Updated July 27, 2023

Equity Formula (Table of Contents)

What is Equity Formula?

The term “equity” refers to the residual business value remaining after its promoters have paid all the liabilities. In other words, in case a company decides to pay off all its debts and creditors, then whatever of the business will be left behind is the equity.

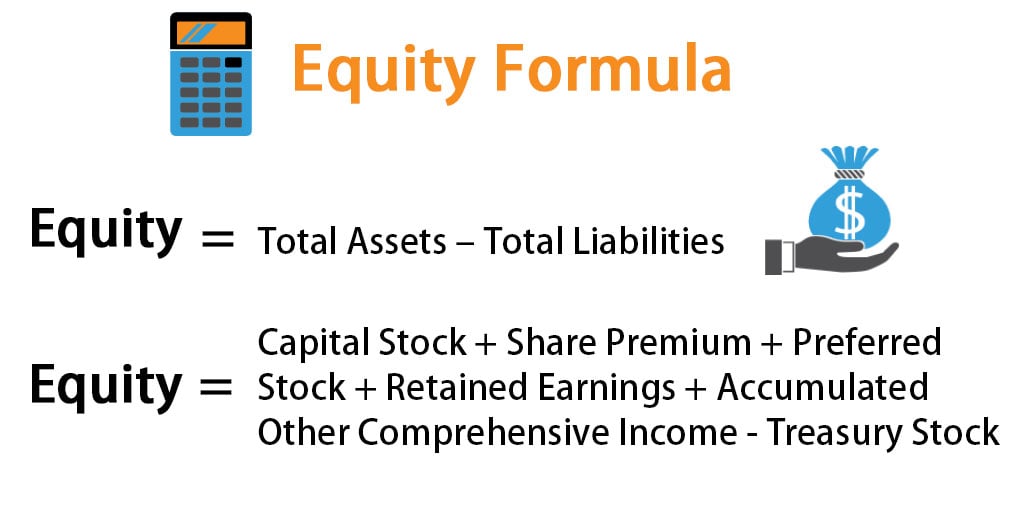

Further, the equity forms an indispensable part of the fundamental analysis of the net worth of a company. The equity is also known as the owner’s equity for an entity with a sole proprietorship, while it is known as stockholder’s equity in case of a corporation. The formula for equity of a company can be easily derived by deducting all the liabilities from all the assets of the company. Mathematically, it is represented as,

There is another method to derive the equity of a company. In this method, all the different classes of equity capital, which includes common/capital stock, share premium, preferred stock, retained earnings and accumulated other comprehensive income, are added while the treasury stocks are deducted. Mathematically, it is represented as,

Examples of Equity Formula (With Excel Template)

Let’s take an example to understand the calculation of Equity in a better manner.

Equity Formula – Example #1

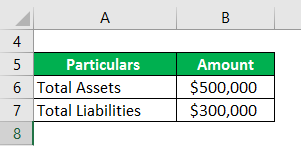

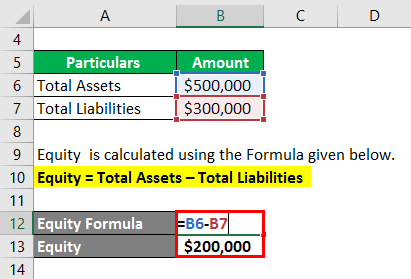

Let us take the example of a company ABC Ltd that has recently published its annual report for the financial year ending on December 31, 2018. As per the balance sheet, the total assets of the company stood at $500,000, while its total liabilities stood at $300,000 as on December 31, 2018. Determine ABC Ltd’s equity as on the balance sheet date.

Solution:

Equity is calculated using the Formula given below.

Equity = Total Assets – Total Liabilities

- Equity = $500,000 – $300,000

- Equity = $200,000

Therefore, ABC Ltd’s equity stood at $200,000 as on December 31, 2018.

Equity Formula – Example #2

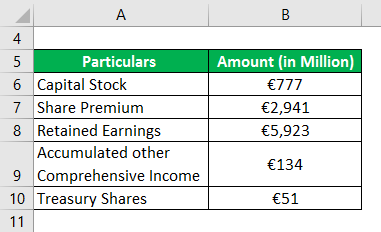

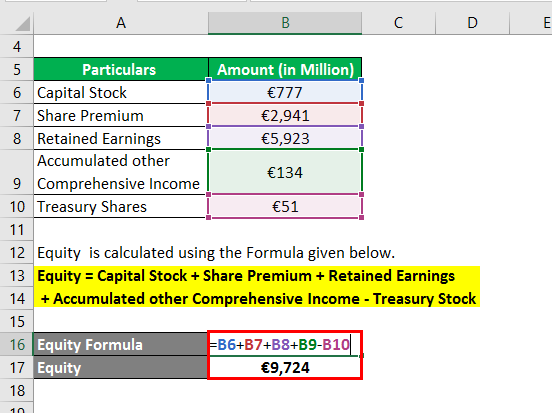

Let us take the Real-Life example of Airbus SE’s published annual report as on December 31, 2018. As per the balance, the information is available. Calculate Airbus SE’s equity based on the given information.

Solution:

Equity is calculated using the Formula given below.

Equity = Capital Stock + Share Premium + Retained Earnings + Accumulated Other Comprehensive Income – Treasury Stock

- Equity = €777 + €2,941 + €5,923 + €134 – €51

- Equity = €9,724 million

Therefore, Airbus SE’s equity stood at €9,724 million as of December 31, 2018.

Explanation

The formula for equity can be derived by using the following steps:

Step 1: Firstly, determine the total assets of the company, which is the last line item on the asset side of the balance sheet and includes plant, machinery, cash, bank deposits, investments, etc.

Step 2: Next, determine the total liabilities of the company, which is also available in the balance sheet and includes all kinds of debt obligations, payables, etc.

Step 3: Finally, the formula for equity can be derived by subtracting the total liabilities (step 2) from the total assets (step 1) as shown below.

Equity = Total Assets – Total Liabilities

Under the other method, the formula for equity can be derived by using the following steps:

Step 1: Firstly, identify all the different categories of equity capital from the balance sheet.

Step 2: Finally, the formula for equity can be derived by adding up all the categories of equity capital except ones that have been repurchased and retired (also known as treasury stock) as shown below.

Equity = Capital stock + Share premium + Preferred stock + Retained earnings + Accumulated other comprehensive income – Treasury stock

Relevance and Uses of Equity Formula

From the perspective of an investor or an investment analyst, it is important to understand the concept of equity because it predominantly used to evaluate the real value of a company (net worth). In fact, the value of one’s equity investment in the company is captured by the equity value and as such the shareholders are typically concerned with the net worth of the company.

The value of equity can be both positive or negative. A positive equity value indicates that the company has adequate total assets to pay off its total liabilities. On the other hand, a negative value of equity indicates that the company may be on the way to become insolvent as the total liabilities exceed its total assets. Consequently, the investor community, in general, considers a company to be risky and perilous if it has a negative equity value. However, the value of equity in isolation may not give very meaningful insight into a company’s financial health. But an investor can use the equity value to analyze the company to draw significant conclusions if it is used in combination with other financial metrics.

Equity Formula Calculator

You can use the following Equity Formula Calculator.

| Total Assets | |

| Total Liabilities | |

| Equity | |

| Equity = | Total Assets – Total Liabilities |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Equity Formula. Here we discuss how to calculate Equity along with practical examples. We also provide an Equity calculator with a downloadable excel template. You may also look at the following articles to learn more –