Updated July 29, 2023

Difference Between Equity vs Royalty

Equity and royalty play crucial roles in business; organizations utilize equities and royalties from resources. Resources play important roles in the organization day to day operations. The organization distributes equity as the surplus profit to investors after settling all liabilities. Company shares distribute equity, representing units that grant investors ownership. Royalty is payment or fees paid to an owner of assets (Tangible or Intangible Assets) for those assets by a person or organization who wishes to use those assets for generating revenue and other activities.

Equity

The investors who hold Equity in the organization get profit in the form of a dividend or Capital Gain, and it’s paid as per the percentage of ownership they hold in the organization. Equity Shareholders also receive special rights in the organization depending on the type of shares they hold.

The main components of Equity are-

- Common Stock or Equity Share/ Ordinary Shares.

- Preference Shares

- Premium Share

- Accumulated/Retain Earning

Royalty

So, in short, it is a payment made to the legal owner of assets. The legal owner of such assets allows other persons or entities to use those assets against some consideration. The most common assets are –

- Patent

- Copyright

- Property/Land

- Natural Resources

One of the best examples of Royalty is that when the book’s publisher published the book, he paid the author based on the number of copies sold in the market, so paying amount is called Royalty.

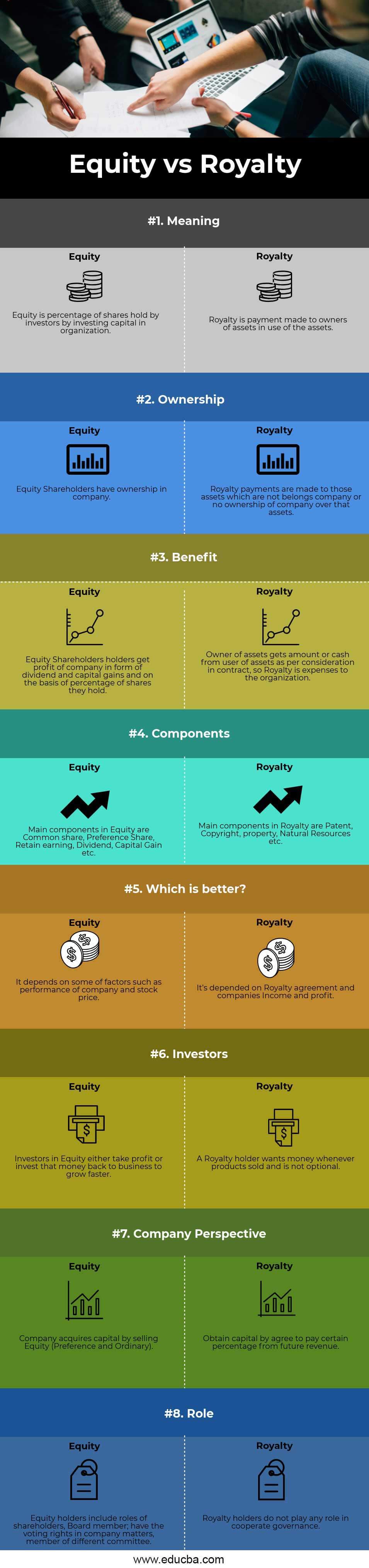

Head-to-Head Comparison Between Equity vs Royalty (Infographics)

Below is the top 8 difference between Equity vs Royalty:

Key Differences Between Equity vs Royalty

Let us discuss some of the major differences between Equity vs Royalty:

- Equity is ownership in the company informing the unit of shares. The user of assets makes the payment to the owner of assets, known as a royalty. Furthermore, the company’s royalty holders do not own the company.

- Equity Shareholders profit from the company in the form of dividends, and the dividend rate fluctuates for ordinary shares and is fixed for preference shares. In contrast, Royalty holders will receive a payment as per consideration in the contract.

- The main components in Equity are Ordinary Shares, Preference Shares, dividends, Capital Gain, etc. However, the main components of Royalty are Patents, Copyright, Property, Natural Resources, etc.

- Royalty is guaranteed income for Royalty holders. Even if the company is not in profit or experiencing less profit, Royalty income will not change. On the other hand, if the company is not in profit, equity holders will not get any dividends or profit from the company.

- Which one is better, Royalty or Equity, depends on a number of factors; for equity performance of the company and the stock price of the company for Royalty, it’s on consideration in the agreement, as company Income and profit.

- Royalty users are legally binding to the contract. However, Equity Shareholders owe capital in the company at their convenience.

- The company pays royalty as a percentage of the gross or net profit from utilizing the owners’ property and sometimes negotiates the terms. On the other hand, the company board determines the dividend rate at which equity shareholders are paid, but only if the company earns a profit.

- In Royalty, you cannot change the terms and conditions of the contract until it ends; however, terms and conditions in Equity can be changed in between; it purely depends on the company board.

Equity vs Royalty Comparison Table

Let’s look at the top 8 Comparison between Equity vs Royalty

| Basis of Comparison |

Equity |

Royalty |

| Meaning | Equity is the percentage of shares investors hold by investing capital in an organization. | Royalty is a payment made to owners of assets in the use of the assets. |

| Ownership | Equity Shareholders have ownership in the company. | The company makes royalty payments to assets that do not belong to it or have no ownership over those assets. |

| Benefit | Equity Shareholders’ holder’s profit from the company through dividends and capital gains based on the percentage of shares they hold. | The user of assets provides an amount of cash to the asset owner based on the contract’s consideration, resulting in the organization expensing the royalty. |

| Components | The main components in Equity are Common shares, Preference Shares, Retained earnings, dividends, Capital Gain, etc. | The main components of Royalty are Patents, Copyright, property, Natural Resources, etc. |

| Which is better? | It depends on factors such as the company’s performance and stock price. | The determination of royalty payments depends on the royalty agreement and the company’s income and profit. |

| Investors | Investors in Equity either take profit or invest that money back into the business to grow faster. | A Royalty holder wants money whenever products are sold and are not optional. |

| Company Perspective | The company acquires capital by selling Equity (Preference and Ordinary). | Obtain capital by agreeing to pay a certain percentage of future revenue. |

| Role | Equity holders include roles of shareholders, Board members; who have voting rights in company matters, and members of the different committees. | Royalty holders do not play any role in cooperate governance. |

Conclusion

From the above, it is evident that in royalty, one party grants permission to other parties to use their assets for a specific period of time, and the user of these assets will compensate the owner; however, investors in equity hold ownership in the company and contribute capital to the organization, and in return, they receive dividends if the company performs well. In short, the company expenses Royalty, while Equity allows it to raise funds to meet its requirements.

Royalty holders earn money even if the company is not profitable, and the Royalty agreement does not change even if companies sell or change the company’s board. Equity holders get dividends only if the company is in profit; if it is sold, they will receive part of the sale amount. The major difference between equity vs royalty is the ownership criteria. Sometimes asset users pass Royalty fees to a final beneficiary of the product by increasing the pricing of the product, so in this way, the company covers their expenses.

Recommended Articles

This has been a guide to the top difference between Equity vs Royalty. Here we also discuss the Equity vs Royalty key differences with infographics and comparison table. You may also have a look at the following articles to learn more –