Updated July 10, 2023

Definition of Equipment Lease

An equipment lease is a lease agreement for equipment like plant and machinery, vehicles, and other accessories like computers, furniture, etc., used in business or production to avoid the heavy investment in the machinery and effectively utilize the money to earn the maximum returns on investment.

Explanation

For running the business organization and producing goods, lots of investment in plant, machinery, and other assets are required, which blocks the money for a long time. Hence, some organizations take the machinery and other equipment on a lease basis to avoid heavy investments and prevent the organization from taking debt for investing in machinery. For equipment leasing, only lease rent is to be paid, which saves the organization from heavy investment and blockage of money; the money can be invested in some other way to earn the maximum returns. The ownership in case of equipment leasing will remain with the leasing company. Maintenance charges are borne per the leasing company’s and the lessee’s agreement, i.e., business organization.

Characteristics of Equipment Lease

- The duration of the lease depends upon the need of the lessee and the terms of the contract, which may cover the life of the equipment.

- Lease payments are to be paid monthly, quarterly, half-yearly, or yearly, depending upon the type of equipment and terms of the agreement.

- It gives tax benefits to both lessor and lessee as the lessor will be borne depreciation, and the lessee has to pay lease rent which is allowed as an expense.

- The lease can be renewed, or at the end of the lease, a period lessor may offer the purchase of leased equipment at a price that may be less than the market price.

Example of Equipment Lease (With Excel Template)

Let’s take an example to understand the equipment lease calculation better.

Example

An Ltd needed machinery for one year to complete the export order at the earliest. The machine cost was $ 50,000, and the monthly lease rent was $ 3,500. The rate of loans prevailing in the market was 7%. Suggest the company purchase the machine or go for a lease agreement. The terms of the lease are as under:

The lessee must bear the maintenance charges of $ 500 per year. Depreciation is to be borne by the lessor.

Solution:

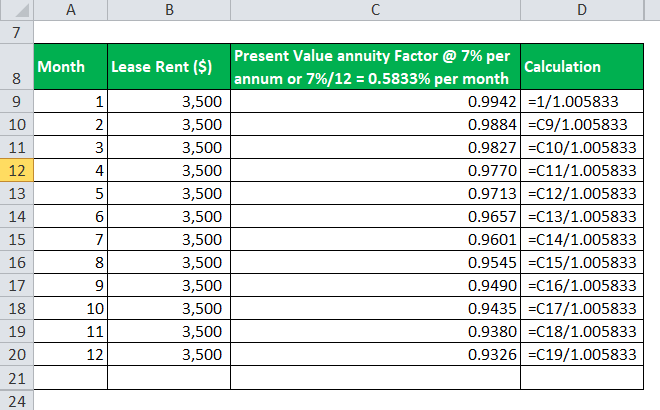

Calculation of Present Value of Lease Rent

The present value annuity Factor is calculated as

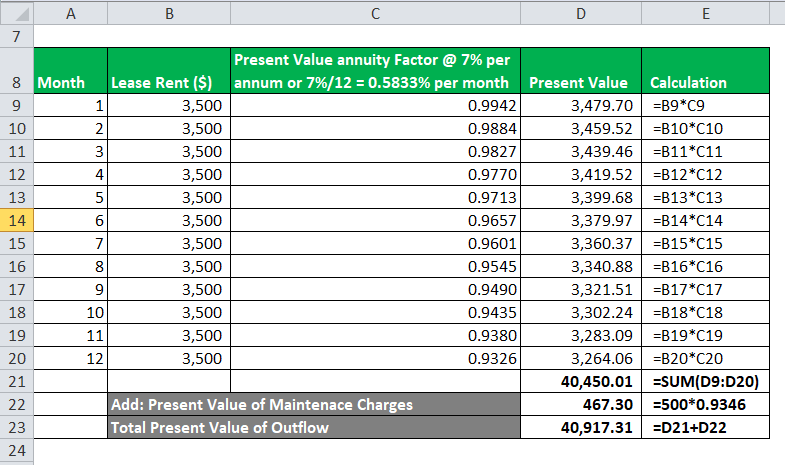

The present value is calculated as

| Month | Lease Rent ($) | Present Value annuity Factor @ 7% per annum or 7%/12 = 0.5833% per month | Present Value |

| 1 | 3,500 | 0.9942 | 3,479.70 |

| 2 | 3,500 | 0.9884 | 3,459.75 |

| 3 | 3,500 | 0.9827 | 3,439.80 |

| 4 | 3,500 | 0.9770 | 3,420.20 |

| 5 | 3,500 | 0.9713 | 3,400.60 |

| 6 | 3,500 | 0.9657 | 3,381.70 |

| 7 | 3,500 | 0.9601 | 3,362.80 |

| 8 | 3,500 | 0.9545 | 3,343.90 |

| 9 | 3,500 | 0.9490 | 3,325.35 |

| 10 | 3,500 | 0.9435 | 3,307.50 |

| 11 | 3,500 | 0.9380 | 3,288.60 |

| 12 | 3,500 | 0.9326 | 3,271.10 |

| 40,481.00 | |||

| Add: Present Value of Maintenance Charges | 467.30 | ||

| Total Present Value of Outflow | 40,948.30 |

As the Present Value of outflow is less than $ 50,000. Hence the company should go for Equipment leasing.

Types of Equipment Lease

There are two types of Equipment leases which are explained below:

- Operating Lease: An operating lease refers to a lease for a short-term period, which may include time less than one year, and in an operating lease, generally, the maintenance and other cost is borne by the lessor, and only lease rent is to be borne by the lessee, and the ownership remains with the lessor only.

- Financial Lease: Financial Lease refers to the type of lease which covers almost 75% of the life of the equipment, and at the end of the lease, the lessee has the option to purchase the leased equipment at a price less than the market price. The lessee must bear the depreciation and other charges in case of a financial lease.

Demand

- Due to the lack of availability of capital, most organizations prefer equipment leasing instead of purchasing equipment as it saves the organization from blocking the money in assets and allows them to explore better investment opportunities.

- To cope with technological advancement, large organizations will also prefer Leasing because of equipment leasing; they can shift to advanced technology equipment instead of purchasing and selling it.

So leased equipment is an advanced concept and helps the business organization utilize the resources effectively. The demand for Equipment leasing is high in the market.

Equipment Lease Vs Finance

- It refers to taking the equipment on Leasing, which may be for the long term, whereas finance refers to borrowing the money to purchase equipment.

- The cost of equipment leasing is lower than the cost of finance.

- In equipment leasing, the ownership is not transferred to the lessee, whereas in finance, the ownership is transferred to the borrower.

- In the case of equipment leasing, there is a lease agreement that governs the terms of Leasing, whereas, in the case of finance, there is a loan agreement that governs the rules of financing.

Advantages

The advantages of Equipment Leasing are as under:

- As the leading payment involves monthly payments in small portions, it does not create a problem in case of a cash shortage.

- With Equipment Leasing, the organization can shift to advanced technology equipment easily.

- It reduces the blockage of money in the assets, allowing investors to earn the maximum returns.

- Tax benefits will be more in the case of equipment leasing as lease rent is allowed as an expense in the profit and loss account.

Disadvantages

Disadvantages of Equipment Leasing:

- Sometimes the present value of outflow can be more than the asset’s value. So, it can be proved to be loss-making.

- The organization cannot claim capital allowances like depreciation and other costs.

- The agreement of lease sometimes demands early deposits.

- Leasing terms can be complex, leading to difficulty in managing the lease.

Conclusion

It is the type of lease where the equipment, like machinery, computers, etc., are to be taken on lease instead of purchasing the same. It reduces the blockage of money. Hence the organization can invest more in other opportunities to earn better. With an equipment lease, shifting to highly advanced technology products becomes easy. But sometimes, the cost of the outflow of equipment lease can be more than the cost of equipment, which leads to loss from the equipment lease.

Recommended Articles

This is a guide to Equipment Lease. Here we also discuss the definition and types of equipment lease along with advantages and disadvantages. You may also have a look at the following articles to learn more –