Updated July 4, 2023

What is Euribor?

Euribor (Euro Interbank Offered Rate) is a standard interest rate that European banks have to pay when borrowing money from other banks. The European Money Market institute publishes this rate daily at 11 am Central European Time.

For instance, as of 03 January 2023, the Euribor rate for a 6-month bond is 2.739%. Suppose PQR Ltd sells a bond with pricing of Euribor rate + 10 bps points. As the 1 bps point is 0.01%, 10 bps will be 0.1%. Therefore, the bond rate will be 2.739% + 0.1%, which is 2.839%.

Euribor is the benchmark rate at which around 18-panel banks lend or borrow from each other. This panel provides daily quotes on these rates rounded to three decimal figures. The lending or borrowing can vary from one week to 12 months. Moreover, it is often structured to maintain banks’ liquidity and provide excess cash stability when needed. Also, the rates are published daily at 11 am Central European Time by the European Money Market institution.

Key Highlights

- Euribor, short for Euro Interbank Offered Rates, are short-term interest rates that European banks and lending organizations have to pay on loans.

- It is calculated by a standard administrator known as the Global Rate Set Systems Ltd. and presented by the EMMI or European Money Markets Institute.

- There are 5 maturities; one week, one month, three months, six weeks, and 12 months.

- A total of 18-panel banks make significant contributions to the rates.

- All 18-panel banks must report their interbank interest rates following the contribution process of the COPB or Code of Obligations of Panel Banks.

Examples

Example #1:

XYZ bank issues floating rate bonds linked to the Euribor rates. Assume it issues bonds at Euribor rate plus 100 bps points. Let us calculate the bond rate as per current and 6-months Euribor rates.

Solution:

- 1 bps= 0.01%, so, 100 bps = 100*0.01% = 1%.

- If current Euribor rates are 2%, then XYZ bond’s rates will be 2% + 1% = 3%.

- If, after six months, Euribor rates change to 3%, XYZ bank’s bond rate will be 4% (3% + 1%).

Example #2:

Let’s say ABC has a bond that equals the Euribor rate plus 250 bps points. Let us calculate the present bond rate and the rate after three months.

Solution:

- As 1 bps = 0.01%, 250 bps = 250 * 0.01% = 2.50%.

- If the current rate is at 3.5%, the current bond rate will be 3.5% + 2.5% = 6%.

- After 3 months, if the Euribor rate is at 5%, then the 3-Month Bond Rate will be 5% + 2.5%, which is 7.5%.

How to Calculate Euribor Using Technical Features?

- The Euribor rates are determined by the European Money Market Institute (EMMI) with some financial institutions‘ assistance.

- It’s important to note that the 30% trimmed mean technique is followed to calculate the average interest rate presented by the panel banks for various maturities.

- The panel bank provides its rate data by 10.45 am CET on its private page. A specific panel bank can only view this private page, and the Thomson Reuters staff is responsible for creating the quotes. The Panel banks can review and update the rate from 10.45 am to 11 am.

- At 11.00 am, Thomson Reuters will calculate and process the rates. For the calculation process, Thomson Reuters removes the top and bottom 15% rates, then takes the average rates up to three decimal places and updates them.

- At 11.00 am, after the calculation, Thomson Reuters publishes the calculated Euribor rate, which is made available to data vendors and subscribers.

- If any panel bank fails to provide the data by 11 am, then Thomson Reuters will calculate and update the rate. If more than 50% of the panel banks fail to provide the data, then Thomson Reuters delays publishing the data by 11.15 am CET.

Current Euribor Interest Rates

Below are the updated rates for different maturities:

|

Duration |

01/3/2023 | 01/2/2023 | 12/30/2022 |

12/29/2022 |

| 1 week | 1.838 % | 1.876 % | 1.872 % | 1.882 % |

| 1 month | 1.854 % | 1.883 % | 1.884 % | 1.901 % |

| 3 months | 2.172 % | 2.162 % | 2.132 % | 2.184 % |

| 6 months | 2.739 % | 2.732 % | 2.693 % | 2.726 % |

| 12 months | 3.321 % | 3.316 % | 3.291 % | 3.288 % |

(Source:euribor-rates.eu)

Why is Euribor Negative?

The central bank introduced negative interest rates at the time of the year 2014. This boosted the economy by forcing the banks to lend more money to the market. However, with negative interest rates, banks effectively gave money to the central bank for depositing money which doesn’t make sense. Hence the idea was to reduce the deposit in the central bank and provide more loans to people and businesses. But it has adverse effects also, such as more NPA pressure for banks and low liquidation.

Euribor Forecast

Below is a comprehensive list of forecast details:

|

Year |

Month | Minimum | Maximum | Close | Mo,% |

Total% |

| 2023 | Jan | 2.687 | 3.321 | 2.858 | -13.2% | -13.2% |

| 2023 | Feb | 2.552 | 2.878 | 2.715 | -5.0% | -17.5% |

| 2023 | Mar | 2.680 | 3.022 | 2.851 | 5.0% | -13.4% |

| 2023 | Apr | 2.814 | 3.174 | 2.994 | 5.0% | -9.0% |

| 2023 | May | 2.896 | 3.266 | 3.081 | 2.9% | -6.4% |

| 2023 | Jun | 3.041 | 3.429 | 3.235 | 5.0% | -1.7% |

| 2023 | Jul | 3.193 | 3.601 | 3.397 | 5.0% | 3.2% |

| 2023 | Aug | 3.353 | 3.781 | 3.567 | 5.0% | 8.4% |

| 2023 | Sep | 3.186 | 3.592 | 3.389 | -5.0% | 3.0% |

| 2023 | Oct | 3.027 | 3.413 | 3.220 | -5.0% | -2.2% |

| 2023 | Nov | 3.178 | 3.584 | 3.381 | 5.0% | 2.7% |

| 2023 | Dec | 3.337 | 3.763 | 3.550 | 5.0% | 7.9% |

| 2024 | Jan | 3.504 | 3.952 | 3.728 | 5.0% | 13.3% |

| 2024 | Feb | 3.679 | 4.149 | 3.914 | 5.0% | 18.9% |

| 2024 | Mar | 3.708 | 4.182 | 3.945 | 0.8% | 19.9% |

| 2024 | Apr | 3.523 | 3.973 | 3.748 | -5.0% | 13.9% |

| 2024 | May | 3.699 | 4.171 | 3.935 | 5.0% | 19.6% |

| 2024 | Jun | 3.795 | 4.279 | 4.037 | 2.6% | 22.7% |

| 2024 | Jul | 3.802 | 4.288 | 4.045 | 0.2% | 22.9% |

| 2024 | Aug | 3.653 | 4.119 | 3.886 | -3.9% | 18.1% |

| 2024 | Sep | 3.653 | 4.119 | 3.886 | 0.0% | 18.1% |

| 2024 | Oct | 3.638 | 4.102 | 3.870 | -0.4% | 17.6% |

| 2024 | Nov | 3.660 | 4.128 | 3.894 | 0.6% | 18.3% |

| 2024 | Dec | 3.653 | 4.119 | 3.886 | -0.2% | 18.1% |

| 2025 | Jan | 3.835 | 4.325 | 4.080 | 5.0% | 24.0% |

(Source: https://longforecast.com)

Euribor vs. Libor

|

Euribor |

Libor |

| It stands for Euro Interbank Offered Rates. | LIBOR stands for London Interbank Offered Rates. |

| It is the average interbank rate at which European banks are willing to lend to one another. | Libor is the typical rate at which several London-based banks are willing to lend to one another. |

| It only deals in Euros. | Deals in 10 different types of currencies, including the Euro. |

| It has eight maturities or lending periods, i.e., 1 and 2 weeks & 1, 2, 3, 6, 9, and 12 months. | Libor has seven maturities or lending periods, i.e., overnight, 1 week & 1, 2, 3, 6, and 12 months. |

| Methods used to generate it are the same as those of Libor, but a bigger panel of banks from around Europe submit their estimates of interest rates. | Thomson Reuters calculates and releases Libor on behalf of the British Bankers’ Association (BBA). |

| The European Banking Federation administers it. | The British Banking Association administers it. |

Graphs

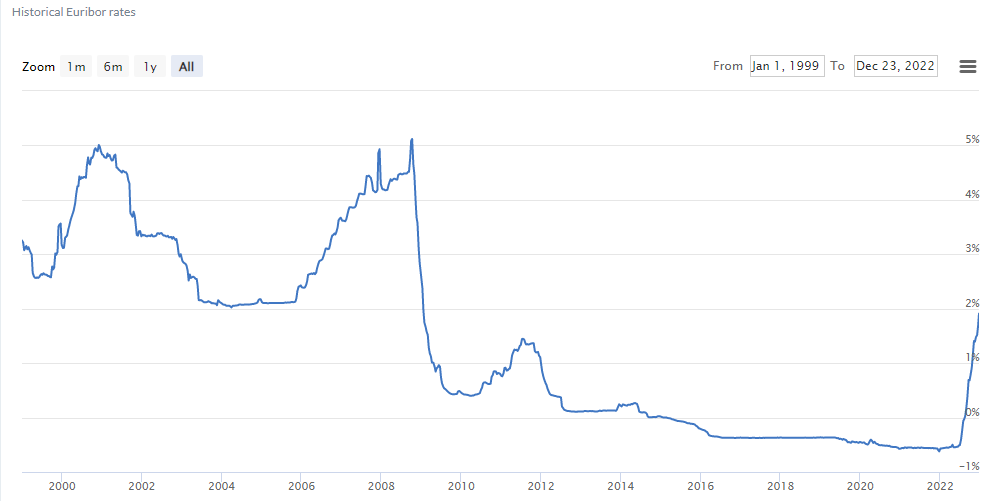

#1 Chart: Euribor All-year rate

The chart below accounts for the data since its inception till date. We can see that the highest rates were around 5% in 2009.

(Source: euribor-rates.eu)

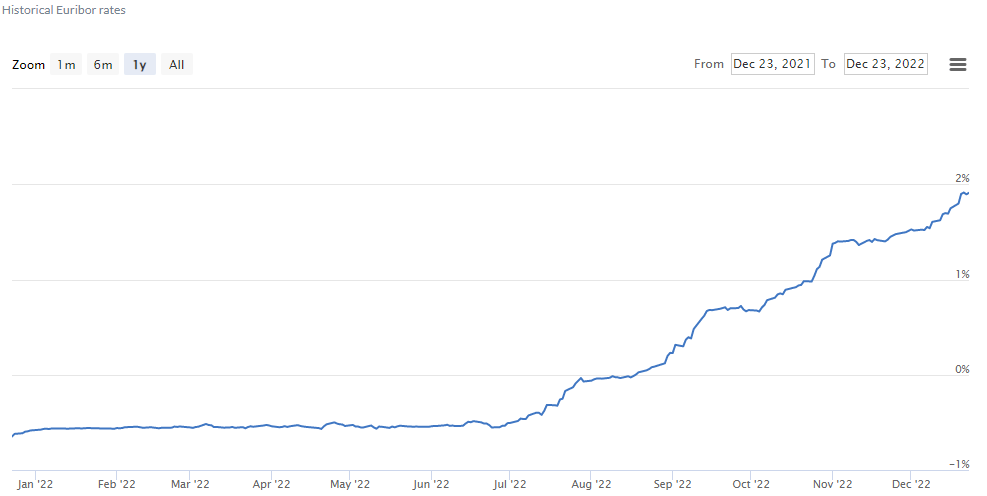

#2 Chart: Euribor 1-Year rate

The chart below accounts for the data for a year. We can see that the highest rates were around 2% during December 2022. Mostly the data was negative.

(Source: euribor-rates.eu)

Importance of Euribor

- It is an average reference rate for loans and other products with future interest payments.

- The rates are useful in pricing various euro-denominated derivative instruments like short-term interest rate futures contracts, forward rate agreements, interest rate swaps, and many financial products, like loans, savings accounts, etc.

- Moreover, it is of systemic importance for financial stability. The European Money Market Institute, or EMMI, authorized that it supports more than 180,000 billion euros worth of contracts.

- Also, it can be said that the role of Euribor in the Eurozone is similar to that of Libor in Great Britain & the United States.

Final Thoughts

It is an important benchmark and yardstick for the banks to lend and borrow money to each other and the eurozone market. The new trend is the negative Euribor rate, which is a ripple effect on the economy.

Frequently Asked Questions (FAQs)

Q.1 What is the Euribor rate today?

Answer: The latest Euribor rate published on the 03rd of January, 2023, was 1.838%. The Euribor rates are published weekly at 11:00 CET. Therefore, the next rate will be released on January 10th, 2023, which you can check from the official website.

Q.2 Who issues Eurodollar bonds?

Answer: A Eurodollar bond is a U.S.-dollar-denominated bond issued by an overseas corporation and kept in a foreign institution outside the United States and the issuer’s home country. Eurodollar bonds are a significant source of capital for foreign governments and international corporations.

Q.3 What is Euribor 3 month rate?

Answer: The interest rate at which many European banks lend money to one another in euros with a 3-month duration is known as the 3-month Euribor interest rate.

Q.4 Does Euribor still exist?

Answer: Euribor was first published in 1999 and was reformed in 2019. Since then, it has been in use, and there’s no such anticipation that Euribor will be discontinued or ceased in the near future.

Q.5 Who issues Eurobonds?

Answer: Eurobonds are typically issued on behalf of the borrower by a global syndicate of financial institutions, one of which may underwrite the bond and guarantee the sale of the entire issuance. Major issuers in the Eurobond market include multinational firms, institutions like the World Bank, and corporations.

Q.6 Is Euribor the same as euro Libor?

Answer: Euribor and Libor are said as the comparable base rates. The average interest rate at which European banks are willing to lend to one another is called the Euribor. The average interest rate that different banks on the London money market are willing to lend to one another is called LIBOR.

Recommended Articles

This is a guide to Euribor. Here we also discuss the definition and why Euribor is negative, along with features and examples. You may also have a look at the following articles to learn more –