Updated July 29, 2023

Difference Between Equity Shares vs Preference Shares

Equity Shares are the main source of raising funds for the firm. It is a form of partial or part Ownership in the company in which shareholders bear the highest business risk. All equity shareholders are collectively owners of the company, and they have the authority to control the affairs of the business. Ownership in the company depends on the unit of shares they hold. The Equity shareholders get the company’s profit in the form of a dividend, but the dividend rate is not fixed; it fluctuates as per profit i.e. if more is the profit, they will get more dividends and vice versa.

Equity shares are also called ordinary shares. Preference shares, as the name suggests, are shares in which shareholders receive dividends from the company’s profits before equity shareholders at a fixed dividend rate. The money raised through the issue of preference shares is termed preference share capital. Preference shareholders do not have the authority to control the company’s affairs. Regarding company insolvency issues, Preference shareholders paid first from company assets.

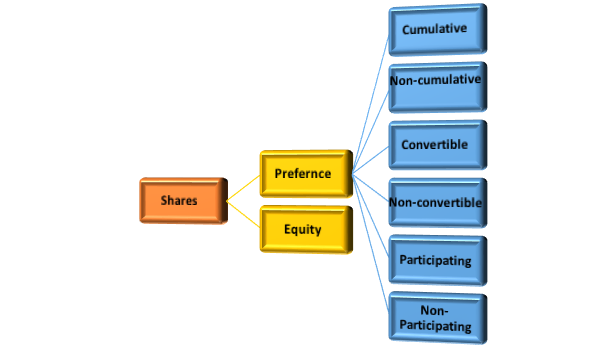

Shares are Classified into Two Main Types

1. Equity Shares

2. Preference Shares.

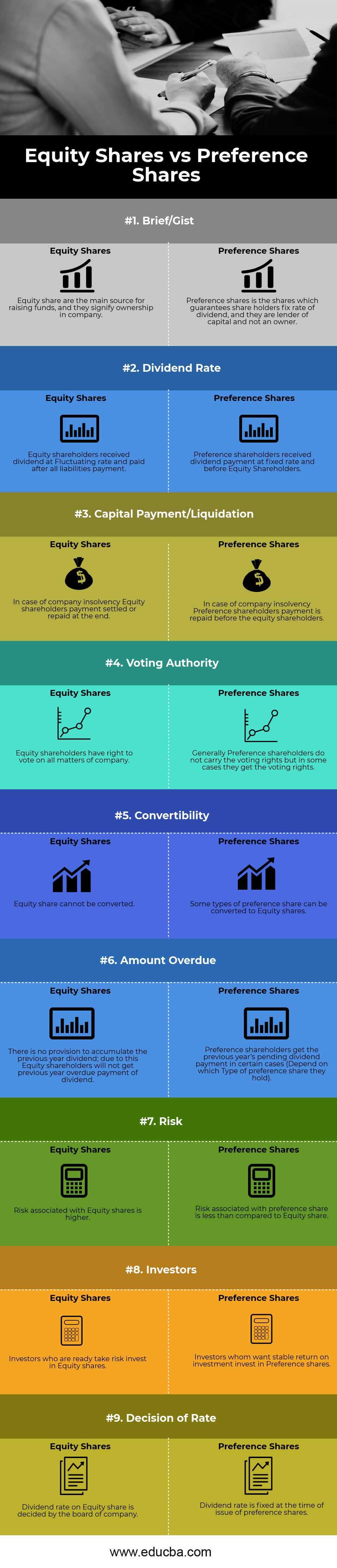

Head to Head Comparison Between Equity Shares vs Preference Shares(Infographics)

Below is the top 9 difference between Equity Shares vs Preference Shares

Key Differences Between Equity Shares vs Preference Shares

Let us discuss some of the major differences between Equity Shares vs Preference Shares

- Equity Shares are the main source of finance for the company, and they hold ownership in the company. In contrast, preference shareholders are the lender of capital to the company and do not hold voting rights.

- Investing in preference shares is safer than Equity shares.

- Equity shareholders get the company’s profit in dividends at fluctuating rates, whereas preference shareholders get dividends at fixed rates and before Equity shareholders.

- The person holding the Equity share cannot convert its shares into preference shares; however, a person holding preference shares can convert its shares to Equity shares.

- Equity shareholders have the authority to vote in all matters. However, preference shareholders’ voting authority is restricted.

- Equity shareholders have the authority to participate in the company’s management; however, preference shareholders do not have the authority to participate in the company’s management.

- At the time of the company’s bankruptcy, preference shareholders get the refund of capital first after selling company assets. After that, Equity shareholders get a refund of the capital amount.

- Paying the dividend is not compulsory to equity shareholders; however, payments to preference shareholders are paid only when the company earns a profit.

- Equity share is for those investors who are ready to take a risk and interested in a higher return; on the other hand, preference share is preferred by those investors who are willing to invest in the company but do not want to take a risk with fluctuating share prices. Hence, they favor preference shares to earn fix rate of dividends.

- Preference shares are sold back to the company; however, Equity shares are sold back to someone (Buyer) in the stock market.

Equity Shares vs Preference Shares Comparison Table

Let’s look at the top Comparison between Equity Shares vs Preference Shares.

| Source of Division | Equity Shares | Preference Shares |

| Brief/Gist | Equity share is the main source for raising funds, and they signify ownership in the company. | Preference shares guarantee shareholders fix the dividend rate and are a lender of capital and not an owner. |

| Dividend Rate | Equity shareholders received a dividend at a Fluctuating rate and paid after all liabilities payments. | Preference shareholders received dividend payments at a fixed rate and before Equity Shareholders. |

| Capital Payment/Liquidation | In the case of company insolvency, the payment to equity shareholders is settled or repaid. | In the event of company insolvency, the repayment to preference shareholders prioritizes before the repayment to equity shareholders. |

| Voting Authority | Equity shareholders have the right to vote on all matters of the company. | Generally, Preference shareholders do not carry voting rights, but in some cases, they get the voting rights. |

| Convertibility | Equity shares cannot be converted. | Some types of preference shares can be converted to Equity shares. |

| Amount Overdue | There is no provision to accumulate the previous year’s dividend; due to this, Equity shareholders will not get the previous year’s overdue payment of dividends. | Preference shareholders get the previous year’s pending dividend payment in certain cases (Depending on which Type of preference share they hold). |

| Risk | A risk associated with Equity shares is higher. | A risk associated with a preference share is less than an Equity share. |

| Investors | Investors who are ready to take the risk of investing in Equity shares. | Investors who want a stable return on investment invest in Preference shares. |

| Decision of Rate | The board of the company decides the dividend rate on Equity shares. | The company fixes the dividend rate at the time of issuing preference shares. |

Conclusion

From the above, it is evident that companies issue equity and preference shares as types of shares to raise funds and fulfill their requirements. Public and private companies issue shares, and if the company is in profit or performs well, shareholders get that profit in the form of dividends at a fixed and fluctuating rate.

Equity shares give the highest return on investment at the cost of the highest risk; however, preference shares give a fixed sum of money at the cost of zero or minimal risk. Anyone looking to invest money in shares must know about the stock market to avoid losses from an upward and downward price.

Any company’s share price depends on the company’s performance and some external factors. Long-term investment in shares provided good returns for longer periods. If anyone is looking for a risk-free investment, investing in a mutual fund is the best option as a risk in this comparatively less than stock.

Recommended Articles

This has guided the top difference between Equity Shares and Preference Shares. Here we also discuss the Equity Shares vs Preference Shares key differences with infographics and comparison table. You may also have a look at the following articles to learn more –