Understanding Your End-of-Service Benefits in Kuwait

End-of-service benefits are monetary payments and allowances due to employees once their employment is terminated. They are a legal right that serves as a form of severance pay in return for long service. Depending on the duration and terms of service, they are there to support the worker financially after termination, retirement, or resignation.

Who Is Eligible for EOS Benefits in Kuwait?

EOS benefits in Kuwait are available to all employees operating under the country’s labor laws, irrespective of nationality. Full-timers and part-timers in both the private and government sectors shall qualify for these benefits as long as they have successfully completed a legally specified period of service with the same employer under a legal contract.

Legal Framework: Kuwait Labor Law Provisions

The Kuwait Labor Law treats EOS entitlements under Law No. 6 of 2010. Certain provisions deal with the circumstances of the employees, viz. resignation or termination, under which the entitlements fall due, and the other provisions which cover the method of calculating the entitlements. These provisions would be binding on the employer; infringement of any provision may be challenged legally and through a labor court application on behalf of the concerned worker.

Calculating Your End-of-Service Gratuity

Your end-of-service gratuity depends on your final salary and the total number of years you have worked. For five years, employees are entitled to a 15-day salary every year. After five years, it will be increased to a monthly salary yearly. This computation is slightly varied for the private sector instead of the government sector. With the Kuwait Indemnity Calculator, you can easily calculate the bonus.

How to Maximize Your End-of-Service Entitlements?

Through the following points, you can learn how to maximize your End-of-Service entitlements:

- Understand Your Contract and Labor Laws: Read your contract carefully, alongside the clauses of Kuwait Labor Law, about end-of-service benefits. Know your rights to make ascertaining the correct gratuity amount easy while avoiding miscalculations or illegal deductions done by employers that could affect your entitlements.

- Create and Keep Accurate Records of Work: Such date records are vital in the full work history, including start and end dates, salary file changes, overtime, and leave for you, as they prove worth in the calculating amount of gratuity and are indispensable if a person has a dispute during settlement.

- Avoid Early Resignation: Before resigning, try to serve for five years at least. According to Kuwait’s labor law, resigning before this means receiving either part or no EOS benefits. Full-term guarantees the employee the maximum possible gratuity.

- Ensure Timely and Complete Documentation: Passing your resignation letter, Civil ID copy, clearance forms, etc., complete and on time may guarantee that your case will not get slowed down by processing or the final payout because of delayed or missing paperwork. Checking the status regularly through HR is recommended.

- Seek Legal Advice if Needed: If you are not sure of your entitlements or are facing delays, it is advisable to consult a legal expert or labor office. Hygiene advice lets you get information about your rights while taking appropriate measures if the employer fails to comply with EOS measures.

Government vs. Private Sector Differences

Differences in EOS benefits enjoyed by government employees are due to their tendency to be governed more by internal regulations that may establish an entirely different payout regime or practically guarantee some additional benefits. The private sector, on the other hand, is completely bound by its entitlement under the Kuwait Labor Law. Employees must check their contracts for terms and consult the HR department for an entitlement calculation.

End-of-Service Benefits Processing Time & Payment Methods

Typically, the EOS applications are processed within two to four weeks, depending on the internal company policy on processing such requests and how complete your documentary support is. The normal method of payment is bank transfer and checks. Employees are supposed to check with their respective companies for the method of payment and follow up with HR if it exceeds the expected time.

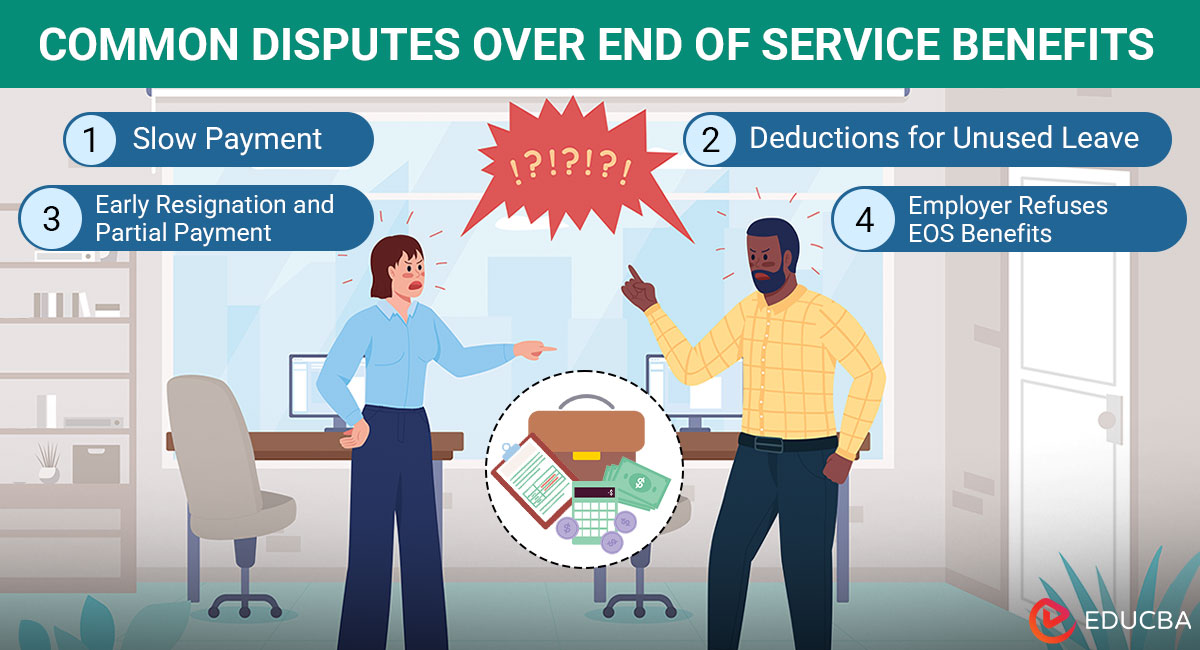

Common Disputes Over End-of-Service Benefits

Here are some common disputes regarding EOS benefits in Kuwait:

- Slow Payment: The most common problem encountered is the employer’s delay in effecting the End of Service (EOS) benefits upon resignation or termination. Lawfully, companies should pay employees within some weeks, and any delay can be a little frustrating. Employees have the right to follow up with HR within acceptable time limits and file a complaint with the labor office if necessary.

- Deductions for Unused Leave: Some employers deduct from EOS benefits for unused days, whether vacation or sick leave. However, most laws provide for judgment on employees’ entitlements, which will not be payable unless specifically spelled out in the employment contract. What leads to disputes is when these deductions are considered excessive or unreasonable.

- Early Resignation and Partial Payment: An employee resigns before completing the full-service period and faces a reduction in their End of Service (EOS) benefits. The employee argues that the years worked before resigning should count toward justifying their gratuity entitlement.

- Employer Refuses EOS Benefits: An employer will refuse to make any payment regarding EOS benefits, citing that the contract violation or termination was for cause. However, employees must verify the legal justification of their termination if the employer withholds EOS benefits. They can approach or file a case in the labor court.

Deprivation of End-of-Service Benefits in Kuwait

Deprivation of end-of-service benefits can occur when an employee is terminated on account of gross misconduct or some violation of the terms of the contract. Under the Kuwait Labor Law, an employee has the right to gratuity unless dismissed under Article 41 on grounds such as theft, assault, or gross misconduct. The employer must provide documentary evidence supporting its position and comply with due processes before depriving the worker of any entitlements.

Final Thoughts

To ensure you receive your full End-of-Service benefits in Kuwait, it is crucial to understand your rights, keep accurate records, and be proactive in handling your documentation. By staying informed and seeking guidance from HR or legal experts when necessary, you can ensure you receive all the termination benefits you’re entitled to.

Recommended Articles

We hope this guide on End-of-Service benefits gives you a clear understanding of your rights and entitlements. Check out these recommended articles for more insights into employment benefits and financial planning.