Best Books to Learn Economics

Economics books are a great way to keep up-to-date with the latest changes in the field. Students can learn more with the help of this book. Similarly, professionals can understand the new policies and ideologies developed in this field.

Reading various books is one of the finest ways to identify your area of interest in economics. This collection includes various classic and modern works offering a historical economic grasp. They give an idea of how modern economics is applied today. However, it is a partial study of the best economic writings.

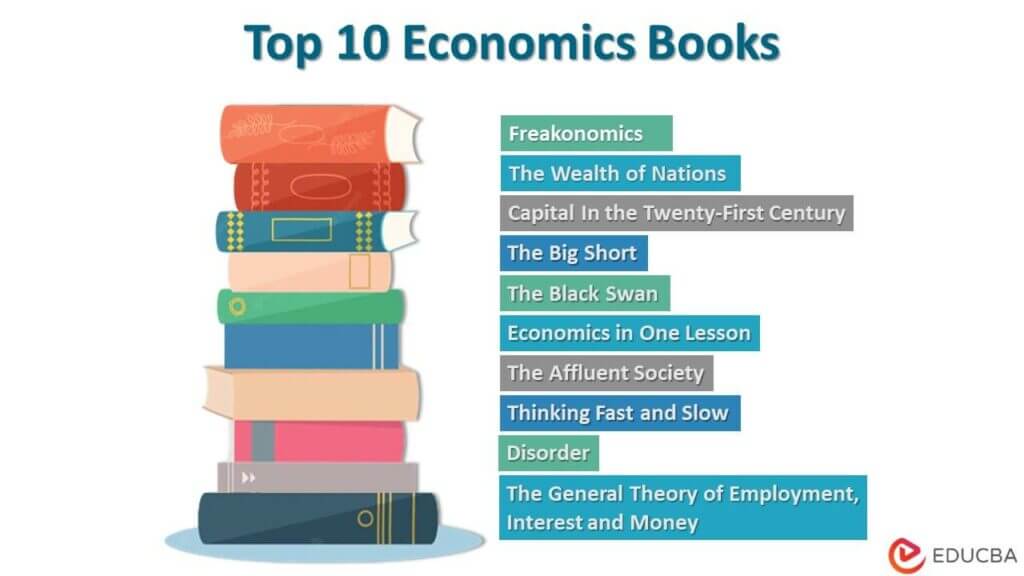

Here are the top 10 economics books to read to get the maximum benefit.

|

# |

Book | Author | Published |

Rating |

| 1 | Freakonomics | Steven D. Levitt and Stephen J. Dubner | 2006 | Amazon: 4.5

Goodreads: 4.00 |

| 2 | The Wealth of Nations | Adam Smith | 2018 | Amazon: 4.5

Goodreads: 3.91 |

| 3 | Capital In the Twenty-First Century | Thomas Piketty | 2014 | Amazon: 4.5

Goodreads: 4.05 |

| 4 | The Affluent Society | John Kenneth Galbraith | 1958 | Amazon: 4

Goodreads: 4.0 |

| 5 | The Big Short | Michael Lewis | 2015 | Amazon: 4.7

Goodreads: 4.29 |

| 6 | Thinking Fast and Slow | Daniel Kahneman | 2011 | Amazon: 4.6

Goodreads: 4.18 |

| 7 | The Black Swan | Nassim Nicholas Taleb | 2010 | Amazon: 4.5

Goodreads: 3.95 |

| 8 | The General Theory of Employment, Interest and Money | John Maynard Keynes | 2016 | Amazon: 4.2

Goodreads: 3.85 |

| 9 | Economics in One Lesson | Henry Hazlitt | 1988 | Amazon: 4.6

Goodreads: 4.17 |

| 10 | Disorder | Helen Thompson | 2022 | Amazon: 4.4

Goodreads: 4.03 |

Let us discuss each book thoroughly now. We will explore its reviews and key points in detail.

#1 Freakonomics

Author: Steven D. Levitt and Stephen J. Dubner

Buy this book here.

Book Review:

In Freakonomics, writers Steven D. Levitt and Stephen J. Dubner explore seemingly non-economic topics. Freakonomics is a provocative and amusing crash course in populist economics. In a series of essays written by the writers, Freakonomics especially combines pop culture subjects with economic theory by focusing on entertaining or intriguing examples.

Key Points:

- Freakonomics is a provocative and amusing crash course in populist economics.

- Levitt and co-author Stephen J. Dubner demonstrate how people obtain those things they desire or need when others have similar needs.

- In Freakonomics, they look at the unrevealed aspects of everything.

- According to the book, the modern world is even more fascinating than we realize. Freakonomics takes a fresh perspective and sees the world differently.

#2 The Wealth of Nations

Author: Adam Smith

Buy this book here.

Book Review:

The Wealth of Nations was made available in 1776. The book was a paradigm shift in how people thought. Due to its thoroughness and precise description of the economic mechanisms in modern economics, the study was a seminal contribution to history and economics. Smith favors the meritocratic system. Smith stressed the steps to advance if one desires to do so. Simply put, this is among the most significant works on economics ever written.

Key Points:

- We get an accessible overview of economics at the start of the Industrial Revolution in the book.

- Modern economic theory is based on the concept of the book majorly.

- The Wealth of Nations is frequently the first textbook given to economics students.

- Reading it repeatedly will help them better understand the principles of the subject. It also helps to understand how they have changed over 300 years.

#3 Capital In the Twenty-First Century

Author: Thomas Piketty

Buy this book here.

Book Review:

Your intriguing inquiries concerning numerous facets of capital and its movement are discussed here. Piketty outlines his suggested solution in this book: a “participatory socialism” that gradually abolishes capitalism through a progressive income tax and an inherited wealth tax. They are then used to finance a basic income and a “capital endowment” for each individual. It discusses various issues, including the long-term evolution of fundamental social issues like inequality, the extreme concentration of wealth among a minority population group, and how the political economy is fundamental to a developing country’s prospects for economic progress.

Key Points:

- This book provides the appropriate solutions and clear and straightforward explanations.

- Thomas Piketty examines the capital flow of the twenty-first century. He uses data from twenty countries that stretch back to the eighteenth century. He does so to reveal the essential factors underlying social and economic trends.

- His responses will establish the following generation’s wealth-related goals.

- He demonstrates how the world has overcome the extreme inequality that Karl Marx foresaw on an apocalyptic scale because of the confluence of modern economic expansion and knowledge.

#4 The Affluent Society

Author: John Kenneth Galbraith

Buy this book here.

Book Review:

Harvard economist John Kenneth Galbraith published The Affluent Society in 1958 (fourth edition, revised in 1984). John Kenneth Galbraith gets to the heart of financial stability with his trademark clarity, eloquence, and humor. After World War II, the United States became impoverished in the private sector. Simultaneously it maintained its underdeveloped social and physical infrastructure and maintained income disparities. At the time, the book generated a lot of public discussions. It also makes the phrase Conventional Wisdom more well-known.

Key Points:

- John Galbraith’s economic model for investing in public wealth (a word he invented that has since entered our vernacular) questions a production-based economy’s long-term value and the underlying nature of poverty.

- The conflict in Affluent Society presents the common wisdom that underpins contemporary economic theories and ideas.

- He issues a warning against individual and societal complacency about economic inequity.

- The Affluent Society is just as pertinent now on the subject of wealth in America as it was in 1958, and it is also incredibly predictive and politically contentious.

#5 The Big Short

Author: Michael Lewis

Buy this book here.

Book Review:

The Big Short tells the tale of four outsiders in the high-finance industry who correctly predicted the burst of the credit and housing bubbles before anybody else. In strange feeder markets where the sun does not shine and the SEC does not dare or bother to tread the crash, or the quiet crash, had already occurred over the previous year. Who could have comprehended the risk associated with assuming that real estate prices would continue to rise, a daily risk increased by the production of those mysterious, manufactured securities that were founded shakily on mountains of dubious mortgages? Michael Lewis addresses that question in this appropriate follow-up to Liar’s Poker in a narrative that is rife with outrage and dark comedy.

Key Points:

- Financial writer Michael Lewis’ book is a narrative of the events leading up to the global financial crisis of 2007–2008.

- The book follows many people who thought the housing bubble would break.

- They ultimately profited very much when they did so by placing bets against the collateralized debt obligation bubble.

- It mentions how in the fall of 2008, when news of the U.S. stock market crash broke, it was already outdated.

#6 Thinking Fast and Slow

Author: Daniel Kahneman

Buy this book here.

Book Review:

While System 2 is slower, more deliberate, and more rational, System 1 is quick, intuitive, and effective. We cannot fully appreciate the effects of overconfidence on corporate strategies, the difficulties of predicting what will make us happy in the future, or the profound impact of cognitive biases on everything from stock trading to planning our next vacation until we understand how the two systems affect our judgments and decisions. Thinking Fast and Slow is a modern classic and a vital book that has changed the lives of millions of readers. It has been at the top of bestseller lists for nearly ten years.

Key Points:

- In Thinking Fast and Slow, the author describes how two brain systems compete to control your behavior and actions.

- It explains how this can lead to memory, judgment, and decision-making errors. It teaches you what you can do to correct it.

- The author provides helpful and informative insights into how we make decisions in our professional and personal lives. He also mentions how we can utilize various strategies to avoid the mental lapses frequently leading to problems.

- In a vibrant discussion of how we think, Kahneman draws the reader in and explains when and how we should trust our intuitions. It talks about taking advantage of sluggish thinking.

#7 The Black Swan

Author: Nassim Nicholas Taleb

Buy the book here.

Book Reviews:

Your perspective on the world will change after reading this book. Everything, from the emergence of religions to the occurrences in our personal lives, is influenced by black swans. A black swan is a very unlikely event with three key characteristics: it is unpredictable, has a significant impact, and invent an explanation for it after the fact that makes it seem less unlikely and more likely than it was.

Key Points:

- The Black Swan talks about comprehending unforeseen, severe occurrences.

- For example, the 9/11 attacks, the emergence of the internet, and stock market catastrophes.

- The book focuses on the dramatic consequences of such events.

- According to Nassim Taleb, we won’t be ready for the next significant event as we rely too heavily on shoddy historical narratives, faulty models, and inadequate theories.

#8 The General Theory of Employment, Interest, and Money

Author: John Maynard Keynes

Buy this book here.

Book Review:

Distinguished John Maynard Keynes, a British economist(1883-1946), launched several movements that fundamentally changed how economists perceive the world. Keynes criticized the laissez-faire policies of his time in his most significant work, The General Theory of Employment, Interest, and Money (1936). He specifically criticized the idea that full employment would result from a normal market economy. Thanks to Keynes’s forward-looking work, economics has changed from being solely a descriptive and analytical discipline to one that is policy-oriented. Keynes believes the disparities and instability of unrestrained capitalism must be curbed through wise government intervention in a country’s economic life.

Key Points:

- This book resulted in a significant shift in economic theory. It gave macroeconomics a key role and influenced much of its terminology. It was termed the Keynesian Revolution.

- The relationship between the desires for saving, investment, and liquidity forms the foundation of Keynes’ economic theory (i.e., money).

- Although saving and investing are equivalent by necessity, decisions about them are influenced by several factors. According to Keynes’ theory, the urge to save is largely a function of income: the wealthier a person is, the more money they will try to save.

- The relationship between the return on capital available and the interest rate, on the other hand, determines the profitability of an investment.

- The economy needs to reach a balance where no more money is being saved than will be invested. This can be done by reducing income and, as a result, the level of employment.

#9 Economics in One Lesson

Author: Henry Hazlitt

Buy this book here.

Book Review:

Economics in One Lesson, a seminal text by Hazlitt, was published in 1946. It is concise, educational, and deceptively foresighted in its efforts to expose economic myths that are so pervasive they have nearly come to be accepted as new dogmas. Politically diverse economic observers have credited Hazlitt with foreseeing the global economic collapse, which occurred more than 50 years after the first release of Economics in One Lesson. Economics in One Lesson is just as relevant and valuable today as it has been since it was first published because of Hazlitt’s emphasis on non-governmental solutions, his strong and strongly reasoned anti-deficit position, and his general emphasis on free markets, the economic liberty of individuals, and the dangers of government intervention.

Key Points:

- You must know the fundamentals of the subject so that you can fully understand this book, as comprehension of complexity is not a base.

- A key argument in this book is that the economy is a dynamic, complex system.

- It also says that government interference in a free market economy is similar to playing whac-a-mole. In which unintended, hard-to-see negative consequences, such as those of nth order (n > 1), dominate the intended, obvious positive effects, resulting in a net loss for all.

- There are a few dozen seemingly unrelated examples per chapter—such as tariffs, rent control, unions, minimum wages, government infrastructure projects, technological creative destruction, price fixing, savings, etc.

- There is, however, an argument that these examples reflect the same general pattern and recurring fallacies.

#10 Disorder

Author: Helen Thompson

Buy this book here.

Book Review:

Helen Thompson discusses long-standing political rivalries with the major powers in her well-received book Disorder: Hard Times in the 21st Century. The book was a contender for the Financial Times Best Books of the Year in September 2022. It traces the development of the current political climate over many years. The book tells the stories of three historical periods—geopolitics, the global economy, and Western democracies—and shows how, during the years of political unrest before the pandemic, the disruption in each of these periods coalesced into one major narrative. It demonstrates how much of this turbulence was caused by issues brought on by the use of fossil fuels, and it explains why the long-standing issues that energy always creates will persist when the green transition takes place.

Key Points:

- University of Cambridge political economist Helen Thompson explores enduring political rivalries among the major powers in this book.

- Helen does persuade the audience that oil has had a considerably larger impact on world politics, economics, and financial markets than is typically acknowledged, even in 1971.

- Her book is nicely written and supported by a ton of research.

- It also significantly impacts how we perceive the impending switch to net-zero energy.

Recommended Books

This article reviews the top 10 economics books for students and professionals. To know more, read the following books,