Updated July 26, 2023

Definition of Equity Ratio

The term “equity ratio” refers to the financial ratio that helps assess how much of the company’s assets are funded by the capital contributed by the shareholder. In other words, it aids the comparison of the capital contributed by the shareholders and the capital contributed by the creditors in accumulating the assets.

A lower ratio value means the company has used more debt to pay for its assets. On the other hand, a high ratio value indicates a higher stake of the management in the business. This can be comforting for other investors because, inherently, it is believed that a higher proportion of the owner’s fund lowers the degree of risk in the business. Therefore, it provides reassurance and confidence to other investors. However, a higher equity ratio also means that the company is not taking advantage of financial leverage to grow its business by using a higher amount of debt.

Formula

The formula for the equity ratio is represented as,

The total equity typically includes common stock, retained earnings, treasury stock, and other comprehensive income. In contrast, total assets are all current and non-current assets like cash, plant & machinery, accounts receivable, etc.

Examples of Equity Ratio (With Excel Template)

Example – #1

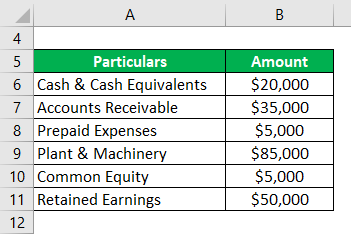

Let us take the example of a company named TDF Inc., which published its annual result last month for the year 2018. As per the annual report, the following information is available. Calculate the equity ratio of TDF Inc. based on the given information.

Solution:

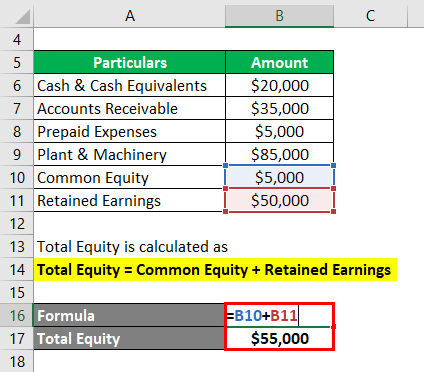

Let’s calculate total equity:

Total Equity = Common Equity + Retained Earnings

- Total Equity = $5,000 + $50,000

- Total Equity = $55,000

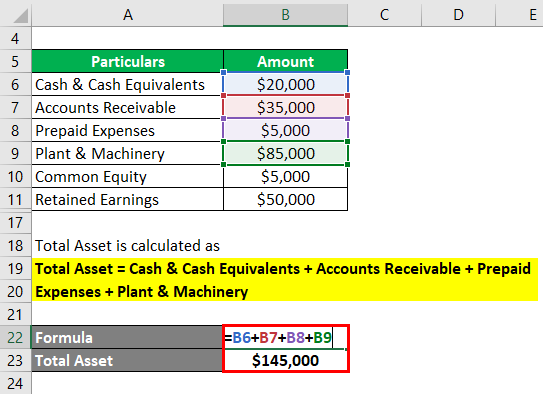

Lets calculate total assets

Total Asset = Cash & Cash Equivalents + Accounts Receivable + Prepaid Expenses + Plant & Machinery

- Total Asset = $20,000 + $35,000 + $5,000 + $85,000

- Total Asset = $145,000

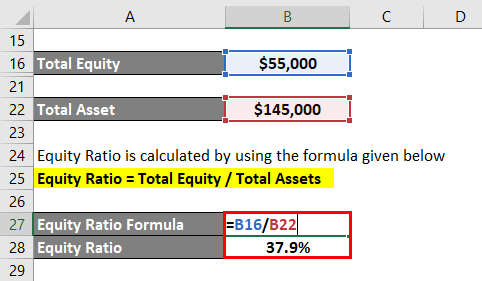

Let’s calculate the equity ratio:

Equity Ratio = Total Equity / Total Assets

- ER = $55,000 / $145,000

- ER = 37.9%

Therefore, the equity ratio of TDF Inc. was 37.9% in 2018.

Example – #2

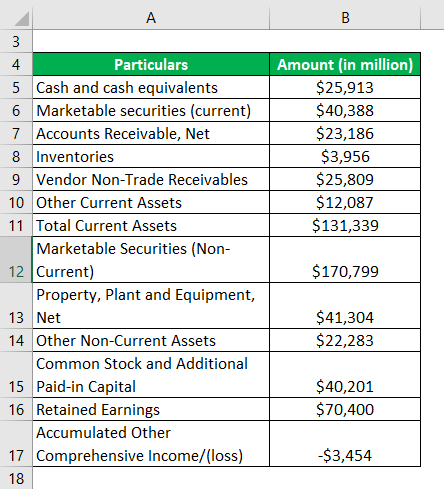

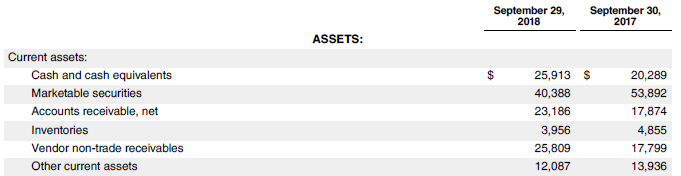

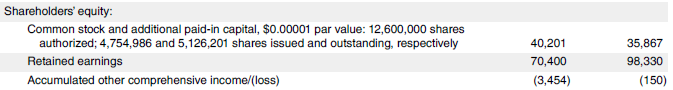

Let us take the real-life example of Apple Inc. to calculate the equity ratio for the year 2018. The following financial information is available for the year:

Solution:

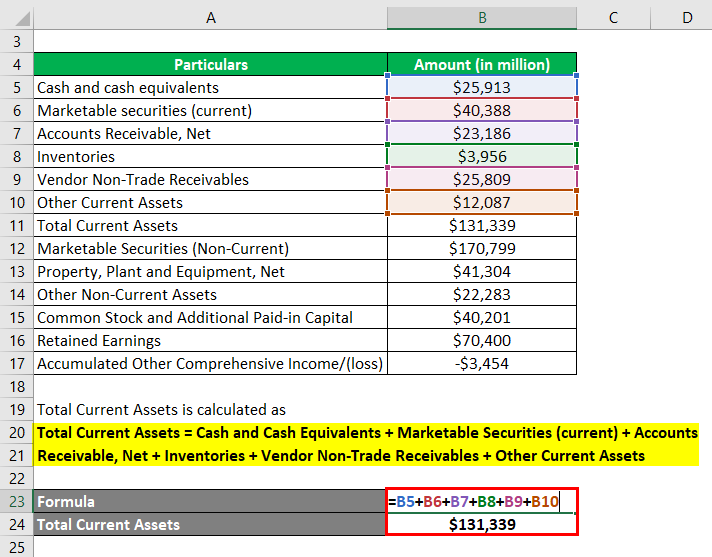

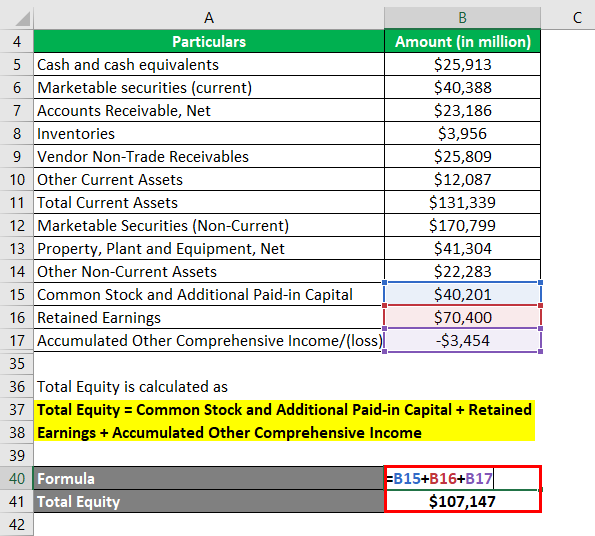

Let’s calculate Total Current Assets:

Total Current Assets = Cash and Cash Equivalents + Marketable Securities (current) + Accounts Receivable, Net + Inventories + Vendor Non-Trade Receivables + Other Current Assets

- Total Current Assets = $25,913 Mn + $40,388 Mn + $23,186 Mn + $3,956 Mn + $25,809 Mn + $12,087 Mn

- Total Current Assets = $131,339 Mn

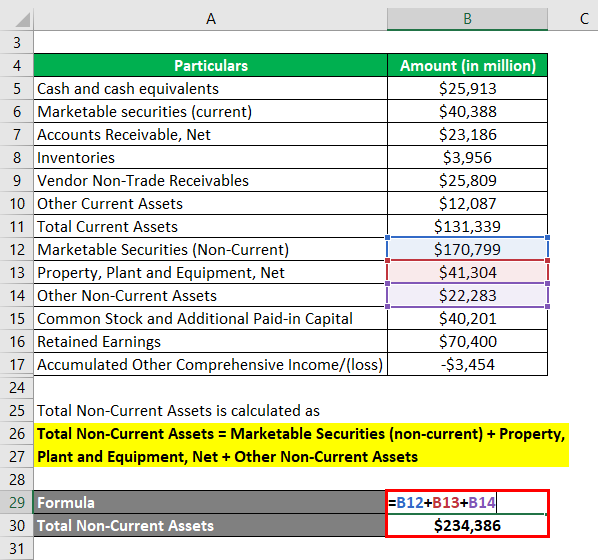

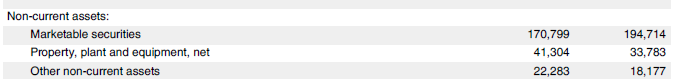

Let’s calculate Total Non-Current Assets:

Total Non-Current Assets = Marketable Securities (non-current) + Property, Plant and Equipment, Net + Other Non-Current Assets

- Total Non-Current Assets = $170,799 Mn + $41,304 Mn + $22,283 Mn

- Total Non-Current Assets = $234,386 Mn

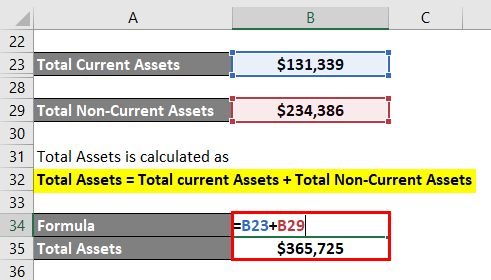

Let’s calculate Total Assets:

Total Assets = Total current Assets + Total Non-Current Assets

- Total Assets = $131,339 Mn + $234,386 Mn

- Total Assets = $365,725 Mn

Let’s calculate Total Equity:

Total Equity = Common Stock and Additional Paid-in Capital + Retained Earnings + Accumulated Other Comprehensive Income.

- Total Equity = $40,201 Mn + $70,400 Mn + ($3,454 Mn)

- Total Equity = $107,147 Mn

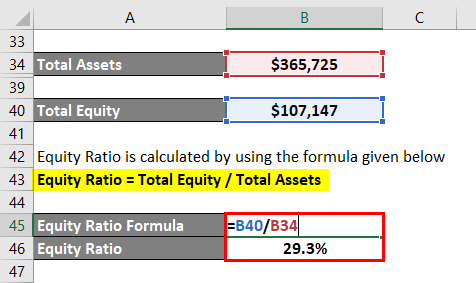

Equity Ratio = Total Equity / Total Assets

- ER= $107,147 Mn / $365,725 Mn

- ER = 29.3%

Therefore, Apple Inc.’s equity ratio stood at 29.3% for 2018.

Source: Apple’s Annual Report

Advantages and Disadvantages

Advantages

- The ratio gives a fair idea about the company’s capital structure, i.e. what portion of the business is funded by the promoters.

- At the time, this ratio can also be a reflection of the intent of the management. Any significant decline in the ratio can be a matter of concern and should be red-flagged to the investors.

Disadvantages

The ratio can be manipulated by the accounting of accrual-based revenue that increases retained earnings and accounts receivables. Eventually, it will improve the equity ratio, although the business per se has not improved.

Conclusion

So, the equity ratio is another financial ratio that helps in the assessment of the capital structure of a company that tells how much of the company assets are funded by a contribution from the shareholders or promoters. However, using this ratio in conjunction with other liquidity and solvency ratios is always advisable to capture the true picture of the company’s financial position.

Recommended Articles

This has been a guide to the Equity Ratio. We discuss the introduction, examples, advantages, disadvantages, and a downloadable Excel template. You can also go through our other suggested articles to learn more –