Updated June 15, 2023

Part 8 – Employee Stock Options

In our last tutorial, we understood the features of convertible bonds. Now we will learn about employee stock options.

Step 8: Calculate ‘In the Money” Stock Options

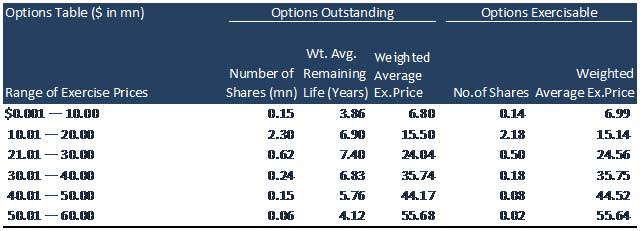

Apart from the capital structure stated before, ABC has also issued employee stock options, as shown below.

What are Employee Stock Options?

An employee stock option is a call option on the common stock of a company, issued as a form of non-cash compensation. Restrictions on the option (such as vesting and limited transferability) attempt to align the holder’s interest with those of the business’s shareholders. If the company’s stock rises, holders of options generally experience a direct financial benefit. This incentivizes employees to behave in ways that will boost the company’s stock price.

Management mostly offers employees stock options as part of their executive compensation package. However, they may also be offered to non-executive level staff, especially by businesses that are not yet profitable, as they may have few other means of compensation. Alternatively, one can offer employee stock options to non-employees: suppliers, consultants, lawyers, and promoters for services rendered. Employee stock options are similar to warrants, which are called options a company issues with respect to its own stock.

Treasury Stock Method for Calculating the Additional Number of Shares Issued

This method assumes that a company’s proceeds from an in-the-money option exercise serve to repurchase common shares in the market. In order to comply with generally accepted accounting principles (GAAP), a company uses the treasury stock method when computing its diluted earnings per share (EPS).

The net of new shares that are potentially created is calculated by taking the number of shares that the in-the-money options purchase, then subtracting the number of common shares that the company can purchase from the market with the option proceeds. This adds to the total number of shares in the denominator and lowers the EPS number.

For example, assume that a company currently has in-the-money options that cover 10,000 shares with an exercise price of $50. If the current market price is $100, the options are in the money and, based on the treasury method, need to be added to the diluted EPS denominator. The company’s proceeds will be $500,000 ($50 x 10,000), allowing them to repurchase 5,000 shares on the market ($500,000/$100). Therefore, the net of new shares is 5,000 (10,000 option shares – 5,000 repurchased shares).

Why Options Exercisable is Used for Treasury Stock Method

When employees receive stock options or restricted stock, they often do not gain control over the stock or options for a period of time. This is the vesting period, which usually lasts for 3 to 5 years. During the vesting period, the employee cannot sell or transfer the stock or options. As a result, the total options issued are known as Options Outstanding. However, after the vesting period, an employee can sell their stock options, known as Options Exercisable. Hence, an analysis should contain only those stock options that an employee can exercise and convert into shares (Options Exercisable).

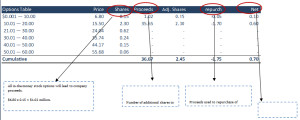

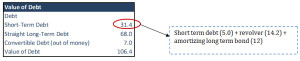

In ABC, calculations of in-the-money options undertaken using options exercisable are shown below.

From the above table, net 0.70 million shares issue because of Stock Options.

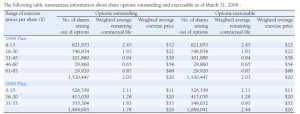

Assignment: Infosys Options Table

Below is an extract of the Options Table of Infosys from the 2008 Annual Report. Use the Current Market Price of Infosys (Rs2,450/- per share) and the table below to calculate the effect of stock options on the Equity Base.

Use Exchange rate $1=Rs46

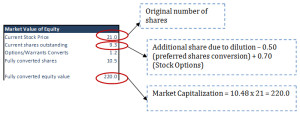

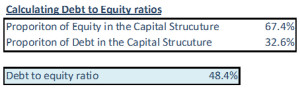

Equity

Debt

Total Capital = 220.0 + 106.4 = 326.4

The above proportions come into use for calculating the Weighted Average Cost of Capital (WACC).

What’s Next

In this article, we have understood the basis for the calculation of the Weighted Average Cost of Capital (WACC). We will be taking a detailed video of WACC in our next article.

Recommended Articles

Here are some further articles to learn more: