Updated July 12, 2023

What are Factor Models?

Researchers developed factor models to approximate the returns of financial securities or transactions by applying various statistical techniques to factors influencing the compared return. Therefore, the models are so-called because the outcome depends on the factors included.

Explanation

The weight assigned to each factor depends on how much it affects the return or the dependent variable, considering factors such as government rules and regulations, seasonality, market environment, etc.

There can be various types of models depending on the depth of the analysis. Therefore, they are broadly classified into two heads, which are single and multi-factor models. Regression is a popular method for using simpler or more complicated statistics.

Types of Factor Model

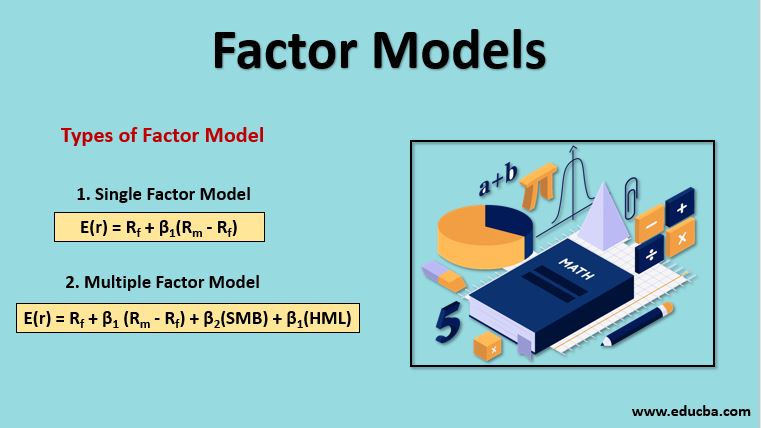

As described above, there can be two broad heads of these models, Single Factor Models and Multi-Factor Models. The equations of each are as follows:

1. Single Factor Model

- This model involves using only one independent variable to approximate the dependent variable and has an equation of the following form:

- y = α + β1X1 +∈1

- Here y is the dependent variable, = the intercept variable, = the slope variable, = the independent variable or the factor, = error term

- CAPM equation is an example of the single factor model wherein the equation is as follows:

- E(r) = Rf + β1(Rm – Rf)

- Here we approximate the expected return on the basis of risk-free return and the market risk premium. At the same time, beta is the slope coefficient, and risk-free return is the intercept coefficient.

- The intercept coefficient implies the value of the dependent variable when the factor value = 0

- The slope coefficient determines the rate of change in the dependent variable to the rate of change in the independent variable.

2. Multiple Factor Model

- This model involves using multiple independent variables to approximate the dependent variable and has an equation of the following form:

- y = α + β1X1 + β1X1 + ⋅⋅⋅ + βnXn + ∈

- Here y is the dependent variable, = the intercept variable, and all variables are the slope coefficients for different independent variables

- Fama Fench equation is an example of the multi-factor model wherein the equation is as follows:

- E(r) = Rf + β1 (Rm – Rf) + β2(SMB) + β1(HML)

- HML = Value Premium

- SMB = Size Premium

Uses and Importance

- The Finance industry presently utilizes many different models, while organizations can develop new models for specific industries or any other purpose.

- These applications extend beyond Finance and encompass various disciplines such as science, economics, sociology, anthropology, etc.

- Investors use factor models developed by many indices to predict their returns, aiding them in investing decisions.

- These models are also used in identifying the most appropriate capital structure for a company because the WACC formula is also a multi-factor model that considers the costs and weights of capital sources and therefore helps calculate the cost of capital for different capital structures.

- Analysts use such models to identify the causes of a given return in the performance attribution of portfolios. Thus, the skill and performance of the portfolio manager are also quantified, based on which her remuneration number is generated.

Advantages and Disadvantages of Factor Models

Below are the points that explain the advantages and disadvantages of the same:

Advantages

- Factor models help pinpoint the cause of the change in the dependent variables and identify the factors causing the same. Once the cause-and-effect relationship is clearly defined, it is easier to harness and predict such impacts in a structured manner.

- Investing can be scientific and higher returns can achieve using models with high predictive power. Therefore, algorithms can generate automated trading. However, such automation is only used when the stakes are not very high because this limits the losses, which might be huge otherwise.

- Businesses can develop marketing and expansion strategies based on factor models of their domain and thereby develop a plan to achieve higher profits and then closely monitor the results. This helps them align the company’s goals and objectives as a whole.

Disadvantages

- Identifying the right factors is not an easy task, and many cautions need to be considered to draw a valid conclusion out of a given model. If the data set is affected by multicollinearity or serial correlations and other violation of regression assumptions, then the model can become unstable and not have any consistent predictive power.

- Factor models are not highly cost-effective. They require sophisticated statistical techniques, which in turn require expensive technology and, therefore, cannot be used by smaller companies or retail investors who don’t possess the necessary resources.

- These models require highly skilled human capital because these require advanced mathematical acumen; therefore, the people involved in such research come at a high cost.

- At times adding more factors might not explain the effect on the dependent variable, and therefore, the model might reach a particular limit and that might not be too extensive to justify the time, money, and effort that goes into such analysis.

Conclusion

So, to sum up, Factor models help predict the change in the dependent variable to the change in a set of independent variables known as factors. There can be single and multi-factor models as per the need and resources available to the research, and therefore, they can have a varying degree of predictive power.

Even though these models are very popular, they are not free from cons, their implementation is expensive, and therefore not all investors or businesses can use them; plus, they require highly skilled human capital, which is not always available. Even so, as the world is becoming more technology-driven, modeling is becoming an inherent and indispensable part of how businesses are conducted.

Recommended Articles

This is a guide to Factor Models. Here we discuss what Factor Models are, the types with their equation, explanation, importance, and advantages and disadvantages. You can also go through our other related articles to learn more –