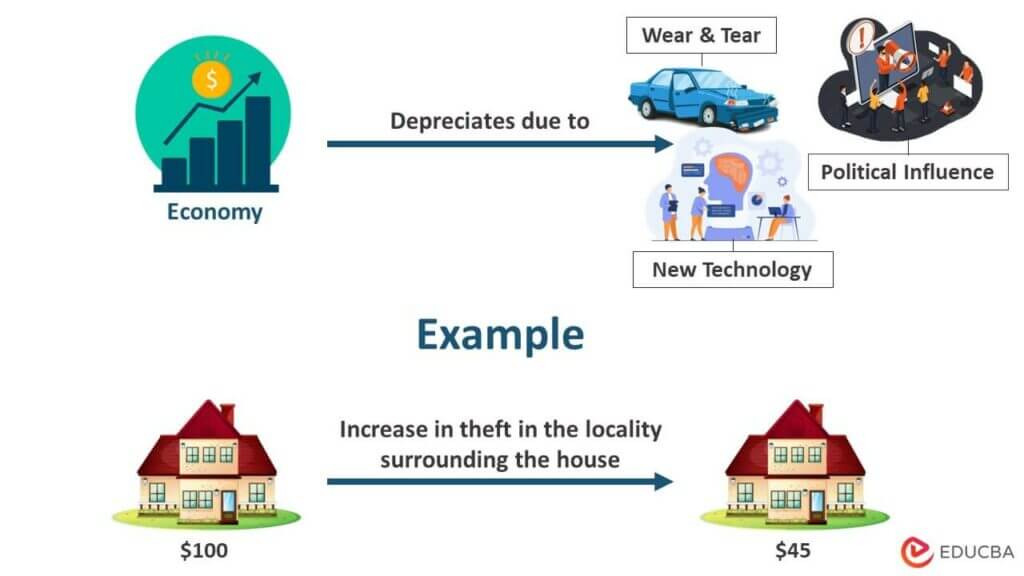

Economic depreciation measures the decline in an asset’s market value due to economic factors, such as government policies, wear & tear, market conditions, etc., over time.

For example, Sri Lanka has been ranked 4th in depreciation currency against USD. The depreciation in the value of a currency was due to various economic factors, one being an increase in imports.

It helps us understand the market trend and projections of the future worth of an asset. It is usually related to real estate. Several real-time factors affect the price of an asset, such as real estate, supply and demand changes, and asset desirability.

Key Highlights

- Economic depreciation is a decline in the financial value of an asset due to economic factors which constitute the economic environment surrounding that asset.

- It can be seen most commonly in real estate.

- When selling the asset, influential economic factors have a more significant impact on the asset when compared to accounting depreciation.

- It is more relevant than accounting depreciation for owners who wish to sell their assets at the market price.

How Does Economic Depreciation Work?

Real estate is the most common asset type where we observe Economic Depreciation. It considers a loss due to influential factors of the market. Even though loss aversion is one of the founding principles of accounting, we don’t consider economic factors when reflecting the value of an asset in the books.

Even though we cannot calculate it on assets other than stocks, much like traditional means of depreciation, it contributes to finalizing an asset’s selling price. Factors such as geographical location, government policies, and nearby economic influences play an important role in determining asset value. The factors influencing depreciation don’t focus on a single entity. Thus, a single asset is not affected due to economic depreciation; It is generally the asset group that is affected.

Economic Depreciation Examples

Example #1

Josh bought a house worth $500,000. A few years later, a fire broke out inside the house, causing permanent damage to certain parts. Upon his transfer to a different city, Josh decided to sell the house. The house’s market value dropped to $220,000 due to the fire incident. The loss of $280,000 in the market value is the depreciation.

Example #2

ABC is a car manufacturing company. Stocks of company ABC were trading at $56 in 2019. However, a report suggested a fundamental defect in ABC’s vehicles. The company’s stock fell to $22 in 2022, a few months after the story broke. This fall in the price of stocks is a sign of depreciation due to economic reasons.

Economic vs. Accounting Depreciation

|

Particulars |

Economic Depreciation |

Accounting Depreciation |

| Purpose | To figure out the actual reselling value of the asset. | To figure out the remaining value of the asset. |

| Calculation | It doesn’t have a formula inferred from economic factors.

Stock Depreciation (Kt+1) = Kt – δ + It. |

It has a formula that calculates the value of the asset.

Cost of the asset = Salvage value/useful life of the asset. |

| Orientation | Sales oriented. | Purchase oriented. |

| Impact on valuation | The impact is detailed based on the understanding of different economic factors. | The impact is quantifiable based on figures derived from a formula. |

| Use | It provides an accurate picture concerning economic factors. | It provides an accurate picture of expenses over the years. |

Causes of Economic Depreciation

Government Policies

- Government policies of any country provide a map of goals to achieve.

- It makes specific policies to achieve those goals.

- These policies affect economic factors, which as a result, contribute to Economic Depreciation.

Geographical Factor

- Geographical factors such as the location of the asset, especially in real estate, cause Economic Depreciation.

- Places with better facilities and career options often have higher prices.

Wear and Tear

- The decline in the physical value of an asset is natural.

- This decline results in depreciation over the financial value of the asset.

Introduction of New Technology

- Introduction of technology that can outperform the asset currently in possession results in depreciation.

Expiration of Rights

- Intangible assets, like software, licenses, etc., are bound to expire after a certain period.

- It naturally results in depreciation.

Ever-changing Economics

- The economics of every industry is dynamic.

- One factor is dependent on other factors, and they function together.

Advantages of Economic Depreciation

- Incurring depreciation can save you from paying any excess taxes.

- As per some laws, the asset owner is morally responsible for accounting for depreciation.

- If not considered, there will be less expenditure on the books. As a result, profit may appear to be more than it is.

- It is also essential in forecasting revenues in the future.

Final Thoughts

Economic depreciation provides an inferred value of an asset based on economic factors instead of the asset’s value. It considers every other aspect that accounting depreciation ignores. Therefore, it provides an accurate picture of asset value when the asset sells. It can help in the valuation of asset classes such as real estate.

Frequently Asked Questions (FAQs)

Q1. What does depreciation mean in economics?

Answer: The financial value of an asset decreases over time due to factors like use, the introduction of new technology, poor market conditions, etc. This phenomenon is known as depreciation.

Q2. How is economic depreciation calculated?

Answer: Economic depreciation doesn’t have a formula for tangible assets. However, there is a formula that we can use to calculate depreciation on stocks.

Where Kt is the price of the stock in the present, Kt+1 is the price in the future, It is the investments made in the stock during period t, and δ is the depreciation coefficient.

Q3. What are the types of depreciation?

Answer: The different types of depreciation are straight-line, units of production, double declining balance, and the sum of the years’ digit depreciation. Straight-line depreciation is the simplest form, where the expense amount remains constant every year over the working life of an asset. The double declining balance method proves that depreciation expenses are more significant during an asset’s early years than in the later years.

The units of Production method computes the depreciation of an asset based on the total number of hours used or total units produced. The sum-of-the-years-digit method is much like straight-line depreciation, explaining that we incur a higher expense level during an asset’s early stages than in the later stages.

Q4. What are the main causes of depreciation?

Answer: Two main causes of depreciation are natural causes, such as a decline in quality due to use, and unnatural causes, such as fire accidents, floods, etc. Other causes include ever-changing economics, sudden policy changes, and geographical factors.

Q5. Why is depreciation important?

Answer: Depreciation helps us estimate the actual market value of the asset. The amount of depreciation incurred proves vital while selling the asset.

Recommended Articles

We hope this EDUCBA guide on Economic Depreciation was useful. For further information, EDUCBA recommends these articles,