Introduction of Exchange Traded Funds

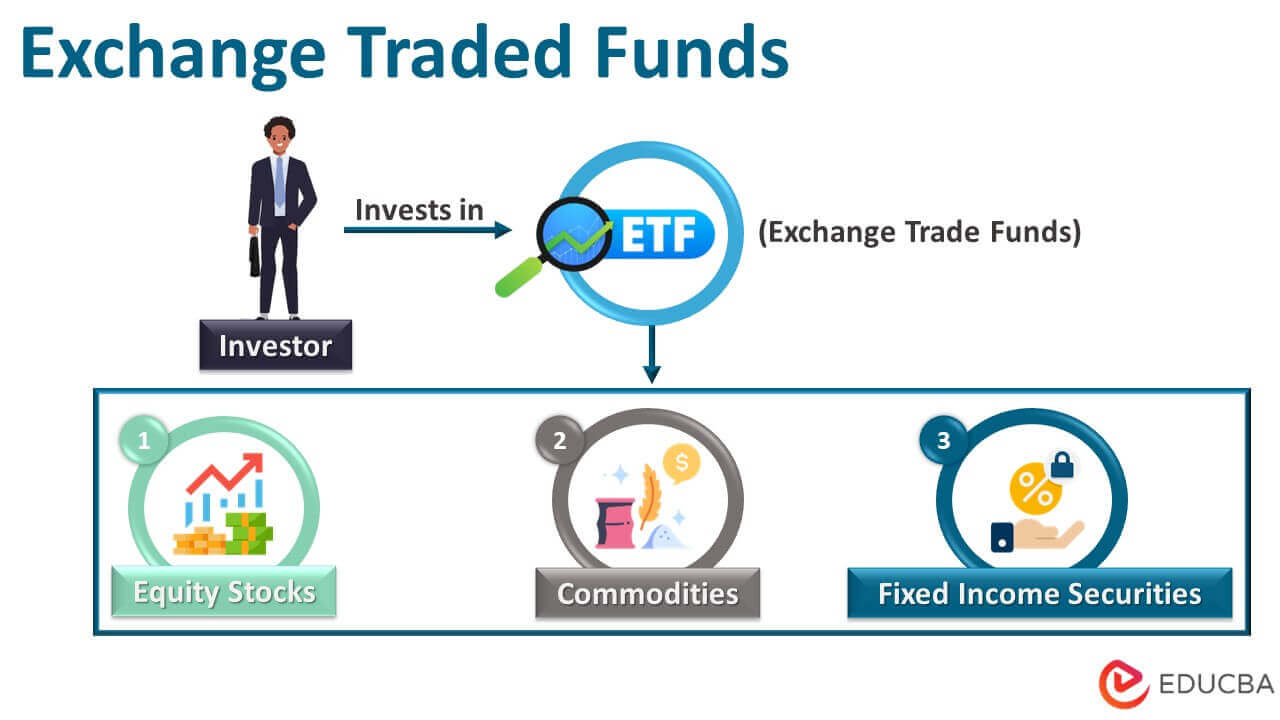

Exchange traded funds (commonly referred to as “ETF”) are financial instruments or a type of security formed by a collection of different kinds of securities, such as equity stocks, fixed income securities, commodities, etc., which are traded on the exchange. Their prices fluctuate each trading day as soon as the fund is purchased or sold on the exchange.

Explanation

- There are many stocks, commodities, fixed-income securities, etc. Trading on the stock exchange. Each security has its price per unit. However, not everyone knows the fair prices or entry points into the securities or exit price points from the securities. Hence, a fund is established by experts in the field.

- Here, the investor prefers to purchase units of exchange-traded funds instead of purchasing the stock. Thus, such funds are financial instruments that provide access to diversified portfolios without the monopoly of single-stock exposure.

- The fund manages the money received from various investors & ensures minimum return according to the type of exchange-traded fund.

- This sounds similar to mutual funds. However, these funds can be traded (i.e., purchased or sold) only during trading business days of the market.

How Does It Work?

- It starts with the authorized participants wanting to invest in the exchange-traded funds through an investment basket.

- The authorized participants approach the ETF & invest in the funds.

- The ETF issues units to the investors against the proceeds received from them. Using the proceeds, the ETF invests the same into the financial instruments as per its type or funding strategy.

- The ETF earns out of those investments & manages its expenses.

- The investment basket reflects the stock index like the way the S&P 500 index is reflected.

- The trading of the fund units is based on the Net Assets Value on each trading day. It can be traded throughout the day. Thus, these funds carry both the features of open-ended & close-ended funds.

- Almost the exact process is followed in case of redemption of units.

Example of Exchange Traded Fund

A unit of ETF has a net assets value (NAV) of $ 32. The NAV of an exchange-traded fund is different than the NAV of a mutual fund. Depending on the demand & supply elements of the units in the market, the actual price of units may trade in the range of $ 31.97 / $ 32.04. It means the investors can purchase the units at $ 32.04 today, or one may sell the units at $ 31.97. This difference between NAV & actual price reflects the load component.

At the time of redemption, the NAV of the fund may change according to the investment cycle of the ETF. The investor can redeem the units at prices prevailing at that time.

Types of Exchange Traded Fund

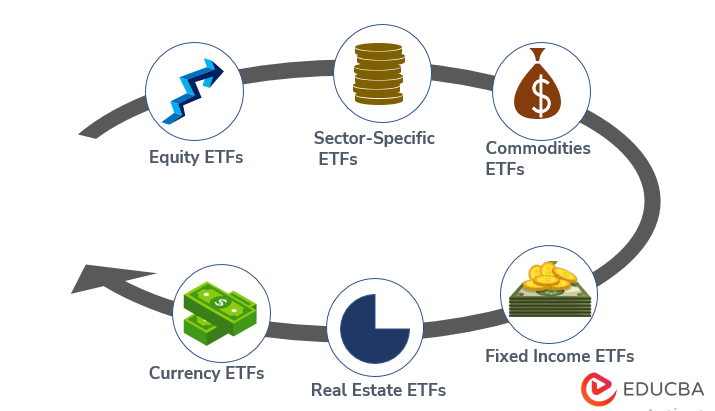

Each exchange-traded fund has an underlying instrument. Thus, the exchange-traded funds can be categorized into the following types:

- Equity ETFs: As the name suggests, the underlying instrument is equity stocks. Buying high-value stocks may not suit the budget of each investor. Instead, one prefers to purchase units of equity-based exchange-traded funds. These types of funds invest in various sectors of equities markets & earn a handsome amount from such diversification. However, one should note that the quantum of risk in such funds is higher than in other fund types.

- Sector-Specific ETFs: As the name suggests, such funds invest in stocks or bonds for any specific sector of the market. However, one should note that the risk in such ETFs is sector-specific.

- Commodities ETFs: The correlation of one investment with another is significant if you wish to earn huge. Investments with positive correlations are always avoided in the investment segment. A positive correlation means both returns will either give you profits or losses. The negative correlation makes you profitable at all times. The commodities market & stock market have a negative correlation. Thus, it is suggested to have some investment in such ETFs as well.

- Fixed Income ETFs: These will invest in fixed-income securities which have lower volatility & average risk. Due to the lower quantum of risk, the returns are also inferior. Thus, a person’s risk appetite defines the quantum of investment he wants in such ETFs.

- Real Estate ETFs: The return perspective of such ETFs is higher due to the risk exposure of this type of ETF. It invests in real estate segments. The prices of real estate change drastically with time. Thus, the investor can generate super-average profits in the real estate industry during boom times.

- Currency ETFs: Such ETFs park their money only in the currencies market. The currency market is highly volatile to changes each day. Again, the investor’s risk appetite drives the return segment in this ETF. For example, Bitcoin ETFs are becoming increasingly popular as they focus on the cryptocurrency market, offering investment opportunities in digital assets. Investors can use BTC ETF inflow and outflow data to assess fund movements, demand trends, and potential market shifts, helping them make informed investment decisions.

Criticism of Exchange Traded Fund

The common criticism received for the exchange-traded fund is as follows:

- Income from the exchange-traded fund is treated as passive income & not an active source of income.

- Thus, it may lead to inefficiency in the financial markets.

- Too much dependency on exchange-traded funds results in underperformance by investors.

- Since ETFs are treated as passive investment vehicles, they may jeopardize the consistency of stability of the entire financial system. In turn, it may also lead to economic destruction.

- Financial destruction affects the distortion of the capital base of the investor.

Advantages

Some of the benefits are given below:

- There is excellent transparency in operations compared to hedge funds or mutual funds. This enhances the confidence level of investors.

- Many exchange-traded funds provide margin facilities. This leverages the investment profile of investors.

- The transaction costs are generally lower for exchange-traded funds. Also, it is observed that there are no exit fees charged on such funds.

- These fund flow in line with the index & thus, they are passive funds. The costs such as management cost, distribution of units cost, higher perks of manager, etc., are managed in a low expense ratio compared to mutual funds.

- They are available for trade during the entire day. Thus, the investor enjoys features such as stop loss orders, limit order types, etc., during trading days.

- The transaction taxes are lower in the case of exchange-traded funds.

- Liquidity & flexibility to trade is higher in the case of exchange-traded funds.

Disadvantages

Some of the disadvantages are given below:

- One type of ETFs is equity ETFs. Even though there is a lot of transparency in exchange-traded funds, one may not know the quantum of risk contained in the equity segment of the ETF. Thus, the investors may be exposed to unknown risk elements.

- Exchange-traded funds do not have the option to reinvest the number of dividends earned. This happens to be a loss-bearing deal for investors.

- The diversification ratio of exchange-traded funds is lesser than normal mutual funds—lower diversification results in a higher concentration of risk in a particular sector.

- If diversification does not affect the investor, he should invest in stocks directly. The reason is that “he is going to bear the same risk, then why not a lower cost than ETF cost.”

- The investor may have to pay a higher capital gains tax in a few cases.

Conclusion

Exchange-traded funds are relevant for investors with shorter horizon periods who intend to implement scalp trading type of strategies due to the up-scale of ETF advantages compared to mutual funds. On the other hand, the long-term investor may not choose to invest in ETFs. At last, it depends on the risk exposure acceptable for an investor. ETFs are sector-specific vehicles of investment & thus, the risk appetite drives the return perspective of the investor. Exchange-traded funds are anyways featured with a higher amount of liquidity & flexibility.

Recommended Articles

This is a guide to Exchange Traded Funds. Here we also discuss the introduction and types of exchange-traded funds along with their advantages and disadvantages. You may also have a look at the following articles to learn more –