Updated July 17, 2023

Definition of Equity Investment

Equity investment is an investment in a company’s shares that are typically traded on the stock market. The returns depend upon the company’s performance or profits, and there are no fixed returns on equity investment. Equity will return to the shareholders if the company winds up after all liabilities are paid off.

Investors who have a high-risk appetite prefer equity investment over debt instruments. Since there is no fixed return on equity investment, equity investors may or may not get any dividend sometimes when the company is not performing too well or has decided to plow back the profits for the growth of the business. But as it goes, the higher the risk, the higher the reward, the shareholders’ money grows with the company’s growth, and returns in the form of dividends and capital appreciation also become high.

Some equity investors invest in shares to make profits by selling them off when their price goes high. Numerous factors in the stock market decide the stock price. The first factor is market forces like demand and supply; they have a major role in determining the stock price, and sometimes the announcement of the company’s growth plan also leads to a rise in the share price.

Example of Equity Investment

XYZ Ltd wants to raise capital of $20,000, of which 70% is to be raised through equity finance and the rest through debt. Therefore, the capital raised from the equity source of finance would be ($20,000 x 70%), i.e., $14,000. Now the company issues 1400 shares for $10 per share in the market. Any investor purchasing the company’s shares would be a shareholder, and it is a form of equity investment.

This is just one form of equity investment; we will discuss several other types in the next heading.

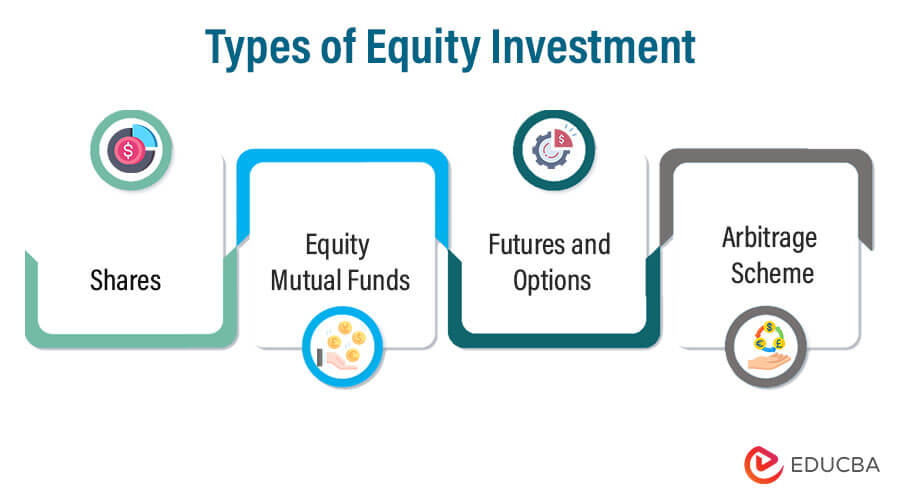

Types of Equity Investment

- Shares: A business unit or a company raises equity source of financing by issuing shares in the stock market. Investors purchase these shares, expecting their money to grow long-term or anticipating a handsome dividend return.

- Equity Mutual funds: Mutual fund is a pool of investment money from multiple investors who invest in the funds per the investors’ risk appetite. Equity mutual funds primarily invest in the shares of the company. Equity mutual funds can be a perfect choice for investors who want a diversified portfolio by investing in shares or stocks but do not have the time and knowledge to do so.

- Futures and options: Future and options are derivatives; derivatives are financial instruments that derive value from the underlying asset. Future and options derivative contracts let investors buy the securities at the current price and postpone the execution of the agreement at a pre-determined future date. In future contracts, the buyer and seller are legally bound to execute the agreement at a predetermined date. In contrast, in the option contract, investors have a right but not an obligation to execute the agreement as per the agreed price at any time during the contract.

- Arbitrage Scheme: Arbitrage scheme refers to selling the same type of stock in two markets or exchanges simultaneously. Investors reap benefits from the difference in stock prices in two different markets. It is difficult for individual investors to invest in arbitrage schemes, but they can always go for arbitrage mutual funds. The list covers the main types of equity investments but is not exhaustive.

Who Should Make Equity Investment?

There are a few points to consider for investors to decide whether they should be the ones to invest in the equity form of investment:

- Investors who want to invest in equity should have a high appetite for risk. As equity investments are market-linked instruments thus, there are no fixed returns.

- Investors wanting to invest in equity should gather proper market knowledge and skills; if they cannot, they can always go for equity mutual funds, which professional investment managers manage.

- As equity investments are volatile, the prices can fluctuate in the short term; investors wanting to make equity will need to understand that they will have to hold the investment for the long term to get a higher rate of return.

Risk of Equity Investment

The various risks relating to equity investment are as follows:

- Market risk: The risk of loss due to market factors, like economic slowdown or equity investment in the negatively impacted sector. This risk is also known as systemic risk, as it is mainly driven due to macro factors in the economy.

- Performance risk: If any particular stock is not performing well or up to the mark, the investors will have to bear the losses. This is a performance risk.

- Liquidity risk: The share or stock can be sold anytime at a fair price. But this also leads to a situation where due to a lack of liquidity, investors sell the shares at a lower price than the market price, which leads to the loss of money.

- Legislative risk: Change in the business performance due to legislative changes which eventually impact the share prices due to which investors may have to bear the losses.

Benefits

- Investors get the opportunity to increase the value of their money invested, not at a fixed rate. They get it in the form of capital gains or dividends.

- Equity investment helps investors diversify their portfolios at a minimum initial investment.

- Investors also get opportunities from the company within which they have invested to increase the number of their shares in the form of rights or bonus issues.

- Investors, as shareholders, get ownership of the company proportionate to their shares and can exercise control accordingly.

Disadvantages

- A dividend on equity investment is not fixed; sometimes, investors get nothing when the company is not performing well or making a loss.

- Equity investment carries a high risk and is not good for risk-averse investors.

- Equity investors are mainly small investors with limited ownership of the company and cannot much impact the management’s decision.

- Returns are received by equity investors only if there is any profit remaining after paying off all liabilities and providing interest on debt instruments.

Conclusion

Equity investment is a very good form of investment. If an investor is looking for a diversified portfolio, a high rate of return in the long-term, and wants ownership in the form of shares, they should go for equity investments. Investors should gather proper market knowledge of equity investment before investing, but if they cannot, they can invest in equity through equity mutual funds.

Recommended Articles

This is a guide to Equity Investment. Here we discuss the definitions and types of equity investment, benefits, and disadvantages. You may also have a look at the following articles to learn more –