Updated July 6, 2023

Understanding ETF vs Index Funds

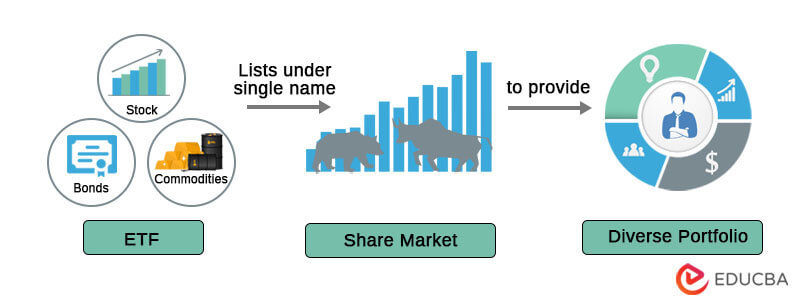

In ETF vs Index Funds, ETFs (Exchange Traded Funds) have a range of stocks, bonds, or commodities under a single name on the share market to provide investors with a diversified portfolio. On the other hand, Index Fund is an investment pool where investors can invest in a group of stock market securities and track their returns as per the market index.

For example, Smith purchases $12,000 of Auto-XYZ ETF on the stock exchange. It comprises a diverse group of stocks from the automobile industry. Smith will either gain profit or face a loss depending on how the automobile sector performs.

In contrast, James invests $10,000 in the Smart & Co. 10 index fund. The index fund splits the capital amount ($10,000) in 10 divisions ($1,000). The fund comprises 10 companies, and the divisions are individually invested equally or unevenly.

Key Highlights

- Index fund is an open-ended SIP scheme that allows investors to make investments and withdraw their money whenever they want.

- ETFs are traded exactly like stocks; therefore, investors who want to buy them need a DEMAT account.

- Index Funds provide both growth and dividend alternatives, enabling investors to select an investment that matches their level of risk tolerance.

- ETFs allow investors to receive dividend income, which they can reinvest in the stock market.

What are ETFs?

- An ETF stands for Exchange Traded Fund, a marketable security fund that tracks commodities, bonds, assets, and indexes.

- This concept has similarities with mutual funds. However, these are more liquid and charge lesser fees than mutual funds – which is why they are traded more than mutual funds.

- ETFs have higher daily liquidity and lower fees than other mutual fund schemes, which is the only factor that makes them an attractive and efficient alternative for individual investors.

- Moreover, ETFs are traded like regular stocks in the market due to their liquidity.

- In recent years, ETFs are those valuable products that have been created especially for individual investors. If used wisely, they help to achieve the investor’s investment goals.

What are Index Funds?

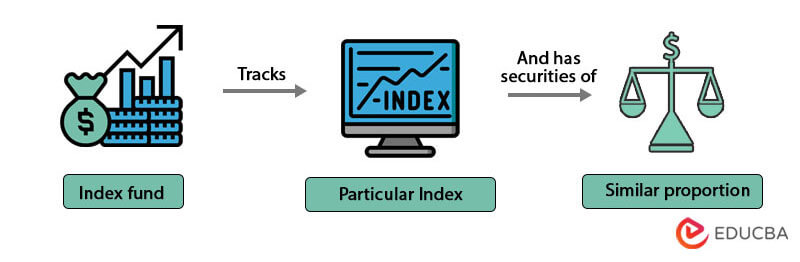

- An Index fund tracks the performance of any specific benchmark in the market as closely as possible. This is a passive investment strategy.

- Index funds are exchange-traded mutual funds that follow a specific index, track its movement, and derive their value based on that index.

- Generally, index funds include a list of large, mid, and small-sized companies. Moreover, it contains a combination of profitable and risky companies in definite proportions to balance the portfolio.

- They perform as mutual funds and a subset of the ETFs. Like mutual funds, these funds are managed by portfolio managers, and investors can purchase these from such managers.

- They are easy to track being traded on an exchange and thus are widely traded into. The most commonly sold Index Fund is S&P 500 Index Fund.

Head-to-Head Comparison Between ETF vs Index Funds (Infographics)

Below is the top 6 difference between ETF and Index Funds:

Key Difference Between ETF vs Index Funds

- One significant benefit of ETF and Index Funds is that they are superior to trading the underlying asset alone. As they form a mix of different assets and often get valued based on the index as a whole, they are less riskier to the individual underlying purchase.

- Both ETF and Index Funds allow risk diversification as they follow a particular index, not any specific company, sector, or industry. ETFs require a lower minimum investment as compared to Index funds.

- ETFs are more tax-efficient than index funds when you tend to sell them off.

- As the costs incurred are lower than other funds, ETF and Index funds attract lower tax implications, making them preferable to different types of funds.

- Investing in ETF or Index Funds can relate the performance of various industries and sectors to each other and thus make their analysis to create the right balance of their investments.

- ETFs are not available for investors as fractional shares. On the other hand, index funds are always available in fractional amounts.

- Both ETF vs. Index Funds can generate greater profits in the longer horizon than those compared to individual stocks.

- Individual investors readily have access to ETFs as investment options, whereas retirement plans primarily include the purchase of index funds.

- Brokers can buy or sell ETFs, which are like stocks. Fund managers allow investors to purchase index funds directly.

ETF vs Index Funds Comparison Table

Below is the topmost comparison between ETF and Index Funds:

|

Exchange Traded Funds |

Index Funds |

|

| Meaning | An exchange-traded fund, or ETF, is a collection of assets that may be purchased and sold on a stock market similar to a single unit of stock. | Index funds are a collection of stocks or bonds that portray the performance of a specific part of the financial market index.

|

| Liquidity | They are more liquid than an Index Fund, as they cover a more extensive range of underlying assets and hence a larger (or almost the whole) market. Thus, people prefer to invest in such funds.

|

They are less liquid than ETFs, as they target a particular index and companies that constitute part of such an index. Hence, has a lesser scope for market analysis.

|

| Trading Time | Similar to stocks, ETFs can be traded all day long on exchanges. As a result, an ETF’s price fluctuates during trading hours.

|

Index Funds, however, can only be purchased and sold at a price made public at the end of every trading day.

|

| Purchasing Price | ETFs are typically purchased in units. Therefore, you must buy 1 unit, seven units, 100 units, etc., of an ETF in the same manner that you would purchase 10 or 20 shares of a firm.

|

On the other hand, index funds are typically purchased in dollar amounts. For example, you can invest $700, $900, or $1,000 into an index fund.

|

| Investment | ETFs have lower minimum investment requirements than index funds. Typically, it is the same as the amount needed to buy a share.

|

For index funds, brokers tend to put minimums in place, which may be significantly higher than the average share price.

|

| Flexibility option | ETFs can be shortened, stopped, bought on margin, and even limited.

|

Index funds, on the other hand, only have the option of investing and disinvesting.

|

Final Thoughts

Although ETF vs Index Funds seems similar at the time of investment, there are significant differences in the calculation of returns (and risks). Hence, one should read all the terms and conditions of the offered documents and then invest to maximize returns and lower chances.

Frequently Asked Questions (FAQs)

Q1: Which one is better, ETF or an index fund?

Answer: Choosing between an Index Fund and an ETF depends solely on your expectations. While Index Funds simplify many of the trading decisions an investor must make, ETFs provide lower expense ratios and greater flexibility. Therefore, your first preference should be index funds.

Q2: What is ETF vs. index fund expense ratio?

Answer: The expense ratio is the percentage of the assets paid to run the fund. Index funds charge an expense ratio of 0.07%, and ETFs charge an expense ratio of 0.18%.

Q3: Index funds vs. ETF, which is better for passive investors?

Answer: Both Index funds and ETFs are great for investing. However, if you are an investor looking for a safer and cheaper way to invest, always give a heads-up to index funds.

Q4: Why choose an ETF fund over an index fund?

Answer: Choosing ETF or an index fund is not complicated, but it depends upon your goals for investment and the type of investor you are. If you actively participate in trading and are tax-sensitive, then you should go for ETFs. If you wish to invest frequently and look for an investment that can beat the market, then you should use index funds.

Q5: What is a 0 expense ratio index fund?

Answer: Zero expense ratio index funds are those kinds of funds that do not require any investment amount for opening the funds account.

Q6. What are the current ETF & Index Fund values?

Answer: According to Nasdaq, the value of Shares S&P 500 Value ETF (IVE) is $148.44 as of 19 January 2023. The current high and low stands at $149.36 and $147.96, respectively. The fund’s previous closing price was at $149.94.

Recommended Article

This has been a complete guide on the top difference between ETF and Index Funds. Here we also discuss the ETF vs. Index Fund critical differences with infographics and comparison table. You may also have a look at the following articles –