Updated July 28, 2023

Effective Tax Rate Formula (Table of Contents)

- Effective Tax Rate Formula

- Examples of Effective Tax Rate Formula (With Excel Template)

- Effective Tax Rate Formula Calculator

Effective Tax Rate Formula

In very simple language, the effective tax rate is the average rate of tax at which the income of a corporation or an individual is taxed. In the case of an individual, it can be calculated by taking a ratio of total tax expenses and taxable income.

For corporations, it is calculated by dividing total income tax expense by the earnings before taxes. We should always remember that the effective tax rate is not the same as the statutory or marginal tax rates. The statutory tax rate is the dollar amount of tax levied per $100 of taxable income.

On the other hand, the marginal tax rate is the rate that is applicable to additional income earned. Generally, income tax is progressive in nature. This implies that the income is segregated into slabs, and a higher-income slab will carry a higher tax rate and vice versa. So all the income will not be taxed at the same rate, and we can see the effective tax rate by dividing the total tax by total taxable income.

Formula For Effective Tax Rate :

Examples of Effective Tax Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of the Effective Tax Rate in a better manner.

Effective Tax Rate Formula – Example #1

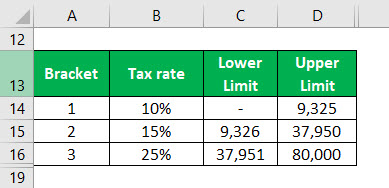

In many countries, an individual’s income is divided into tax brackets. Each taxed at a different rate. Let’s take an example of Tax calculation in the US for individuals.

Following are the tax brackets for a single individual:

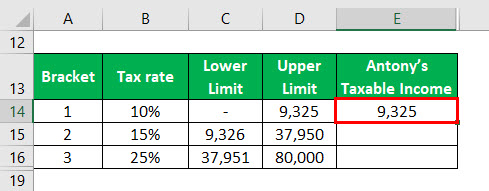

Let’s say Antony is a financial analyst. His annual income is $100,000, and he put some of his income in tax savings financial instruments. Let’s assume that amount to be $20,000. So his taxable income is $80,000.

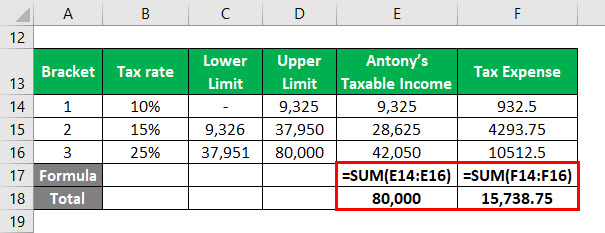

Since the lower limit is zero, the value of Taxable Income will be 9,325, i.e., upper limit.

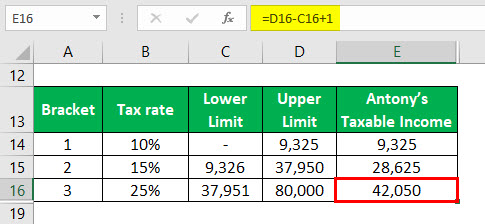

Calculation of 2nd Tax Bracket:

Similarly, we will calculate the taxable income for the 3rd bracket.

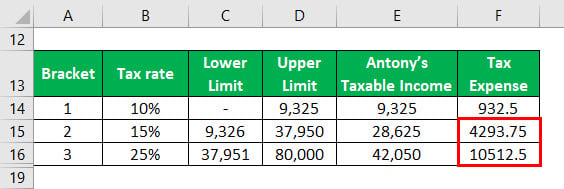

We must find the tax expenses based on the above brackets to find his effective tax rate.

Similarly, calculate Tax Expenses for other brackets.

Then we have calculated the total of Antony’s Taxable income and a total of tax expense as follows,

The formula to calculate the Effective Tax Rate is as below:

Effective Tax Rate = Total Tax Expenses / Taxable Income

- Effective Tax Rate = 15,738.75 / 80,000

- Effective Tax Rate = 19.67%

You will know the difference in all three tax rates if you see closely. The tax rate on every bracket is the statutory tax rate. The marginal tax rate is the incremental tax rate (15% on 28,625 and 25% on 42,050). So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax. The reason for that is the progressive nature of taxation.

Effective Tax Rate Formula – Example #2

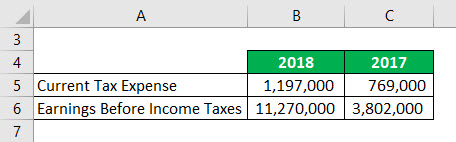

Below is the extract of Amazon’s financial statements to calculate the effective tax rate for a corporation.

Solution:

The formula to calculate Effective Tax Rate is is as below:

Effective Tax Rate = Total Tax Expenses / Earnings Before Taxes

For 2018

- Effective Tax Rate = 1,197,000 / 11,270,000

- Effective Tax Rate = 10.6%

For 2017

- Effective Tax Rate = 769,000 / 3,802,000

- Effective Tax Rate = 20.2%

Explanation

Because of the progressive tax system, all the income will not be taxed at the same rate. So individuals and companies will pay different taxes for different levels of income. Effective tax rate helps us in comparing companies and taxpayers. For individuals, they might not have much leeway to decrease their effective tax rates, but for corporations, it plays a vital role, and they take various measures to reduce that amount.

Every business has a unique structure, plan, circumstances, and tax implications. Because of this, every company pays a different effective tax rate. For example, companies that are not doing well and have experienced financial losses in the past can use their losses to decrease their taxable income. Also, for research and development costs, there are tax breaks from the government that can affect not only net income but applicable income tax rates. Similarly, corporations with operations in different countries may strategically choose to expand operations in countries where the tax rates are most favorable. So, they will reduce their tax amount, which they would otherwise pay if they had not chosen that country.

Relevance and Uses of Effective Tax Rate Formula

The effective tax rate is one of the measures investors use as a profitability indicator for a company. This value can change in any direction, and sometimes the changes are very drastic. But it cannot be interpreted immediately why it has happened. Sometimes this happens due to operational efficiencies or limitations. But sometimes, companies can indulge in activities like asset manipulation to reduce their tax burden. So one should keep a close eye on that.

It can also help us compare the company’s actual tax liability. For example, 2 companies, A & B, are in the same bracket with a marginal tax rate of 25%. But this will not give us a clear picture of the tax exposure of these businesses. We need to see the effective tax rate and compare it. So if company B has more money taxed at 25% than A, it will have to pay a higher effective tax rate than A. So if we say the effective tax rate of company A is 18.5% and B is 21.3%, this will be a more accurate reflection of a company’s tax liability.

Effective Tax Rate Formula Calculator

You can use the following Effective Tax Rate Calculator

| Total Tax Expenses | |

| Taxable Income | |

| Effective Tax Rate for Individual | |

| Effective Tax Rate for Individual | = |

|

|

Recommended Articles

This has been a guide to the Effective Tax Rate Formula. Here we discuss calculating the Effective Tax Rate and practical examples. We also provide an Effective Tax Rate calculator with a downloadable Excel template. You may also look at the following articles to learn more –