Why Students Should Consider Education Loan Factors?

Education is crucial for personal and professional growth, but financing higher education can be challenging. An education loan is a helpful alternative for arranging expenses for higher education. It can help students pursue their dreams without the immediate need for large sums of money. However, students must consider several education loan factors when applying for a loan. Understanding these factors will help ensure the loan meets your needs and remains manageable throughout your education.

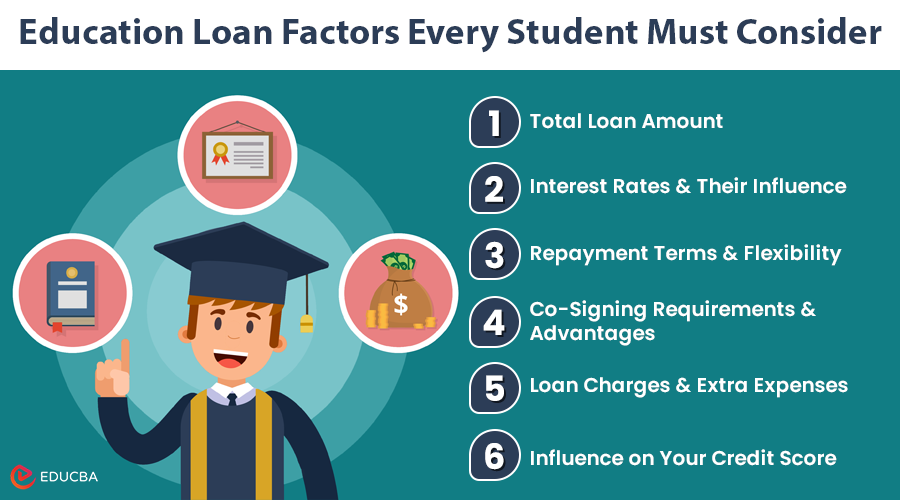

6 Essential Education Loan Factors

Here are six crucial education loan factors to think about when seeking an education loan:

1. Total Loan Amount

The first step before applying for an education loan should be determining the required loan amount. The amount should cover tuition fees, housing, textbooks, materials, travel, and living expenses.

Understanding your requirements is crucial to prevent borrowing too little or too much. Borrowing a lower amount can leave you short on funds, while borrowing a higher amount may result in debt. You should thoroughly assess all expected costs to decide the appropriate amount required.

2. Interest Rates and Their Influence

Education loan interest rates vary among lenders and can significantly impact repayment. Therefore, compare the interest rates of various institutions to secure the most favorable terms. There are two main types of interest rates:

- The fixed interest rate stays the same for the loan duration, ensuring monthly payments.

- The variable rates can change depending on market conditions, leading to changing monthly payments and potentially higher future payments.

3. Repayment Terms and Flexibility

Another critical education loan factor to evaluate is the repayment terms of the loan and the flexibility it provides.

- Some require immediate repayment after funds are disbursed.

- Others offer a grace period until after graduation, allowing you to focus on your studies.

Look for flexibility in repayment options. For instance, some lenders offer income-based repayment schemes, where monthly payments are tied to income.

4. Co-Signing Requirements and Advantages

If the borrower’s credit history is limited or non-existent, a co-signer is necessary when applying for student loans.

A co-signer with a strong credit history can enhance your chance of loan approval and also help you obtain a lower interest rate.

It’s important that the co-signer fully understands their responsibilities and agrees to the terms before committing.

5. Loan Charges and Extra Expenses

Student loans typically come with charges that can increase borrowing costs. These charges may include:

- Loan origination fees

- Application fees

- Late payment penalties

Lenders incorporate origination fees to cover loan processing costs, and they are usually a percentage of the borrowed amount.

Being aware of these charges will allow you to compare loan options effectively and select one that offers a favorable overall value.

6. Influence on Your Credit Score

Timely payments on your education loan establish a good credit score, which is advantageous for future borrowing opportunities. However, missing or delaying payments can decrease your credit score.

Knowing how a loan will affect your credit score and planning to maintain a good one is important.

Final Thoughts

Applying for an education loan requires careful consideration of multiple factors. You can make an informed loan decision by understanding these six education loan factors. Furthermore, regular monitoring and proactive management of your loan can ensure a successful academic and financial future.

Recommended Articles

For further insights into managing your finances and making informed decisions, explore the following articles: