Updated July 7, 2023

What is the Factor Market?

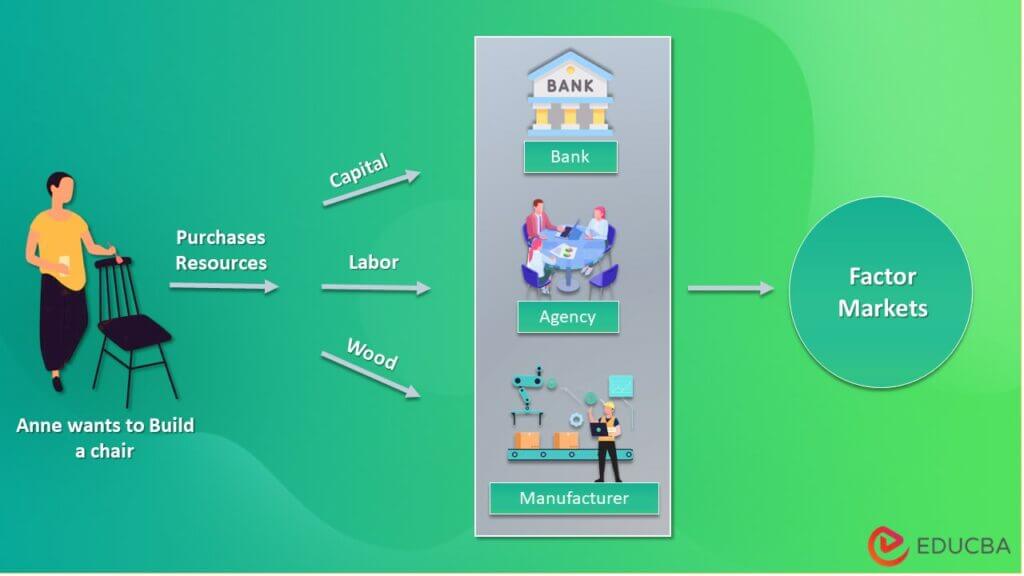

A factor market is a marketplace of resources, such as raw materials, labor, and capital, that businesses require to produce goods/services.

For example, Anne wants to produce and sell a chair to consumers. Thus, she needs numerous things like a place to keep the raw materials, wood, and an artisan to design the chair. As there is an added cost to it, she also requires capital. Suppose she takes a bank loan for the capital, hires the artisan through an agency, and buys the wood from a manufacturer. All these venues (bank, agency, manufacturer) act as a factor market.

Key Highlights

- There are two types of markets. The first is the factor, and the second is the good-and-service market.

- It can also be named the input and the output market.

- The input markets deal with raw materials, land, labor, and capital to produce finished goods

- The output market deals with the consumer pedagogy of purchasing goods and services.

- It is dependent on the demands of the goods and services.

Principles

There are four principles. These are as follows:

- Land: One needs a place to furnish or make the product

- Labor: Some artisans are required to design or make potential goods

- Capital: Liquid cash is an important marker in purchasing raw materials

- Raw Materials: We need raw materials to furnish products. For example, we need raw materials like wood and steel to design a chair.

How Does it Work?

- It is generally the input market; therefore, its supply and demand determine the price of finished goods.

- For instance, coffee prices rise when demand increases, and the supply of coffee beans cannot keep up with the demand.

- In another scenario, the demand for the final goods can determine the costs for the production inputs. For example, the cost of steel will rise if the price of automobiles does

- Therefore, the demand for the factors of production generates from the desire for the final good.

Examples

Example#1:

- Everyone in the world largely participates in a variety of factor markets. The most straightforward illustration is companies seeking property to build factories or showrooms. If the government or a family owns the land, it may be bought or leased from them.

Example#2:

- Let’s say you wish to start a company needing outsourcing services. As per the business framework, we need manpower to establish the company. Hence, labor should be our prime goal here.

- Once the eligible labor is hired, you would need capital to keep the business in flow. The labor hired for the services would generate money, and we can use the money to enhance our business.

- Also, to enhance the business outsourcing services, we would need land. Hence, property investment will be a part of the capital market.

The Monopoly of Factor Markets

- Let’s assume that a traditional handicraft company deals with making exotic carpets. Since the patent of the particular product is unique, the seller can charge high prices because of the demand caused. This hurts it because of the high price.

- Due to the higher price regulation, the demand for the goods steeply decreases because the consumers refrain from buying and going for the substitution effect. The substitution effect is when consumers choose affordable options, leading to a decline in sales for high-priced products.

- Hence, higher prices can affect demand for the finished product. Thus, the derived demand for the factor resources can also decrease, adversely affecting the monopoly selling the factor resources.

Importance of Factor Market

- The land, labor, capital, and money market are important indicators for assessing the factors’ modalities.

- Its equation derives the health of microeconomics, or vis-a-viz, the behavior of the individual contributor in the markets. Hence, land, labor, capital, and money markets are correlated, and the effect on one indicator will influence the other, keeping it unstable.

- For example, in the absence of land, there won’t be any place to produce goods, which will not attract laborers, and there will be a loss of productivity efficiency, leading to the collapse of the money market.

Factor Market vs. Product Market

| Factor Market | Product Market |

| It is a marketplace for purchasing and selling various production elements such as land, capital, and labor. | It is the marketplace for finished goods and services. |

| Businesses typically hire more people if there is a high demand for their manufactured goods. | It satisfies the demands and desires of the consumer. |

| A bank providing money to businesses is one example. Others include posting job openings and worker vacancies. | Examples are a farmers’ market, a store with various goods, an Apple showroom, a theater, etc. |

Frequently Asked Questions(FAQs)

Q1. What are the input market and output market?

Answer: An input market is where all the basic production resources are available, while the output market results from the production activity. For example, Weyerhaeuser Co. is an input market, whereas IKEA is an output market.

Q2. What are the principles of the factor market?

Answer: Factors of production include land, labor, capital, and entrepreneurship. All four principles work together to keep the economy stable.

Q3. How can Monopoly hamper factor markets?

Answer: In a monopoly, only one seller, i.e., a small group of leaders decides on the input prices. Therefore, they can set unattainable prices that can badly affect the economy.

Q4. What is the importance of factor markets?

Answer: The land, labor, capital, and money market is an important indicator to assess the modalities of the factor markets. Its equation derives the health of microeconomics, or vis-a-viz, the behavior of the individual contributor in the markets. Hence, land, labor, capital, and money markets are correlated, and the effect on one indicator will influence the other, keeping the factor market unstable.

Recommended Articles

This article has served as a guide on the factor market. We saw principles, examples, importance, and much more here. You can find out more by reading the following articles: