Introduction to Great Depression

The Great Depression of the 1930s is one of modern history’s most defining economic crises, with global reverberations. It serves as a stark reminder of the fragility of economic systems and their profound impact on society. The 1929 stock market crash, often known as Black Tuesday, sparked widespread economic chaos and wiped out billions of dollars in value in hours. For instance, in the United States alone, unemployment soared to unprecedented levels, reaching nearly 25%, leaving millions without work and plunging families into poverty. This essay delves into the myriad causes, far-reaching consequences, governmental responses, and lasting lessons from this pivotal historical period.

Historical Context of the Great Depression

- Post-World War I Prosperity: The 1920s saw a period of unprecedented economic growth in many parts of the world, particularly in the United States, buoyed by industrialization, technological advancements, and a surge in consumerism.

- Economic Boom: The Roaring Twenties witnessed a surge in consumer spending fuelled by easy credit, speculative investment in the stock market, and the proliferation of new consumer goods.

- Stock Market Speculation: The stock market became a symbol of the era’s excesses, with rampant speculation driving prices to unsustainable levels, leading to an artificial inflation of stock values.

- International Debt and Instability: The aftermath of World War I left many countries burdened with massive debts and struggling economies. The global interconnectedness of economies meant that economic downturns in one country could quickly spread to others.

- Agricultural Crisis: The agricultural sector faced significant challenges during the 1920s, as falling crop prices and overproduction led to widespread rural poverty and farm foreclosures.

- Unequal Distribution of Wealth: Despite the overall prosperity, wealth was highly concentrated among the elite, leading to growing income inequality and disparities in living standards.

- Policy Responses: Governments, particularly in the United States, pursued laissez-faire economic policies, with minimal regulation of financial markets and limited economic intervention, setting the stage for the severity of the subsequent economic collapse.

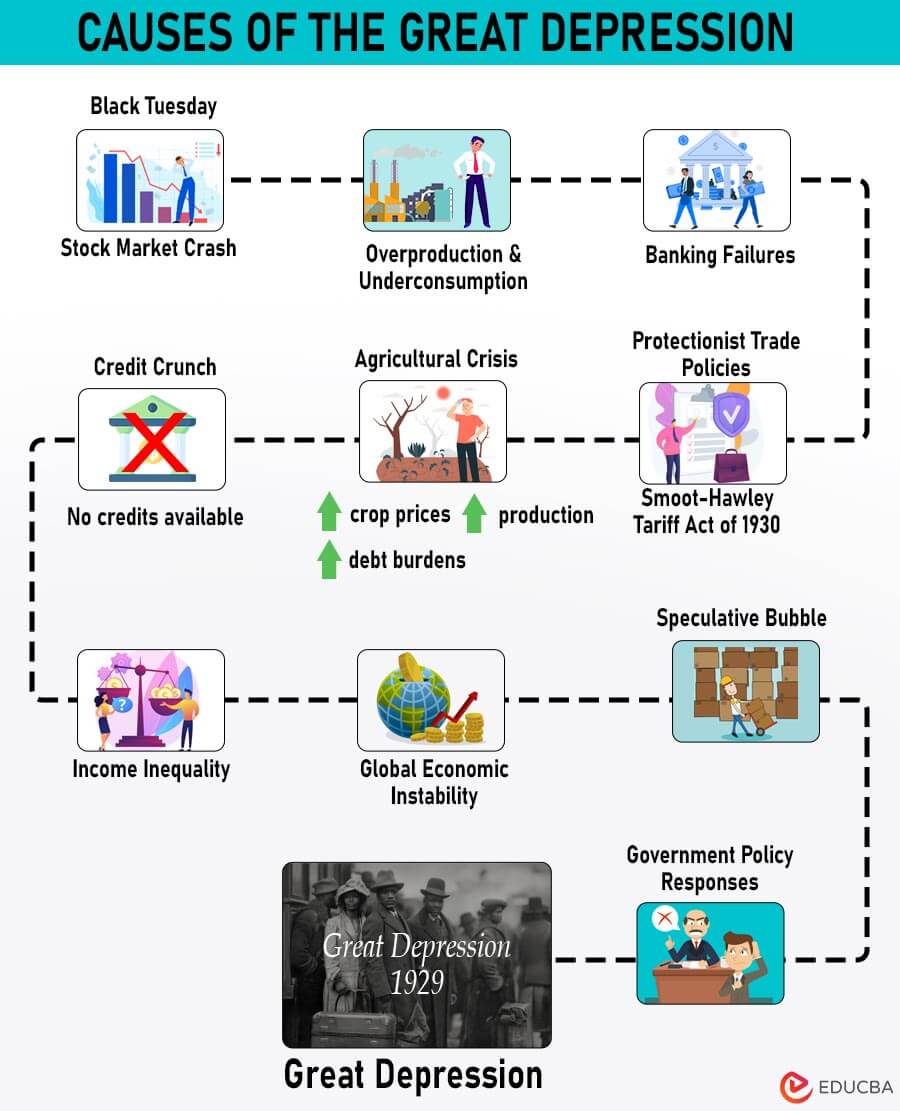

Causes of the Great Depression

- Stock Market Crash: The infamous stock market crash of October 1929, known as Black Tuesday, marked the beginning of the Great Depression. It triggered a collapse in stock prices, wiping out billions of dollars in wealth and eroding investor confidence.

- Overproduction and Under-consumption: The 1920s witnessed a surge in industrial output and productivity, leading to overproduction of goods. However, wages failed to keep pace with productivity gains, resulting in a mismatch between supply and demand and contributing to a decline in consumer spending.

- Banking Failures: Bank failures were rampant during the Great Depression, with thousands of banks closing their doors due to insolvency. The failure of banks caused a loss of confidence in the financial system, leading to widespread bank runs and further exacerbating the economic downturn.

- Protectionist Trade Policies: The imposition of high tariffs, such as the Smoot-Hawley Tariff Act of 1930 in the United States, exacerbated the global economic downturn by reducing international trade and hindering economic recovery efforts.

- Agricultural Crisis: The agricultural sector faced significant challenges during the 1920s, with falling crop prices, overproduction, and debt burdens leading to widespread farm foreclosures and rural poverty.

- Credit Crunch: The banking system’s collapse and the subsequent loss of confidence in financial institutions resulted in a severe credit crunch, making it challenging for businesses and consumers to obtain credit, thereby further hampering economic activity.

- Income Inequality: During the 1920s, there was a notable consolidation of wealth among a privileged few while most of the population grappled with financial difficulties. This widening income gap contributed to declining consumer purchasing power and weakened overall economic stability.

- Global Economic Instability: The interconnectedness of global economies meant that economic downturns in one country quickly spread to others. The Great Depression was exacerbated by economic crises in Europe and other parts of the world, leading to a synchronized global downturn.

- Speculative Bubble: The stock market boom of the 1920s was fueled by speculative fervor, with investors borrowing heavily to purchase stocks. When stock prices began to decline, margin calls forced investors to sell their stocks, exacerbating the downward spiral.

- Government Policy Responses: Inadequate government responses, particularly in the early years of the crisis, worsened the severity of the Great Depression. Governments’ hesitancy to intervene in the economy and enact effective policy measures exacerbated the economic downturn, prolonging suffering for millions of people.

Stock Market Crash

The Great Depression began with the 1929 stock market crash, called “Black Tuesday.” Here’s what happened:

- Speculative Bubble: Throughout the 1920s, the United States experienced a period of unprecedented economic growth and prosperity. Stock prices soared as investors poured money into the market, fuelled by speculation, easy credit, and the belief that the bull market would continue indefinitely. The stock market became a symbol of the era’s excesses, with many investors borrowing heavily to finance their purchases.

- Black Thursday: The speculative bubble began to show signs of strain in late October 1929 as investors became increasingly nervous about the sustainability of stock prices. On October 24, 1929, known as Black Thursday, panic selling set in, causing stock prices to plunge and trading volumes to skyrocket. Despite efforts by bankers and brokers to stabilize the market, the sell-off continued, leading to widespread losses and investor anxiety.

- Black Monday and Black Tuesday: In the subsequent week, the selling pressure intensified, reaching its peak with two more days of panic selling on October 28 and 29, 1929, famously referred to as Black Monday and Black Tuesday, respectively. Black Tuesday saw a record 16.4 million shares traded, and within hours, stock values crashed, wiping away billions of dollars in wealth. The stock market crash sent shockwaves throughout the economy and shattered investor confidence.

- Bankruptcies and Bank Runs: The stock market crash exposed weaknesses in the banking system, as many banks had invested heavily in stocks and were left insolvent when prices collapsed. Bank runs ensued, with depositors rushing to withdraw their savings, further depleting bank reserves and exacerbating the crisis. Thousands of banks failed, wiping out savings and disrupting credit markets.

- Economic Consequences: The stock market crash precipitated a severe economic downturn, as consumer spending and investment plummeted, businesses laid off workers, and economic activity contracted. The breakdown of the banking system and the erosion of confidence in financial institutions resulted in a credit crunch, posing challenges for businesses and consumers to obtain credit, thereby exacerbating the economic downturn.

Social and Economic Impacts of the Great Depression

- Unemployment and Poverty: The Great Depression led to a staggering increase in unemployment rates, leaving millions without jobs and pushing families into poverty. Breadwinners struggled to find work, and many households faced financial hardship, unable to afford basic necessities.

- Homelessness and Displacement: Economic instability resulted in widespread homelessness as individuals and families lost their homes due to foreclosure or eviction. Many were forced to live in shantytowns known as “Hoovervilles” or rely on charity for shelter and sustenance.

- Decline in Consumer Spending: With disposable income shrinking and confidence in the economy waning, consumer spending plummeted during the Great Depression. This sharp decrease in demand worsened economic conditions, leading to further layoffs and business closures.

- Psychological Toll: The pervasive uncertainty and despair of the Great Depression took a profound toll on mental health. Rates of depression, anxiety, and suicide surged as individuals grappled with financial insecurity, loss of livelihoods, and an uncertain future.

- Disruption of Families and Communities: Families faced immense strain as unemployment strained relationships and eroded familial stability. Communities rallied together to support one another through mutual aid networks and charity organizations, but the fabric of society was deeply affected by the widespread suffering.

- Health Consequences: Access to healthcare became increasingly limited as people struggled to afford medical care and medications. Malnutrition and inadequate living conditions contributed to a decline in public health, exacerbating the already dire circumstances for many.

- Educational Challenges: The economic downturn disrupted education for countless children and young adults. Families needed help paying school fees, forcing many students to drop out to contribute to household income, thereby limiting their future opportunities.

- Impact on Minorities: Minority communities, particularly African Americans and immigrants, bore the brunt of the Great Depression’s social and economic impacts. Discrimination in employment and relief efforts exacerbated their hardships, widening existing racial and ethnic disparities.

- Shift in Gender Dynamics: Women’s roles in society underwent significant changes during the Great Depression, as many entered the workforce to support their families financially. However, they faced unequal pay and limited job opportunities, reflecting enduring gender inequalities.

- Long-Term Legacy: The scars of the Great Depression lingered long after the economy began to recover. The experience reshaped societal attitudes towards government intervention, social safety nets, and economic policy, influencing subsequent generations’ approaches to addressing economic crises and social welfare.

Government Responses and Policies

- Hoover’s Response: President Herbert Hoover initially favored a voluntarist approach, encouraging businesses to maintain wages and avoid layoffs. He also implemented limited government intervention, such as public works projects, to stimulate economic activity. However, his reliance on private-sector solutions proved inadequate in addressing the scale of the crisis.

- Emergency Relief: As the economic downturn’s severity became apparent, Hoover signed legislation to provide emergency relief to struggling individuals and communities. Although established to provide loans to banks, railroads, and other businesses, the Reconstruction Finance Corporation (RFC) had limited impact.

- The New Deal: Franklin D. Roosevelt’s election in 1932 marked the beginning of a new era characterized by government intervention, exemplified by the implementation of the New Deal. Roosevelt’s administration launched a series of ambitious programs to provide relief, recovery, and reform. These included the Civilian Conservation Corps (CCC), the Works Progress Administration (WPA), and the Tennessee Valley Authority (TVA), which created jobs, built infrastructure, and provided financial assistance to millions of Americans.

- Banking Reform: Enacted in 1933, the Banking Act, commonly called the Glass-Steagall Act, aimed to stabilize the banking sector by introducing the Federal Deposit Insurance Corporation (FDIC) to safeguard bank deposits and segregate commercial and investment banking operations. This restored confidence in the banking system and helped prevent future bank runs.

- Agricultural Adjustment: The Agricultural Adjustment Act (AAA) aimed to address the agricultural crisis by reducing crop surpluses and stabilizing farm incomes. The AAA paid farmers to reduce production and implement soil conservation practices, helping to raise agricultural prices and improve farm conditions.

- Social Security: The Social Security Act of 1935 instituted a social insurance system to offer financial aid to the elderly, unemployed, and disabled. It created programs such as Old Age Insurance (OAI) and Unemployment Insurance (UI), laying the groundwork for the modern social safety net.

- Securities Regulation: Lawmakers enacted the Securities Act of 1933 and the Securities Exchange Act of 1934 to introduce regulations to reinstate confidence in financial markets and prevent future abuses. These laws required companies to disclose information about their securities offerings and created the Securities and Exchange Commission (SEC) to enforce securities laws.

- Fiscal and Monetary Policy: The Roosevelt administration pursued expansionary fiscal policies, including deficit spending on public works projects and social programs, to stimulate economic recovery. The Federal Reserve also accommodated monetary policies by reducing interest rates and boosting the money supply to stimulate investment and consumption.

- Criticisms and Opposition: The New Deal faced criticism from various quarters, including conservative opponents who viewed it as excessive government intervention and socialist-leaning policies. Some argued that the New Deal did not go far enough in addressing the root causes of the depression or alleviating poverty and inequality.

- Legacy: Despite its shortcomings and controversies, the New Deal left a lasting legacy, fundamentally reshaping the role of government in the economy and society. It laid the foundation for the modern welfare state and introduced reforms that helped mitigate the worst effects of the Great Depression while shaping economic policy for decades to come.

Cultural and Artistic Responses

- Literature: The Great Depression inspired a wealth of literature that captured the struggles and hardships of the era. Authors such as John Steinbeck, whose novel “The Grapes of Wrath” depicted the plight of Dust Bowl migrants, and John Dos Passos, known for his “U.S.A. trilogy,” provided vivid portrayals of the social and economic upheaval of the time.

- Photography: The Great Depression also spurred a surge in documentary photography, with photographers like Dorothea Lange and Walker Evans capturing iconic images of poverty, unemployment, and social dislocation. Their photographs, featured prominently in publications like Life magazine, brought the harsh realities of the depression to a wider audience and galvanized public support for government relief efforts.

- Music: The music of the Great Depression reflected the mood of the times, with songs like “Brother, Can You Spare a Dime?” and “Buddy, Can You Spare a Dime?” becoming anthems of the era. Artists like Woody Guthrie and Lead Belly used music as a form of protest and social commentary, singing about the struggles of ordinary Americans and advocating for social justice.

- Visual Arts: The Great Depression also left its mark on the visual arts, inspiring artists to explore themes of poverty, inequality, and social injustice. The regionalist paintings of artists like Grant Wood and Thomas Hart Benton celebrated rural life and American identity, while the social realism of artists like Ben Shahn and Jacob Lawrence depicted the struggles of urban workers and marginalized communities.

- Theatre and Film: The Great Depression significantly impacted theatre and film, with many productions reflecting the economic and social realities of the time. The Federal Theatre Project, a New Deal program, employed thousands of actors, directors, and playwrights to produce plays and musicals that addressed issues such as unemployment, labour unrest, and racial discrimination. Meanwhile, Hollywood produced a number of classic films that explored the human toll of the depression, including “The Grapes of Wrath,” “Modern Times,” and “It Happened One Night.”

- Radio: Radio emerged as a popular form of entertainment and communication during the Great Depression, providing a source of comfort and distraction for millions of Americans. Radio programs such as “The Lone Ranger,” “The Shadow,” and “The War of the Worlds” enthralled audiences with their blend of drama, comedy, and adventure, providing a brief respite from the challenges of everyday existence.

- Folklore and Oral History: The Great Depression gave rise to a rich body of folklore and oral history, with ordinary people sharing their stories and experiences through songs, stories, and personal accounts. Folklorists like Alan Lomax and Zora Neale Hurston travelled the country collecting folk songs and tales, preserving the cultural heritage of diverse communities, and giving voice to those often overlooked by mainstream society.

Global Effects and Legacy

- Economic Fallout: The Great Depression had far-reaching economic consequences beyond national borders as the global economy became increasingly interconnected. The collapse of international trade and investment led to widespread unemployment, deflation, and economic stagnation in countries worldwide.

- Social Unrest: The economic hardships of the Great Depression fuelled social unrest and political instability in many countries. Rising unemployment, poverty, and inequality sparked protests, strikes, and riots as people demanded relief from their governments and sought radical solutions to the crisis.

- Political Upheaval: The Great Depression contributed to the rise of authoritarian regimes and extremist movements in Europe and elsewhere. Leaders like Adolf Hitler in Germany, Benito Mussolini in Italy, and Hideki Tojo in Japan capitalized on popular discontent to seize power, promising to restore order and prosperity through nationalist and militaristic policies.

- Collapse of the Gold Standard: The onset of the Great Depression triggered the abandonment of the gold standard, leading countries to forsake fixed exchange rates and monetary policies supporting the global economy. This led to currency devaluations, competitive currency depreciations, and trade protectionism, further exacerbating economic instability and hindering recovery efforts.

- Shift in Economic Thinking: The Great Depression prompted a reassessment of economic theory and policy, as policymakers and economists sought to understand the causes of the crisis and devise strategies to prevent future downturns. Keynesian economics emerged as a dominant school of thought, advocating for active government intervention to stabilize economies and maintain full employment.

- Expansion of Government Intervention: The Great Depression ushered in an era of increased government intervention in the economy, as policymakers implemented a range of new regulations, social programs, and fiscal policies to mitigate the effects of the crisis. This expansion of the welfare state and regulatory apparatus laid the groundwork for the modern mixed economy.

- Legacy of Hardship: The Great Depression left a lasting legacy of hardship and suffering for millions worldwide. Memories of unemployment, poverty, and insecurity shaped attitudes toward economics, politics, and society for generations, influencing public policy and individual behavior long after the crisis had ended.

- Lessons Learned: The Great Depression taught valuable lessons about the dangers of unchecked speculation, income inequality, and inadequate regulation. It underscored the importance of prudent economic management, financial stability, and international cooperation in addressing economic crises effectively.

- Global Cooperation: The Great Depression also spurred efforts to promote international cooperation and economic stability, culminating in the establishing of institutions like the International Monetary Fund (IMF) and the World Bank. These organizations aimed to facilitate monetary stability, promote economic development, and prevent future financial crises through multilateral cooperation and coordination.

- Enduring Impact: The Great Depression remains one of the most significant events in modern history, shaping economic, political, and social developments for decades to come. Its legacy serves as a reminder of the fragility of economic systems and the need for vigilant oversight, responsible governance, and inclusive policies to ensure shared prosperity and stability in an increasingly interconnected world.

Comparisons to Subsequent Economic Crises

- Causes: Financial crises triggered both the Great Depression and the Great Recession. The Great Depression started with the 1929 stock market crash, while the housing bubble and subprime mortgage crisis in 2008 caused the Great Recession. Excessive risk-taking, speculation, and inadequate regulation played significant roles in both cases.

- Global Impact: Both crises had profound global repercussions, spreading economic turmoil and instability across borders. The Great Depression led to a synchronized global downturn, with countries worldwide experiencing widespread unemployment, deflation, and economic contraction. Similarly, the Great Recession triggered a global financial crisis, with financial markets seizing up, trade volumes plummeting, and economies slipping into recession.

- Unemployment and Poverty: The Great Depression and the Great Recession resulted in soaring unemployment rates and widespread poverty. During the Great Depression, unemployment in the United States reached nearly 25%, while millions lost their homes and livelihoods. Similarly, the Great Recession saw millions of jobs lost, home foreclosures, and a sharp rise in poverty levels, particularly in the hardest-hit sectors like construction and manufacturing.

- Government Responses: In response to both crises, governments implemented unprecedented intervention measures to stabilize financial markets, stimulate economic growth, and relieve affected individuals and businesses. During the Great Depression, President Franklin D. Roosevelt’s New Deal introduced various programs and reforms to provide employment, social security, and regulatory oversight. Likewise, policymakers responded to the Great Recession with massive fiscal stimulus packages, monetary easing, and bank bailouts to prevent a total economic collapse.

- Monetary Policy: Central banks played a crucial role in both crises by implementing accommodative monetary policies to support liquidity, stabilize financial markets, and stimulate economic activity. During the Great Depression, the Federal Reserve initially pursued contractionary policies, exacerbating the downturn, before adopting expansionary measures later on. Similarly, central banks responded to the Great Recession with aggressive interest rate cuts, quantitative easing programs, and unconventional policy tools to restore confidence and spur lending.

- Regulatory Reforms: Both crises prompted calls for regulatory reforms to prevent future financial instability and mitigate systemic risks. In the aftermath of the Great Depression, policymakers implemented a series of regulatory measures, such as the Glass-Steagall Act and establishing the Securities and Exchange Commission, to enhance supervision of financial markets and institutions. Amid the Great Recession, authorities implemented new regulations like the Dodd-Frank Wall Street Reform & Consumer Protection Act to enhance financial transparency, accountability, and resilience.

- Lessons Learned: The Great Depression and the Great Recession underscored the importance of effective regulation, prudent risk management, and responsible governance in maintaining financial stability and preventing economic crises. Both episodes highlighted the dangers of unchecked speculation, excessive leverage, and systemic vulnerabilities, emphasizing the need for vigilance, reform, and international cooperation to safeguard against future downturns.

- Long-Term Impact: The Great Depression and the Great Recession left lasting scars on economies and societies, reshaping economic policy, political discourse, and public attitudes towards capitalism and government intervention. While the Great Depression spurred the expansion of the welfare state and the rise of Keynesian economics, the Great Recession reignited debates over fiscal austerity, income inequality, and the role of central banks in managing macroeconomic stability.

Conclusion

The Great Depression is a pivotal moment in global history, shaping economic, political, and social landscapes for generations. It underscored the vulnerabilities of unregulated markets, leading to reforms and establishing social safety nets. The suffering endured by millions during this era serves as a poignant reminder of the human cost of economic downturns. Yet, the resilience displayed by individuals, communities, and nations in the face of adversity offers hope and lessons for the future. The Great Depression remains a cautionary tale, emphasizing the importance of prudent economic policies, financial stability, and social cohesion in building a more equitable and resilient world.