Updated July 24, 2023

Difference Between European Option vs American Option

A European option defines a call option that investors can only redeem at its expiration or maturity date. Traders usually trade a European option at a discount since the holder has only one opportunity to exercise it. In this article, the holder of the European option vs American option can even choose to sell the option and close his or her position if he or she is unwilling to wait for its maturity or expiration date. Market participants primarily trade European options over the counter, and they are less frequently encountered on major stock exchanges. Conversely, an American option is a call option that investors can exercise at any time between the trading date and the expiration or maturity date.

The holder of such an option gets to wait for the best price, and then he or she can accordingly exercise or redeem the option between the date of options trading or date of purchase and maturity date. In contrast to the European options, American options tend to provide greater flexibility, which is why the latter is widely popular and high in demand. The holder of American options determines the maturity date, making them riskier than European options, which have a fixed maturity date.

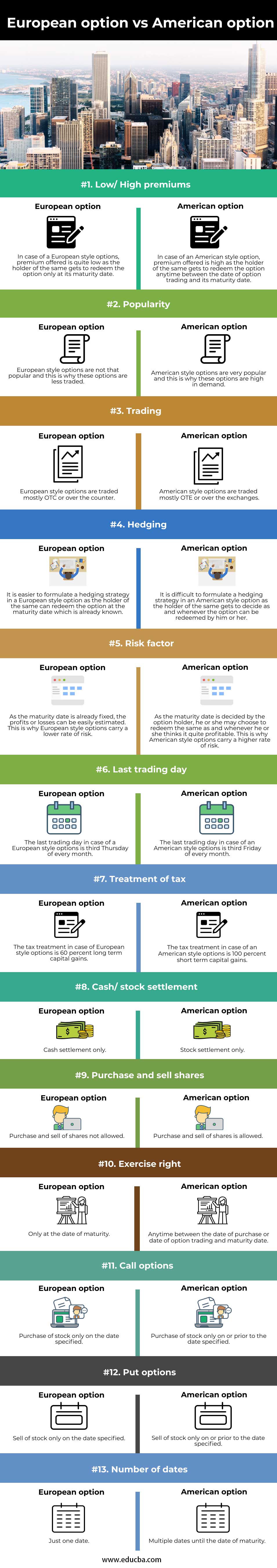

Head To Head Comparison Between European Option vs American Option (Infographics)

Below are the Top 13 comparisons between the European option vs American option:

Key Differences Between the European Option vs American Option

The key differences between the European option and the American option are as follows:

- European style options are less popular and thus low in demand. On the other hand, American-style options are high in popularity and more in demand.

- European-style options are less risky as compared to American-style options.

- In the case of European-style options, the purchase and sale of shares are not offered, whereas American-style options allow for the purchase and sale of shares.

- In European-style options, a settlement is possible only in cash, whereas in American-style options, the settlement is only in stock.

- The premium offered is quite low in the case of European-style options, as the holder gets to redeem the option only at its expiration date. In contrast, American-style options offer a high premium as the holder can redeem the option anytime between the options trading date and its expiration date.

- Market participants primarily trade European-style options over the counter, while they predominantly trade American-style options over the exchanges.

- Formulating a hedging strategy is easier in the case of European-style options, whereas the same is difficult in the case of American-style options.

Comparison of Table Between European option vs American option

Given below are the major difference between the European option vs American option:

| Basis of Comparison | European option | American option |

| Low/ High premiums | In the case of European-style options, the premium offered is quite low as the holder of the same gets to redeem the option only at its maturity date. | The issuer of an American-style option offers a high premium because the holder of the option can redeem it at any time between the date of options trading and its maturity date. |

| Popularity | European-style options are not that popular, so these options are less traded. | American-style options are very popular, and this is why these options are in high demand. |

| Trading | European-style options are traded mostly OTC or over the counter. | American-style options are traded mostly OTE or over the exchanges. |

| Hedging | It is easier to formulate a hedging strategy in a European-style option as the holder of the same can redeem the option at the maturity date, which is already known. | It is difficult to formulate a hedging strategy in an American-style option as the holder of the same gets to decide as and whenever he or she can redeem the option. |

| Risk factor | As the maturity date is already fixed, the profits or losses can be easily estimated. This is why European-style options carry a lower rate of risk. | As the option holder decides the maturity date, they may choose to redeem the same as and whenever they think it is quite profitable. This is why American-style options carry a higher rate of risk. |

| Last trading day | The last trading day for European-style options is the third Thursday of every month. | The last trading day for American-style options is the third Friday of every month. |

| Treatment of tax | The tax treatment for European-style options is 60 percent long-term capital gains. | The tax treatment in the case of American-style options is 100 percent short-term capital gains. |

| Cash/ stock settlement | Cash settlement only. | The stock settlement only. |

| Purchase and sell shares | Purchase and sale of shares are not allowed. | The purchase and sale of shares are allowed. |

| Exercise right | Only at the date of maturity. | Anytime between the date of purchase or date of option trading and maturity date. |

| Call options | Purchase of stock only on the date specified. | Purchase of stock only on or before the date specified. |

| Put options | Sell off stock only on the date specified. | Sell off stock only on or prior to the date specified. |

| Number of dates | Just one date. | Multiple dates until the date of maturity. |

Conclusion

A European-style option is not as pricey as American-style options. The premium offered in American-style options is higher than those offered in European-style options. European style options are usually traded OTC or over the counter, whereas American style options are usually traded OTE or over the exchanges. European options are less risky as the option holder gets to redeem the option only at the date of maturity. In contrast, the American-style options are way riskier as the option holder gets to redeem the option anytime between the date of purchase and the maturity date.

Recommended Articles

This is a guide to the European option vs the American option. Here we discuss the difference between the European option vs the American option, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–