What is an Escrow Account?

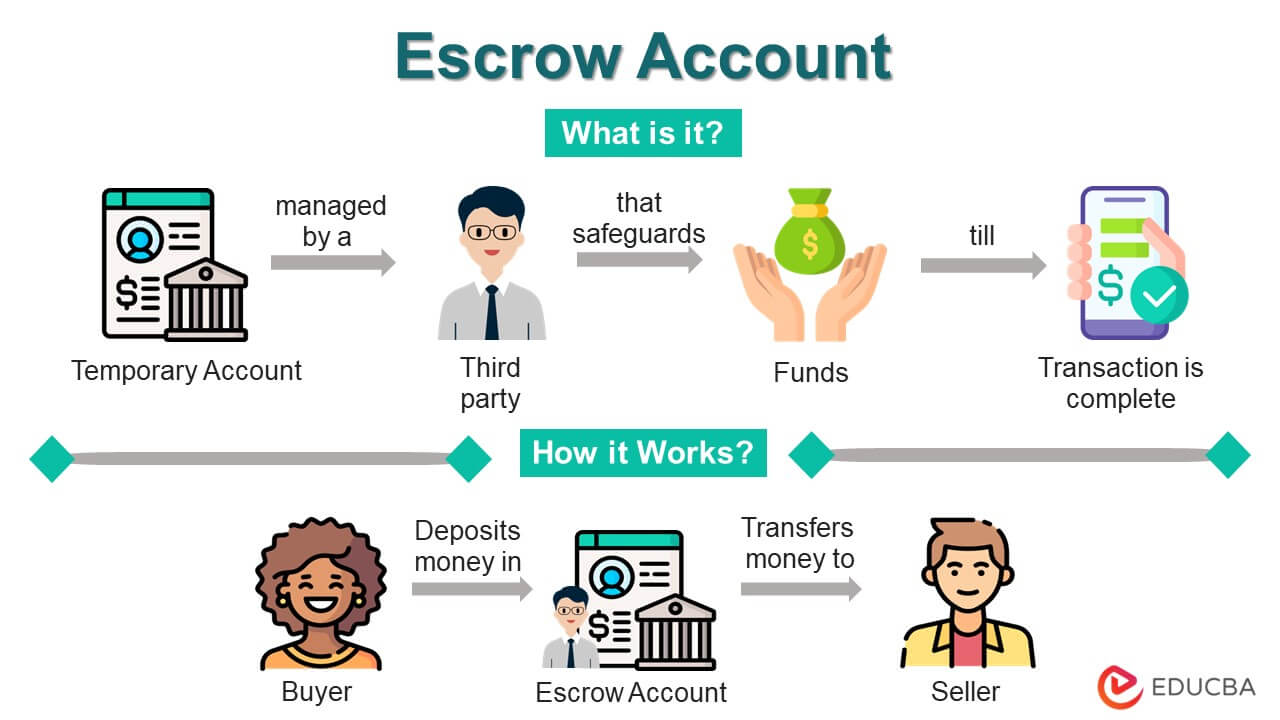

An escrow account is a temporary account held by a neutral third party (the escrow agent) who safeguards the buyer’s funds and only transfers them to the seller once they fulfill the agreement.

If both parties correctly execute the transaction, they receive their respective assets and funds. However, if something goes wrong, the money goes back to the buyer. This provides security against fraud and ensures the transaction completes as per the predetermined agreement. These accounts are useful for buying properties, cryptocurrencies, online sales, and business mergers.

For example, let’s say James wants to buy a vintage piano from Lily. To keep his money safe, he uses an escrow service provided by Tom. James transfers the funds to Tom, who holds the money until the piano safely reaches James. Once James receives the piano and confirms his satisfaction, Tom releases the funds to Lily. This way, James’s money is safe until he gets the piano, and Lily knows she’ll get the money once James is satisfied with the transaction.

Table of Contents

How does Escrow Work?

Here is how an escrow account works from its establishment to the completion of the transaction.

- Agreement: The parties (buyer and seller) involved in the transaction sign a contract outlining the terms and conditions of the transaction.

- Selection of Escrow Agent: Both parties select an escrow agent who is a neutral third party for managing the transaction amount. They both agree on the terms they must follow in order to release the funds or assets from the account.

- Deposit: The buyer (or party who pays) transfers the funds into the escrow account. It is often called the “deposit” or “earnest money.” Meanwhile, the escrow agent notifies the seller about the funds.

- Verification: The escrow agent verifies the deposited amount and ensures it meets the agreed terms and conditions.

- Performance of Obligations: The seller completes all the necessary documents, any repairs from their side, etc.

- Transfer of funds: Once both parties fulfill their commitments, the escrow agent disburses the funds or assets to the seller and the property or product to the buyer.

- Completion: After the transfer, the escrow agent may provide documentation to both parties as proof of the finalized transaction and then close the account.

Example – Real Estate Purchase

Georgia Willams wants to purchase a house in Houston. She has found a suitable property listed by Austin Brown, the seller. Both Georgia and Austin want to make sure they have a smooth transaction. So, they decide to open an escrow service account to manage the fund transfer safely.

Escrow Timeline

Day 1: Initial Agreement

Georgia and Austin agree on the important aspects of the transactions, like the initial price of the house, details of the property, etc.

Days 2-3: Exchanging Documents & Home Inspection

Austin sends Georgia all the required documents regarding the property, such as its past repairs, any known issues, condition reports, etc. Apart from that, Georgia hires a professional home inspector to personally check the property’s condition to determine its fair market value.

Days 4-10: Final Negotiations

After Georgia shares the reports from the inspection with Austin, both discuss any arising concerns and finally decide on the final price for the house as $320,000.

Day 11: Opening Escrow

Georgia contacts Houston Escrow Services and opens an escrow account. She and Austin give necessary information like the purchase agreement they created, their financial data, and other essential documents.

Days 12-15: Examining the Transaction

The Houston Escrow Services examines the property to make sure it has no legal disputes, debts, etc., and the legal ownership is in Austin’s name.

Days 16: Transfer of Funds

After all the inspections by the escrow service team, Georgia transfers the amount of $320,000 to the escrow account.

Days 17-25: Fulfilling the Agreement

In the next few days, Georgia and Austin will work on fulfilling the terms mentioned in their agreement. While Georgia transfers her house insurance to the new property, Austin works on all the final repairs of the house.

Days 26-30: Completing the Transaction

Once both of them have fulfilled all the conditions mentioned in the agreement, Georgia and Austin sign the final closing documents. As soon as Austin transfers the ownership of the house to Georgia, the escrow company sends the $320,000 to Austin, and the transaction completes.

How to Open an Escrow Account? (Step-by-Step)

Here is a step-by-step guide on how you can open an escrow account:

Step#1: Finalize the Purchase Agreement

The buyer (client) or seller (beneficiary) agrees on a temporary account for the transaction process and sets a final price and other terms of the purchase.

Step #2: Find the right Escrow Agent

After finalizing the purchase agreement, they choose an escrow agent like an independent agent, escrow company, bank, or insurance agency offering escrow services.

Step #3: Open Escrow Account

An escrow agent opens an account with details like the buyer and seller’s names and addresses, the asset’s price, description, financing information, and any down payment.

Step #4: Sign the Escrow Agreement

After finalizing all the requirements and conditions, parties sign the contract, namely an “Escrow agreement.” The agreement also includes the service fee of an escrow company.

Step #5: Get Account details

The escrow agent then gives the escrow account details to the parties. Parties must keep it safe and can use it to contact the agents for any updates.

Step #6: Deposit Funds

The buyer then deposits the funds into the escort account. This step ensures the security and transparency of the transaction.

Types

There are several types of escrow accounts available for different purposes and benefits. Here are the most common types:

#1 Real Estate Escrow: In real estate transactions, an escrow service account holds the buyer’s funds till the seller fulfills all terms and conditions and transfers the property to the buyer.

Example: Let’s say Mike wants to buy a house. Mike and the seller, Kelly, agree to use escrow, and Mike deposits the purchase amount into the escrow account. The escrow company holds the funds until Kelly fulfills all house inspections, repair works, and other necessary processes. Kelly then transfers the ownership of the property to Mike. Once Kelly and Mike meet all the conditions, the escrow company sends the money deposited by Mike to Kelly.

#2 Online Sales Escrow: Escrow accounts are a safe medium for online transactions, especially e-commerce. It ensures that the buyer receives the product as described, and the seller gets paid once the buyer is satisfied with the product.

Example: Suppose Sarah purchases jewelry from an online seller but is concerned about the product’s condition and authenticity. Sarah deposits the amount to an escrow service to ensure a secure transaction. After Sarah receives the jewelry product in a good and safe condition, the escrow agent releases the funds to the seller. This way, Sarah and the seller can trust the transaction’s fairness and security.

#3 Construction Escrow: Contractors or builders use these accounts to hold and disburse funds for a construction project/building while dealing with large amounts of money.

Example: Garry is a contractor remodeling an old house, which requires a lot of money. So, Garry takes a loan from a bank, and both Garry and the bank set up an escrow account. Garry mentions that he will require the funds at each stage of the project as he will complete the project in several phases. The bank deposits the total money into the account, but the agent only releases the funds to Garry when he requests them at each stage. This way, Garry manages the financial aspect of the remodeling project effectively, and the bank has confidence that the funds are secure.

#4 Mortgage Escrow: A mortgage escrow is an agreement between a borrower and mortgage lender for monthly mortgage payments (repayment amount). The lender keeps a portion of the amount as principal and interest amount and uses the rest to pay property taxes, insurance, etc., on behalf of the borrower.

Example: Mathew (borrower) had taken a mortgage from Emily (lender) to buy a house. They set up a mortgage escrow account to repay the loan, where Mathew adds monthly payments. Emily uses one-half of the monthly payment for property taxes, insurance premiums, homeowner association fees, etc. She keeps the rest of the amount as her repayment of the loan.

#5 Business Acquisition Escrow: Small businesses often use this account during mergers & acquisitions or to hold a portion of the purchase price until the transaction finishes.

Example: When two or more companies decide to enter a merger or acquisition deal, there is significant risk involved. So, to protect their funds, assets, or titles, they can set up an escrow account. Therefore, the escrow agent will release the funds only after completing the merger or acquisition according to the terms of the agreement.

Escrow Account Rules

While specific rules and regulations may vary depending on the country and jurisdiction, here are some general principles and guidelines that typically apply to escrow accounts:

- The escrow agent’s role is to hold funds in trust and release them only upon fulfilling specified conditions.

- The agreement must be in writing, outlining the terms and conditions of the transaction.

- If a seller delays asset delivery, the buyer can call off the deal by instructing the escrow agent to withdraw the funds from the account.

- The funds in the account are only usable for specific activities mentioned in the agreement between the buyer and seller.

- Escrow agents charge a fee for their services, which one or both parties involved in the transaction typically pay. The escrow agreement should clearly outline the fee structure in the escrow agreement.

- The escrow agent cannot use the funds in the account for personal purposes.

Benefits

- Security: It provides a secure way to handle large amounts of complex transactions. The funds are held by a trusted third party, reducing the risk of fraud or misappropriation.

- Risk Mitigation: Individuals use these accounts in real estate transactions, mergers and acquisitions, and other large deals. They help reduce risks for both the buyer and the seller, ensuring the funds are released only after meeting the agreed-upon terms and conditions.

- Neutral Oversight: The escrow agent acts as a neutral third party, ensuring the transaction follows the agreed terms and conditions. This impartial oversight adds credibility and trust to the process.

- Transparency: All parties involved in the transaction can have clarity in the escrow account, which helps build trust and confidence in the deal.

- Smooth Transactions: Escrow accounts facilitate smooth and organized transactions. Payments are processed securely, and the release of funds depends on meeting certain predefined conditions.

- Regulatory Compliance: In some cases, relevant laws and regulations may require you to open these accounts.

- Payment Scheduling: Escrow accounts can facilitate installments, as in construction and business acquisition escrow.

Frequently Asked Questions (FAQs)

Q1. What is an escrow account in the bank?

Answer: An escrow account in the bank is a special account set up by a lender to cover property expenses. Borrowers pay monthly mortgage payments in that account. When the payment is due, lenders use this money to pay property taxes, insurance, and other fees monthly. In this way, the lender ensures timely payments and financial protection for both parties.

Q2. Differentiate between escrow vs. trust account.

Answer: In a trust and escrow account, an owner deposits money via a third party, and funds release only after fulfillment of all terms. The difference lies in the purpose of that account. In a trust account, a trustee manages the funds and releases those funds upon specific conditions, like when minors reach a specified age, marriage, or death in the family. In contrast, an escrow account is an independent and impartial account between the buyer and the seller, mostly in real estate transactions.

Q3. Does an escrow account earn interest?

Answer: The interest on the amount of the escrow account depends on regulations and agreements. This interest either adds to the account balance or stays with the bank/escrow company. It depends on the terms and conditions of the contract.

Recommended Articles

This article explains what an escrow account is, how to open it, its types, examples, rules and benefits, and examples. You can visit the following links to read related articles: