Updated July 29, 2023

Equity Value Formula (Table of Contents)

- Equity Value Formula

- Examples of Equity Value Formula (With Excel Template)

- Equity Value Formula Calculator

Equity Value Formula

I need to calculate the equity value of a company. Wait, what?

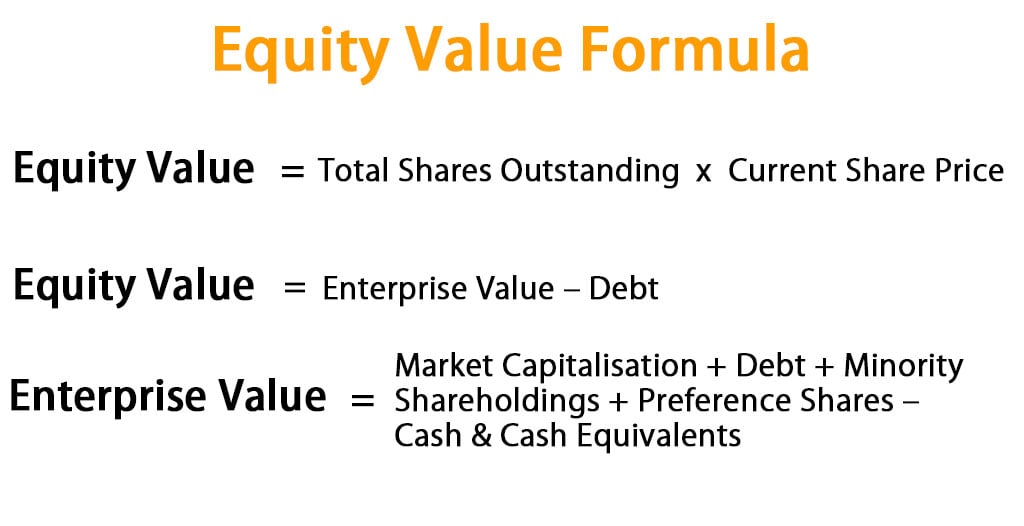

Equity value is simply the value that is attributable to the shareholders of a company, for they provide the equity. Equity value results from multiplying the total outstanding shares by the current price.

OR

The Enterprise value of a company is the firm’s total value that includes other metrics, such as debt, minority shares, cash & cash equivalents, and preference shares.

Examples of Equity Value Formula (With Excel Template)

Let’s take an example to understand the calculation of the Equity Value formula in a better manner.

Example #1

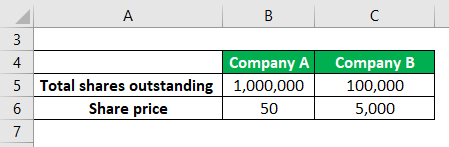

Let’s assume there are two companies, A and B. We have to find which of the two has a high equity value.

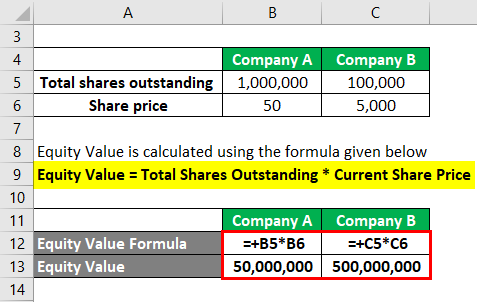

Equity Value is calculated using the formula given below

Equity Value = Total Shares Outstanding * Current Share Price

Equity Value of Company A

- Equity Value = +1,000,000 * 50

- Equity Value = 50,000,000

Equity Value of Company B

- Equity Value = +100,000 * 5,000

- Equity Value = 500,000,000

In the above example, we observe that the equity value (calculated by multiplying the shares outstanding by the share price) for company B is higher than for company A. Despite the lower number of shares, the equity value for company B is higher.

Example #2

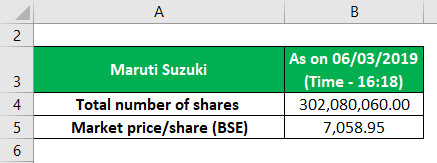

Let’s take an example of a Maruti Suzuki company to calculate the equity value.

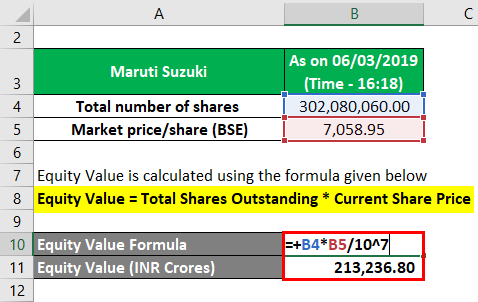

Equity Value is calculated using the formula given below

Equity Value = Total Shares Outstanding * Current Share Price

- Equity Value = +302,080,060.00 * 7,058.95 / 10^7

- Equity Value = 213,236.80

As we can see in the above Excel snapshot that the market value or the equity value of Maruti Suzuki India is around two lakh crores.

- The share price is the latest.

- The number of shares denotes the total shares in circulation (outstanding).

Example #3

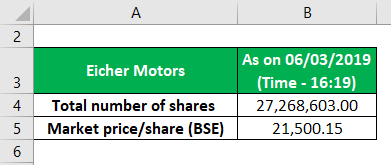

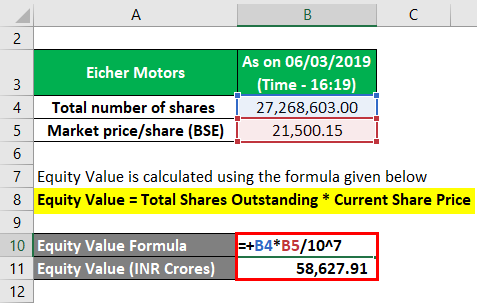

Let’s take an example of an Eicher Motors company to calculate the equity value.

Equity Value is calculated using the formula given below

Equity Value = Total Shares Outstanding * Current Share Price

- Equity Value = +27,268,603.00 * 21,500.15 / 10^7

- Equity Value = 58,627.91

As we can see in the above Excel snapshot, the equity value for this company is around fifty thousand crores.

- The share price is the latest price.

- The number of shares denotes the total shares in circulation (outstanding).

Explanation of Equity Value Formula

For instance, If I were to buy a business and the person on the selling side told me that the business is worth 1 crore INR, there is a loan yet to be paid that amounts to 15 Lakhs INR. Then I would say that I will buy the business only when the debt of 15 Lakhs INR is paid off. This is essentially the equity value. When the debt component is there, we are dealing with the enterprise value or the firm’s total value as opposed to just equity.

It is a very important tool for investors as it provides information on what amount they will get if they sell the business. This formula essentially exhibits the market value of the company’s shares. Kindly note that here the value of shares is being calculated, and hence the equity part of the company is being valued. If I need to value the whole company, in that case, I will also have to value the debt taken by the company.

If I have to calculate the enterprise value (i.e., the value of equity + debt), I must add the debt to the equity value and exclude the cash component.

When using the equity value formula, we see that the formula is dependent on two parameters: the shares outstanding and the share price. You might have observed that some companies have fewer shares but a huge equity value. Companies such as Eicher Motors have a very high share value; hence the equity value shoots up.

This is a caveat before investing in companies. Some companies can have a high equity value for some time (some companies with a bad business gain due to a market frenzy) that might not be stable.

The other peculiarity about the equity value formula is that no real money is involved, but it is all about the share price. Many big blue-chip companies have lost billions of dollars in equity value due to temporary bad news. It is all about how the investors perceive the company’s growth and how management drives it. For instance, the share price of Eicher Motors is a whopping 19000 INR. The fat success of this company has a major contributor behind it, and that is the Royal Enfield. People are crazy about that machine, which converts into the company’s huge equity value.

Relevance and Uses

The equity formula is most common in the Price to earnings ratio or the P/E ratio. Although this ratio only gives the value of equity as multiples. The other ratio, the EV/EBITDA ratio, gives the firm’s value instead of equity value. The price-to-earnings ratio, or the P/E ratio, is the price per share divided by the earnings per share.

This ratio also gives an indication of how expensive or cheap a stock is with respect to the other stocks in the same industry. The P/E ratio gives a comparison among companies within the same sector.

The value at which a company can sell off the equity. The equity formula gives us an estimate of the value of a company at a particular point in time. If the equity formula value keeps shooting upward, the investor sentiment toward a specific stock also strengthens. But some companies with bad businesses also rise because of a market frenzy. But the investors must be careful about such temporary risings.

There’s a saying: “The bigger they are the harder they fall”

This is also true in the case of stocks.

Equity Value Formula Calculator

You can use the following Equity Value Calculator

| Total Shares Outstanding | |

| Current Share Price | |

| Equity Value Formula | |

| Equity Value Formula = | Total Shares Outstanding x Current Share Price |

| = | 0 x 0 = 0 |

Conclusion

The equity value formula yields the value that is a combination of the total shares outstanding and the market price of the share at a particular point in time. It keeps changing per the company’s performance and the investors’ perception of the company. This formula does not include any debt part to it. Hence to calculate the total value of a company, we have to include the debt to the equity value and exclude the cash & cash equivalents.

Recommended Articles

This article has been a guide to the Equity Value formula. Here we discuss how to calculate equity value along with practical examples. We also provide an equity value calculator with a downloadable Excel template. You may also look at the following articles to learn more –