Introduction to Emergency Fund

Life is full of surprises—some pleasant, others not so much. Whether it is a sudden medical bill, an unexpected car repair, or even a job loss, financial emergencies can happen at any time. This is where an emergency fund becomes essential. It acts as a safety net for your finances, enabling you to handle unexpected expenses without depending on credit cards or loans. Without it, even a minor setback could lead to financial stress or debt. In this article, we will explore why an emergency fund is crucial, how much you should save, and practical steps to build one effectively.

Why an Emergency Fund is Important?

An emergency fund offers financial stability during unexpected situations. It ensures you can manage urgent expenses without disrupting your regular budget. Here are some key benefits:

- Covers Unforeseen Expenses: Helps pay for medical bills, car repairs, or sudden home maintenance.

- Reduces Financial Stress: Prevents you from falling into debt during emergencies.

- Avoids High-Interest Debt: Keeps you from relying on credit cards or loans.

- Offers Peace of Mind: Provides confidence in handling financial uncertainties.

How Much Should You Save?

The ideal amount depends on individual financial situations, but a general rule of thumb is:

- Beginner Level: Start with at least $500 to $1,000 for minor emergencies.

- Basic Level: Save three months’ worth of essential expenses (rent/mortgage, utilities, food, insurance, etc.).

- Ideal Level: Six to twelve months’ worth of living expenses for better financial security.

To determine your target amount:

- Calculate your monthly essential expenses (rent, utilities, groceries, insurance, transportation).

- Multiply that amount by 3, 6, or 12 months based on your needs.

For example, if your essential expenses are $2,500 per month, a 6-month security fund would be $15,000.

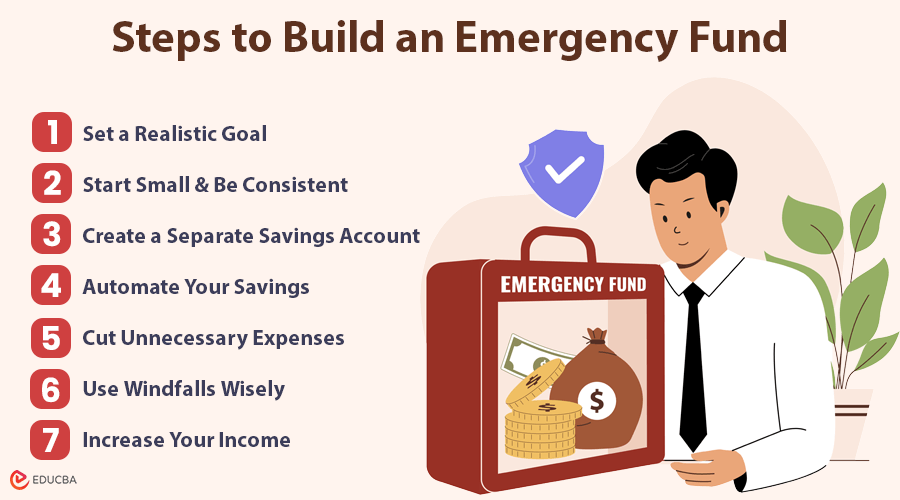

Steps to Build an Emergency Fund

Below are the essential steps and detailed explanations of how to achieve an emergency fund:

#1. Set a Realistic Goal

Before you start saving, determine how much you need in your fund. Financial advisors advise saving three to six months’ worth of living expenditures.

This amount should cover essential costs like:

- Rent or mortgage payments

- Utility bills

- Groceries

- Insurance premiums

- Loan payments

- Transportation expenses

If you are self-employed or have an unpredictable income, aim to save around six months’ worth of expenses for added financial security.

#2. Start Small and Be Consistent

If saving a large amount seems overwhelming, begin with small contributions. The key is consistency, as small, regular deposits add up over time.

How to stay consistent:

- Every month, set aside a particular portion of your salary (e.g., 5-10%).

- Treat savings like a monthly bill—non-negotiable and mandatory.

- Increase contributions as your financial situation improves.

#3. Create a Separate Savings Account

Keeping your security fund in a separate savings account will stay unaltered until it is needed.

Benefits of a separate account:

- Reduces the temptation to spend the money on non-emergencies.

- Helps track progress toward your savings goal.

- A high-yield savings account earns interest, allowing your money to grow.

#4. Automate Your Savings

Automating savings eliminates the need to transfer money manually and ensures consistent contributions.

Ways to automate savings:

- Establish automatic transfers between your savings and checking accounts.

- If your employer permits, deposit a portion of your paycheck into a separate savings account.

- Use apps or online banking tools to round up purchases and transfer spare change to savings.

#5. Cut Unnecessary Expenses

Finding extra money to save may require reducing unnecessary spending.

Ways to cut expenses:

- Limit dining out: Prefer home meals rather than ordering takeout.

- Cancel unused subscriptions: Review entertainment, fitness, and other memberships.

- Shop smart: Look for discounts, use coupons, and avoid impulse purchases.

- Reduce utility bills: Use energy-efficient appliances and turn off unused lights.

#6. Use Windfalls Wisely

Unexpected funds like tax refunds, bonuses, or gifts provide an excellent chance to grow your emergency savings.

Best ways to use windfalls:

- Deposit at least 50% of any extra income directly into savings.

- Resist the urge to spend all of it on non-essentials.

- Prioritize financial security over short-term gratification.

#7. Increase Your Income

If saving is challenging due to a tight budget, consider increasing your earnings.

Ideas to boost income:

- Take on freelance work or a side hustle (writing, tutoring, graphic design, etc.).

- Sell unwanted stuff at a garage sale or online.

- At your current job, request a raise or a promotion.

- Work overtime or a part-time job temporarily to accelerate savings.

#8. Don’t Use Emergency Fund for Non-Emergencies

Using your fund only for emergencies, such as medical expenses, job loss, urgent home repairs, or car breakdowns, is crucial.

How to prevent unnecessary withdrawals:

- Define what qualifies as an emergency before dipping into savings.

- Create a separate savings account for planned expenses like vacations or home upgrades.

- If you use the fund, plan to replenish it immediately.

Where to Keep Your Emergency Fund?

An emergency fund should be available yet separate from your daily spending accounts. Consider these options:

- High-Yield Savings Account: Offers liquidity and earns interest while keeping funds safe.

- Money Market Account: Offers a little greater interest rate than a standard savings account, but with limited check-writing capabilities.

- Certificates of Deposit (CDs) with No-Penalty Withdrawal: If you want higher interest rates while keeping funds relatively accessible.

- Cash at Home (small amount): Keeping a small amount in cash is useful for immediate emergencies, but avoid storing large sums due to security risks.

When Should You Use Your Emergency Fund?

Use your emergency fund only for genuine financial emergencies. Before withdrawing money, ask yourself these questions:

- Is this expense urgent and necessary?

- Do I have any alternative options to cover this cost?

- Will using this money put me at financial risk for future emergencies?

If the answer to the first question is “yes” and the others are “no,” it is a legitimate reason to dip into your fund. Examples include medical emergencies, major home or car repairs, or sudden job loss.

Final Thoughts

Financial stability depends on having an emergency fund, which provides security, comfort, and a safety net for life’s unforeseen events. Whether you start with $500 or aim for six months of expenses, every step toward building this fund strengthens your financial future. You can establish a solid security fund to support you during unexpected situations by prioritizing savings, automating contributions, and avoiding unnecessary withdrawals.

Recommended Articles

We hope this guide to building an emergency fund helps you secure your financial future. Check out these recommended articles for more tips on smart saving and financial planning.