Updated September 14, 2023

What is Elliott Wave Theory?

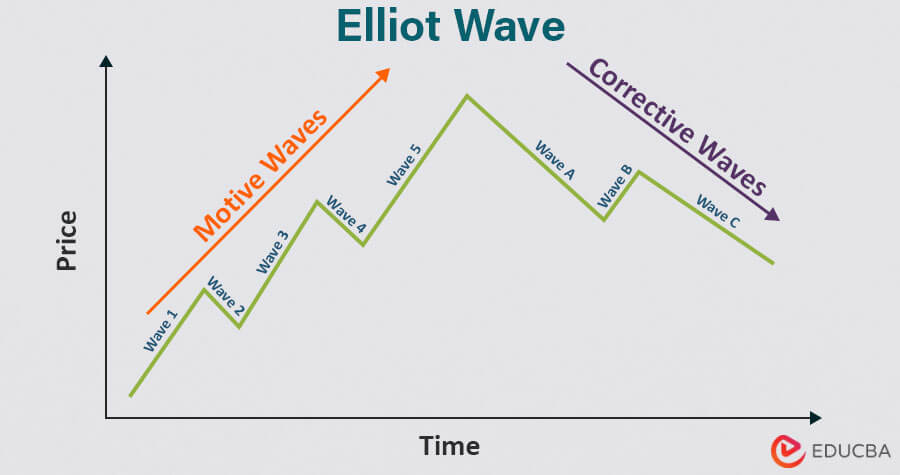

In the 1930s, Ralph Nelson Elliott observed that stock markets move in repetitive wave patterns, which led him to develop the Elliott wave theory. He found that there are a total of eight waves that show a 5-3 wave pattern, with 5 waves moving with the trend and 3 moving opposite to the trend. He concluded that these waves result from the psychological behavior of traders and investors.

These waves are useful for analyzing and forecasting market movement. Thus, financial analysts, portfolio managers, and traders can get an insight into the current market trend by identifying these wave patterns. It is also helpful to analyze and forecast price and market movements to make informed trading decisions.

Table of Contents

Key Highlights

- Elliott wave theory claims that stock markets move in timely, rhythmic, and repetitive patterns through waves.

- There are two types of waves: Motive and Corrective Wave.

- Motive waves have five sub-waves (Wave 1,2,3,4,5), and Corrective waves have three sub-waves (Wave A, B & C).

- The Fibonacci ratio is useful to identify the market entry, exit, correction, or extension points in Elliott waves.

- This theory helps traders identify stock market patterns, predict moves, and make informed decisions while managing risks and setting entry/exit points.

Types of Elliott Waves

There are two types of waves: Motive and Corrective. Let’s understand Eliott waves in detail.

1. Motive Waves (With-Trend)

Motive waves are the main waves that move in the direction of the trend. They consist of five waves: Wave 1, Wave 2, Wave 3, Wave 4, and Wave 5.

Structure of motive waves:

- Wave 1, 3, and 5 are in the direction of the trend (going in an upward direction).

- Wave 2 and 4 move against the trend (going in a downward direction).

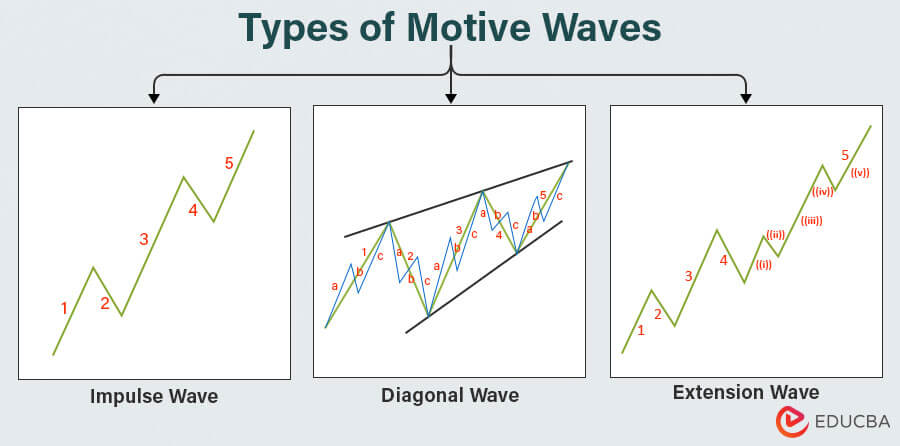

There are three subtypes of motive waves:

- Impulse Waves: Impulse waves move with the overall direction of the general market trend. They comprise all 3 motive waves (1, 3, & 5).

- Diagonal: When the prices move significantly, i.e., if the retrace waves (Wave 2 & 4) are equal to the impulse waves (Wave 1, 3, and 5), it forms a diagonal pattern.

- Extension waves: If the impulse waves (Wave 3 or Wave 5) extend and move further, it is known as extension waves.

2. Corrective Waves (Counter-Trend)

Corrective waves move against the direction of the main trend. It usually shows temporary pauses or corrections within a larger trend.

Structure of corrective waves:

- Wave A: This is the first wave, showing a counter-trend move.

- Wave B: A corrective wave that retraces part of Wave A.

- Wave C: This wave moves toward the larger trends.

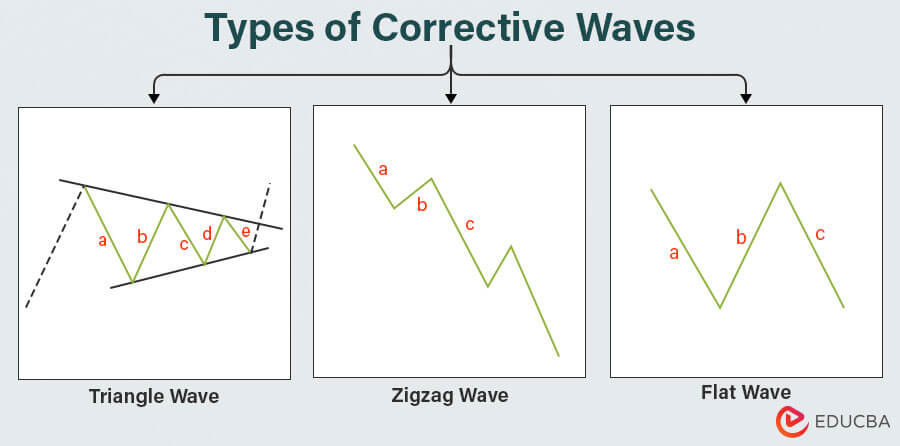

Corrective waves have three types:

- Triangle: A triangle wave pattern shows sideways movement. It occurs when prices narrow into a range. This wave consists of five waves: A, B, C, D, and E.

- Zigzag: A Zigzag wave pattern is either formed by downward movement (A-B-C) or upward trend (3-5-3). It serves as a counter-trend move.

- Flat: A flat pattern forms when waves move sideways in A B C format.

General Rules and Guidelines

Below are some of the general rules and guidelines of waves.

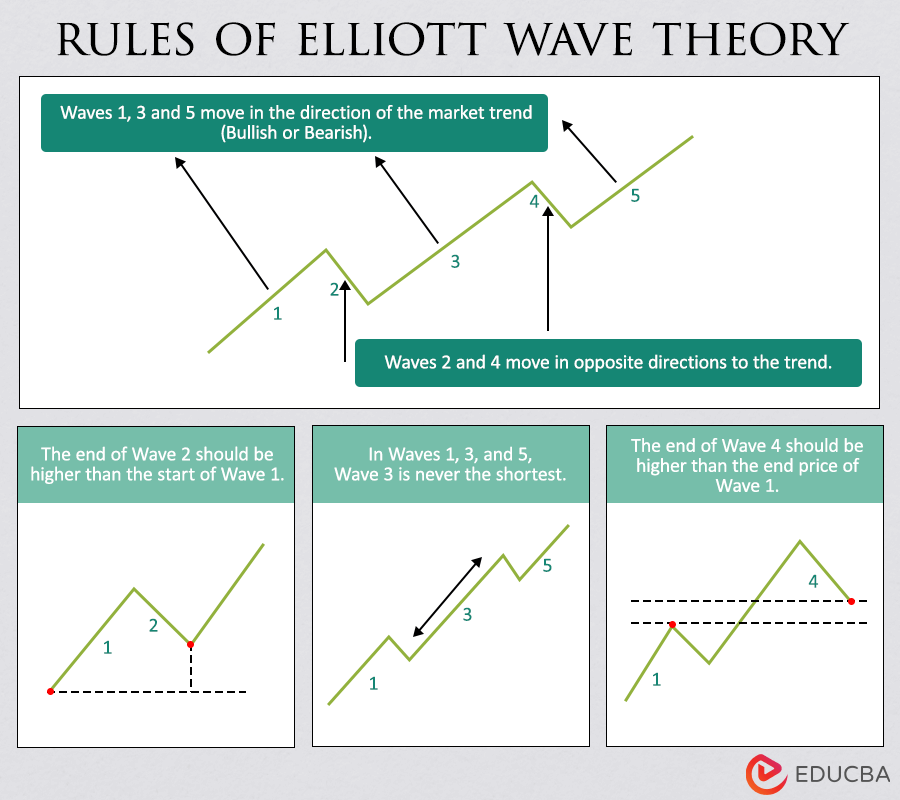

- Waves 1, 3, and 5 move in the direction of the market trend (Bullish or Bearish).

- Waves 2 and 4 move in opposite directions to the trend.

- The ending point of wave 2 should be higher than the starting point of wave 1.

- In Waves 1, 3, and 5, wave 3 is never the shortest.

- The end price of Wave 4 should always be higher than the ending price of Wave 1.

These rules help traders and analysts identify and interpret Elliott Wave Theory’s waves to predict potential price movements.

Fibonacci Ratios

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones, like:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144.

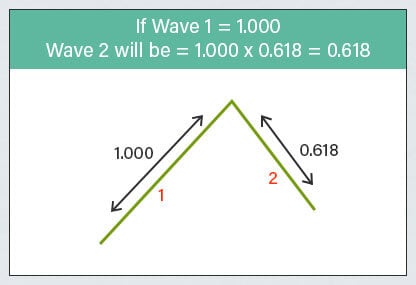

The Fibonacci ratio is a way to figure out how much a wave in the Elliott Wave pattern will move. It helps us predict market corrections and potential profits in trading.

It also shows the connection between different waves in the Elliott wave pattern. The most common Fibonacci ratios for Elliott waves are 0.618, 1.000, 1.618, and 0.382.

Here’s how you can apply Fibonacci ratios in Elliott Wave Theory:

- 0.618:

Traders can use this ratio to figure out how much the price might go down or up compared to its past price. They do this for waves that retrace, like Wave 2 and Wave 4. These retracing waves usually move back a bit from the previous strong wave, like Wave 1 or Wave 3. So, to find out how much they might move, you can multiply the impulse wave (Wave 1 or Wave 3) by 0.618 to get the retracement level for the retracing wave (Wave 2 or Wave 4).

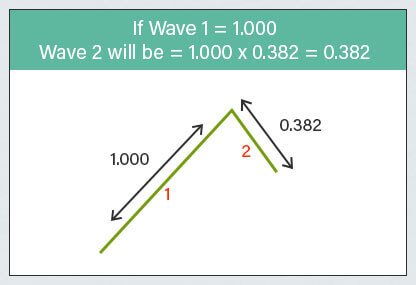

- 0.382:

This is another ratio to find the retracement level. Similar to 0.618, multiply this with the impulse wave value. However, it is not strictly a Fibonacci ratio but is still common among traders.

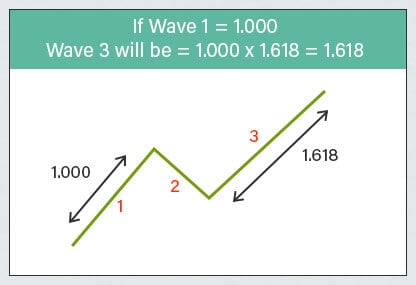

- 1.618:

This is one of the most important extension levels. As we know, wave 3 is often the longest and strongest of the impulse waves. So, traders use the 1.618 ratio to find the length of wave 3. They simply multiply the ratio (1.618) to the wave 1.

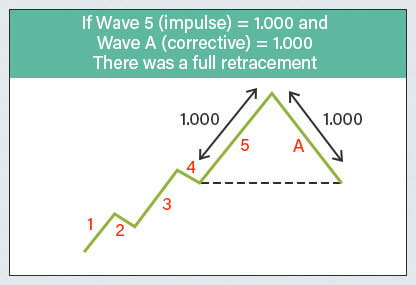

- 1.000:

This represents a full retracement, meaning that the corrective wave goes back 100% compared to the previous wave’s value. We can see in the image below that wave A retraces 1.000, the same as wave 5. Therefore, there was a full retracement. However, a full retracement is less common.

Therefore, traders and analysts apply Fibonacci Ratios to various waves to estimate possible price entry, exit, reversal points, corrections, or extension points.

How to Use Elliott Wave Theory?

Trading using the Elliott Wave Theory involves identifying repeating wave patterns to analyze price charts. Here’s a basic guideline which you can follow:

Step #1: Learn the basic principles of Elliott Wave Theory’s regulations, including motive and corrective waves.

Step #2: Determine whether the market trend shows a bull or a bear phase.

Step #3: Identify motive waves (1-2-3-4-5) and corrective (A-B-C) waves and label them.

Step #4: Apply Fibonacci ratios to measure potential reversal or extension levels of waves.

Step #5: Use additional technical indicators to analyze and understand the wave.

Step #6: Practice regularly to recognize wave patterns and plan trade accordingly.

Example

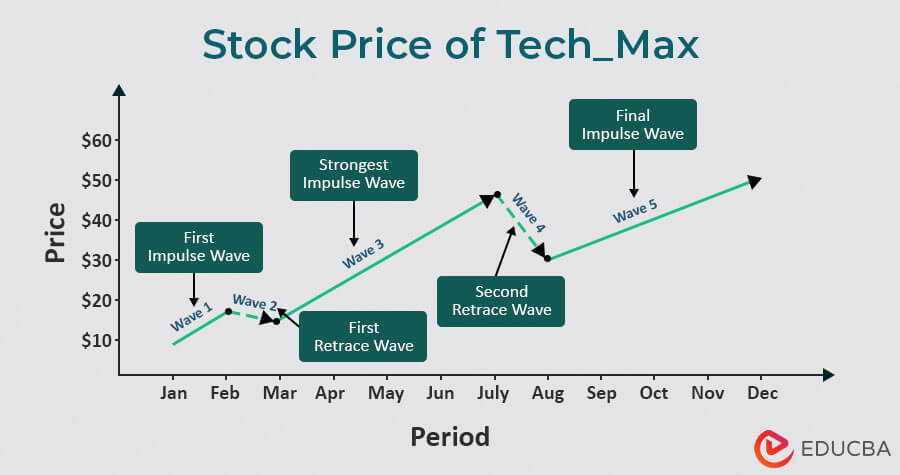

Let’s say you are analyzing the stock price movement of an imaginary company, Tech_Max, using the Elliott Wave Theory. You notice that the stock’s price reached $50 from $10 with upward and downward trends over the course of a year.

Now, let’s understand and interpret how these changes occur through waves.

- Wave 1 (Impulsive Wave): The stock price of Tech_Max company starts from $10 in January 2022 and reaches $18 in February 2022. It represents the first impulse wave, which shows an upward trend.

- Wave 2 (Corrective Wave): A pullback occurs from wave 1, meaning a temporary dip in the stock price. This Wave 2 retraces from Wave 1 and reaches $15 in March.

- Wave 3 (Strong Impulsive Wave): The stock price goes from $15 to $45 in July. It may be due to a change in market trends and increased product demand. It is the longest and strongest upward wave.

- Wave 4 (Corrective Wave): There is a slight dip again. Wave 4 retraces from wave 3, reaching $45 to $30 in August.

- Wave 5 (Final Impulsive Wave): The stock rises from $30 to $50 in December. Wave 5 marks the upward trend and is not as strong as wave 3.

After wave 5, the stock price may vary, showing corrective or impulse waves again.

Frequently Asked Questions (FAQs)

Q1. What are the pros and cons of the Elliott Wave Theory?

Answer: Here are some of the pros and cons of the Elliott wave theory:

Pros:

- It provides a framework for understanding market patterns and trends.

- It helps to identify these patterns and predict potential market movements.

- Traders gain insights into entry and exit points for trading to set up stop-loss and take profit levels.

- It helps in risk management and decision-making.

Cons:

- It is a subjective concept, and identifying and labeling waves may be difficult.

- It can lead to incorrect interpretation, prediction, and analysis of waves and cause loss for the traders.

- The theory relies on historical price data and patterns, which might not accurately predict future market behavior.

Q2. How to learn Elliott Wave theory?

Answer: This comprehensive article should help you completely understand the Elliott wave theory. However, for more information, you can learn from recognized books, like “Elliott Wave Principle” by Robert Prechter. You can even check our Financial Analyst Course to get insights into investment banking, trading and investing.

Recommended Articles

This article provides a comprehensive guide to Elliott wave theory. You will learn its types, rules, and guidelines, how to use it, its relationship with the Fibonacci ratio, and examples. For more technical analysis content, you can refer to the following articles,