Updated July 17, 2023

Definition of Fallen Angel

A bond initially classified as an investment-grade bond but reduced to a junk bond due to the downfall in the issuing company’s financial condition, referred to as a Fallen Angel. The term ‘Fallen Angel’ is occasionally used to represent a stock falling hastily from its peak standard.

Explanation

The downfall of investment-grade bonds is the irregularity of revenue, which makes the issuer unable to pay the interest due on bonds. Such type of securities attracts investors with the attitude of rejecting popular opinions or a contrarian willingness to capitalize by believing that the company will cope with these temporary obstacles. The issuers of fallen angels are generally large institutions having a wide area of network and privileged brand names. Thus, they can bounce back to the investment rating class.

Characteristics of a Fallen Angel

Following are some of the salient features:

- The fallen angel bonds are sold in the market in bulk quantity.

- They attract investors who trade for speculation purposes.

- A fall in the investment-grade bond results in a downfall in the company’s status.

- The fallen angel bonds give the highest rate of return, but the risk involved in them is comparatively more.

- A fallen angel is such a bond that is turned down to junk status due to the financial deterioration of the issuer.

List of Fallen Angel Companies

Here are some examples of fallen angel companies:

- Kraft Heinz

- Delta Air Lines

- Royal Caribbean Cruises

- Spirit Aero Systems Holdings

- Patterson- UTI Energy

- EQM Midstream Partners, LP

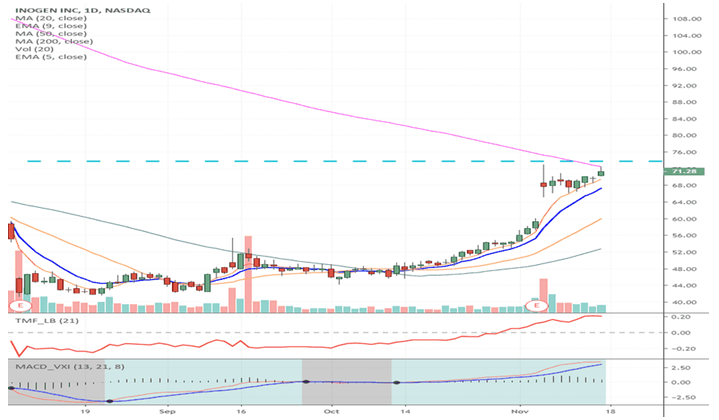

Fallen Angel Chart

Here, you can look at the price chart of fallen angel security.

Source: https://www.tradingview.com/chart/INGN/YZ2ewoq9-INGN-Long-Setup/

As evident from the chart, the prices initially declined and struggled over time. After a few months, the prices seem to increase, benefiting the stakeholders.

Risks of Fallen Angels

Investment-grade bonds that reduce to junk bonds due to the inefficiency of the issuer to pay interest dues decrease the price of the company’s bonds, attracting contrarian investors as they believe in the possibility of the company coping with a temporary reversal.

But not every company can cope with such setbacks, which may be due to the change in taste of the customers or any other ever-lasting impact. In such cases, the investors investing in such companies must bear a heavy loss. Due to the financial position of such issuing companies, there is always an excellent level of risk in fallen angels.

Recoveries of Fallen Angel

Following are the instances which can most effectively result in the successful recovery of a fallen angel

- Change in the division/segment of the business: The reduction in the investment-grade bond might happen due to a part of the business causing loss. Such part of the business can be revised to recover the fallen angel. Such restructuring of underperforming segments can contribute to effective recovery from financial distress.

- Trimming in the expenditure: The fallen angels can be recovered if there is an appropriate reduction in the company’s expenses, which includes employing fewer workers with comparatively more workload than before. A company may also limit its resource expenses by negotiating with the supplier regarding cost.

- Change in the structure of capital utilization: The fallen angels can recover if the capital involved in the company is used correctly. Capital can yield more profit only if used properly and at places that generate profit. This involves effectively utilizing the money by de-allocating funds from less profitable areas to a comparatively more profitable segment.

Advantages

Investing in fallen angles offers the following advantages:

- Big opportunity: The fallen angels give the investors a huge opportunity but are risky also. Investors can earn high returns if they are ready to take the underlying risks.

- Higher interest: The interest rate in the fallen angels is high. Investors could earn a high-interest rate on their investments if they invested in the fallen angels compared to other schemes.

- Low-price bonds: The bonds of the fallen angel company are priced less due to the reduction in the value of an investment-grade bond. This allows investors to earn a high return with less investment.

- Temporary setback: Companies usually keep a fund to recover themselves from future losses. A good company always has a backup plan, so they know how to recover from temporary setbacks.

Conclusion

The high risk goes hand in hand with high profitability. The fallen angels have a high risk, and any investor looking to invest in them must consider the risk factor. But if the investor is ready to take risks, the investor can earn a high rate of return; it is like gambling, as it attracts speculators. An investor may earn through investing in fallen angel bonds by buying them just before or after their degradation because, by this time, the prices of these bonds are the lowest. As and when the fallen angel would recover their increasing prices, they may lead to a benefit on the part of the investor. Thus, in-depth market knowledge and appropriate scenario analysis may help you earn more, as a life-changing opportunity is always a decision away.

Recommended Articles

This is a guide to Fallen Angel. Here we also discuss the definition, List, Chart, and characteristics of a fallen angel, along with its advantages. You may also have a look at the following articles to learn more –